Top 8 Banking Software Development Companies in 2026

Any banking software development company will confirm that finance and software have some similarities because, with errors in both areas, everything can collapse without a chance of recovery. That is why we provide reviews of crucial nuances regarding this topic for you to kickstart your journey to success.

Implementing banking software development services for businesses has become easier since data is now used to improve the efficiency of processes. AI integration in the hands of experienced programmers helps in credit decisions and financial risk management. It is only critical to designate the right systems and progress will not take long to come, and our overview will help you with this.

The introduction of advanced technologies into banking software development companies‘ practices certainly helps to control costs and improve the quality of customer service. But when compiling our list of providers, we also selected those who skillfully combine valuable existing developments with modern trends.

List of providers offering banking software development services

Founded: 2017

Headquarters: London, United Kingdom

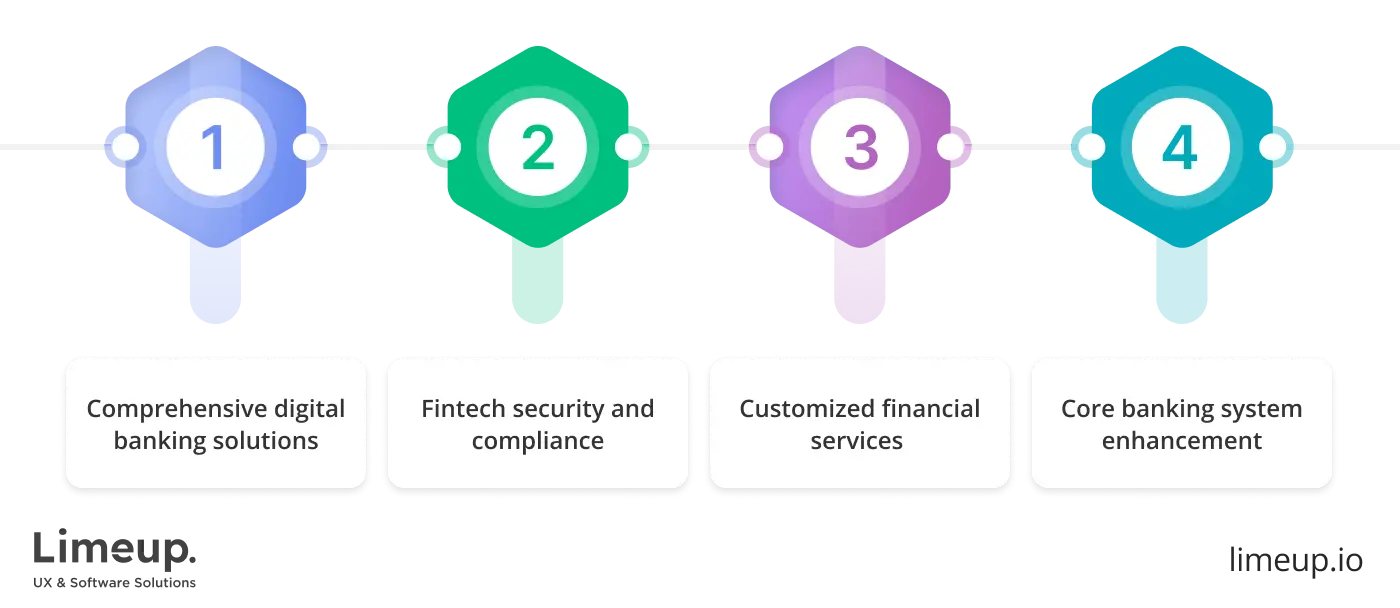

Our digital masters create secure and reliable products quickly and within the agreed budget to ensure efficient settlements and transactions. We guarantee to follow all trends in full compliance with the protocols and regulations of the fintech industry.

Limeup specializes in creating applications and platforms that not only solve existing problems but also provide the implementation of the most innovative tools, including AI and machine learning. Our team consists of professional developers and testers capable of using top-notch technologies to reduce risks and automate essential processes.

Key services:

Industries:

- Fintech

- Healthcare

- Education

- Real estate

- Manufacturing

- Logistics and supply chain and many more

Reach out to Limeup team with any hassles you have about banking software production.

Why choose them:

For over 10 years, Limeup, as one of the best representatives of this realm, has been crafting user-friendly platforms with intuitive navigation and seamless architecture, as well as highly secure banking sites and applications that target the needs and expectations of end users to achieve business goals and stable growth without effort.

Select case studies:

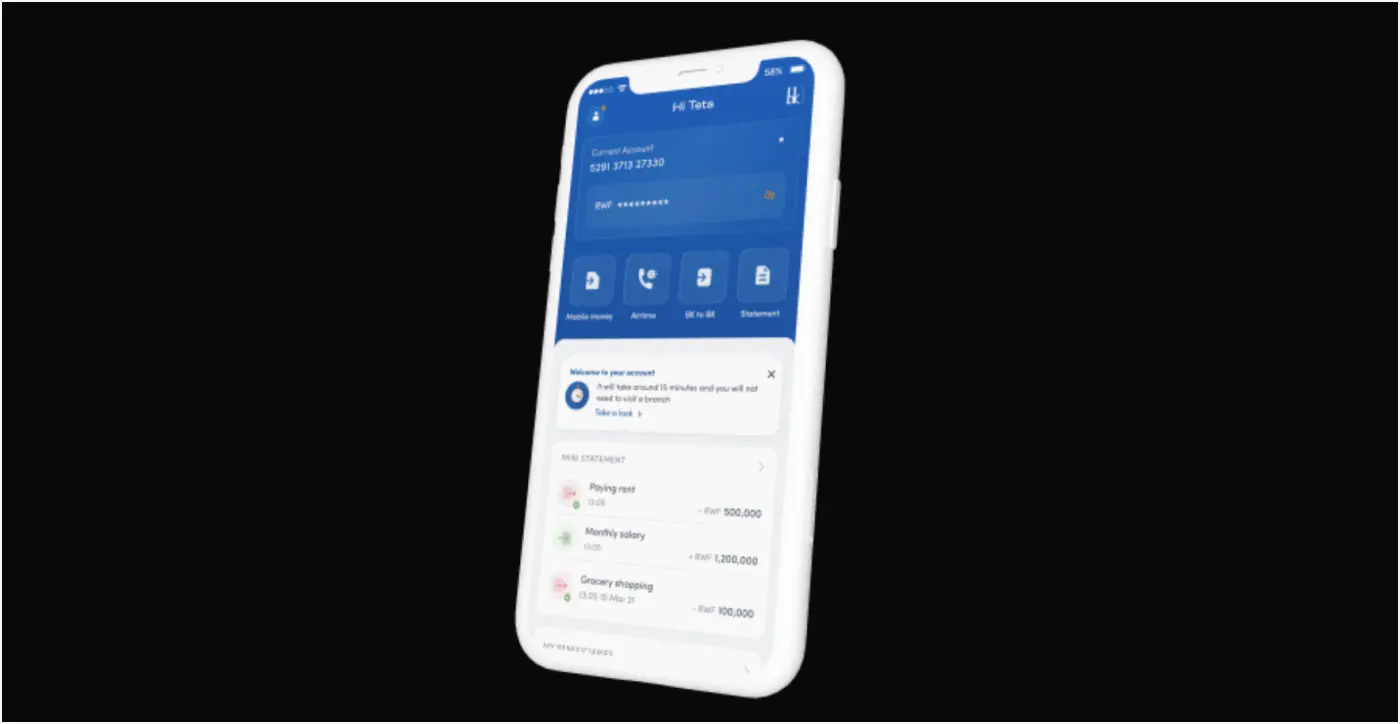

- VoloBank came to us with the goal of creating a banking application, and the Limeup squad set out to develop a platform that provides users with a flexible and unique way to manage their own finances, changing the generally accepted approaches and preserving proven principles.

- By setting up modern software and intuitive design for Trading Finance, we also solved the problem of invoice monitoring and full control thanks to a custom architecture developed from scratch.

Present our examples of successful projects.

Founded: 2017

Headquarters: Berlin, Germany

Allow seasoned professionals with extensive industry expertise to turn your concept into a product and launch it successfully. impltech is dedicated to contemporary software development services that revitalize brand identities. Each task or concept is fine-tuned to the unique requirements of every client, with careful selection of the technologies that best support the company’s aims.

Key services:

Industries:

Why choose them:

The number of customers who highly appreciate the level of skills of the employees is approaching a hundred, and the growing mass of successfully implemented projects confirms the professional mastery of the technical stack of this provider. All products for the fintech industry have the highest level of protection and work flawlessly for the benefit of banking structures and their users.

Select case studies:

- Designing a complex platform for Traders One was effortless for impltech, as a result was an efficient and solid product that ensures smooth transactions and secure storage of digital assets.

- The challenge from the Trading Platform was to stand out from the competition through sophisticated design and extra opportunities for investors. The impltech team solved the challenge by creating a flawless user experience that took business operations to a new level.

- Uncover their variety of project spotlights.

Sombra

Founded: 2013

Headquarters: Lviv, Ukraine

For more than 10 years, Sombra’s unique identity has been a global business that offers assistance with programming while specializing in the implementation of innovative technological features. Sombra operates from Eastern Europe but, being global, has clients from all over the world, delivering goods through a team of 300+ people.

Key services: Software development, IT consulting, AI and ML, data and analytics.

Industries: Finance, advertising and marketing, education, information technology.

Why choose them:

Sombra’s expertise enables fintech products to stand out in the market. They provide customized enterprise resource planning software offerings to achieve business goals and enhance customer experience in banking, wealth management and payments. They ensure compliance with data protection standards and seamless integration of the program with the financial part.

Select case studies:

To form your own opinion about their squad, take a look at the great ideas they have brought to life and turned into successful projects.

CQUELLEl

Founded: 2021

Headquarters: Hamburg, Germany

QUELLE focuses on addressing issues related to delays and escalating costs by developing solutions that yield quantifiable results. Their tailored approach guarantees the accurate attainment of objectives aimed at enhancing operational efficiency and ensuring optimal security.

Key services: Software and product development, solution design.

Industries: Fintech, education, medical, insurance.

Why choose them:

The provider seeks to revolutionize the financial sector by leveraging innovative vision and practices that are trending. They develop secure, dependable and user-centric platforms that enhance transaction efficiency, facilitate asset management, and offer real-time analytical insights.

Select case studies:

Explore successful solutions to learn how these experts help businesses achieve their goals by combining cutting-edge technology with industry-leading skills.

The Software House

Founded: 2012

Headquarters: Gliwice, Poland

A team of programmers with fluency in building web applications, APIs and many more for millions of end users. Full-cycle coders, designers, quality control engineers and business analysts know how to create a flexible cloud architecture and integrate the most demanded features needed in the modern market.

Key services: Software and mobile development, cloud engineering, digital product design.

Industries: Finance, information technology.

Why choose them:

The process of coding will become faster and better thanks to the professionals of The Software House, who offer advanced knowledge in working with the cloud, and serverless solutions. The majority of clients express their endorsement of the contractor, highlighting their reputation as a producer of dependable and highly secure innovations in their reviews.

Select case studies:

Explore previous examples from firms with similar challenges that have already innovated their digital product and set the direction for sustainable progress.

Django Stars

Founded: 2008

Headquarters: Kyiv, Ukraine

Django Stars is a tech-driven crew that houses a remote-first culture, spreading across the world and promoting flexibility and collaboration among its employees. They believe in taking part continuously in the Python and Django community, wherever they recognize innovation in sharing knowledge and keeping abreast of the changing industry.

Key services: Software product development, IT consulting and advisory, ML and AI.

Industries: Fintech, education, medical, eCommerce.

Why choose them:

The vendor creates a solid foundation for people to enter the markets in the US, UK and Switzerland and helps them become uncompromising industry leaders. For its part, Django Stars ensures that the product is scalable, secure and compliant; improved risk assessment and better visibility of performance will complete the list of benefits.

Select case studies:

Learn how they take businesses to the next level with practical examples using modern frameworks.

Coreblue

Founded: 2015

Headquarters: London, England

Comprising a squad of expert technologists with proficient skills in design, coding, quality assurance, DevOps and project management, this provider is ready to turn new ideas into reality. Coreblue ensures perpetual support for the maintenance and expansion of the product range, tackling issues, introducing new enhancements and adjusting to dynamic needs.

Key services: Custom software, mobile and web app development.

Industries: Fintech, government, hospitality and leisure, education.

Why choose them:

The team works in sectors where safety, security and risk mitigation are paramount, so Coreblue understands the importance of being certified with all modern authorizations. The crew has worked on hundreds of ideas over the last decade and is familiar with applying a wide range of technologies, the choice of which always meets the needs of the project.

Select case studies:

Evaluate technology vision in a portfolio of works created for organizations seeking change.

INOXOFT

Founded: 2014

Headquarters: Philadelphia, PA, USA

Inoxoft is a global enterprise specializing in modern technologies, providing tailored goods and groundbreaking concepts supported by top programmers from various regions worldwide. The company delivers secure digital instruments, featuring resilient core banking systems and cutting-edge applications to enhance the customer experience seamlessly and engagingly.

Key services: Custom software and mobile app development, software product discovery.

Industries: Fintech, education, real estate.

Why choose them:

This organization focuses on the efficient integration of corporate banking software with current systems, ensuring a smooth workflow. Furthermore, it is skilled in revamping legacy systems through the implementation of top-notch banking tools to optimize internal process performance.

Select case studies:

Examine diverse cases with the same challenges and how the engineering team converted these obstacles into state-of-the-art solutions.

What is a banking software development company?

It is a group of people who really know how to create and maintain specialized systems for financial institutions like banks, credit unions and other bodies related to lending or payment. These suppliers know just the right touch when designing platforms that streamline specific fintech operations while enhancing security levels and customer satisfaction.

The banking software development usually covers all the interactions with special mobile apps, online portals, ATM management systems, core systems and so on. Hence, business owners remain ahead of the pack in this quickly emerging industry.

Banking software developers are making all possible efforts to equip their solutions with regulations for smooth digitized transactions, with the know-how on technologies such as the blockchain, artificial intelligence and cybersecurity. Additionally, these programmers are involved in custom projects connected with loans, risk control and payment processing.

This type of work is fundamental to turning traditional models into efficient, secure and user-centric digital environments that allow financial establishments to keep their finger on the pulse of modern technical advancements.

How to select a vendor to create banking software?

Thanks to the active fintech software development, this area is rapidly increasing its capacity and becoming one of the leading places among the clients of such corporations. As the market is constantly expanding, so is the competition among software providers willing to create new solutions for banks and similar organizations. Today, advertising pages contain not even hundreds, but thousands of such companies.

But fortunately, there are criteria that should be used to choose among banking software development firms. And in many ways, they can show how a particular candidate will be able to generate a complex product, as well as comply with all the necessary security standards and industry protocols. We invite you to read our study with us, and to make complex tasks easier, use the short instructions from reviewers who have collected information about this area bit by bit.

So, starting with the simple, we will draw your attention to the experience of developing software for banks. If you think that a set of basic skills will be enough here, we hasten to disappoint you, this is only the tip of the iceberg. It is after successfully completing projects in which engineers show and reinforce mastery over new technologies, including AI, machine learning, big data, data mining, etc.

The second, but no less important point is the level of technical expertise. The availability of capacities for creating specific products and the ability to ensure smooth and seamless integration with your existing system are the keys to future success. Don’t ignore this point, as the global fintech market is projected to reach $698.48 billion by 2030, meaning you have little time to jump on this high-speed train.

Think you can save money by going with a small, humble banking software development company? Don’t be in a hurry because the larger and more extensive the firm’s staff, the more likely it is that your task will be assigned to a balanced and dedicated team with enough resources to meet the agreed deadlines and scope of work.

The topic of data and transaction security is too essential not to mention again, so we remind you that you should definitely make sure that banking software development agencies you are looking for understand the importance of an intrusion detection system or have a disaster recovery plan, which is a must for any data breach in the fintech industry.

Well, where can you go without soft skills? If, despite all the technical aspects, communication is not comfortable and feedback on updates must be waited for weeks, you will have to look for another provider. It is difficult to predict in advance what the format of the relationship will be, but if you talk to previous clients, you can make certain preliminary conclusions that will be confirmed or refuted at the first meeting.

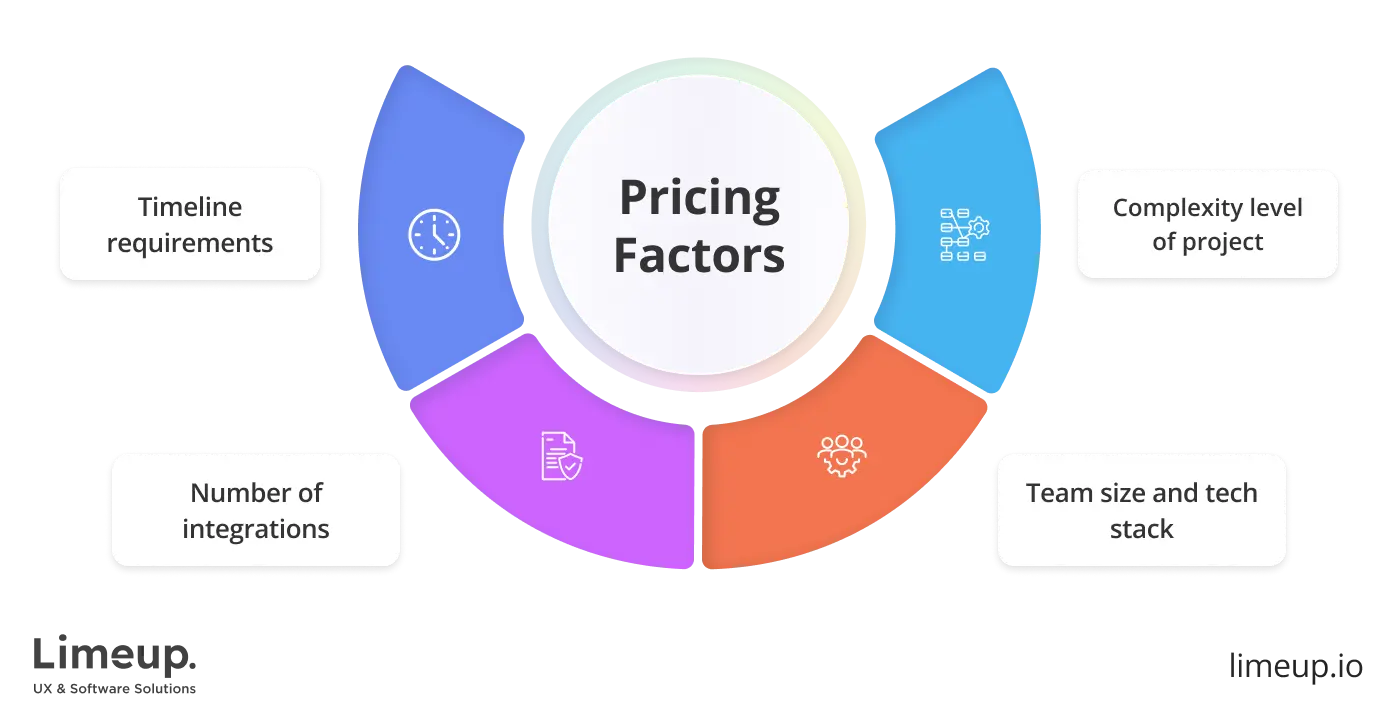

How much do custom banking software development services cost?

Developing a financial management and accounting operating system involves various stages, each with its own associated fees. Let’s dive into this part of the workflow to understand what this specific type of software development cost will consist of.

| Type of Cost | Importance of the Stage | Price Range |

| Planning and Design | At this stage, the buyer’s requirements are analyzed in detail, and wireframes and prototypes are synthesized to create the program architecture. This is a kind of base for engineering, taking into account scalability, security and performance. | Small-scale $30,000 to $150,000 |

| Coding and Implementation | The cost, as usual, depends on the size and complexity of the program, the integration of necessary functions, and the creation of the user interface, as well as the proficiency of the vendor offering banking software development services. | Mid-range $150,000 – $250,000 |

| Testing and Quality Assurance | This stage includes testing, bug fixing and performance optimization, which helps to eliminate problems, improve the user experience and ensure compliance with standards. | Enterprise-level $250,000+ |

| Maintenance and Upgrades | Regularly maintaining the working condition of the product by updating, securing, and operating optimally. Also includes the timely updating of elements. | Annual maintenance 15%-20% of the initial investment |

Today, the price of developing digital utilities for the banking sector varies from $30,000 to $500,000+ and its certain amount will be determined after the first consultations with fintech software development companies, taking into account your request, the scale of the project and the specific tools used in the process. But you definitely shouldn’t save on these works because reliability and security in the fintech field are a must-have with no room for error.

Looking for banking software developers?

Remote access, online payments and investment apps have become the new norm, which has led to an increase in demand for such companies. Wanting to create a solution that improves the security of digital transactions, institutions are striving to increase their income and manage finances effectively. But this is only possible if you cooperate with a professional among banking software development companies nowadays.

If, even after reading our article, you still can’t make a final decision and are wondering who will be your guide to success, we invite you to schedule a consultation with Limeup experts, who are always ready to help and clarify details or give valuable advice. We hope that soon, your modern application or website will successfully serve new customers and facilitate access to goods for existing ones.