How to Develop Insurance Software: a Complete Brief

Insurance software development is an intricate topic due to several factors: first, this market evolves and reshapes, tasking coverage providers to look for new approaches that will be relevant, second, operating with personal data, engineering requires serious security measures. To to make the picture clear, we gathered this all-in overview of the system creation process.

Reading our synopsis, you’ll find out how to build insurance software action-by-action, learn about what such a program means and what functionalities you need to pay attention to when constructing an application. You’ll also be presented with the cost of services arranged according to the complexity of an endeavor.

After getting acquainted with the points of software development for insurance, you’ll get insights into the insurance solutions and be knowledgeable about the supplier filtering algorithm. Let’s move further to the grand scheme of creating a distinctive and up-to-date underwriting platform and selecting a trustworthy engineering company.

What is insurance software?

The underwriting sector is one of the biggest in the world, with an estimated worth of almost $7T. This sector is rich in enrollers, as it is slow regarding digitalization. However, digital insurance software development is a direction that is drastically reshaping the landscape of the loss prevention domain and we can see entities like Lemonade and Insureon rise to prominence thanks to their modern methodologies.

Implementing technologies benefits all the parties involved: clients get an opportunity to receive special offers tailored to them, purchase policies, submit information and connect with an assigner responder remotely, saving a tremendous amount of time. The provider, from their side, has the possibility of modifying their services, accelerating the procedures, uncovering deception and effectuating service delivery.

What are the steps for insurance software development?

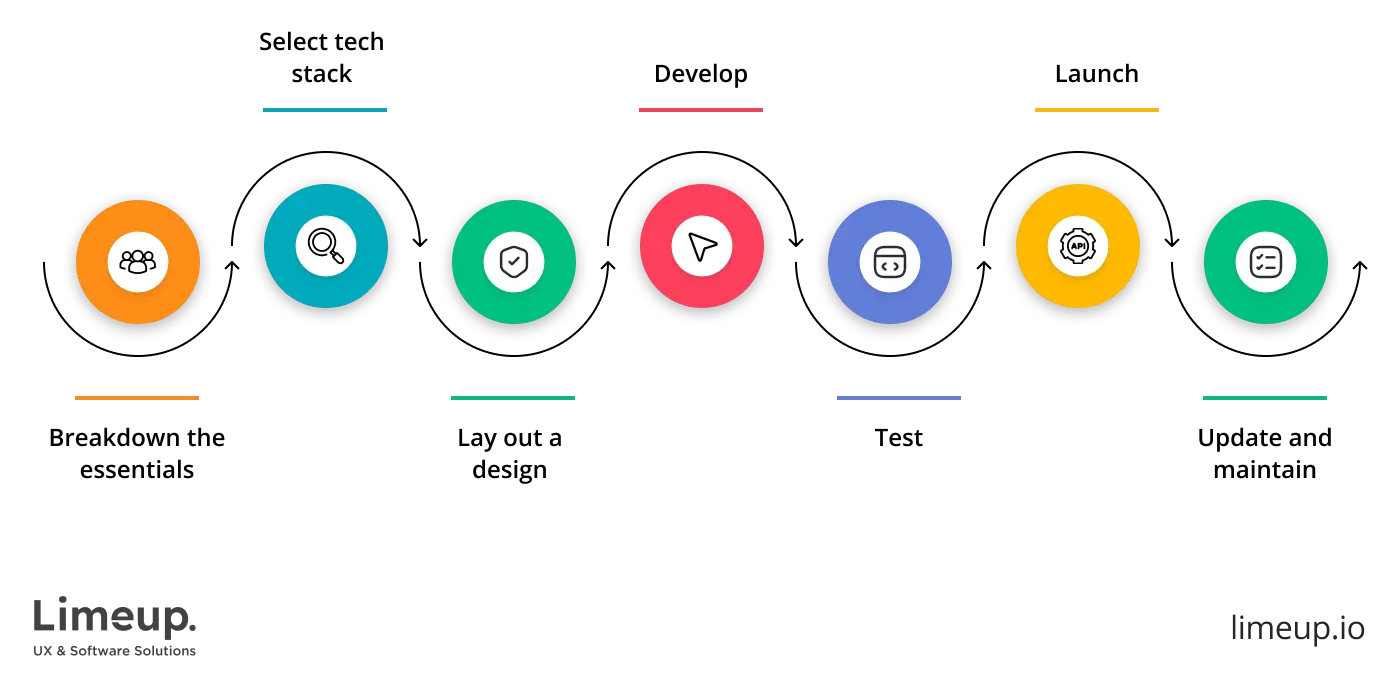

The algorithm for carrying out a project is strict, with a defined order bit by bit. A well-thought-out constructing strategy prevents the appearance of downtimes, ramps up execution and ensures consistency. The following summarizes the correct sequence of stages to go through:

Step 1. Breakdown the essentials

Before kicking things off, you and the tech visionaries you will hire need to come to a common vision of the future outputs. It demands thorough discussions between both parties concerning the determinations of the missions, target audience, purposes and milestones you are aiming to reach. Before proceeding to the following phases, all the misconceptions and uncertainties must be resolved.

To supply the picture entirely, a provider conducts comprehensive market research to identify the paint points of the prospects, identify the competitors and outline beneficial strategies.

Step 2. Select tech stack

The stage that follows after the briefing of a blueprint is specifying the necessary set of technologies required for completing the initiative. Insurance software developers analyze the task thoroughly and define which libraries, programming languages and frameworks should be applied in a concrete case.

For example, based on the characteristics of your undertaking, they opt for instruments for server-side coding such as Python, Ruby or C#. This also holds true for customer interface architecting, database integrations and access control tools. For every function, they need to find a key in the form of a resource that will help produce it.

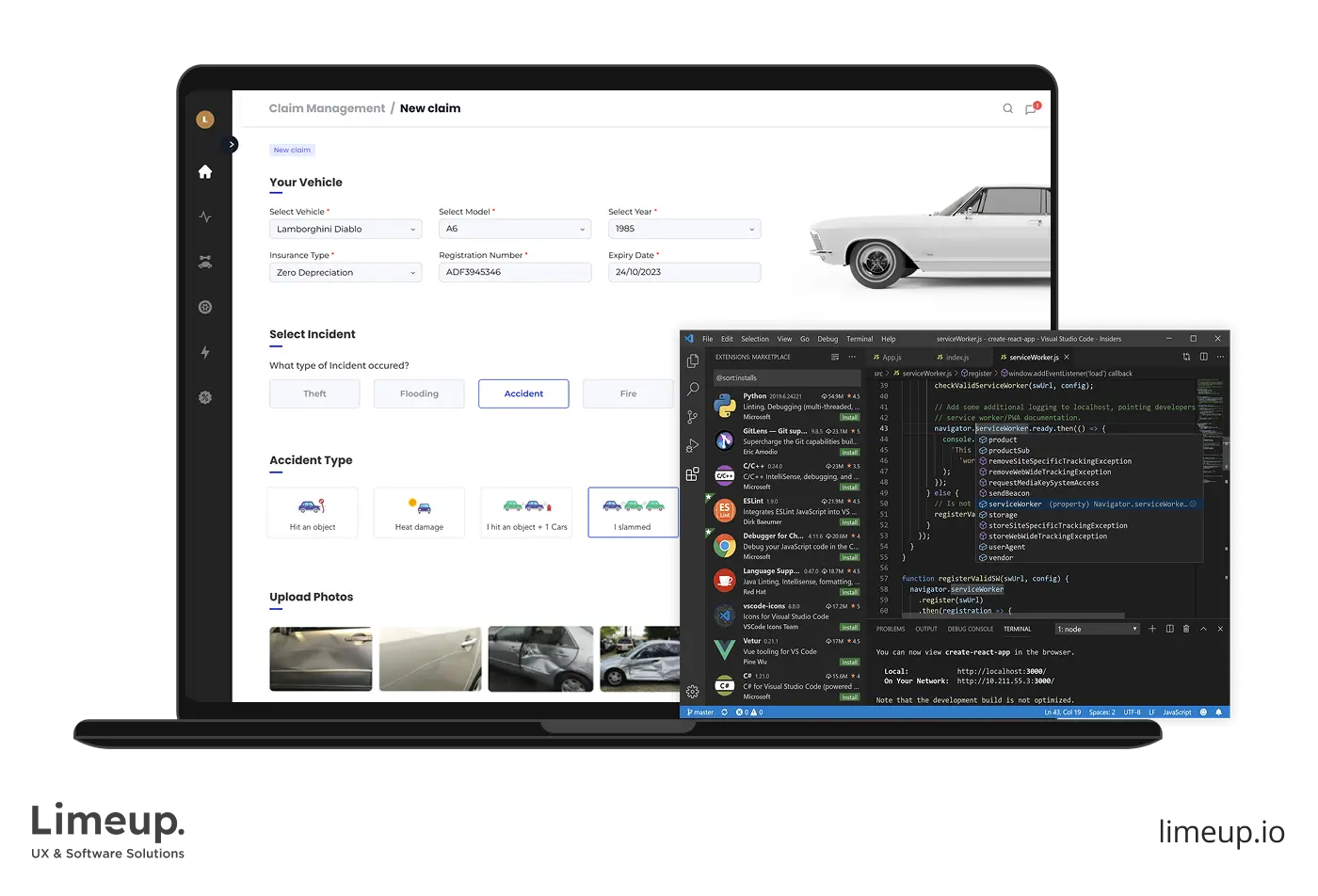

Step 3. Lay out a design

The UI of your digital asset is its face and is one of the most important activities in a tall order of engineering a coverage program. It should be a blend of well-arranged configurations, easy to follow so people from different backgrounds can understand how to coordinate it without difficulties, and simultaneously, it must include all the functions we briefed in the next section.

Step 4. Develop

When the visible part has been refined, the part of insurance software development will be started. That’s when the architecture of your application is built and the functionalities like strong security and fraud detection are embedded. Through the course of structuring, coders make it possible to send notifications and process claims.

Tech savants need to ensure that the incorporated techniques are in line with the standards such as GDRP and HIPPA, directed toward data protection or PCI-DSS if you are oriented on fintech software development.

Step 5. Test

The software development for an insurance business can’t be claimed finished before it undergoes a meticulous analysis. Speaking of the output inspection, there is an entire roadmap of checkups to ascertain that the portal runs smoothly, is well-protected, corresponds to usability and accessibility norms, has impeccable third-party integrations and good performance. The number of evaluations is long, but completing them reduces costs in the long run.

Step 6. Launch

Deploying the final product, executors transfer the code of the working environment to the space where it can be reached by the target audience. If you plan to present your proposal to a limited category, there is a suitable option in the form of soft-launch which means that you disclose your endeavor to people in certain locations or only to employees to collect the feedback.

Having received the reviews, your workaround passes through full-scale deployment when it becomes available for all applicants as a website that can be found in search engines or as a utility that consumers install from the App Store or Google Play on their smartphones. But the custom insurance software development services don’t finish here.

Step 7. Update and maintain

As the cycle of delivery progresses here, running smoothly entails periodical fixes. For example, when new standards are introduced or you just simply want advancements regarding safeguarding profiles or providing offerings.

By adhering to this logic, tech innovators release systems with client satisfaction in their cores that empower them to draw interest and spark curiosity.

What are the key features of building insurtech solutions?

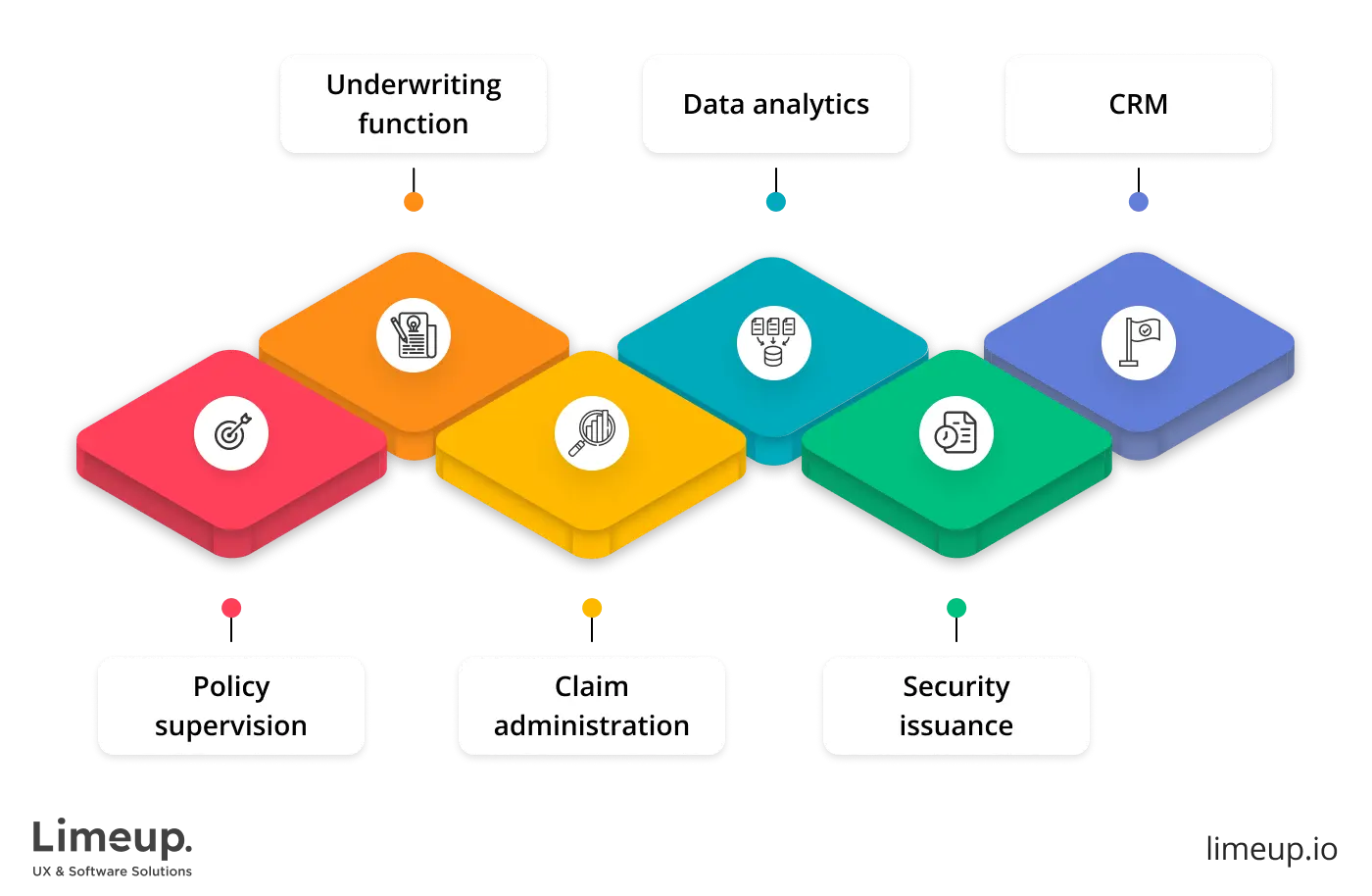

As an example, we’ll take an app that facilitates diverse roles, enhancing both agents and contract holders. Tap into the ins and outs of virtual coverage portals that mold them into what they are:

Policy supervision. Renderers add new contracts, renew the old ones or cancel those that don’t fit anymore owing to this attribute. It’s the foundation of an application that helps maintain the lifecycle of packages.

Claim administration. Facing issues, policyholders correspond to the financial guarantors. The entire loop includes a few stages, from the initial conversation to overview, investigation and decision-making. Custom insurance software development helps you to eliminate human errors, spot repetitive patterns and minimize monotonous work, so the examiners are empowered to more effectively handle supervisions.

Underwriting function. Dealing with a large number of premium payers, risk carriers have to operate with tons of metrics to be sure that they supply their consumers with beneficial conditions while avoiding financial losses. By embedding Artificial Intelligence technologies, code writers equip brokers with instruments that compute records of individual users impeccably and present accurate findings.

Security issuance. Since such workarounds are designed to store people’s sensitive information and be connected to payment getaways, their protection must be robust to withstand leaks of information and cyber attacks. In today’s reality, you can expect an insurance software development company to employ a blockchain ledger tactic, which is the latest word in safeguarding.

Data analytics. Statistics and insights are the modules that fuel the entire program. ML and AI elevate the examination of input, paving the way for predictive outputs, advantageous framework and evidence-based problem-solving. Gathering critical takeaways from different types of sources gives you means to refine your offerings and adjust them to your prospects’ preferences, starting from formulating coverage plans to improving intrusion prevention.

CRM. All the interactions you have with beneficiaries should be noted carefully and nothing is as effective in this occurrence as the Customer Relationship Management system. It helps hold results of discussions across multiple channels so that your evaluators will be able to quickly get acquainted with the person’s profile to give advice and sell.

When you hire software developers whose tech savviness stands out from the crowd, obtaining a platform that incorporates all the elements we described goes off without a hitch.

How much does software development for insurance cost?

Pricing is a unique metric that can’t be predicted accurately based solely on the parameters of your undertaking or on the tier of expertise of assistants you are planning to hire: only the blend of those characteristics will provide you approximate figures. So, the following numbers are not the ultimate interpretation since the expenditure plan should be counted on an individual basis. However, our rough estimate will give you at least near meanings.

In the table below, we included a few lists of deliverables in accordance with their complexity, having divided the groups of insurance software development services into three segments.

| Extent of intricacy | Set of features | Payment per project |

| Basic | Administration of policy, client profile, claim producing | $25,000 – $50,000 |

| Moderate | The package from above + automation of the flow, CRM leveraging. | $50,000 – $250,000 |

| Advanced | A full collection of the stated deliverables + blockchain utilizing, APIs integrations, AI-fused components and analytics. | $250,000+ |

Let’s consider another crucial point that doesn’t make numbers appear or disappear but, in some instances, facilitates more effective ways of controlling finances and organizing money transferring:

- Hourly rates — the most widely used framework is to cover expenses for time spent on reaching specific results. Numerous adoptions are explained by the simplicity of this methodology. If an extension is needed, it doesn’t take too long to prolong the duration of a venture. You’ll come across different tariffs in various regions as specialists from certain locations charge more due to competitive skills and level of life.

Also, take a look at the wages we summarized pertaining to the knowledge base:

| Grade of versatility | Compensation (per hour) |

| Juniors | $25 – $40 |

| Middles | $40 – $80 |

| Seniors | $80 – $120 |

- Retainer method — gearing toward long-term insurtech software development, you may find ongoing service agreements more compatible with the specifics of your initiative. This concept is integrated in situations when the completion of an endeavor surpasses a 12-week period. An orderer sends a particular sum every month without dealing with estimating and administering burden.

- Project-based strategy — rather than taking the closing stage as the main criterion determining the price, there is an approach that allows the bill to be settled for completing certain parts of the work. In terms of building risk management portals, it can be implementation of monitoring means or designing the interface. This model is primarily appropriate when the delivery of insurtech software development services doesn’t take long.

As you can see, personalization is present in the price formation process and you can discover even more details about software development cost.

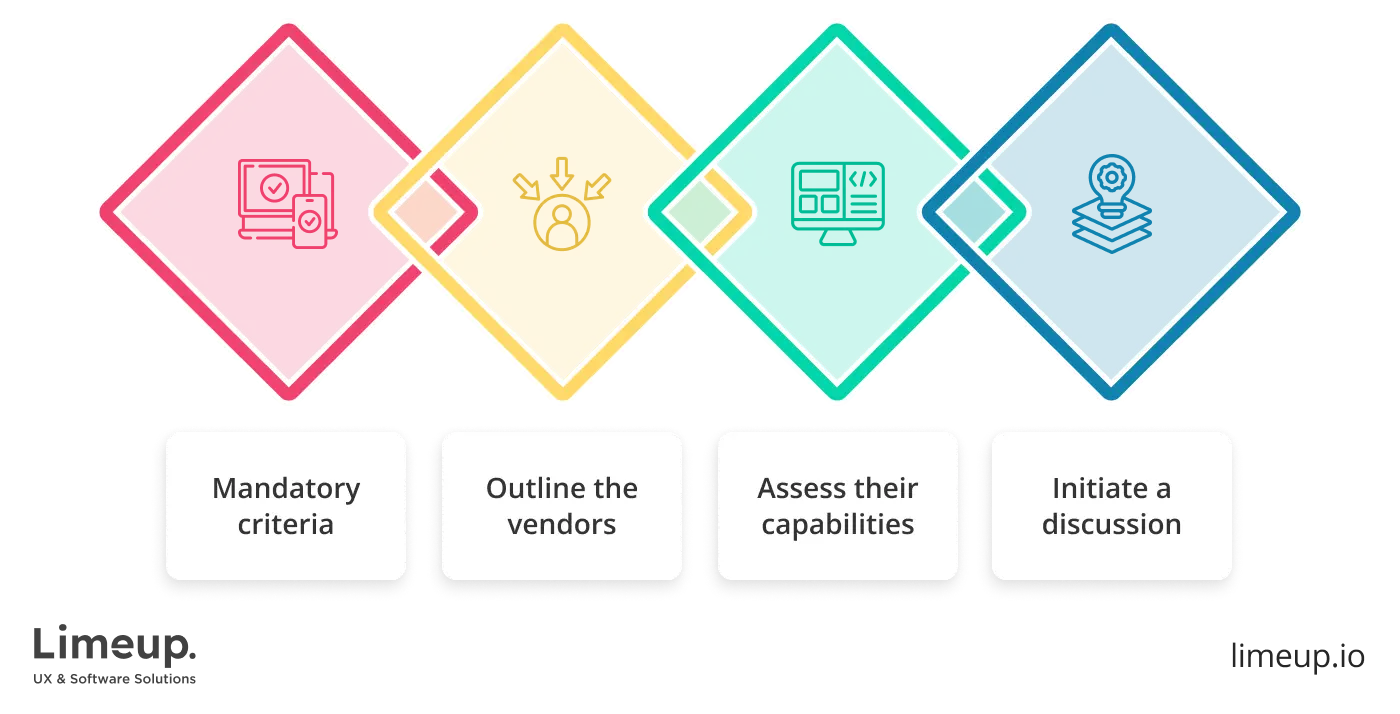

How to choose insurance software development companies?

While heading toward candidate evaluation, first of all it’s paramount to define the mandatory criteria you look for in suppliers.

The number of experts, their grade of proficiency, the experience in closing cases successfully and the availability of certain competencies such as blockchain versatility or regulatory instrument comprehension are the crux of the matter. Others, such as location, languages spoken, communication style and leadership still have their weight on the execution even though they are not so related to technical requirements.

Spend time exploring the comfort cooperation conditions and discover the most beneficial.

As soon as you settle on the preferable parameters, outline the vendors that align with your expectations. Pinpointing the suppliers of custom insurance software development isn’t a tough nut to crack. We advise you to connect with your partners, especially those you’ve heard underwent digital transformation.

Nevertheless, there’s an even more advantageous way — checking listings of fintech software development companies. Compiled directories are a great source of varied-scale innovative firms; studying them you’ll definitely be able to single out a match.

Having outlined some of the potential studios, proceed to assess their capabilities. There are a few sources you can look into. First, of course, scrutinize their success stories. Get acquainted with the details of previous cooperations, the duration of the carrying out, participants, objectives and results. Responsible providers almost always disclose the particulars of at least a few undertakings as it proves their versatility.

Apart from attentively observing their portfolio highlights, pay attention to what insurance software development services they have. Referring to the modern tendencies that insurers include in their products and buyers expect to see, engineers need to be aware of how to deliver first-rate AI fraud detection assets, threat analytics and scoring and automated claims.

Finally, to have a complete picture of their competencies, research information about the technology stack they have mastered. For example, if you plan to release a mobile utility to reach wider audiences and want to make it available on Android and iOS, see whether they refined their techniques in cross-platform programming or, if you are focused on hi-tech advancements, audit their blockchain solutions.

When you find the evidence of an insurance software developer’s might, initiate a discussion with the candidates to define how well they explain complex terms and how eager they are to embrace your challenge.

Summing up

We hope our extensive brief helped you narrow the divide between your ideas and their realization. It won’t be daunting to navigate through the process of building portals with accurate analytic systems and high defense when you know the workflow and the features required.

Although we tried to describe all the essentials as broadly as we could, it was impossible to outline all the fundamentals of creating a risk management portal. Otherwise, it would take a day to get a good grasp of it. However, contacting Limeup will save you time since we’ll discuss your project in the frame of its characteristics without dividing attention on side aspects.

If you have a goal to partner with a reliable and leading insurtech software development company that possesses experience in delivering high-quality custom applications, reach out to us. Let’s see what we have for you.