How to Choose an Insurance Software Development Company (2026)?

Joining forces with an insurance software development company will help you serve your clients in the way they prefer: via customer portals and mobile applications or through a phone call. And it can be challenging to navigate through multiple firms when selecting an InsurTech partner. To support you in choosing the right firm, we’ve done this extensive analysis.

We’ve compiled this list of the top insurance software development companies after reviewing hundreds of vendors worldwide using the following criteria: industry experience, services provided, and completed projects.

After assessing their insurance software development services, you’ll get insights into their approaches and accomplishments that will allow you to evaluate and compare their client testimonials, cooperation models, and team sizes. Use our guide to make a data-driven decision and streamline policy management, underwriting workflows, and error reduction.

List of insurance software development companies

Founded: 2017

Headquarters: London, United Kingdom

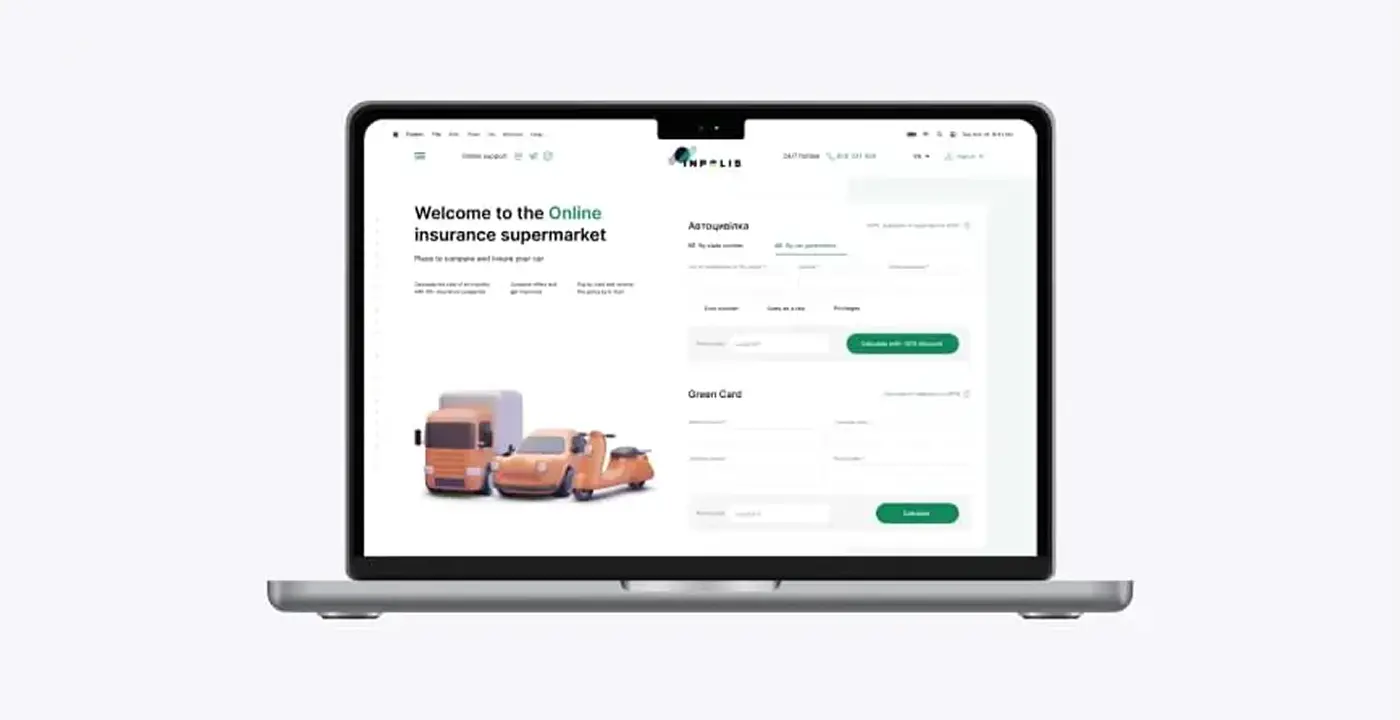

Limeup is a provider of custom insurance software development services with expertise in meeting regulatory requirements for PCI DSS, GDPR, and HIPAA for health insurance. Following Agile methodology, we launch new products quickly, adapting to trends and implementing emerging technologies, such as AI, cloud computing, and blockchain.

Our team of 80+ experts has delivered 200+ successful projects. We’ve partnered with industry leaders, such as Vodafone, Connect, Inventor, and Hotline.Finance, an online insurtech marketplace that has helped their customers choose and purchase over 2,000,000 insurance policies online.

Key services:

Industries:

Why choose us:

Whether modernizing legacy systems or building software from scratch, our partners profited from entering new insurance markets and improving pricing and underwriting through analytics, having earned $36 million in total revenue after integrating our solutions.

Select case studies:

- Limeup has developed a secure online platform for Trading Finance for crypto investors. Its design is simple, enabling newcomers to navigate through the app quickly. Users can bookmark currencies and features for fast access, get rewards, buy and sell assets, and share their experiences through affiliate programs.

- ApexAssure cut processing time by 35% through automation tools, and client interactions increased by 25%. A WebSocket integration streamlined request handling. The system manages 5,000+ policy events per week without downtime.

- Conduct further investigations into various success stories.

Founded: 2017

Headquarters: Berlin, Germany

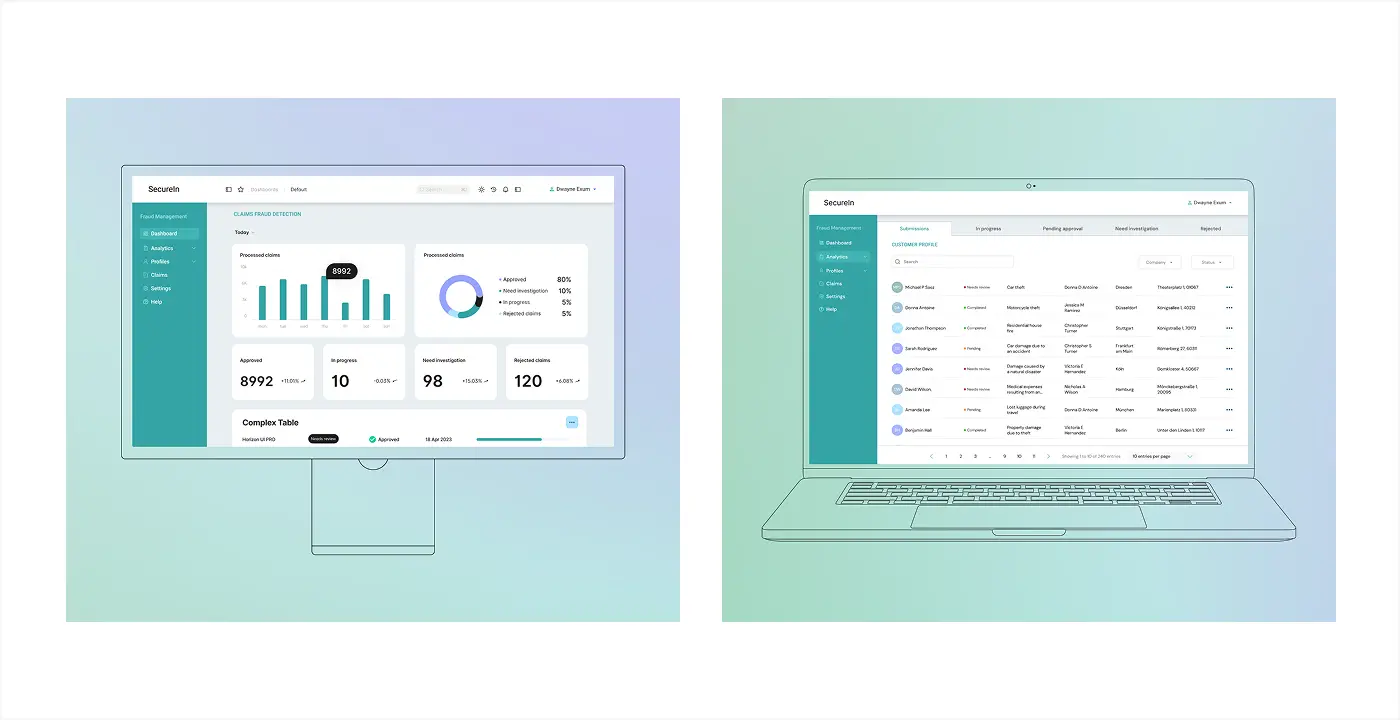

As an insurance software development services company with knowledge of the European, British, and American markets, impltech can be a reliable vendor to help expand your business presence and increase your customer base.

Their 80+ developers build unique systems with smart automation and AI-driven fraud-detection tools as well as claims management platforms that deliver enhanced speed and accuracy.

Key services:

Industries:

Why choose them:

Having completed 100+ projects, impltech professionally solves problems such as slow service, high operational costs, disconnected systems, and regulatory compliance issues. The team’s platforms help reduce administrative overruns, accelerate processes by 30%, improve accuracy across departments and offer better personalization.

Select case studies:

- impltech has put maximum effort and skills into establishing an efficient and invulnerable platform for Traders.One. The result is a combination of cutting-edge technology and an attractive user interface and experience, with an emphasis on secure data storage and hassle-free operation.

- To bring into being a complex design for the i88 trading platform, impltech employees ensured smooth navigation for trade administration, currency filtering, and dashboard changes. This web and mobile application attracted many crypto enthusiasts within the first months owing to SEO and PPC.

- See more in the catalog of works.

TechMagic

Founded: 2014

Headquarters: Kraków, Poland

Oleh and Lidia Dats, along with Andrii Kuzmych, started this custom insurance software development company a decade ago. Since then, the supplier has built and integrated multiple solutions, from insurance quoting software to claims and policy management tools. Their platforms comply with regulations, including AML, FCA, and GDPR.

Services: Custom software dev, mobile app building, AI construction, cloud consulting.

Industries: Risk management, medical, media, information technology.

Why choose them:

With a strong background in fintech and understanding of specifics of insurance companies’ workflows, TechMagic is capable of streamlining processes and enhancing accuracy to ensure good customer service.

Select case studies:

TechMagic has been contracted by a multitude of enterprises, as illustrated by the portfolio of works. They depict partnerships with Boopos, TITAN, Bluepallet, and other notable entities.

N-iX

Founded: 2002

Headquarters: North Miami Beach, FL, USA

N-iX operates in 25 countries across Europe and America, which proves that this studio is among the global insurance software agencies. They have worked with dozens of field leaders and Fortune 500 corporations.

The team helps insurers modernize their systems by re-engineering applications and migrating them to the cloud. They also automate reporting, document processing, claims, and underwriting, enabling businesses to cut operational costs.

Services: Software development, IT staff augmentation, BI & big data advisory & SI, AI crafting.

Industries: Financial protection, manufacturing, retail, financial resources, healthcare, automotive.

Why choose them:

N-iX is an ISO 27001 and 9001-certified company with a knack for high-quality management and data security, which are essential for productive cooperation.

Select case studies:

Their completed projects provide you with many details, but the names of companies are hidden due to NDAs. For example, N-iX helped a finance firm speed up tax calculations and improve the customer experience.

Avenga

Founded: 2019

Headquarters: Kuala Lumpur, Malaysia

Avenga has over 20 years of expertise in financial & insurance software development services. They have successfully developed many cloud, fraud detection solutions, and BI toolkits for their clients. The company leverages emerging technologies to create intuitive underwriting solutions and revamp insurance operations.

Services: Custom software development, cloud mentoring, CRM consultations, IT staff addition.

Industries: Insurtech, medical care, pharmaceutical & life sciences, automotive.

Why choose them:

They produce intuitive, user-friendly software that truly walks customers through the underwriting process.

Select case studies:

The agency’s reputation is further strengthened by featured project’s highlights that showcase its role in applications such as IQVIA, Intel, SwissLife, and other outcomes.

Binary Studio

Founded: 2005

Headquarters: L’viv, Ukraine

Two decades in tech have taught this insurance software development agency to see beyond the code so they can center on what matters: venture value, not fleeting trends. By approaching each project with an open mind, the team ensures that the systems they build will evolve along with their clients’ ambitions.

Services: Software construction, mobile application implementation, web development.

Industries: Financial security, medical, real estate, education, fintech.

Why choose them:

Their reputation is built on transparent communication and results that can be relied upon. This supplier prefers mutually beneficial partnerships to dubious short-term victories, so everyone who applies gets complete immersion in the idea and high-quality finesse.

Select case studies:

Over the years, their success stories have helped firms like EasyMoney, Indigo, Options Plus reinforcing their know-how across dissimilar tech stacks.

CHI Software

Founded: 2006

Headquarters: Limassol, Cyprus

CHI Software’s insurance software integration experts helped to establish a whole new era in the claims industry through high-precision engineering, leveraging the added value of AI and big data. It is worth noting that this enables the formation of enterprise resource planning (ERP) systems, predictive analytics tools, and document filing and organization modules.

Services: Generative AI, custom software development, IoT formation.

Industries: Information technology, risk management & financial security, media, education.

Why choose them:

They opened a center in 2019 that focuses on AI research and development to further strengthen its commitment to innovation and open up new horizons for partners. They help quickly identify workflow bottlenecks and low-value operations that hinder commercial blooming.

Select case studies:

Their impressive project repository highlights successful undertakings, emphasizing a commitment to quality and efficiency.

Innowise

Founded: 2007

Headquarters: Vilnius, Lithuania

Innowise is an insurance digital solution provider specializing in developing advanced systems that help risk coverage organizations optimize policy operations, improve accuracy and control, and enhance consumer service.

Combining extreme mechanical skills with market competence accumulated over the years, specialists solve problems of any complexity and scale, always following the highest coding quality standards and a philosophy of sharing smart discoveries.

Services: Blockchain, AR/VR structuring, custom software building, cloud optimization.

Industries: Insurtech, automotive, government, education, gaming, gambling.

Why choose them:

Focusing on automation and inspiration, Innowise creates solutions that help save time and stay ahead of the competition.

Select case studies:

Due to NDA provisions, detailed information about sublicensees cannot be disclosed, but the extensive portfolio of works demonstrates the production of cutting-edge digitized packages.

Stratoflow

Founded: 2013

Headquarters: Wroclaw, Poland

Stratoflow is a leading insurance software development company as it builds life, aviation, marine, government, energy, and climate risk insurance software. The firm is suitable for startups because it offers pre-made application templates to accelerate time-to-market.

They offer clients the option to develop an MVP in 4 weeks after clarifying the scope of work.

Services: Custom software development, research, software integration.

Industries: Insurance, finance, travel, eCommerce, real estate.

Why choose them:

Clients advocate for the Stratoflow project management approaches. Adam Hill, Legerity’s CTO, praised the team’s technical knowledge and flexibility in terms of adapting to changing requirements.

Select case studies:

The Opencoda platform is one of Stratoflow’s project highlights. The agency launched their own product to address the challenges insurers face when they want to build new solutions or update legacy systems.

DICEUS

Founded: 2011

Headquarters: Wien, Austria

DICEUS is a long-standing provider of end-to-end insurance development services. The team has delivered 150+ projects, building individual and group insurance portals, policy management tools, health, life, app, travel applications, and broker platforms. The supplier is well-suited for companies seeking ready-made insurance solutions.

Services: Cloud & SI, IT strategy advisory, custom software structuring, web design.

Industries: Policy market, financial amenities, information technology, healthcare.

Why choose them:

The crew cooperates with recognized industry leaders, including Fairfax Group, UNIQA and WTW. DICEUS is an official Microsoft, Oracle, and Google Cloud partner.

Select case studies:

It took 2 years for 10 developers to build a single cloud database for businesses to manage their clients and records. The RiskVille project and others can be seen in their completed work.

What is an insurance software development company?

An insurance technology development supplier specialises in insurance software development and modernization. Such software development companies in the UK, Europe, and the USA help brokers and agents save time, reduce costs, and improve the efficiency of their activities through automation.

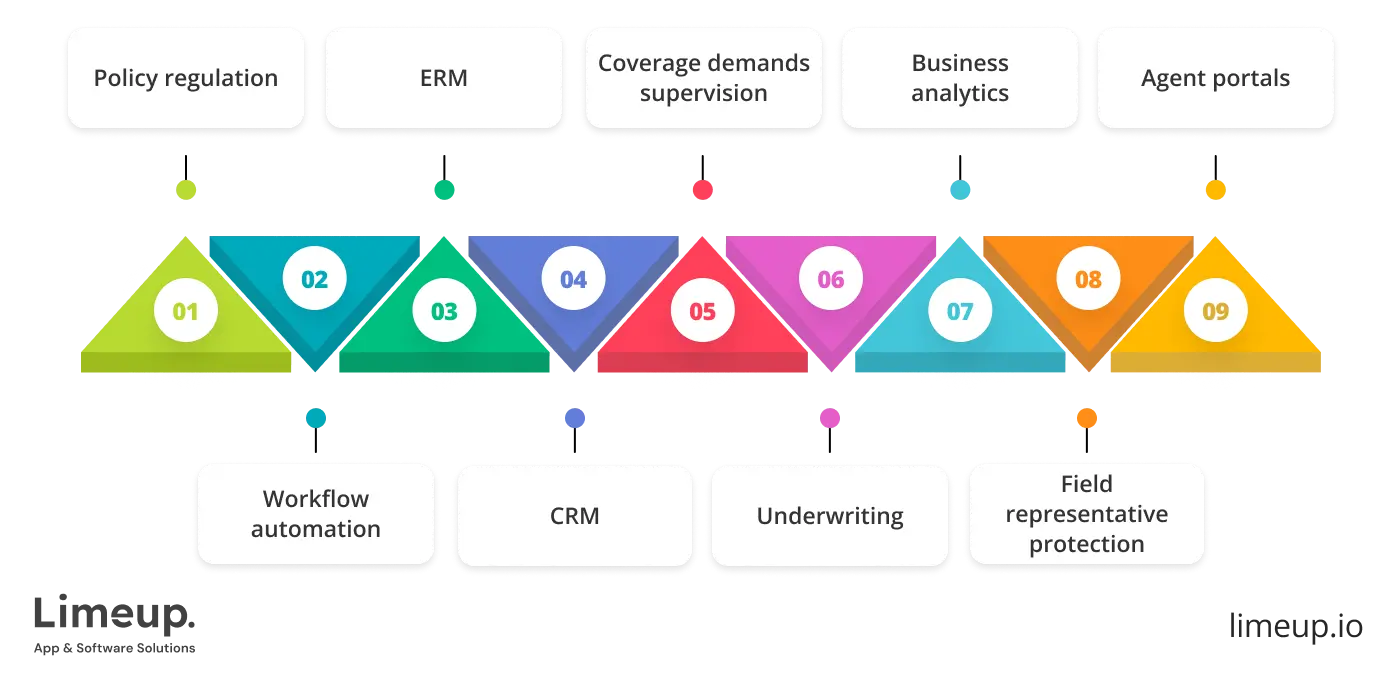

The scope of insurtech vendors’ deliverables is diverse, and it includes:

In such a cooperation, you will benefit from a custom-built system that aligns with your business processes without excessive hassle, as team onboarding and management are handled by the provider.

Understanding what an insurance system developer will help you understand whether their skills match your requirements. In the following sections, we’ll explain to you how to find a suitable insurtech software development firm. We’ll begin with a juxtaposition.

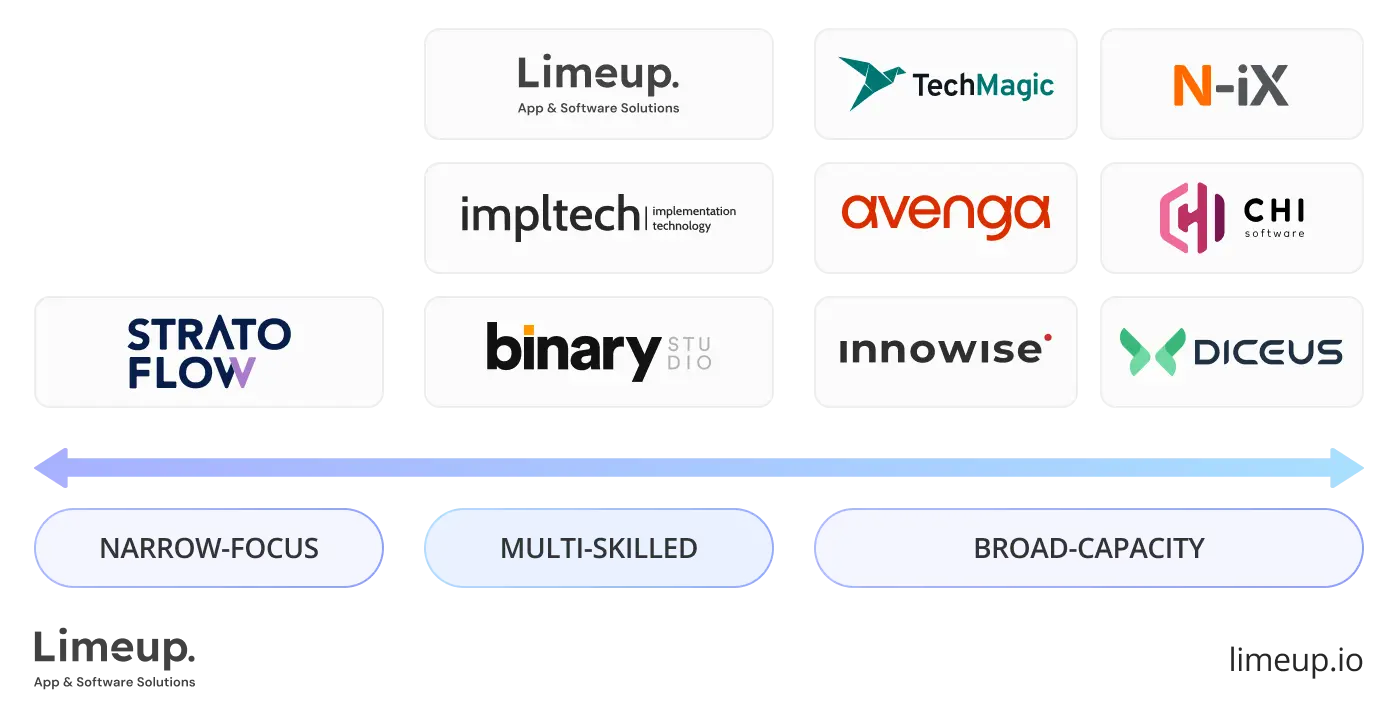

Comparing insurance software companies

Our comparison of the metrics, such as portfolio, client rates, team size, and pricing approaches, will save you time browsing each firm. Information from Clutch, Google Maps, Glassdoor, Trustpilot, and their dedicated pages will allow you to make a quick yet informed decision.

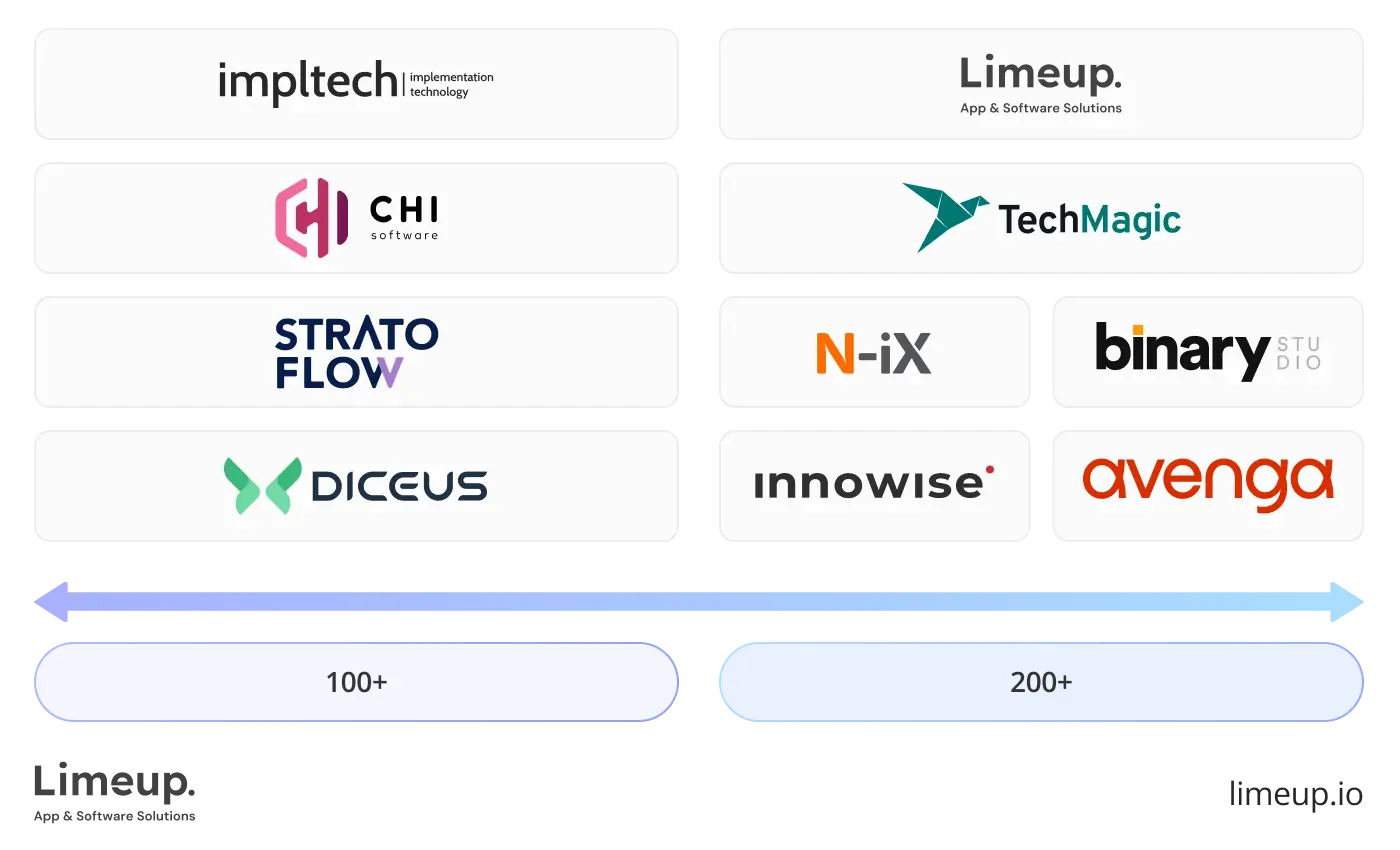

Project portfolio

Insurtech solution vendors rarely share all their success stories. When such records are available, we place them in the appropriate category. If a company doesn’t specify the number of completed projects, we disclose the closest estimate based on our analysis of their case studies. So if you need more details, it’s better to contact the agency directly.

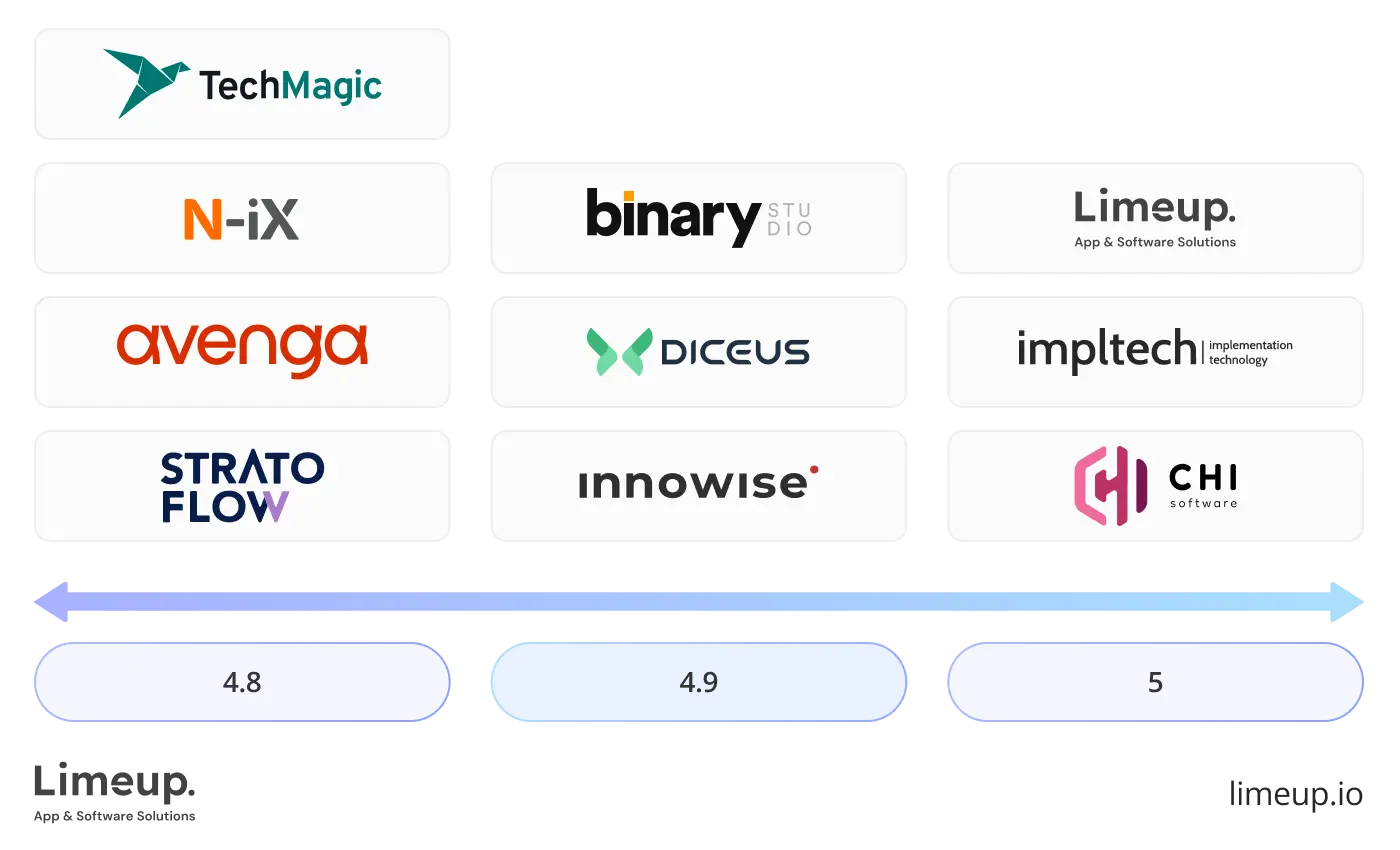

Client reviews

We included in our directory only those insurance app development companies that have trustworthy client testimonials. Utilizing data from Clutch, we evaluated the criteria by which companies have been rated by their partners: pricing, quality, deadlines, and willingness to refer.

Below, developers’ rates are presented. Those with customer satisfaction scores of 4.8 and 4.9 can be trustworthy partners who deliver real business value on time and within scope. Firms with the highest 5-star ratings across multiple evaluations are flexible and expert partners.

Team size

If you are aiming to build a simple solution to store and manage policy or a payment processing tool, the number of members is not the most decisive criterion.

A smaller team tends to be more dedicated to your project. A larger pool of specialists typically means a firm can upscale a crew in no time.

Pricing models

The most adopted cooperation approaches include:

- Dedicated team (a partner allocates a team of a few developers, and they work exclusively on your project for a specific period of time).

- Staff augmentation (tested specialists of specific roles you are looking for are connected with you in no time).

- Fixed price (you determine the requirements, and your partner delivers the program within an agreed period of time).

Below, you will find a table featuring the models of delivering insurance technology development services.

| Company | Dedicated team | Staff augmentation | Fixed price |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ➕ / ➖ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ➕ / ➖ |

| | ✅ | ✅ | ✅ |

| | ✅ | ✅ | ➕ / ➖ |

Not all agencies state their cooperation approaches clearly. That’s why, for some companies, we included +/- markings to indicate the models’ availability in service and case study pages.

Once you understand the difference between agencies, the next step is to thoroughly evaluate potential candidates to determine whether their experience and qualifications match your objectives.

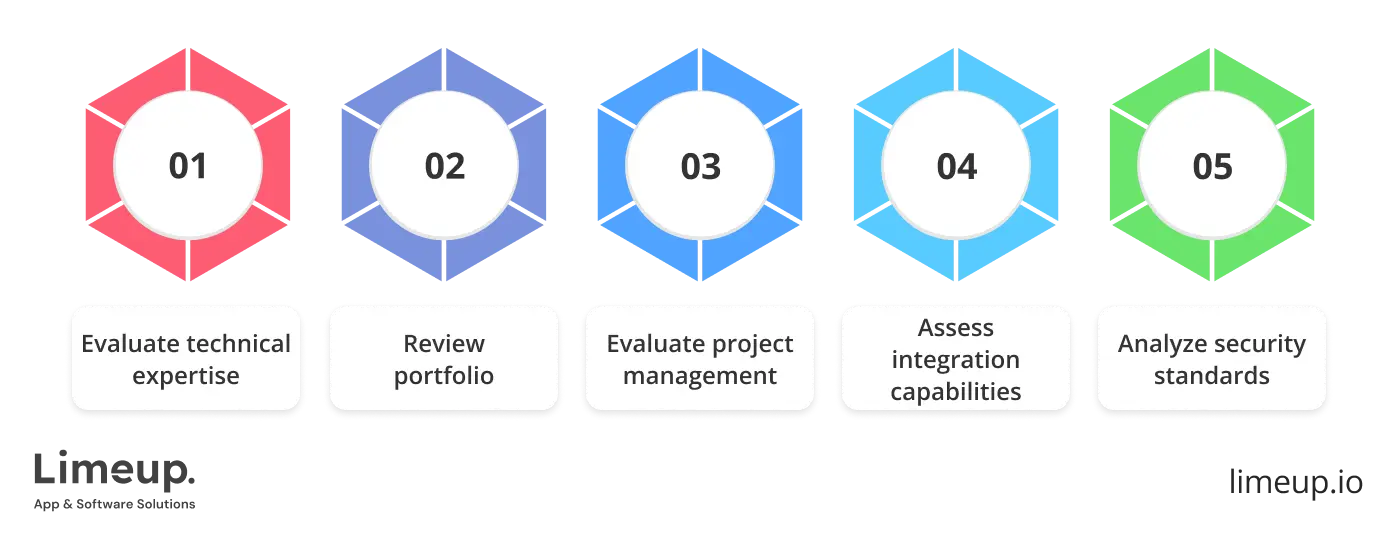

How to select an insurance software development firm?

Today, when asking who to trust when developing a product for the claims sector, owners fall into the trap of oversupply. Based on the data presented in the Business Research study, the global insurtech market is projected to reach $59.57 billion by 2033, growing at a CAGR of 3.60% a year.

That is why our experts have compiled a list of decisive criteria for choosing a worthy insurance technology development provider who is likely to not only solve your problems but also facilitate the path to prosperity.

Evaluate the vendor’s domain expertise

How well do developers understand the workflows in your industry? You can explore this topic by checking the following sources:

- Completed projects

- Services pages

- Industries

Most custom insurance software development companies we’ve outlined provide breakdowns on their solutions at least in one of the mentioned sections. Reviewing completed projects, you’ll see the exact results of their work. For example, there may be the notion of achieving 60% time savings through automation. Or, you can see that adoption grew by 20%.

On the service and industry page, they list the solutions they deliver. They range from cross-platform applications to security advancements and insurance CRM.

Assess communication

Timely reporting and clear technical question explanations will ensure mutual understanding and on time delivery. By contacting several studios directly, you’ll be able to evaluate their answers in terms of responsiveness and trustworthiness and hire software developers with good soft skills.

When communicating with coders, please pay close attention to what channels they use, how they speak, and what they tell. The discussion of technology shouldn’t feel like a mind-bender where your main task is to decipher their messages.

Review security standards

Insurance software must comply with regulatory requirements. It’s PCI DSS for money transactions, GDPR for security, and local data protection laws. Reviewing competitors’ systems and agencies’ completed projects, you can find exemplary solutions that align with your idea.

Additionally, you can contact the insurance software developer of your choice (which you can shortlist based on the comparison above), and clarify their technical measures to protect software from unauthorized access, data leaks, and downtime.

Check integration capabilities with core insurance systems

If you want to connect new custom software with Duck Creek, Guidewire or any other off-the-shelf solution, clarify whether the provider’s deliverables are compatible with your existing system (billing, CRM, claims) to ensure that they understand how to work with your current assets.

Look for fintech software development companies that can show you specific examples of how they’ve handled integration without disrupting a client’s day-to-day business, particularly cases where they maintained business continuity during transitions from old systems to new ones.

Analyze scalability

Insurance software development agencies’ expertise in building scalable solutions determines whether your system will grow alongside your business demands. Evaluate their capacity to handle increased transaction volumes and evolving regulatory requirements without performance degradation.

Successful developers demonstrate experience scaling platforms from regional operations to national or multi-market deployments. Make sure they support a suitable resource allocation model which means they can quickly mobilize additional development teams during critical growth phases.

Once you’ve identified the right insurtech partner for your business, the next key consideration is pricing.

How much do insurance software development services cost?

The value of generating actuarial suites depends on several key factors and varies based on the stakeholders’ capabilities and needs. However, there are general indicators that can guide you at the very beginning of the journey, before discussing details.

Look at this table, which provides approximate figures for carrying out a project based on its features.

| Basic insurtech software hybridization | ||

| Features | Estimated price-tag | Good for |

| Basic policy conduct with a simple customer portal and few integrations | $30,000 – $80,000 | Small agencies aiming to automate simple procedures without complex features |

| Mid-tier underwriting software construction | ||

| Features | Estimated price-tag | Good for |

| CRM-integrated claims control and customer portal featuring basic analytics and automated notifications | $80,000 – $200,000 | Mid-level insurers wanting enhanced integrated computing solutions |

| Advanced risk management software production | ||

| Features | Estimated price-tag | Good for |

| Comprehensive protection administration with AI underwriting, predictive analytics, and multi-channel support | $200,000+ | Large companies or corporations that require comprehensive and individualized solutions |

Asking for an estimate for a project before you hire fintech developers will help you evaluate different offers and choose the best. However, the lowest bill doesn’t always mean the most cost-effective solution, as specific expense lines are sometimes billed separately. Read further to know what to look for.

Hidden fees by insurance software developers

These fees, such as the cost of compliance audits, data migration, and regulatory changes, mount up as the process unfolds and are not always clear until the bill arrives.

- Integration & API connection fees. The ongoing maintenance cost of the API contributes +8% to +12% per year.

- Infrastructure & hosting setup. The cost of setting up the infrastructure can, at times, be charged separately from the main budget.

- Support tier upsells. It adds $2,000 – $10,000 per month based on service level agreements, including 24×7 support, expedited handling of issues and support staff.

Awareness of these extra charges helps understand where these costs come from, enabling effective contract negotiation.

Key cost factors in custom insurance software development

Now, let’s discuss the important points that need to be considered concerning the cost of insurance software development:

— AI/ML premium. Specialized AI or machine learning experts’ services cost $100 – $200 per hour, up 25% compared to 2024. Understanding of advanced LLMs, prompt design, and AI integration translates into substantial market value across industries.

— Insurance domain. Vendors who have certifications in Guidewire or Duck Creek charge additional 20 – 30% for their expertise. In-depth knowledge of insurance sector workflows, underwriting, and claims management remains in high demand.

— Compliance expertise. “Know-how” in the area of GDPR, CCPA, and other insurance industry-related regulatory requirements can increase rates by 15% to 25% or more. In today’s global regulatory landscape, understanding data protection and industry-related compliance demands has assumed prime importance.

— Cloud architecture & DevOps. Cloud expertise in AWS, Azure, or GCP and knowledge of containerization technologies can affect your budget, especially when you have a large customer base.

— Vendor-specific technical certifications. Salesforce, Workday, ServiceNow certifications increase rates by 12% – 22%.

The next section discusses the variation of base rates and premium multipliers by geography, based on expertise in developing these tools.

Average pricing by region

The cost of insurtech software development varies dramatically by region, influenced by local economic conditions, developer expertise, infrastructure maturity, and market demand.

| Region | Junior developers | Mid-level developers | Senior developers | Specialized (AI/ML/Blockchain) |

| North America | $35 – 60/hr | $70 –100/hr | $100 – 160/hr | $120 – 200/hr |

| Western Europe | $35 – 55/hr | $50 – 75/hr | $80 – 120/hr | $110 – 180/hr |

| Eastern Europe | $25 – 40/hr | $40 – 65/hr | $60 – 90/hr | $70 – 130/hr |

| Latin America | $25 – 45/hr | $40 – 60/hr | $55 –85/hr | $65 – 120/hr |

| Asia (India) | $15 – 25/hr | $25 – 45/hr | $40 – 70/hr | $60 – 110/hr |

While outsourcing to offshore regions like Eastern Europe and Asia offers significant cost savings, regional differences in time zones, communication capabilities, and technical infrastructure affect the overall value proposition.

What to ask when selecting a vendor for insurance software development?

Before you hire a dedicated developer, make sure they don’t just create software but bring measurable business value. Featured outcomes questions will guide you in what answers you can get from an experienced supplier.

The list wouldn’t be complete without clarifications on updates and feature enhancements after launch and contract provisions.

Business outcomes

Specific industry outcomes will be available to ensure desirable results are achieved. Namely, if you are seeking to scale your system to support a larger customer base or increase revenue by expanding your product line, a clear explanation of related results that go beyond a short description of case studies on their website will be proof of their accomplishments.

- Do you build solutions that enable cross-selling and upselling opportunities?

Insurance software vendors with a track record of successful insurtech projects know how to create systems that will help you generate more revenue streams without overall cost escalation.

- Do you have any case studies showing trackable cost reduction?

Automation and modernization help reduce manual tasks and drive employee productivity. Inquire about the specific projects that demonstrate clear expense optimization through their software.

- How can your software improve customer satisfaction?

Insurance software development firms personalize customer experience by using AI, accelerate processing time, allowing them to complete their operations quickly without hassle.

Contractual terms questions

A contract with an insurtech development partner should address critical aspects, including scope changes, intellectual property rights, and performance obligations, to protect your investment and ensure business continuity.

- How are changes in scope handed legally?

Look for firms that document scope modifications through formal change requests, outlining timeline and cost adjustments.

- Who owns the intellectual property of custom software?

Ascertain that the contract with an insurance software company explicitly transfers all IP rights to your organization upon project completion.

- What are contract obligations for deadlines, outcomes, and project outputs?

Seek partners with provisions for performance guarantees and remediation if deliverables don’t meet agreed terms.

Post-launch support questions

Deployment isn’t the final step in software development. Ask the insurance software engineering vendor of your choice about the steps they take to ensure that your system is good with end users.

- What post-launch options are available?

The standard package includes security patches, feature improvements based on clients’ feedback, and monitoring.

- What is your response time in addressing issues?

Critical issues should be addressed by insurance software development companies in 15-60 minutes. Ascertain that your future partner has a clear plan for low and top-priority matters, which is vital for customer satisfaction.

- How long does support last, and what are your guarantees?

You and your technology partner will agree on the terms and conditions before development starts, during the planning stage. Service-Level Agreements can be short-term (1 – 3 months) or long-term, with annual renewal.

Looking for an insurance software company?

Today, businesses want a seamless, personalized experience with 24/7 access to resources across all digital channels. This is precisely what insurtech coders are focused on.

Now you know what to ask a potential partner and understand the factors that affect engineering costs, so evaluating agencies and choosing the most experienced supplier will not be challenging.

If you want to partner with a reliable provider of custom insurance software development services without any delays, schedule a free call with Limeup, where professionals are experienced in accelerating product rollouts, lowering customer service costs, and improving regulatory resilience.

FAQ (choosing & comparing)

How do I know if an insurance software vendor is reliable?

There are several methods to check a company. First, they should include a section on partnering with established companies on their website. Secondly, the agency must have a registration number to be allowed to work. Thirdly, make sure they have client testimonials on comment aggregators, in addition to their own company pages.

What are the red flags when selecting insurance software providers?

When choosing an insurtech vendor, be aware of the following red flags:

- Zero information on the Internet

- Negative client testimonials

- Too little information on their websites

Which criteria matter most when comparing insurance software developers?

The types of projects the team has completed will illustrate their outcomes and industry experience. Their rates on independent websites will give you insights into their management and pricing approaches.