Fintech Software Development: Comprehensive Overview

Fintech software development for non-tech-savvy people may seem like sweating bullets in a snowstorm, but when done right, it’s able to automate processes, enhance security and improve customer experience, which simultaneously keeps you in the driver’s seat of the cut-throat fintech industry. In this summary, you will be presented with core points that reveal all the nitty-gritty behind this topic.

Leveraging our experience in software development for fintech, Limeup experts will lead you through the labyrinth of the digital product creation process, revealing how to build a reliable solution, types of systems, the budget needed, tech stack, and more.

Since the global market of this niche is predicted to reach over $1152.06 billion by 2032, fintech custom software development is a VIP pass to the first line of demand area and revenue increase, so after reading this article, you will be able to receive an overall review of financial technology implementations and ways to benefit your business.

For companies entering this competitive niche, collaborating with an experienced software development company in the UK ensures access to top engineering talent and compliance with the latest fintech regulations.

What is fintech software development?

The fintech industry has been generating a lot of buzz recently and is predicted to grow to $644 billion by 2029. In this respect to digitalization, the engineering of financial software becomes very necessary. Digital finance has thus set a very high bar for new entrants in the niche.

The term is coined from the abbreviated form of financial technology, which spans any applications that facilitate international transactions through digital channels.

Instances of the digital approach for tech-driven finance include mobile applications for banking, cryptocurrency trading platforms, crowdfunding investment tools and robo-advisors. All of them have the same goal: maximization of and automation in management, providing smooth and pleasurable experiences to customers.

Everyone concurs that compared to other sectors such as food, transport and health, next-gen finance dev is much more demanding when it comes to security. We owe an appreciation to programmers for their fintech software development services and for contributing to inculcating healthy savings behavior using personal finance tools and to enabling cross-border money transfers utilizing payment applications without incurring exorbitant fees.

As financial software development continues to evolve, the stakes are higher than ever. The pressure to stay in first place is immense, as competition is fierce and innovation is the name of the game. Only businesses that fully leverage the possibilities of a custom app or else build one will survive and flourish in this frantic market.

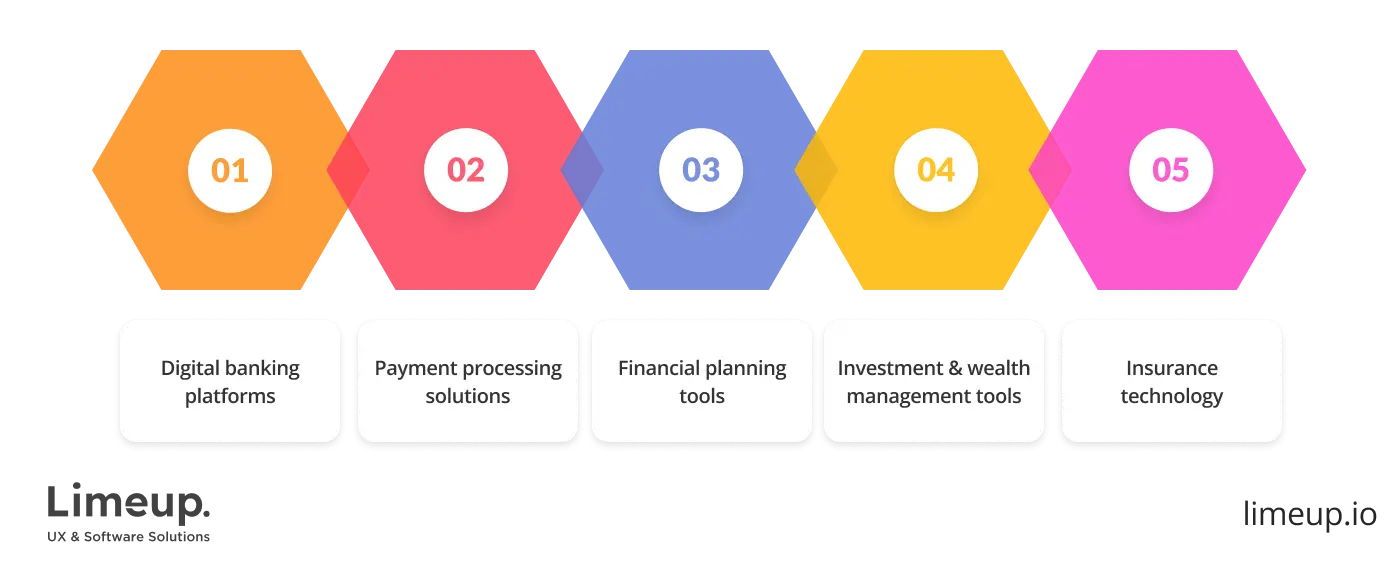

Types of fintech software

A number of important types of programming are at the heart of the dynamic field, propelling various facets in financial services, from productivity to ingenuity. As you dig into this exciting technology landscape, you are going to bump into all sorts of such creations that will automatically fit the complexity of traditional finance into simple and easy solutions.

— Digital banking platform

This implementation involves designing of all-around internet and mobile banking systems to build fintech software that makes operations easy and convenient for users. These are platforms that perform more than just keeping your account, money transfer and bill payments. They are meant to provide an all-in-one digital experience where complex tasks are reduced into simple actions at the push of a button.

— Payment processing solutions

Payment processing platforms convey safe and reliable ways for buyers and sellers to conduct transactions. It wraps the creation of systems for online transfers, digital wallets and credit card payment, ensures that money flows freely as water, thereby enriching customer satisfaction and trust.

Effective and profitable payment processing solutions smooth procedures, make services frictionless and consistent for both consumers and business units, foster confidence and further improve the overall transaction experience.

— Financial planning packages

Preparation tools concern the creation of toolsets that will help people and businesses maintain their finances, create budgets, and plan for long-term goals or objectives. These organization instruments help in tracking expenses, setting savings goals and investment planning, among many other features that keep one’s banking house in order.

The goal is to have users understand the direction for deployment and possible freedom routes so that they make proper choices on their own accordingly. As they empower users to take charge of their destiny by providing them with valuable data and information in a clear and understandable format, such aid in the accomplishment of goals with confidence.

— Investment and wealth management tools

Managing one’s investment portfolio and increasing wealth have been identified as investment and wealth control instruments — they shed light on market trends, portfolio performance and risk management. The idea is to create fintech software that makes investing a walkover with sophisticated analytics and customized recommendations.

That is to say, the user should be able to maximize the returns toward the financial aspirations with minimal effort. Investment resources leverage trailblazing technology to create plain sailing in asset management, automating complex processes and offering clear insights that simplify investment strategies.

— Insurance technology (InsurTech)

InsurTech refers to pioneering solutions in the industry, including underwriting claims processing and customer relationship management plugins. InsurTech irons out the wrinkles in the defense process, bringing efficiency and enhancing the customer experience.

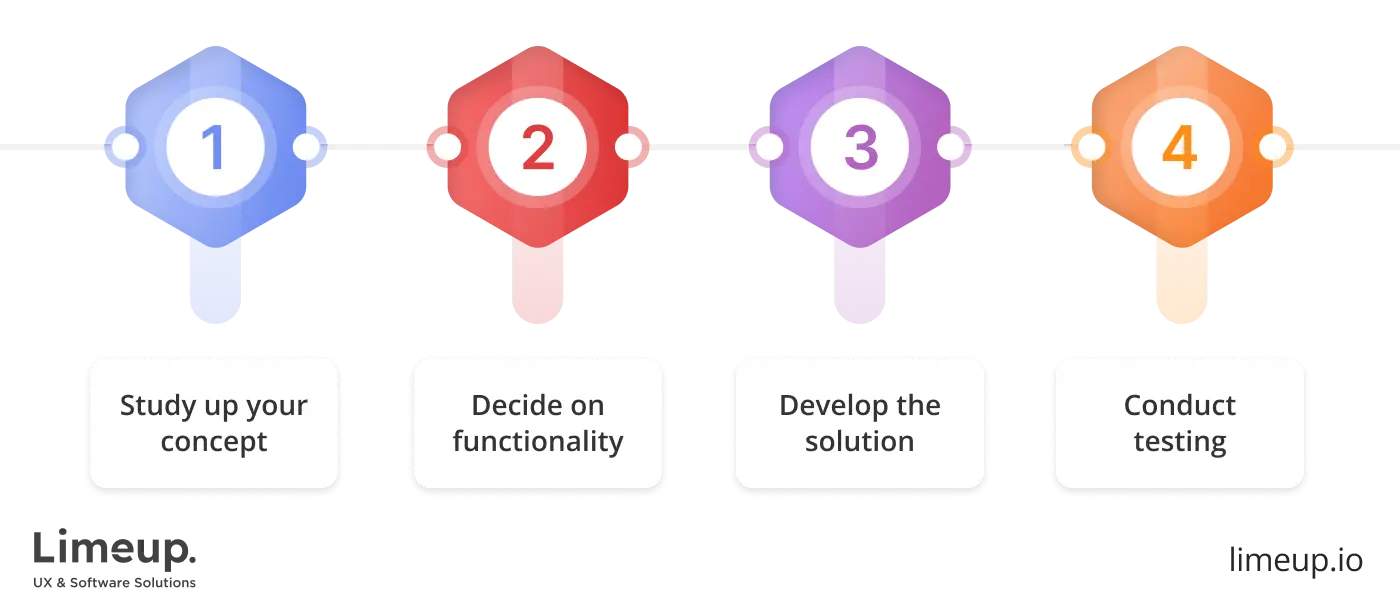

How to build fintech software in 4 steps?

There’s a lot of work to do and we are not trying to scare you yet warn and arm you with the required data so that you will not feel like hammering water into ice with this large task. Yes, managing finances has become a common routine for your potential customers so you have to represent them with a product that provides more than custom features.

We will describe each part of this challenging process and you will feel more confident, having a step-by-step plan on the journey to your revenue-driving platform.

Step 1. Study up on your concept.

Such a complex task can’t be completed overnight, so we recommend focusing on your idea and representation that will be useful for future end-users since you have to launch a product that will be available for new kids on the block in this niche and professionals.

We also would like to note that fintech software engineering involves in-depth analysis of target audience pain points, market and competitors research in other words everything that can reveal hidden insights about in-demand programs.

Step 2. Decide on functionality.

From compliance needed to scalability, without this stage you can leave the idea of creating any type of system since it will be equal to driving at night with the lights down, like you still can do it but it’s a little unproductive and definitely will not lead to good results.

If this analogy sounds not convincingly enough to you, let’s focus on more down-to-earth points like regulatory compliance, yes, it’s more dangerous since practices like Know Your Customer (KYC) and Anti-Money Laundering (AML) are the backbones of financial-related laws that have to be followed if you don’t want to be left behind the ship.

The features you choose will also affect security, UX design, required integrations with payment gateways or banking APIs, and even the ways to monetize your system.

Step 3. Develop the solution.

Well, three words that describe a process that may last for years depending on the complexity, right? Based on our over a decade of experience, they are the best way to describe this stage without spending hours to explain it in 100 words, so let’s define it closely.

The procedure is aimed at strategic planning as a vital part of your project and the only way to get to the next level and reach your objectives, and the most straightforward approach is to contact and hire fintech app development firms.

Based on our decades of experience and knowledge, experts from Limeup prove that proficiency in related product engineering makes it possible for business owners to receive hassle-free collaboration and save money with risk-free partnerships.

Step 4. Conduct manual and automated testing.

To be-all and end-all part of your digital journey that can’t be missed (we know that we told the same about previous ones, it all depends on our expertise) since it enhances vulnerability protection, accuracy in financial operations, optimization of performance.

Another crucial moment stands for bug fixing since you have to ensure the solution works well within core features reliable to your platform, for example, if it’s an app for transactions, check if creating new accounts runs smoothly.

To make this process more pleasurable, we recommend reaching out to a provider with a reliable background in fintech software development solutions crafting.

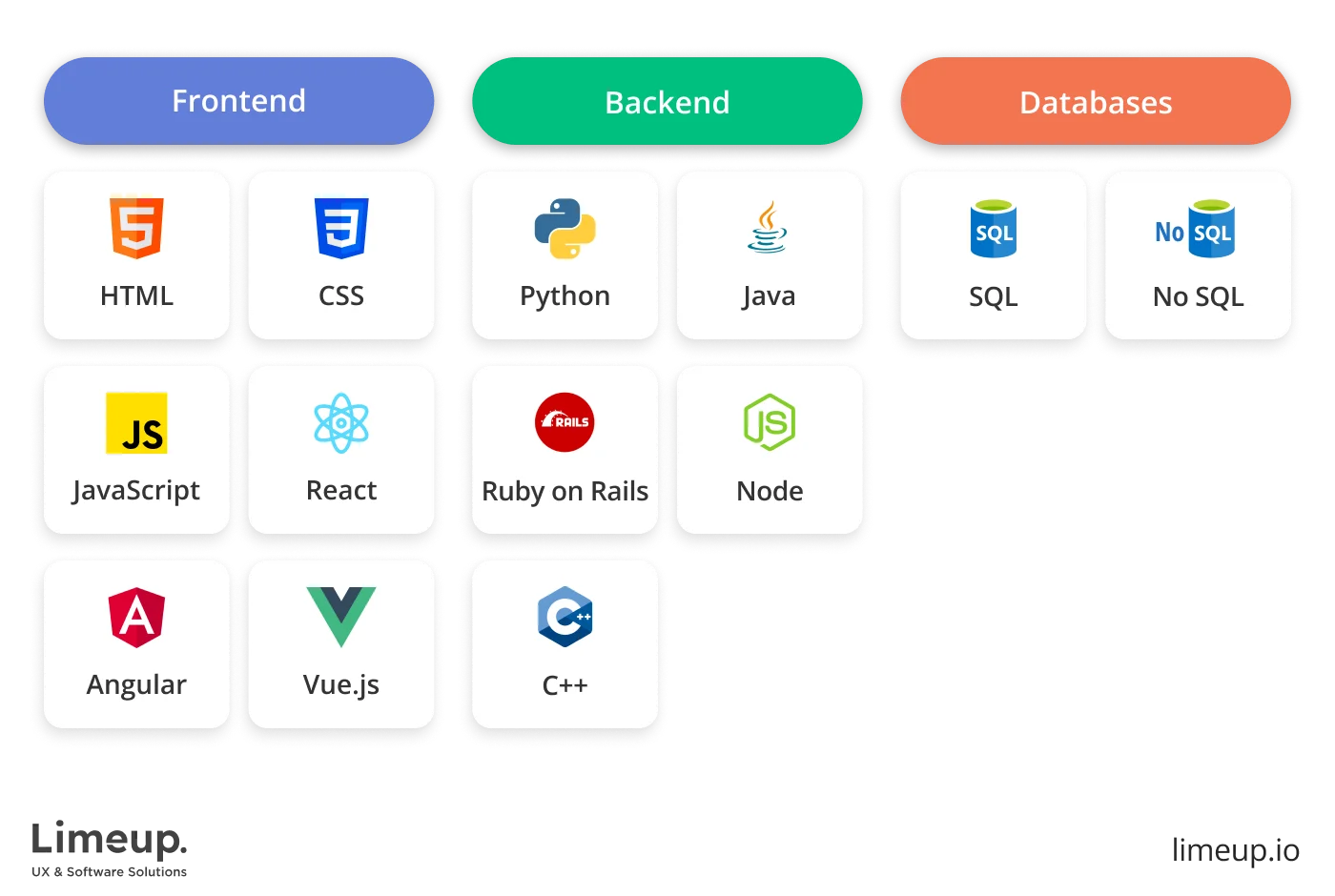

What is the technology stack for financial software development?

Programming languages and tools for creating financial applications are all building blocks of the tech stack. Mainly it has three layers: front-end, back-end where the first layer handles the user-facing portion of the system, the second administers the server-side functionality and the data layer manages information storage.

Besides, to round out the tech stack APIs, cloud services, containerization, DevOps tools and security frameworks are leveraged as further components of technology chain.

Front-end. A fintech software developer should wisely choose inventions to create a profit-oriented user interface that leads the users through quick, responsive and ease-of-use interfaces. Here are a few of the most widely used programming languages:

- HTML. Web pages are capable of being organized with various elements such as headers, paragraphs, links and images using the markup language HTML.

- CSS. The stylesheet language CSS assists web developers in designing a webpage layout, its colors and fonts while keeping appearance separate from content.

- JavaScript. Due to JavaScript, today it is possible to add animation, reaction to user action and dynamic content to a website.

- React. React is one of the most famous JavaScript frameworks for building user interfaces.

- Angular. Angular is a framework that Google designed for web applications.

- Vue.js. Vue.js is a progressive and adaptive tiny-app JavaScript framework.

Back-end is the backbone of any creation provided by a fintech software development company, handling the critical functions of user authentication, security, data manipulation and storage. To ensure the system can handle peak loads and maintain data integrity, such technologies must be highly scalable and dependable.

- Python is one of the many languages used in machine learning, data research and has gained a lot of popularity while developing web applications with frameworks such as Flask and Django.

- Java is an all-work, general purpose programming language that has features which comprise of areas such as high performance, security and scalability. It is used best with two of its most well-known areas: the Android and enterprise solution.

- Ruby on Rails is aimed at generating web solutions with the intention of enhancing their performance by prioritizing over conventions.

- Node.js for fintech software developers is a server-side runtime environment for executing JavaScript, most suitable for scalable and fast building.

- C++ is dominantly used in domains such as scientific computing, gaming and finance, this is the language used in building high-performance, low-latency systems.

Databases. Choosing the correct type of this point while developing applications is essential for efficiently managing, storing and retrieving findings.

- SQL is a traditional relational database, it manages its documents using Structured Query Language (SQL). Some examples of its usage across a fintech software development agency include Oracle, MySQL and PostgreSQL.

- No SQL is the principal use of these non-relational databases is to deal with enormous amounts of informaiton that are unstructured in nature. Among examples are Cassandra and MongoDB.

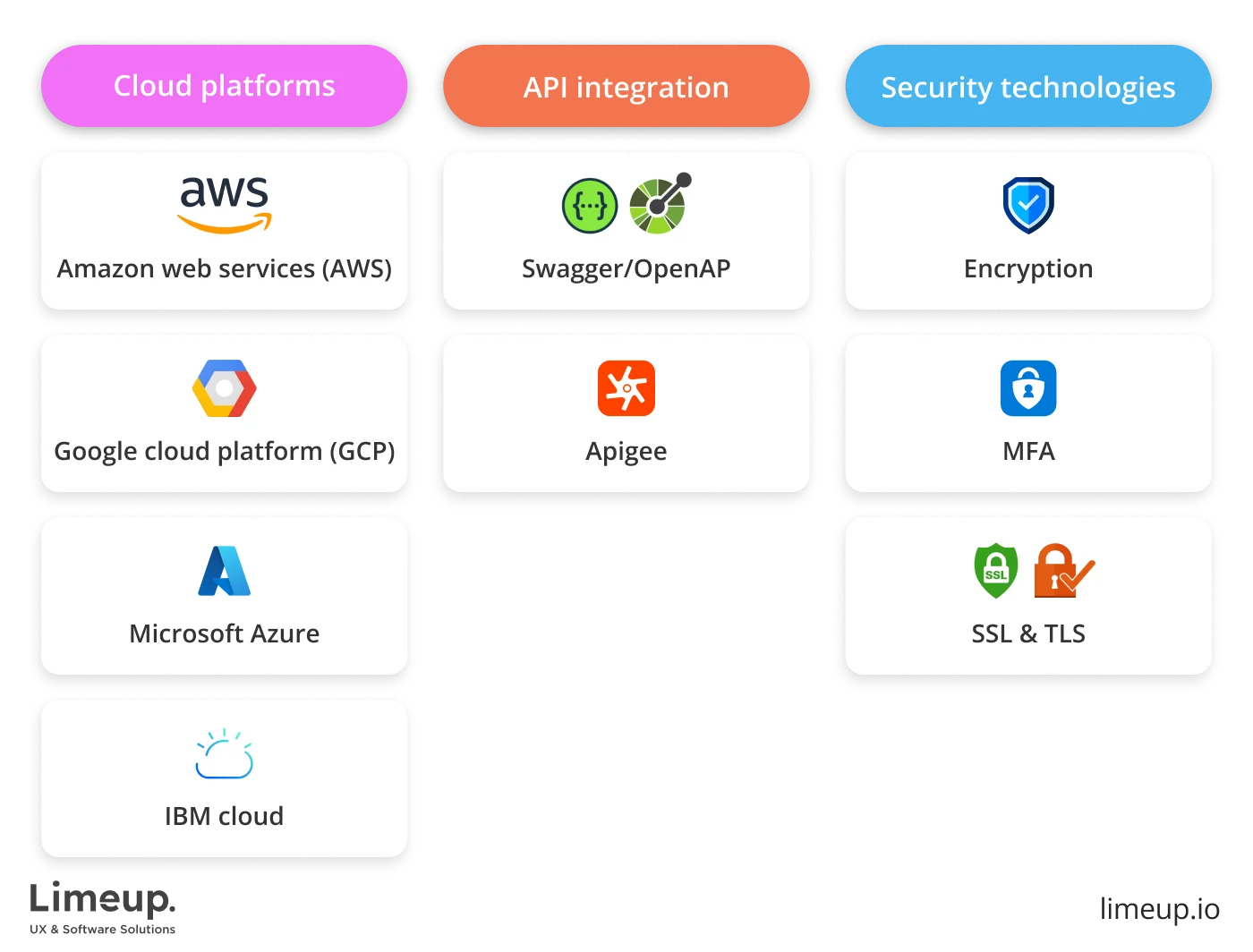

- Cloud platforms. Cloud computing and hosting are the rocket fuel for modern technologies because they facilitate the developer with all the possible ways to develop, launch and expand their app. It is performed fast and efficiently without having to maintain one’s own hardware or infrastructure.

- Amazon web services (AWS). Amazon platform is one of the most used cloud computing platforms that offers flexibility, scalability and reliability to organizations in the domain of banking technology.

- Google cloud platform (GCP). This very platform proves to be an economic and elastic solution for wealthtech organizations that aim to develop fintech software and later deploy it in the cloud at a certain point of time.

API integration. It must use strong APIs to ensure smooth running and alignment with the expected user experience.

- Swagger/OpenAPI. Thanks to Swagger/OpenAPI for custom fintech software development services programmers are provided with the capability of creating well-structured, clear API documentation that ascertains smooth communication between the different components.

- Apigee. Apigee makes sure that organizations are adequately securing, scaling and analyzing their APIs while offering insights on how APIs may be used and optimized for maximum performance.

- Encryption. There are systems like the AES (Advanced Encryption Standard) which helps guarantee that data is protected through encryption when stored as well as when in transit.

- Multi-factor authentication. MFA is considered one of the significant security features that provide an additional level of security by allowing users to identify themselves by passing through two factors.

- Security technologies. The engineers are able to integrate advanced protection methods within fintech solutions software development services that will help to safeguard against cyber threats and therefore secure transactions and personal information.

- Security Socket Layer (SSL) and Transport Layer Security (TLS). SSL mainly and TLS are the protocols developed to ensure security in transferring data through the internet.

What features are essential in software development for fintech?

You are aware of what needs to be done to receive a solution, but what functions do you really need in order to save your money and facilitate the time spent on coding, designing, and others? Definitely, it depends on your requirements, still, we can’t leave you without a basic knowledge of functionality that is common whether you are building an application for banking or trading platform:

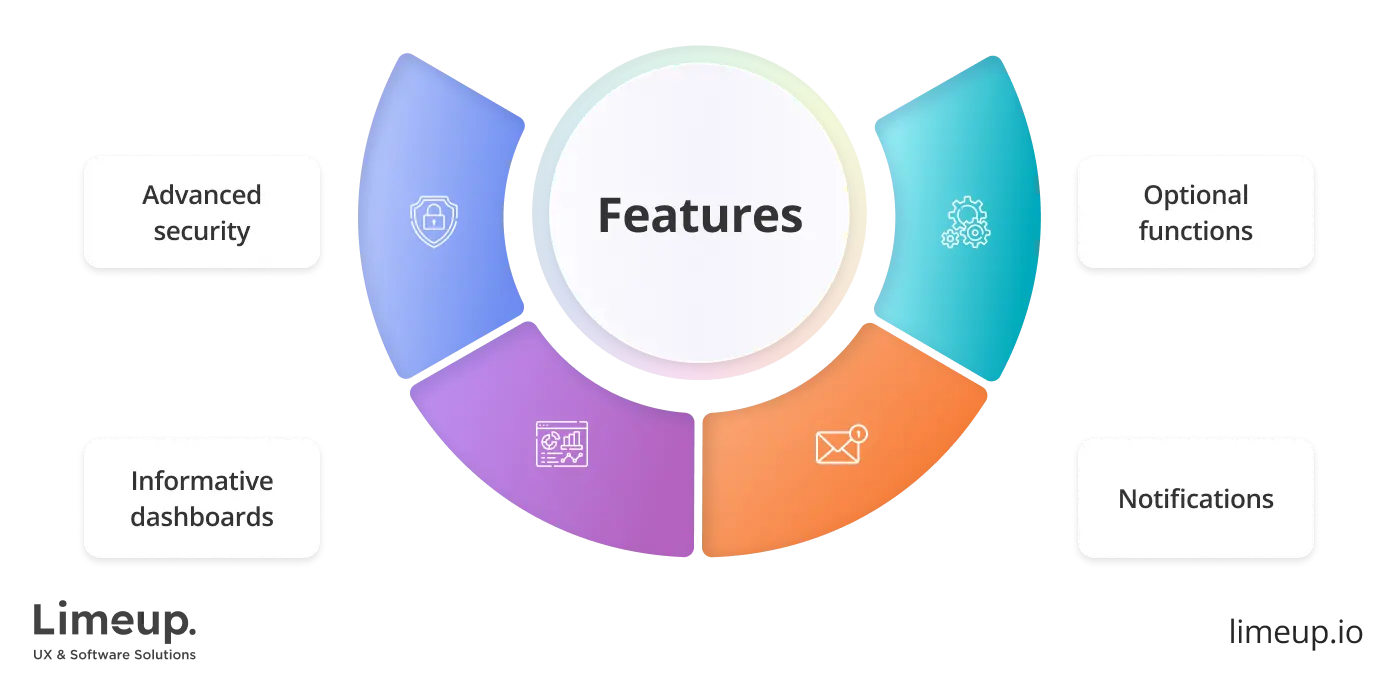

-

Advanced security can be possessed as a factor that has to be used sparingly but our background proves that there’s nothing so vital as this part, since there are thousands of cyberattacks which grow as the number of solutions increase.

It’s advisable to come after multi factor authentication for your custom financial software development, and, if you have resources, to implement biometric additional checking, for example, the customer can access an application using FaceID for iPhone and iPad owners, or fingerprint for other mobile owners.

Moreover, you always can turn to cutting-edge technologies like blockchain and try data encryption, regularity compliances besides vital KYC/AML, constant audit logins and other beneficial moments offered by ongoing maintenance.

-

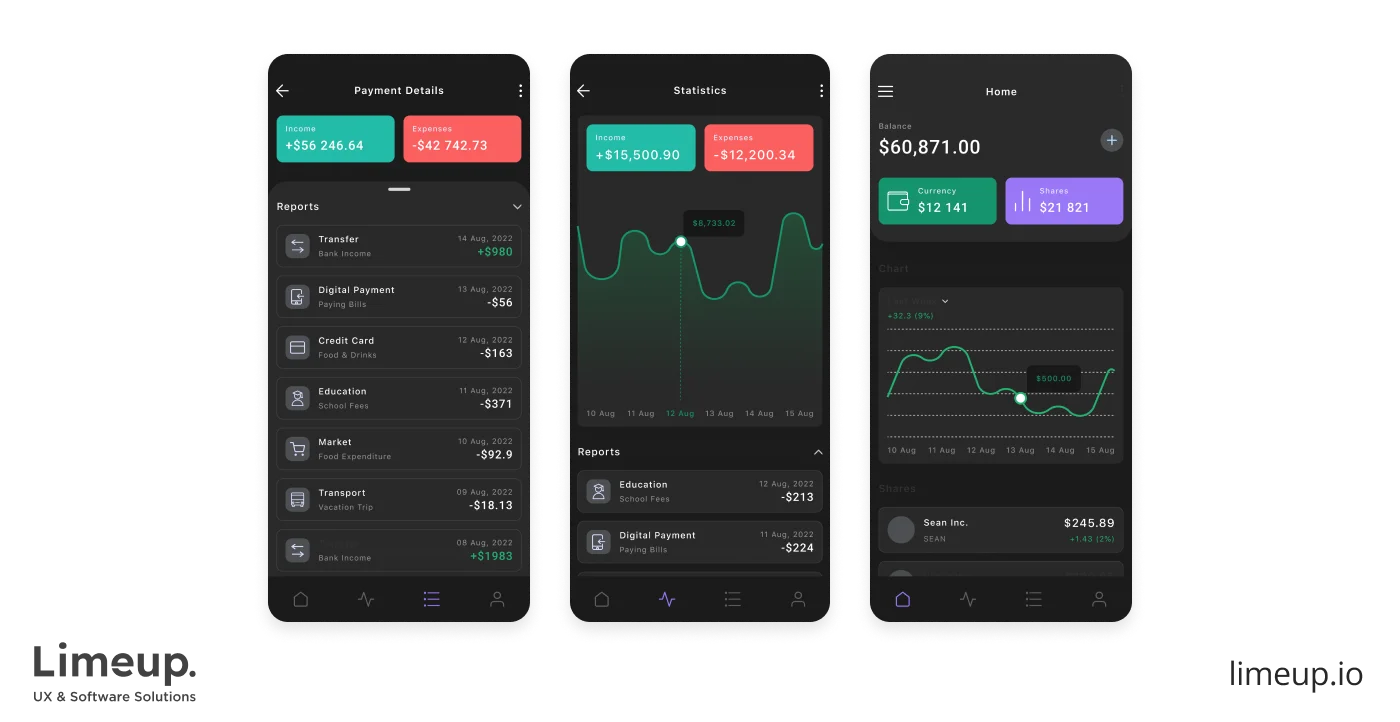

Robust/informative dashboards may sound a little confusing but as you are the owner of resolution for finance nuances, it’s crucial to provide your end-users with overviews of their funds. Based on our experience, some of the common ones are dedicated to personal assets, budgeting, visual board of income/outcome/revenue.

-

Notifications are not that obvious in present times of fintech custom software development as many people say they disrupt them, but your goal is to make so customers will click on your product every time the alert comes up, so what to do?

Keep it simple and customizable, allow customers to choose what reminders they need — budget, regular payments, transactions, etc.

-

Optional functions may intrigue you, and that’s right, since it’s a pretty wide category, covering primary high in cost capabilities powered by artificial intelligence, gamification tools, AI-assistants in finances, and more.

As the statistics say this market will reach $71.0 bn by 2030, such an investment in cutting-edge technologies will be a competitive advantage.

Make no bones about this topic: you are able to opt only what you need and what will be profitable for you and communicate with a financial software development company that knows how to bear fruitful results.

What budget do you need for fintech software development services?

The industry is expanding due to a number of causes, consisting of growing need for financial inclusion, increased digitization, technological innovations like blockchain and AI, shifting consumer preferences toward digital banking, regulatory support and new market opportunities.

The cost is not set in concrete. The peculiarities of the activities and short-term or long-term goals of every enterprise are different and it is these factors that define the price for designing tools most of all. Some of the attributes affecting the price of an app include: the type, features, functionality of the app, location of the fintech solutions software development company and overall app design time.

| Type | Average development cost |

| Digital banking platform | $30,000–$300,000 |

| Payment processing solutions | $150,000–$250,000 |

| Financial planning tools | $35,000–$75,000 |

| Investment and wealth management | $70,000–$150,000 |

| InsurTech | $30,000–$100,000 |

| Personal finance management | $35,000–$75,000 |

The lowest possible fee of a platform that provides users with a secure and convenient method of online transactions is $40,000 and requires three to four months.

On the flip side, mere functionality and UX design will be different and come at between $30,000 to $100,000. The volume of investments can exceed $60,000 to $300,000 and more in case of the developed technology to integrate with third parties with enhanced and advanced offerings within the module.

Moreover, when you think about how to build fintech software, it’s better to check approximate costs, based on the complexity of a built executable, to give you a more realistic idea of the prices:

- Basic. At $30,000 and above — this category includes a basic utilitarian budgeting program that has features such as setting up of fundamental financial targets and tracking spending.

- Average. It is likely that the average range for banking apps may be set to between $100,000 to $200,000 and it may include creation of banking apps for mobile devices that support facilities for money transfer, bill payments and account management.

- Complex. Clearly, more complex features demand a higher price for the fintech app software development beginning at around $200,000. Such functionality provides advanced functionality, such as automated investing robo-advisors or cryptocurrency trading platforms.

Ultimately, depending on the features of the fintech apps development, the construction of the app may cost anywhere from $30,000 to $300,000+ and take anywhere from three to eighteen months to complete.

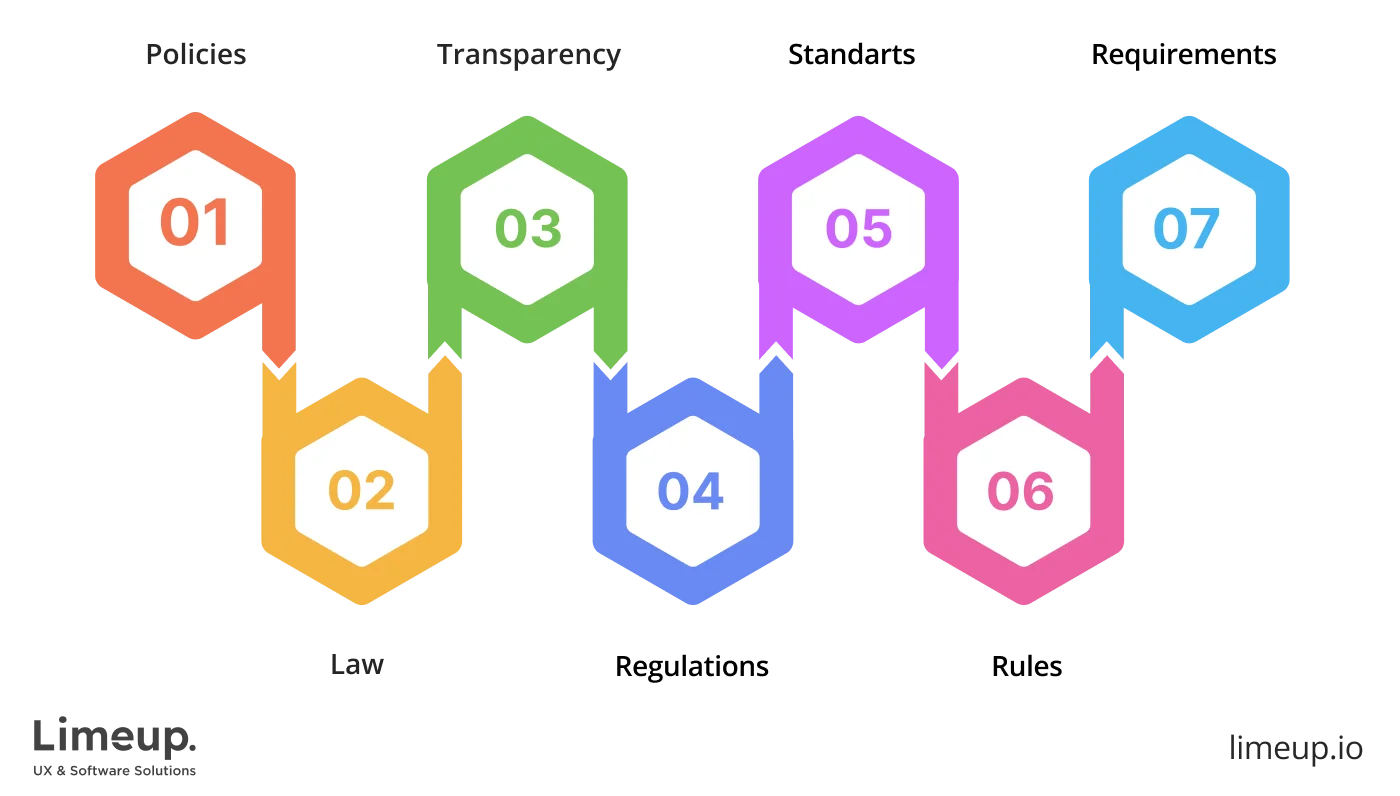

Another important factor is regulatory compliance. Any solution has to comply with different adjustments, such as GDPR, PSD2 or AML/KYC, depending on the region and offered services. Ensuring compliance protects the users’ data from possible vulnerabilities and the business itself from probable legal issues, which again may add to the general cost.

That’s why many companies prefer to work with a seasoned financial software development company in the UK, as it helps balance costs with security, scalability, and long-term reliability.

Rates for fintech software developers

We have outlined the average cost for different types of financial software development services, but what about hourly rates for coders? — our experts have investigated a few platforms and decided to make a comparison table that will help you to get oriented in the budgeting.

They found out that some vendors’ approximate prices vary from $25 to more than $300, and here is more detail:

| Level of programmers | Average $ per hour | Skills |

| Juniors | $25–$40 | Basic fintech stack across Node.js and React mostly, with zero or few experiences, perfect for MVPs and small projects. |

| Middles | $80–$150 | Full-fledged providers with the knowledge of integrations, back-end and front-end, compliances like KYC. |

| Seniors | $150–$300+ | Tech maestros who can run product creation on their own, with full compliance and enhanced security. |

How to choose a financial software development partner?

Let’s get this off your chest: selecting a tech supplier will not be an uphill battle if you know what to do, and our lending help is here. According to our background, every partnership is an uncharted ocean, so we will demonstrate a few experience-based points that will help you to receive collaboration that is a different kettle of fish.

— Find the balance between price and quality.

This concept is not new under the sun, moreover, there is still a risk of getting poor code quality from cheaper coders, as well as the absence of compliances and, as a result, no ability to even enter the financial industry.

Therefore, our advice is to check if the vendor is proficient in fintech software development, security practices, protocols, UI/UX design, simultaneously ensuring the pricing is realistic for you (and the market overall).

— Ensure scalability in every product.

Applying for banking & financial software development that can be scalable due to your demands on the future is a VIP pass. If you think about the ability to add more people to the current team (or future) it’s also a point here, but we would like to focus on scaling up the product so that it can meet new needs, for example, handle more data as millions of users will sign up (why not? We have been there).

— Check testimonials.

Using lists of pre-vetted providers, for example, like we completed to help you find a fintech software development vendor, you can reach out to a number of companies who are leaders on the market, still, you are also able to read reviews with the help of independent sources.

If you would like to learn more about this type of cooperation and project conduction, you can also visit the material we linked above, and find more useful information about the options, cost, and more what stands for software development for financial services and agencies who can handle this challenging process.

What are the trends in custom fintech software development?

Make-or-break tendencies set the rhythm of your journey and ability to remain competitive across centuries even if it sounds too ambitious so here we will break down some core of them that will be in-demand and which are recommended to be implemented.

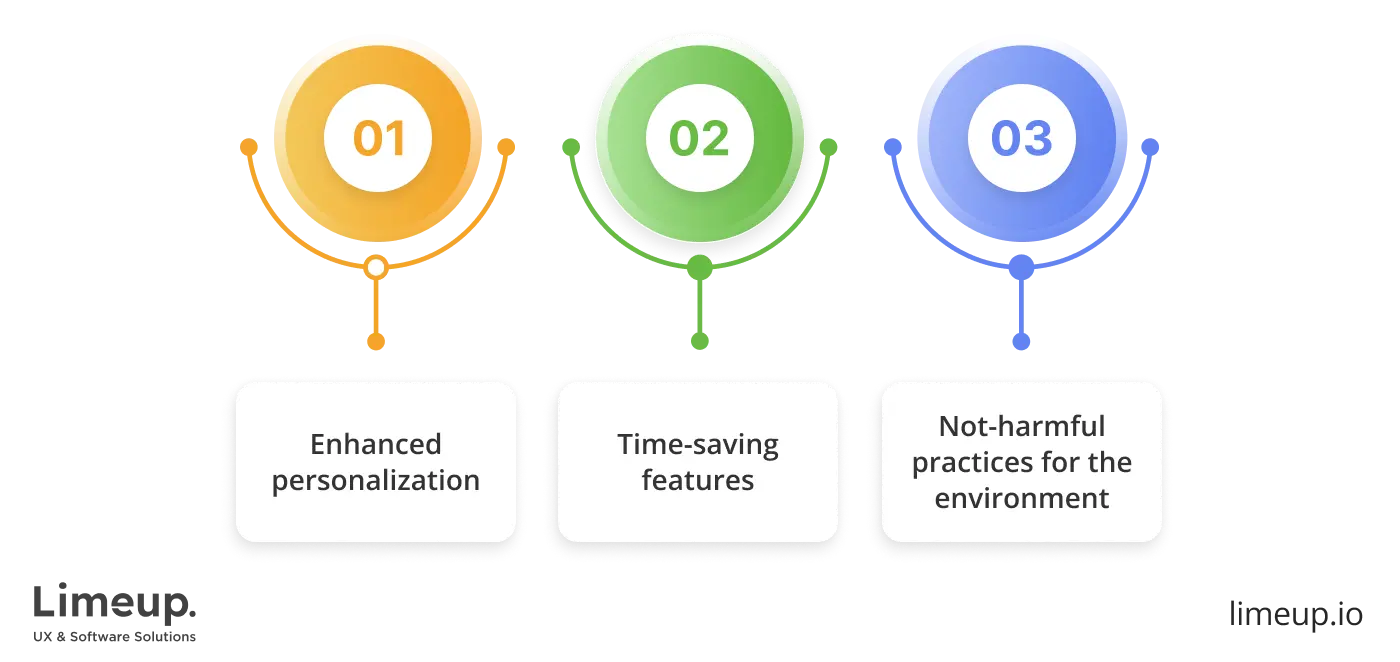

— Enhanced personalization + bonus.

We will reveal all the cards and say that our bonus is about AI used to provide more reliable experiences for your end-users and when it comes to offers it can increase your revenue by 40% as it’s said on one of the reports. With the usage of AI-powered tools you are able to gain insights about buyers’ behavior, define why and how they decide on making a purchase or using an app.

For example, one of our clients under NDA tasked us with building an investment platform so we also added analytics that allow them to provide prediction of the most revenue-driving opportunities on the market.

— Time-saving features.

All businesses are fighting for clients attention and one of the ways is to offer them functionality that requires less time to accomplish previously time-consuming operations, for example, entering data without manual typing but using QR codes or pre-made templates.

It’s also about flashlight payments and user-friendly login and registration since yes, we are aware that security is the core priority but new trends in fintech software creation provide capabilities to facilitate these processes, for example, using built-in features, voice recognition, and more.

— Not-harmful practices for the environment.

There are numerous implementations and we can’t recommend something particular since every one of them is essential so we will provide the one we have met in our practice like using energy-efficient data centers since you have to store enormous amounts of information.

Talking about something that can be adapted even by startups it’s paperless transactions where users don’t have to print any invoices or reports so that you make your online docs legal to be used.

Why develop your fintech software with Limeup?

The described world is a highly dynamic field that combines both innovative ideas and adaptability with vast knowledge of finance and technology. With the rapid pace of change, companies that are able to harness the power of solutions are not just keeping up with the times — they are setting the pace.

The cost considerations involved in custom fintech software development highlight the need for strategic planning and investment. Despite the fact that it may be rather expensive, do not forget about such advantages as improved productivity and around-the-clock availability. The phrase “penny wise, pound foolish” holds here because during the expenditure-cutting phase, costly mistakes might be made.

Organizations will be able to guarantee that they are living not just surviving but existing optimally with the right technologies by their side, having a feel of the terrain of finances and investing in the right areas for this revolution brought about by fintech. If you are seeking a reliable provider, contact us and we will get in touch within 24 hours to discuss your needs.