Digital Wallet Development: Step-by-Step Guide

Looking into eWallet development in 2026? You are at the right address. This guideline offers a clear and focused summary of what it takes to build a competitive product. Whether it comes to basic functions or purchase recommendations and strategic positioning, we will go over the fundamentals without getting lost in technical terms.

Digital wallet development means juggling design, compliance, tech stacks, and user experience, all at once. We will take you through the entire process and show what does or does not inflate the cost and what can make some solutions remarkable in a cut-throat market.

Would you like to create a digital wallet that is more than a money box? One that can be trusted, provide frictionless experiences, and is configured in response to real-world needs? Just hold on, we can do better than that; it is not all theory to us. And perhaps in between the lines, the structure of your future eWallet solution just begins to shape itself.

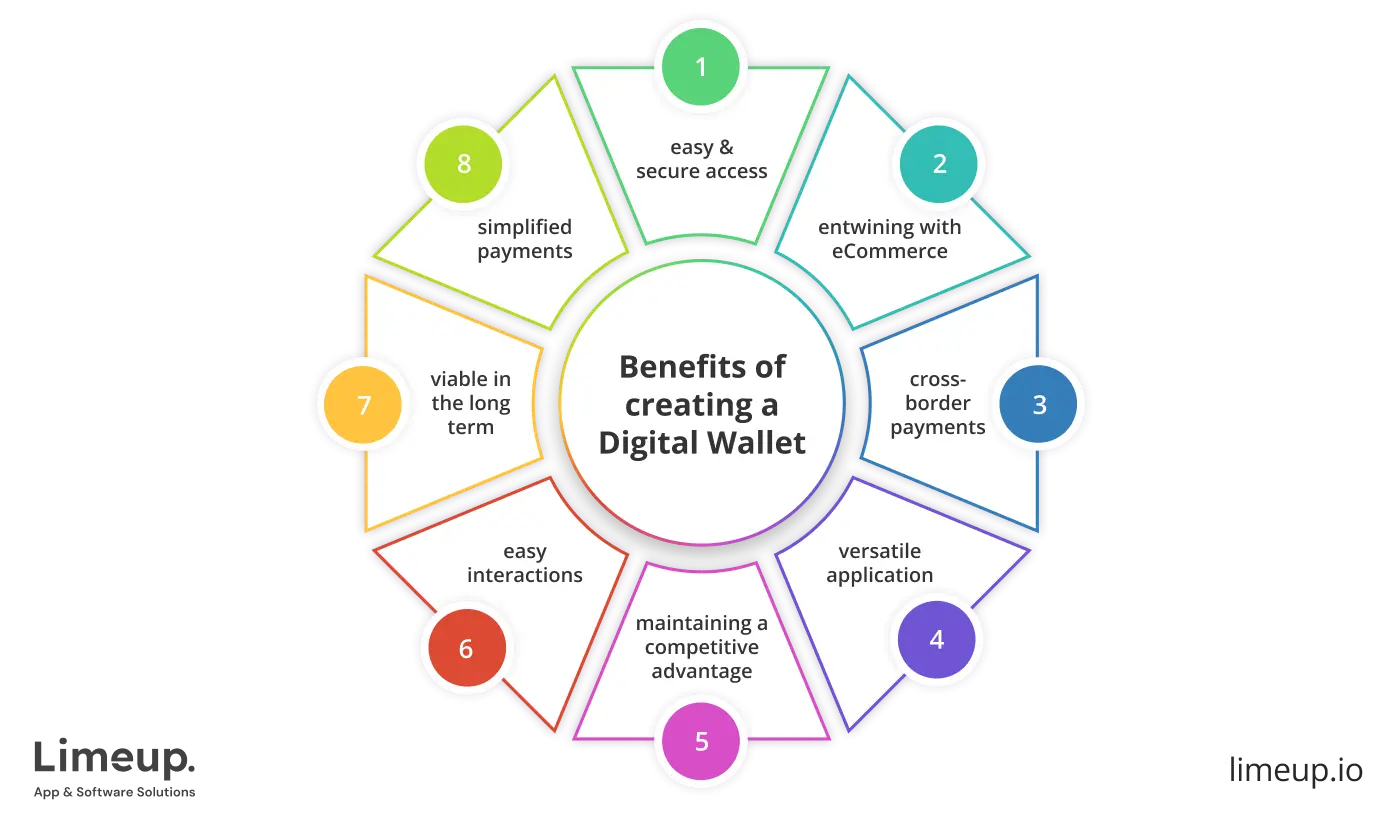

What is digital wallet development?

Fintech wallet app creation is the act of designing and building software that enables users to store, control and consume their mode of payments in an electronic form. Such wallets are used as online receptacles of credit cards, debit cards, bank accounts, loyalty programs or even cryptocurrencies.

With a simplified interface, clients are able to transact, send money, pay bills, and access financial services with ease on a mobile phone or PC.

Security is the key focus of mobile wallet app development. Engineers use encryption protocols, biometric-based authentication and fraud detection systems to make sensitive data remain secure. Teams are required to be up to date with any changes in the laws governing finances in each of the target regions.

The building of the digital wallets also encompasses the presence of back-end systems which accommodate real-time data synchronization, conversion of currencies, in-house analytics as well as API based integrations. This will enable the app to support banks, retailers, and fintech platforms with cared performance and reliability.

User experience is always given top priority during the build. Smooth loading speed, simple navigation, and the ability to work without any connection make a user feel in touch. UI / UX designers collaborate with developers and, together, they make functional, clean layouts that can maximize usability but not overfill the screen.

A great example, Revolut sets the bar high by fusing powerful functionality with a beautiful design, demonstrating that real-time spending analytics, peer-to-peer payments, and frictionless currency exchange can all be found in a single app.

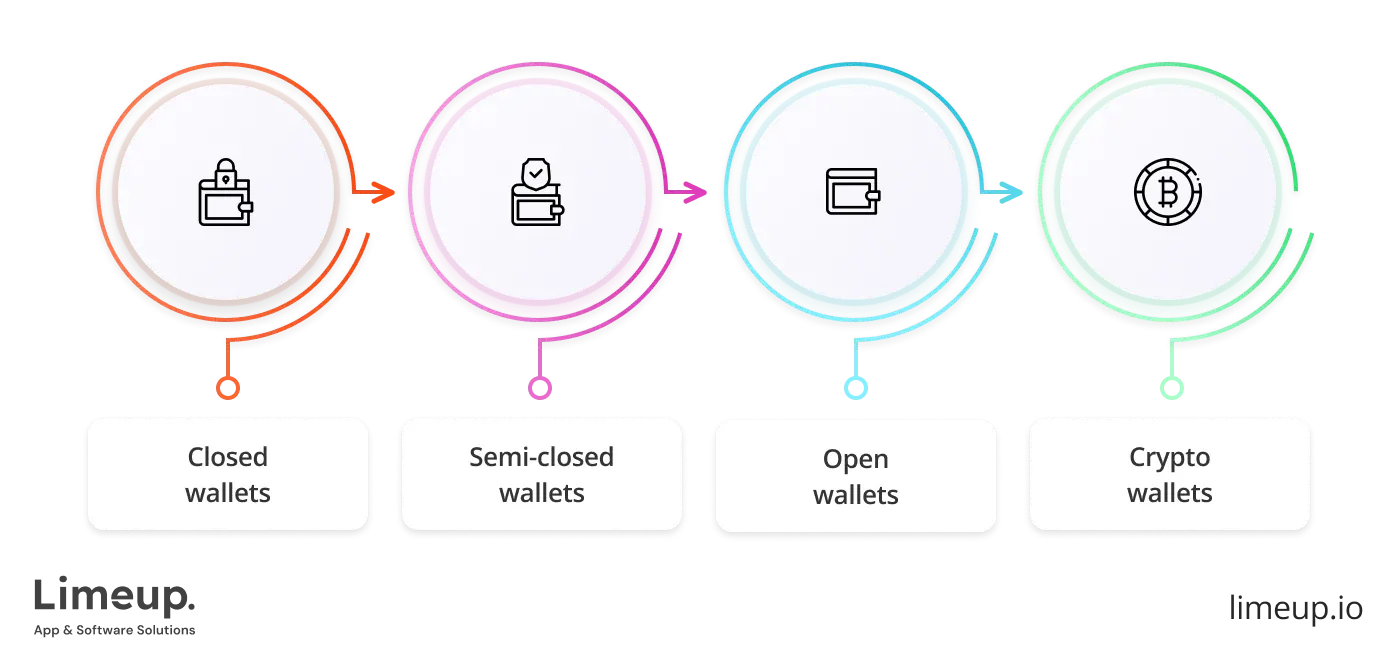

Types of digital wallets

Digital wallets may be divided by the way money is stored in them and which stores they can be used in. These types have various business models and requirements of the users.

- Closed wallets. These are wallets that are provided by a dedicated firm, and can only be utilized within its universe (e.g., Apple, Amazon).

- Semi-closed wallets. Used between multiple merchants on an established network or partners.

- Open wallets. These are linked to banks and can perform a broad variety of transactions including withdrawal of money via an ATM.

- Crypto wallets. Cryptocurrency digital wallets include coins such as Bitcoin or Ethereum and access to blockchain transactions.

Deciding on the appropriate type requires understanding your service range, transaction framework, and financial integration, insights provided by a skilled eWallet app development agency.

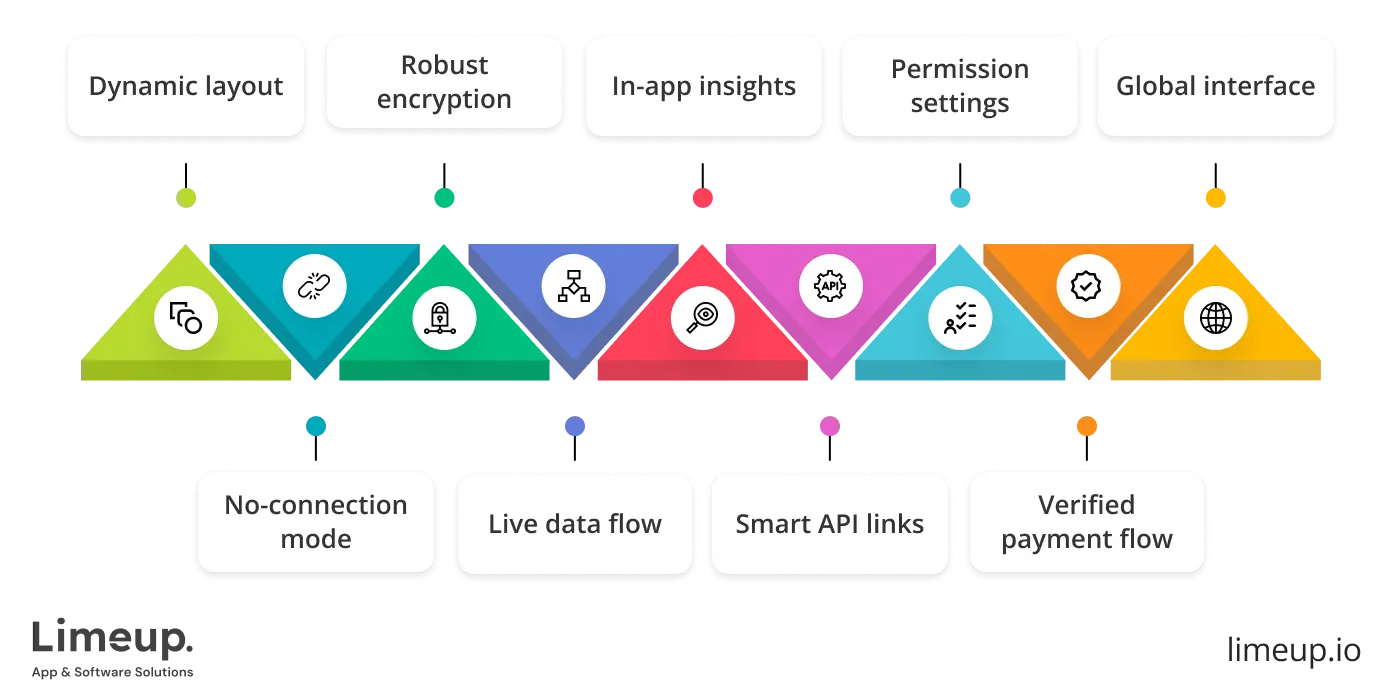

Key features of a digital wallet

Mobile wallet application development involves choosing the appropriate modules that may produce a safe, enjoyable, and convenient experience. These characteristics ascertain the level of effectiveness of the wallet in real life.

- Dynamic layout. Interfaces are real-time responsive to the size of the screen, usage, and volumes of content to remain seamless and device-agnostic.

- No-connection mode. Critical operations such as the transaction history and QR payment continue to be available even in a situation where the internet goes on a break.

- Robust encryption. End-to-end data protection encrypts sensitive data behind walls of military strength and it gets harder to breach that data than theory.

- Live data flow. Your balance and transactions are automatically kept up to date via immediate syncing of users, banks, and payment systems.

- In-app insights. Spending habits, balance estimates, and behavioral nudges are presented right in the app and do not require tab switching or making assumptions.

- Smart API links. The third-party services integrate without friction, loyalty platform to payment gateway, and with high reliability.

- Permission settings. Role-based access puts the control of what can be done by whom and where in the hands of the consumers and admins.

- Verified payment flow. All transactions are verified and validated at each step that reduces the threat of mistakes and fraud without creating friction.

- Global interface. Multi-language support, multi-currency, and regulation-sensitive design provide the feeling of native-ness, regardless of the jurisdiction in which the wallet is opened.

Any high-performing wallet app is based on strong features. They are flexible and allow them to trust and engage in long-term development, as your client base increases.

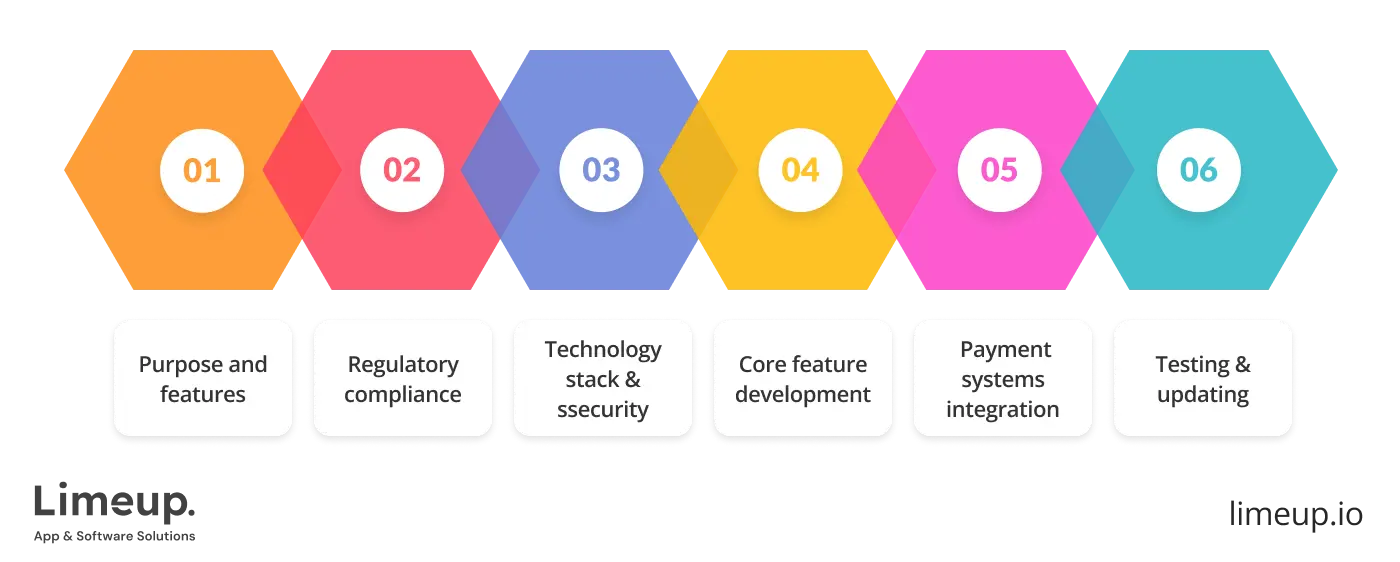

How to make a digital wallet: step-by-step instructions

We are going to start the ball rolling and plunge into this frightening task at first glance, but we are promising you that at the end of our speech this whole procedure will be easier as we will clear it all up to your convenience. A jump from $7.42 billion in 2022 to $51.5 billion by 2030 puts the mobile wallet market on a steep climb. That 28.3% CAGR points straight to the need for teams who can build with intent, not guesswork.

- What is the purpose and features

Knowledge about the possible functions and features of a digital wallet will ensure that it will exceed the expectations of the user through smooth transactions and support of multiple currencies, and ensure high levels of security to match the market requirements.

- Regulatory compliance

Creating a digital wallet is a regulatory compliance effort assuring that the app is in tune with data privacy laws, anti-money laundering (AML) requirements, and standards of payment protection like PCI DSS. This, of course, adds to legal legitimacy and confidence within a tightly regulated financial environment.

- Choose a technology stack and implement security

It will guarantee the seamless interaction of safety, scalability and optimal performance. Modern stacks are often integrated with blockchain frameworks because they are complemented by fortified back-ends such as Node.js or Python for the quality assurance of transactions.

Sensitive data are also supposed to be safeguarded by strong cryptography algorithms like AES or RSA. To create a digital wallet with a convenient experience, you will need front-end technologies that are commonly used, such as React or Angular.

- Core feature development

Reliable cyber payment, authentication (biometrics or two-factor identification) and wallet management (statement of account, transaction history) have now become targeting factors in the making of digital wallets. Furthermore, the convenience of connection with a variety of payment networks and third-party services to create an eWallet should also be stressed in terms of interoperability and end-user comfort.

- Integrate payment systems

Integration of various payment channels, including bank APIs, credit and debit card processors and third-party services like PayPal, Google Pay or Apple Pay, is important for payment systems. These new methods frequently employ some vigilant tokenization, encryption and authentication protocols to ensure user comfort and security.

- Test, monitor and update

Thinking about how to develop a digital wallet, try to focus on how the platform performs and functions in a usable yet reliable manner. There are necessary actions to be taken, such as testing, monitoring and updates.

Rapid industry changes necessitate continual improvements in digital wallets to incorporate the latest tech and legal requirements. Software developing companies oversee persistent monitoring and routine fault assessments.

How long does it take to develop a wallet?

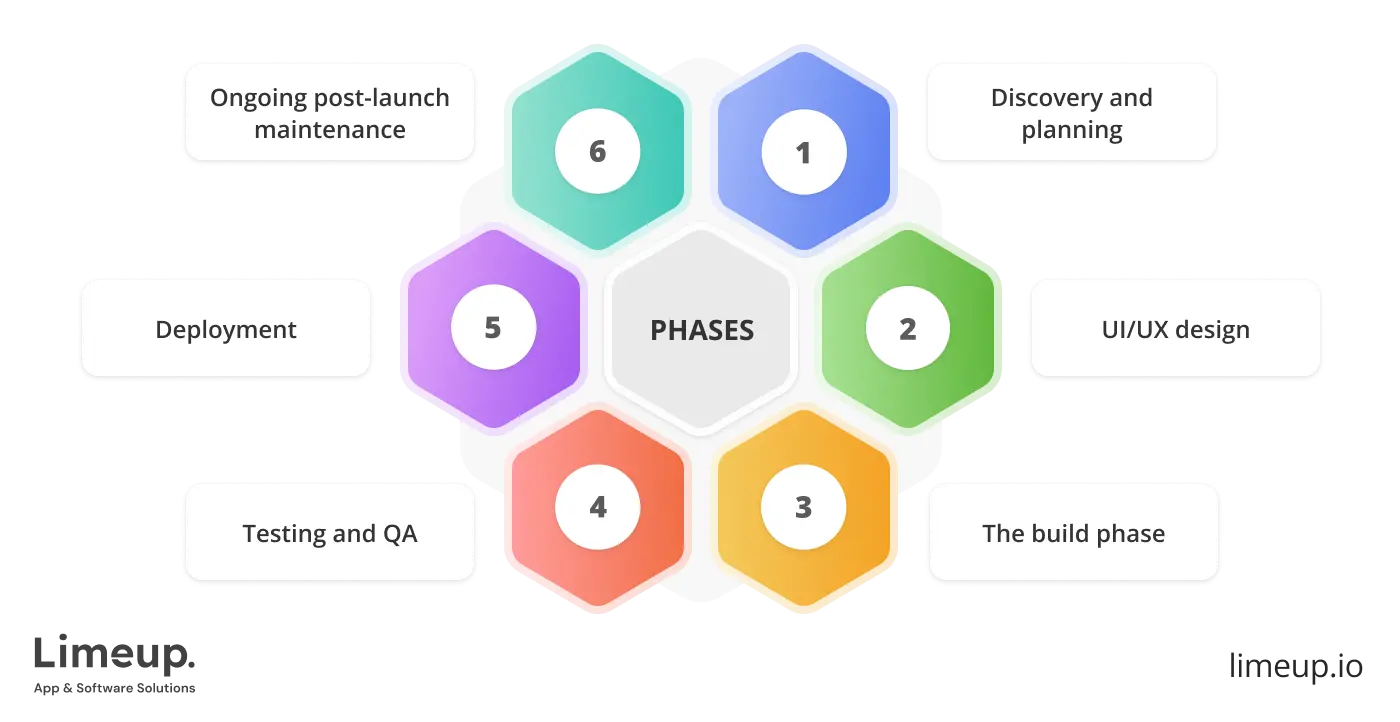

Setting up the digital wallet should not be a weekend exercise. Every stage, namely, planning, design, deployment, and testing has its challenges and time deadlines. The time is based upon the product’s ambition and the team’s preparedness to face both technical and regulatory criteria.

The main steps, as well as their approximate duration, are listed below so you get a better idea of what actually goes into creating the cyber-safe, high-performing wallet.

- Discovery and planning (2-4 weeks)

All successful applications have a good base. The eWallet app development crew cannot afford to design or build anything without having a direction. This will entail getting into the business aspect and technical strategy. Some of the major sets of activities observed in this stage are:

- Core features and user flows

- Determination of regulatory and compliance demands

- Developing a list of technical standards and third-party integrations

The step prevents confusion in the future. The period here saves duration in the programming phase because one would be saving the time that they would have to undo these decisions halfway through. Teams that fail to devise a proper plan usually come to a standstill, which delays schedules.

- UI/UX design (3-5 weeks)

After narrowing in on the scope, the next stage is to get a clean, concise experience to the end user. Design does not only mean selection of colors — it defines the interaction of the consumer with the wallet and the inertia to trust. Common design done activities entail:

- Drawing of wireframes and mockups

- Screen- and user-journey prototyping

- Mobile responsiveness and accessibility design

Digital wallet implementation succeeds when interfaces minimize errors and maximize satisfaction, but wallets aimed at global clients often undergo lengthy localization and device compatibility phases.

- The build phase (8-14 weeks)

This is when the actual construction starts. To bring the blueprint into actual work, you need to hire application developers whose skills match the project’s complexity and requirements. Basic coding activities:

- Constructing the front-ends of interaction with users

- The setup of the back-ends of transactions and security

- Including external services, APIs, and payment gateways

Even though front-end and back-end teams often work side by side, their different paces can sometimes cause delays. Adding things like biometric login, offline mode, or advanced analytics means paying extra attention to detail and testing each feature thoroughly.

- Testing and QA (3–5 weeks)

No matter how clean the code looks, bugs are bound to show up. The testing will assist in ensuring that the app can function normally once used in real life, without compromising on optimal and significant functionalities and putting consumer data at risk. Teams have the tendency to concentrate on:

- Ensuring customer flows and edge cases operate successfully

- Threat inspections and performance stress checks

- Confirming it works good on devices and platforms

Since this is especially important for fintech apps, even a small hiccup with payments or customer verification can damage trust and cause setbacks.

- Deployment (a few days to a week)

Part of learning how to create a mobile wallet app is understanding that deployment comes with its own challenges, far beyond uploading it to a store.

- Completed back-end infrastructure setup

- Submission and evaluation in the App Store and Google Play

- Internal staging and approvals for releases

It is particularly significant in fintech apps, so even the slightest problems related to payments or user verification will break trust and lead to the downfall.

- Ongoing post-launch maintenance

After the wallet is live, development is carried out in rotations. There will never be a plateau in terms of product because real feedback will always show the possibility of becoming better. Subsequent to its launch, the following are some activities to be carried out continuously:

- Regular additions and updates to features

- Solving bugs and patching holes

- Monitoring analytics and performance and guiding future improvements

Failure to respect this phase may end up with the loss of clioents and negative labeling.

Summary based on estimates

Every version is followed by its own clock:

| Wallet type | Engineering time | Description |

| Basic wallet | 2–3 months | Few features, basic interface, few integrations |

| Standard wallet | 4–6 months | Various payment gateways, user roles, real-time synchronization |

| Full-scale enterprise | 6+ months | Multi-featured, high-guaranteeing, analytics and support of multiple languages |

Such projections are based on the possibility of having a dedicated team, a well-spelled-out plan and lack of substantial changes in the process.

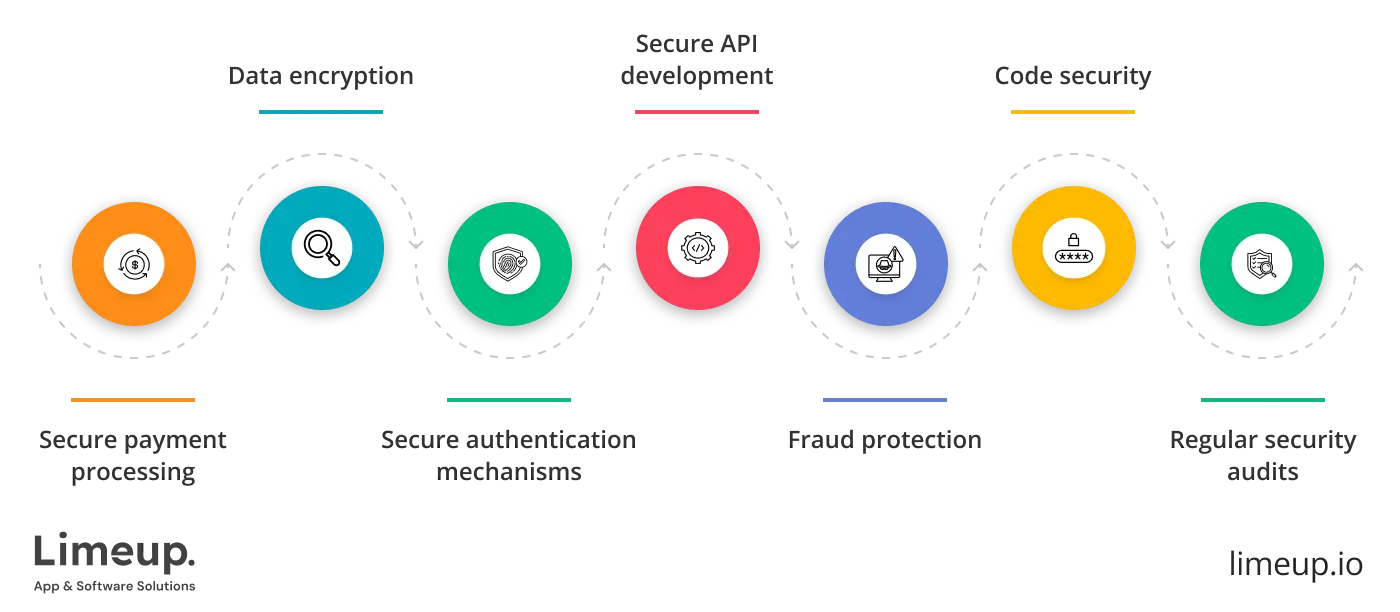

Security tips in digital wallet app development

Talking about finances and all the operations performed online with them, protection must be your top priority so after getting a basis of how to create such applications and why you need them, we will kindly recommend familiarizing yourself with all the protection measures. Just as a castle shields itself from a siege, a strong safeguard protects your app’s security, keeping customer trust intact and helping apps like Venmo maintain their leading status in the market.

— Implement secure authentication mechanisms

Yes, the initial step for safeguarding and answering the question “how to build a digital wallet” is to save information or user accounts against unauthorized access, which starts with shielded authentication procedures.

Such strategic measures act as additional locks on the door, such as token-based authentication (JWT – JSON Web Token) to reduce the risk of hacks. Defense may also be increased by frequent changes to passwords and encryption together with tracking of login times.

— Encrypt data

Protecting financial data through encryption during eWallet setup is a must. Mobile app development companies in the UK apply advanced cryptographic solutions to keep sensitive information secure.

This method affirms that all bases are covered and must have a central position in how to create an eWallet, including keeping in mind industry standards and data protection regulatory compliance.

— Tamper-proof payment processing

An attempt to have a safe system includes introducing multi-factor authentication as well as encryption technology to prevent data leaks. Also keeping to certain industry standards, such as PCI-DS,S validates that the eWallet adheres to the bulletproofing practices for handling payment and card information and thus remains compliant.

— Apply safe API development

Protected APIs establish that strong walls are raised against any cyber threats by enabling encrypted connections between the eWallet app and the external servers. Make sure that the user accounts are protected when you set up a digital wallet by putting in place authentication methods like OAuth, as well as 2FA, so that you don’t leave an open door to any use.

— Protect against fraud

It is necessary to ensure that fraud is kept away in order to establish eWallets that offer security and privacy for financial information. The warning on large or cross-border transactions and frequent monitoring of the transactions for abnormal activity can also be the first sign that could result in the alarm being raised much too late it occurs.

— Code protection

Input validation, the standardized characterization of challenges and the frequent unearthing of susceptibilities amidst other hardened programming protocols should become an ongoing section of the future programming process in order to avoid the possible threats.

You can make a digital wallet that can then guard itself against any cyber threat and guarantee that everything is locked down safely while withstanding trust and compliance.

— Regular safety audits

They are important in setting up an eWallet, as these studies will allow the discovery of flaws and sins that may expose the cash or data of users to possible attackers before the issue becomes serious.

These activities are meant to proactively remediate weaknesses and thus protect vital data and risk-aware infrastructures from developing threats of cyber-attacks, keeping beneficial environments locked as a vault in security and not allowing them to be accessed by hackers and answering the question of how to make an eWallet.

This review contains a lot of valuable insights regarding the eWallet market size and growth for the upcoming years. Digitalization, overall technological improvement for the past 20 years and higher needs for distant transactions caused by COVID-19 were the most impactful factors that made digital wallets an integral part of our lives and at the same time expensive in financial terms.

We can judge how important and successful this area is by looking at the names of the best representatives like Amazon, Visa, Mastercard, PayPal, CashApp etc.

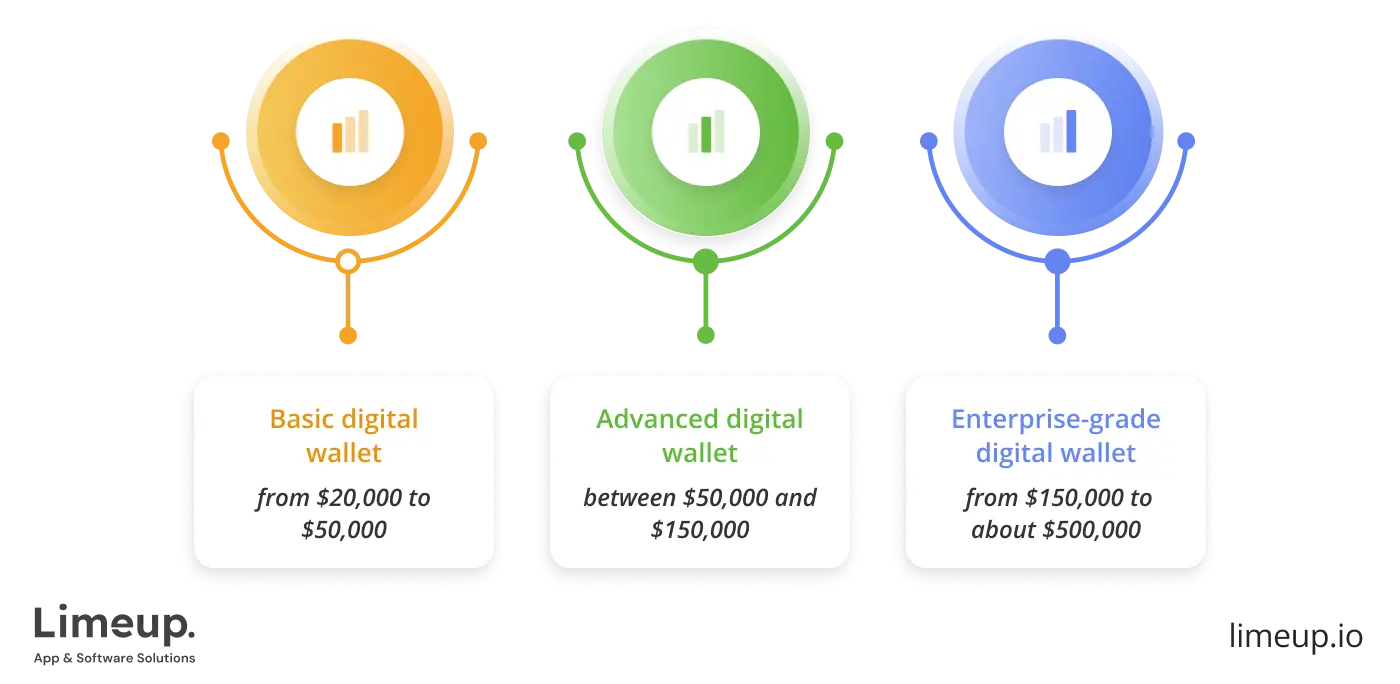

How much does eWallet development cost?

The creation expenses correlate with the depth of features and protection mechanisms integrated. More sophisticated designs demand greater time and funding. British software companies, for example, may have different pricing structures compared to firms in other regions. A considerable cost might also be incurred that arises from customization such as security measures, the payment gateway used and the design of user interfaces.

Factors affecting cost

There is a pool of interlinked drivers that define the total cost of setting up a digital wallet. From key features to your technical execution partner’s location, every decision made during the planning and creation phase affects the budget.

- Scope and complexity. Basic applications are cheaper; real-time synchronization and role management, as well as multi-currency capability, are additional features of an advanced wallet that require a larger budget.

- Available options. The quantity and level of features, such as NFC payments, QR scanning, or crypto transferring, could tremendously alter cost.

- Location of development. Prices vary in different parts of the globe. A group within North America or Western Europe would cost more as compared to one within Eastern Europe or Asia.

- Security criteria. Fortifying data with advanced encryption, biometric signing in and cross-checking all increase the time and monetary investment.

- Integrations. The more systems your wallet should integrate with: banks, PSPs, analytics tools, the more difficult the production will be.

Addressing these variables upfront leads to more accurate budgets and fewer project headaches.

The price for developing of a basic digital wallet application will cost you from $20,000 to $50,000 but it has the bare essentials functionality-wise — tracking balances, saving payment methods and enabling money transfers. Thankfully this is a very straight-up simple entry point into the digital wallet space for potential adopters who have not really been ready to take the plunge but are interested in exploring the option.

How to set up a digital wallet on a very advanced level? The application possesses a lot of high-tech features like NFC payments, multi-currency support, full high-end encryption, advanced safety measures and in addition smooth interactions with many payment gateways. Building such apps cost anywhere between $50,000 and $150,000, showing that excellence is always expensive and you have to pay top bucks to remain cutting-edge.

An enterprise-grade digital wallet is usually viewed as the ultimate in fintech because of its security, flexibility and scalability, and such high-end features are typically reflected in costs — it will not be cheap. Some of those characteristics include enhanced fraud detection, peer-to-peer transfers, QR code payments and cryptocurrency support. Their costs range from $150,000 to about $500,000 or even higher, demonstrating that great quality does not just happen that easily.

To give you a better sense of the landscape, here’s a summary of wallet tiers with features and corresponding price points.

| Wallet tier | Core capabilities | Ballpark investment |

| Starter | Basic balance checks, stored payment options, money transfers | $20,000 to $50,000 |

| Enhanced | Contactless NFC, multiple currencies, robust encryption, seamless payment gateway sync | $50,000 to $150,000 |

| Enterprise-level | Advanced fraud protection, peer-to-peer payments, QR code transactions, crypto compatibility, scalable architecture | $150,000 to $500,000+ |

As you move up the scale, expect enhanced capabilities and greater costs, but also a wallet built to meet the demands of a growing user base and evolving fintech landscape.

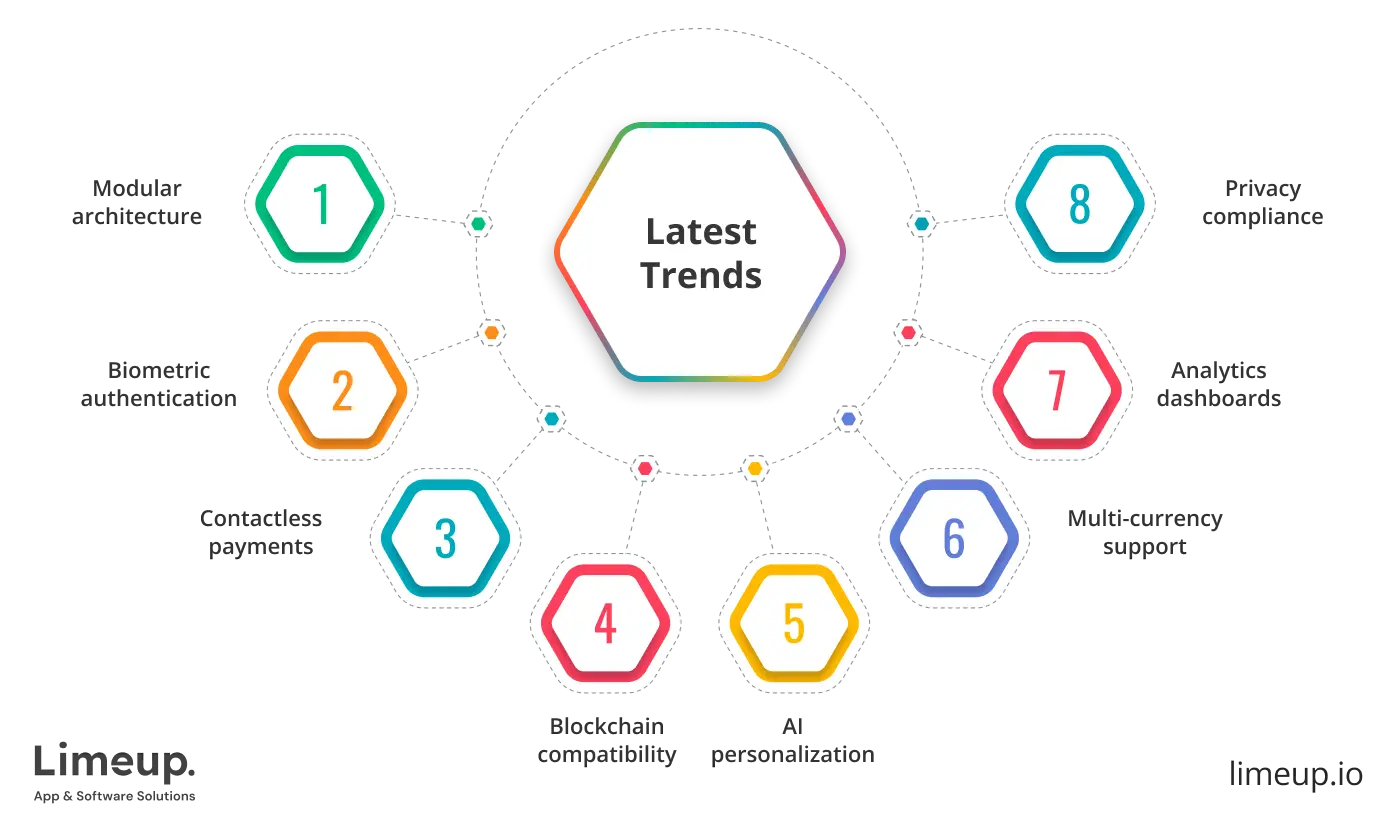

Latest trends to build a digital wallet

Digital wallets are rapidly changing. What was effective five years ago just will not work anymore and keeping up to date means fresh ideas and radical technical steps. The market is now characterized by altered consumer behavior, increased regulation, and soaring advances in payment technology, which companies such as programmers, product owners and fintech entrepreneurs have to reckon with.

— Modular architecture has moved to the front stage.

Dev teams are no longer opting to construct massive monolith apps; instead, they are attracted to constructing structures out of smaller, more manageable modules. When developing a digital wallet, it will reduce the time of updates and will enable swapping out or adding features without friction. It keeps wallets readily movable, high-scaling as a user base grows, and adapts to market changes without significant restructuring.

— Biometric authentication becomes the norm.

Passwords will no longer apply in most wallets which use fingerprint scans and face recognition. The tools provide an additional protection level and streamline everyday transactions and make them smoother. As users become increasingly aware of online security, the existence of these features can determine whether they use an app regularly and stick with it or leave it without using it at all.

— Contactless payment and NFC keep gaining traction.

The rise of contactless payments since 2020 has put the spotlight on every digital wallet development company capable of creating wallets that support near-field communication. These solutions are increasingly found in transit systems and retail environments alike.

— Compatibility with blockchain is emerging as well.

Not all users are trading in crypto, but there is rising interest in wallets that feature storage of tokens, checking blockchain IDs, or having Web3. The wallets are popular among technically savvy users and present opportunities with regard to decentralized finance, gaming, and international remittance.

— User journey is changing with the help of AI-driven personalization.

Machine learning has begun to be applied by wallets to make personalized predictions, warn about fraud, and notify users of applicable deals. To wire in this kind of smart behavior, companies hire dedicated experts who can calibrate machine learning models like a precision instrument.

— The other emerging trend is multi-currency support.

eCommerce across borders and digital nomadism has necessitated the need to have multiple currencies to be used on one platform through wallets. How to create a digital wallet app that handles multi-currency use hinges on solid infrastructure and partnerships with neobanks or exchange services.

— In-app analytical dashboards are also causing ripples.

Digital wallets, instead of merely keeping money, allow users to see their habits, weekly trends in their spending habits, categories, and alerts on financial targets. These tools render the app more than utility. It turns into something that one cannot spend a day without.

— Development of compliance and privacy tooling.

As the world gets more regulated, code wizards are integrating the privacy-first features into wallet architecture itself. Data minimization, opt-in permissions, and consent flows are no longer an option.

The writing of digital wallets is well underway in clear well-defined increments. Those teams pursuing these trends are not after buzz; they are reacting to an actual change in the way people deal with money. The next layer, be it the biometric login or blockchain support, introduces one more dimension to the capabilities of a wallet, as well as to the expectations of its users.

Inside Limeup’s work on a fintech wallet platform

For Traders.One, Limeup delivered a low-latency fintech wallet that could handle rapid trades, market activity, and real-time interaction. Working with a full-stack dev team like us ensured no layer was left unoptimized, from socket connections to UI feedback. In a trading environment, there’s no room for delay or error.

Project overview and goals

Traders.One were looking at a digital wallet that would portray active trading and rely on dealmakers who matter in split seconds as well as tamper-proof transfers. They did not even just want to store funds, they wanted to unify payment, active market interactions and fraud-resistant account control into a single system.

Our strategy showed that Limeup knew exactly how to set up an eWallet for fast moves and tighter security. The work was to render each trade, deposit and consultation instant, reliable and safe.

Key design and technology decisions

Limeup decided to adopt a performance-driven, modern architecture in order to address the requirements of Traders.One:

- Front-end: React.js, which makes a modular and fast UI component possible

- Back-end/API: NestJS and GraphQL, to manage the data operations flexibly and efficiently

- Real-time tools: PostgreSQL, Redis and WebSockets to enable millisecond updates

- Cloud infrastructure: AWS and Docker to avoid multiple deployments and automatic scaling issues

- Auth & payments: Firebase Auth on top of the Stripe API to make safe and PCI-compliant payments

- Live assistance: Encrypted one-on-one trading consultations by means of WebRTC

Speedy data, safe transactions, and scalable design came together, reflecting the expertise behind advanced digital wallet development services.

Challenges and how they were solved

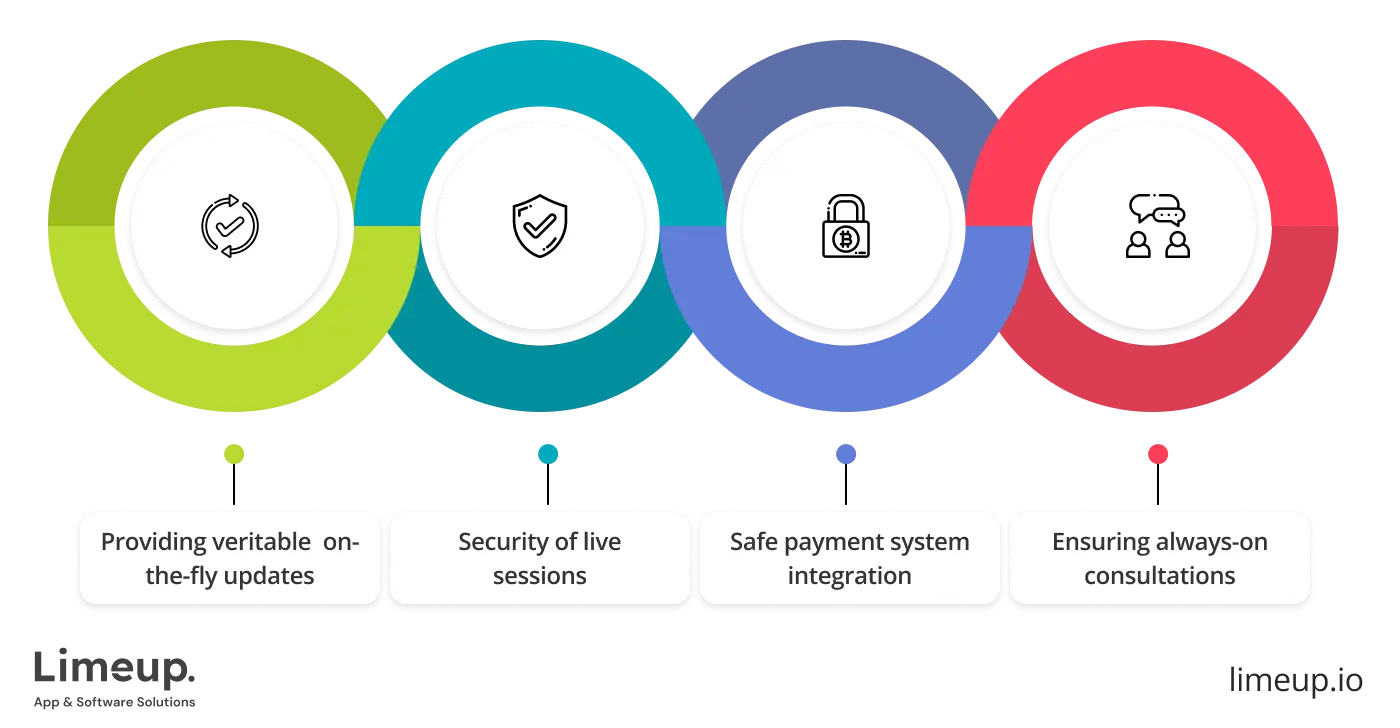

The founding of a fintech platform for active traders presented a number of technical and defense issues that required exacting, workable answers, each of which was handled with a well-defined plan and laser-like execution.

- Providing veritable on-the-fly updates

High-frequency trading requires data that is ready to use. To create eWallet app functionality that supports this demand, Limeup constructed robust WebSocket channels and configured Redis caching to mirror trades and balances in real time.

- Security of live sessions

Dealing with crypto and market information showed that it mustn’t slip. Data was guarded by Firebase authentication, role enforcement by JWT, and encrypted WebSocket links.

- Safe payment system integration

The Stripe API provides support for PCI-certified payments. Limeup enclosed these functions in safe streams and compared to CloudWatch checks to make traces of protected deposits and withdrawals.

- Ensuring always-on consultations

There are occasions where traders require urgent advice. WebRTC implemented the support of encrypted audio and video communication. Limeup allowed participation without revealing information and damaging performance.

Results and business impact

With Limeup’s fintech wallet platform, traders were able to increase their speed and self-assurance:

| Business goal | Outcome |

| Instant market updates | Millisecond-level data delivery via WebSockets |

| Smooth and secure payments | PCI-compliant flows, real-time balance updates |

| In-app live consultations | WebRTC-enabled encrypted communications |

| Scalability and reliability | AWS/Docker setup managed growing user load |

Within a single, shielded wallet interface, the completed network permits users to execute trades, fund accounts instantly, track market movements instantaneously, and get live support. Responses emphasized how seamless the experience was and how important the architecture was to functionality.

Ready to build your own digital wallet app?

Now that we’ve dissected the blocks of building a digital wallet, where we tried to break down every important point for you, including what it involves to the timelines, feature sets, and real-world architecture behind it. We explored wallet types, drilled into the anatomy of a functional app, examined smart security protocols, and spotlighted emerging trends that are reshaping the fintech map.

If you have any concerns or questions left in your pockets, just contact us! You can have some brief issues or something compound but it does not even matter, because we will address every problem you might have on your way.