How to Choose a Fintech Software Development Company: Full Guide

To pick the best supplier out of fintech software development companies for your cutting-edge solution, you would have to sort through dozens of various candidates and know what to look for. We are here to lend a helping hand by presenting a list of top firms currently operating in the market.

Our experts deeply analyzed each fintech software development company based on the offering line, experience in the financial niche, testimonials, and much more. To help you choose a partner, we also put together reviews of agencies along with a useful guide on selecting the right innovation implementor.

By searching through the selected studios, you are sure to indicate the most suitable to help with your needs. Also, you’ll learn more about fintech software development services, prices, and the determinants that influence budget formation. Tap into the cut above the rest of the tech enablers to accelerate your success.

List of fintech software development services providers

Founded: 2017

Headquarters: London, United Kingdom

Limeup is a finance software development company partnering with businesses worldwide. We have a proven track record of building revenue-driving solutions, such as insurance programs, web and mobile banking applications and tailored trading platforms. Our team delivers fully functional and scalable online products that enable our clients to improve retention rates by x3 and streamline processes.

With a 95% customer satisfaction level, we continue to form lasting relationships. Limeup ascertains that everything from complying with regulatory requirements to design intuitiveness and seamless optimization is impeccable. After contacting us, our partners have earned almost $40M in total, and they were satisfied with the quality of the outputs and management.

Our fintech software development services:

- Digital banking development

- Insurance software development

- Trading software development

- Digital wallet development and many more

Why choose us:

Limeup’s tried and tested crew members bring a wealth of expertise to every job. We value honesty, open communication, and a collaborative approach, ensuring that orderers are actively involved throughout production.

Select case studies:

- We synthesized a revolutionary portal yStone. It allows democratic investment into real estate by buying and selling tokenized shares of property in a secure manner.

- Refuture is a blockchain-based tokenization hub that enables users to manage and invest in tokenized housing using user-friendly web and mobile applications.

- Have a peek through our earlier work.

Founded: 2017

Headquarters: Berlin, Germany

impltech is a fintech solutions software development company with more than 7 years of engineering experience and a mature team of professionals that stands tall among their peers and is counted as one of the industry’s top players.

With over 100 successful projects under their belt, time and again, they’ve proven their knack for navigating the trickiest challenges and transforming visions into workable innovations.

Key services:

Industries:

- Fintech

- Healthcare

- Real Estate and more

Why choose them:

Customization is at the heart of impltech’s approach — the digital masterminds architect bespoke neobanking solutions, digital asset management platforms and crypto wallets, ensuring robust security and alignment with the latest trends. The team, 93% of which are high-end programmers, is committed to generating breakthroughs that help expand reach and raise profit.

Select case studies:

- impltech engineered a landmark healthcare portal fo Raccoon.Recovery, which provided an accessible interface for the patients to work out according to their personalized needs, track their progress, and receive doctor support remotely.

- Thanks to the advanced data management system that impltech has provided, ZinsHaus can enhance their operation and minimize erroneous activities, thus making monitoring easier, as well as property administration and data security.

- Look at more case studies.

Sombra

Founded: 2013

Headquarters: Lviv, Ukraine

Sombra is one of the financial software development companies that opened its doors in 2013 and specializes in rendering custom-made fixes. At the core of their values is the balance of enhancing the business potential of their clients and exceeding their expectations.

Key services: Custom software development, mobile app development, IT strategy consulting.

Industries: Business services, consumer products & services, non-profit, government, education.

Why choose them:

Their strategy revolves around precision and results; 98% of projects are completed on time and within scope, allowing those who are interested in their offerings to reach their objectives without needless problems.

Select case studies:

Unfortunately, due to non-disclosure agreements signed with former associates, the case studies do not mention the names of the undertakings they have worked on. However, you can still review what kind of resolution has been created, what the team did to achieve results and how it benefited the seekers of digital transformation in the end.

Coreblue

Founded: 2016

Headquarters: Plymouth, England

Coreblue is a provider of custom fintech software development services. The organization was established by Lewis Boyles-White and Dan Hardman, who believe that bringing together a team of technologists can strengthen entities and create a great impact. With their blend of tech talent, they are perfect innovation drivers for discovery and planning, designing, support and expansion.

Key services: Custom software development, enterprise app modernization, IT staff augmentation, AI consulting.

Industries: Financial services, education, hospitality & leisure, government, non-profit.

Why choose them:

Customers are capable of empowering change when they hire this agency that is pleased to be an HM Cloud Supplier and ISO 9001 UKAS-Accredited, indicating the use of cutting-edge tools.

Select case studies:

Their projects highlight forward-thinking outputs across numerous areas, from community volunteering platforms and luxury vacation rentals to digital banking transformation and executive search workarounds.

Yalantis

Founded: 2008

Headquarters: Warsaw, Poland

Yalantis is one of the full-fledged finance software development companies. Their methodology comprises strategic road mapping, solution design, and finally engineering. The firm’s capabilities cover the needs of startups and corporations.

Key services: Custom software development, IoT, AI, mobile app engineering.

Industries: Automotive, consumer products & services, energy & natural resources, government, manufacturing, medical.

Why choose them:

The squad is adaptable and personalizes approaches to their cooperators, trying to set good collaborative conditions. They believe that success lies in joining efforts. The administration nurtures freedom and openness in its employees, encouraging them to lay out new ways to solve digital challenges.

Select case studies:

Under their success stories page, they list an impressive number of well-known global brands with which they have the privilege of driving synergy. Some of the most notable partnerships include Bosch, Toyota Tsusho, KPMG and Google X.

Gravit-e Technologies

Founded: 2005

Headquarters: Surrey, Canada

Being a fintech software development agency, Gravit-e Technologies has been aiding lenders and traders since it opened their door in 2005 and has been mainly working with businesses in the midmarket. Their work tactic is all about producing virtual advancements for fast-growing organizations.

Key services: Custom software development, cloud consulting & SI, application management & support..

Industries: Business services, financial services, manufacturing, medical.

Why choose them:

As it’s being said on the website, Gravit-e Technologies’ core offerings are the improvements that their team of tech-savvy professionals provides; they place a high value on communication and paying attention to the needs of their clients in every carry-out. The founder and president, Nick Oostveen decided to start this agency and assembled a crew of senior engineers with a wealth of expertise.

Select case studies:

The supplier’s project spotlight demonstrates a skill set in creating distinctive workarounds, such as a global banking platform, orthopedic shoe ordering system, SaaS healthcare apps, tools for managing volunteers and sophisticated production tracking solutions.

Fingent

Founded: 2003

Headquarters: White Plains, NY, USA

As one of the top fintech software development companies, Fingent’s mission is to use powerful instruments to transform operations and increase banking entities’ profitability. They think that novel technologies like machine learning and artificial intelligence, which also offer data-driven insights, could bolster client experiences.

Key services: Custom software and AI development ERP consulting & SI, low/no code.

Industries: Education, financial services, real estate, supply chain, logistics, transport, manufacturing, medical.

Why choose them:

Speaking of the kinds of offerings Fingent excels in, they cover a broad spectrum of options, from assets and insurance to payment management. Facilitating outcomes, the crew is concerned about the impact on society and business performance.

Select case studies:

Fingent’s roster of accomplishments features market leaders like Mastercard, Sony and PwC, delivering bespoke digital systems, including enterprise, mobile applications and ultra-modern platforms that revolutionize operations and spark creativity across various sectors.

Keeper Solutions

Founded: 2011

Headquarters: Limerick, Ireland

Bringing over a decade of experience, this financial services software development company is laser-focused on bringing market-oriented products for fast-scaling payment technology businesses. Walking through the entire production process with stakeholders and interested parties, they propose to employ avant-garde AI instruments to accelerate growth.

Key services: Custom software development, application management & support, generative AI, IT strategy consulting.

Industries: Financial services, information technology, eCommerce.

Why choose them:

Keeper has a long-term perspective and frequently collaborates with clients before they reach MVP level, assisting in expanding these firms to unicorn status and beyond.

Select case studies:

Any prospect is free to scrutinize the catalog of works of Keeper as they are completely transparent about the work they have done and the results they have achieved. Some names include Drift App, Momnt, Rivet Labs, etc.

XAM

Founded: 2014

Headquarters: Sydney, Australia

In the directory of fintech development companies, XAM is a made-right team of 85+ tech-savvy professionals, full of passionate workers who stand behind every venture they implement and launch. They represent the entire lifecycle of product creation, covering experience design, system integrations, and more.

Key services: Custom software development, mobile app and web development, application testing, cloud consulting & SI.

Industries: Financial services, education, government, legal.

Why choose them:

At this point, the firm has completed more than 150 projects and won numerous accolades. Strategic visuals, technical mastery and smarter delivery are the three categories into which the digital experts’ offerings are separated.

Select case studies:

XAM’s previous works shine through their revolutionary decisions, including advanced AI tools, next-generation mobile banking and streamlined platforms that redefine customer and business interactions.

DigiTrends

Founded: 2010

Headquarters: Dubai, United Arab Emirates

The team and founders of this best fintech software development company are passionate about generating improvements that are future-proof for a constantly changing sector.

Key services: Custom software and web development, CMS development, web design, digital marketing, progressive web apps.

Industries: Healthcare, hospitality, real estate, fintech, financial services, retail, automotive, advertising.

Why choose them:

After their founding, DigiTrends has overcome numerous obstacles and won the endorsement of more than 600 organizations, comprising Fortune 500 corporations and internationally renowned enterprises. Their collective has a forward-thinking vision and is committed to presenting their partners with solid digital services and competent marketing strategies.

Select case studies:

DigiTrends’ success stories reveal an adherence to advancement, with breakthrough deliverables such as DigiPill for healthcare, Lawyered Up for legal access and Beesmart for the beauty sphere, all aimed to enhance user experiences.

What is a financial software development company?

A digital transformation studio is an influential player in the finance technology sector, rendering modern virtual products and extensive domain knowledge to assist businesses in changing over time and establishing their foundation. Below, we will summarize some essential tips that will aid you in the search process.

Trailblazing agencies are key in revolutionizing traditional banking and payment services with the help of instruments that make things just a notch higher, effectuating and securing. They look into areas like payment processing and investment management to correspond to their clients’ needs, taking care not only about codes but thoroughly exploring the current state of the market to architect improvements that help their partners thrive.

A good fintech software development company knows how to start strong so businesses remain at the top of the game in a dynamic area.

Furthermore, most of these firms have outstanding project records, having finished over 150 projects on behalf of associates. Fintech software development teams comprise gut-old professionals with great specification knowledge and smart approaches that nail the bones and meet regulatory requirements, e.g., GDPR.

Providers push the envelope with technology like artificial intelligence and blockchain. It isn’t only about keeping up with trends; it’s about setting new precedents for excellence in satisfying consumers. Simply put, a top production organization is an entity that is full of an agile and firm commitment to client success.

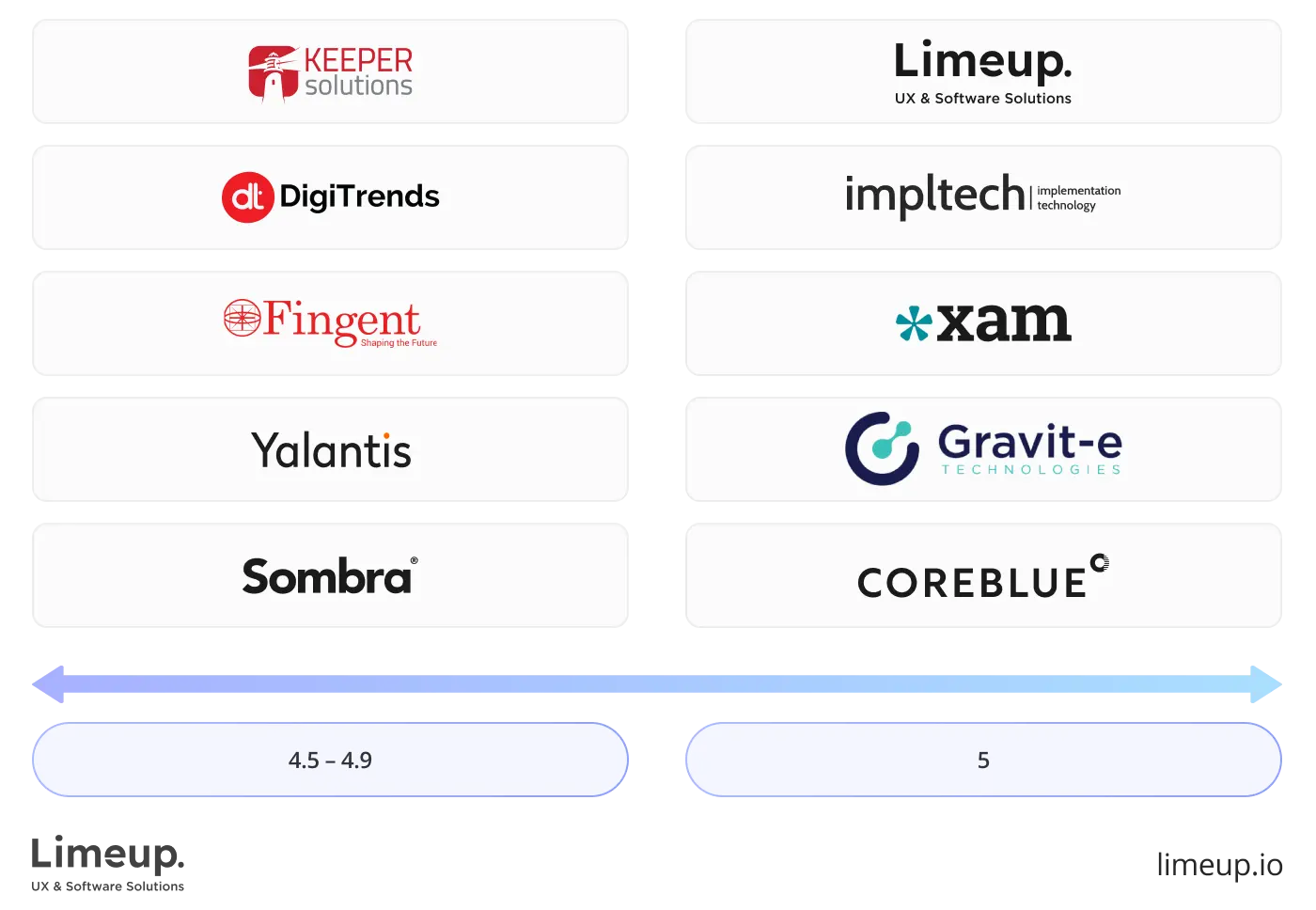

Comparing fintech software development companies

Screening providers of innovative services takes a lot of time, especially when you want to know all the nuances, which can have direct influence on cooperation. We explored every avenue to outline the contrasting characteristics of suppliers to simplify the selection process. Upon reading, you will find information about the number of specialists in each firm, their digital personas, pricing figures, and ratings they received from their cooperators.

Let’s examine the studios we selected for you:

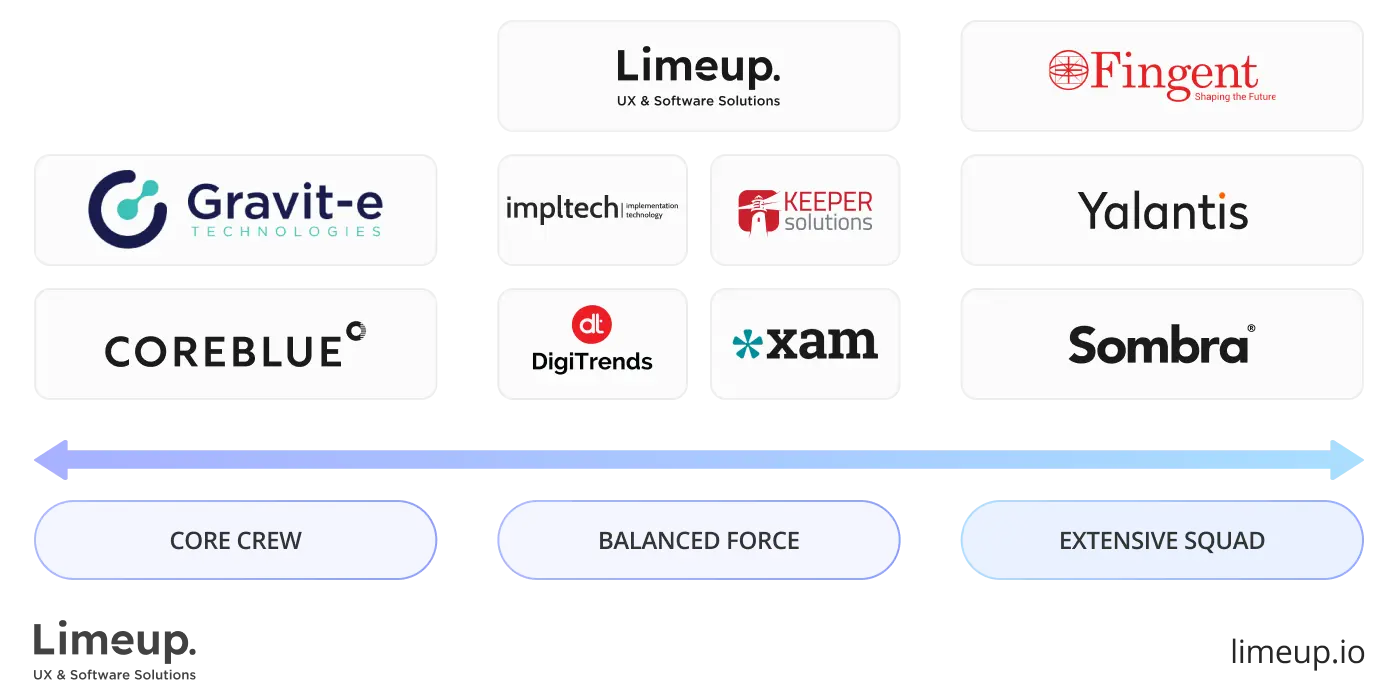

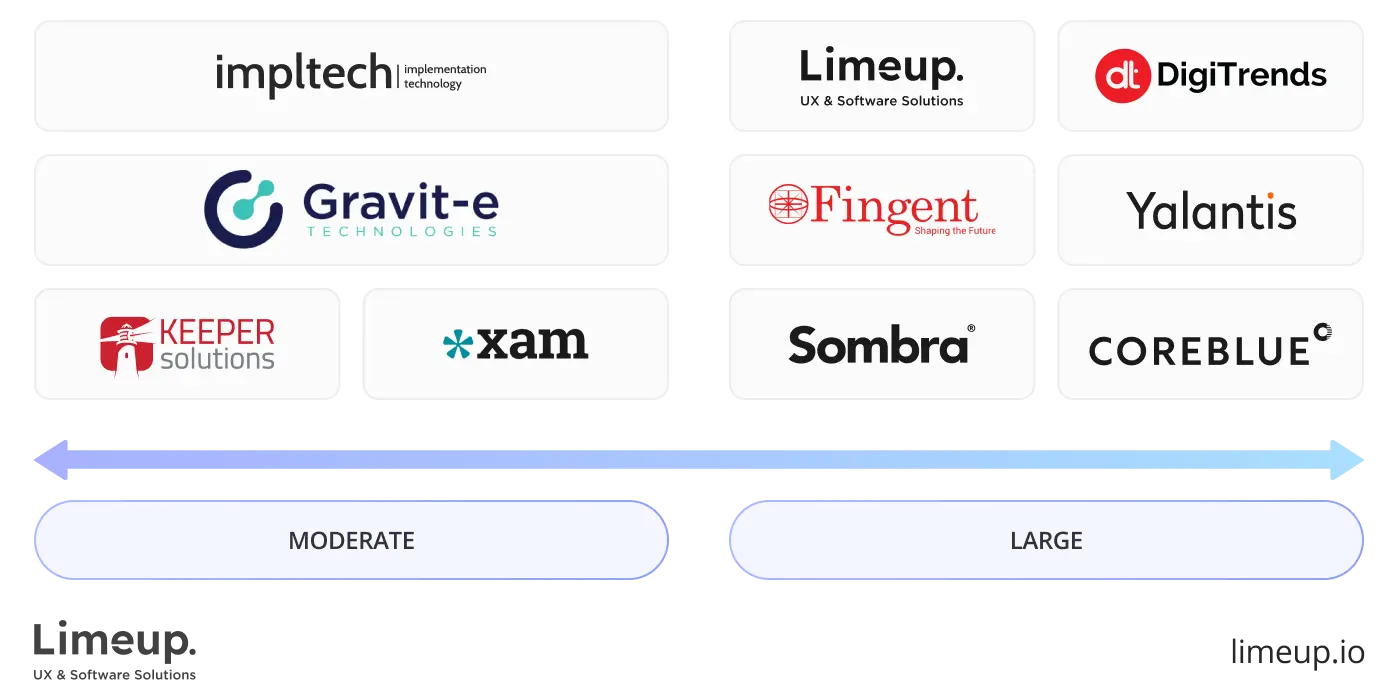

Team size

If you seek assistance to get deliverables with a basic set of functions, it doesn’t matter whether you join efforts with a full-scale tech hive or a provider with a limited workforce. However, growing expectations require corresponding workgroups to prevent risks (if, for example, employees leave the studio you cooperate with, they quickly add missing fintech software developers to the crew).

Online presence

Evaluating every contender, we paid attention to several factors. First, we inspected the case studies regarding their descriptive and illustrative materials. Second, we assessed tech blogs and got acquainted with the reviews. Third, we took into account their pages on social media (Linkedin, Instagram, X and YouTube).

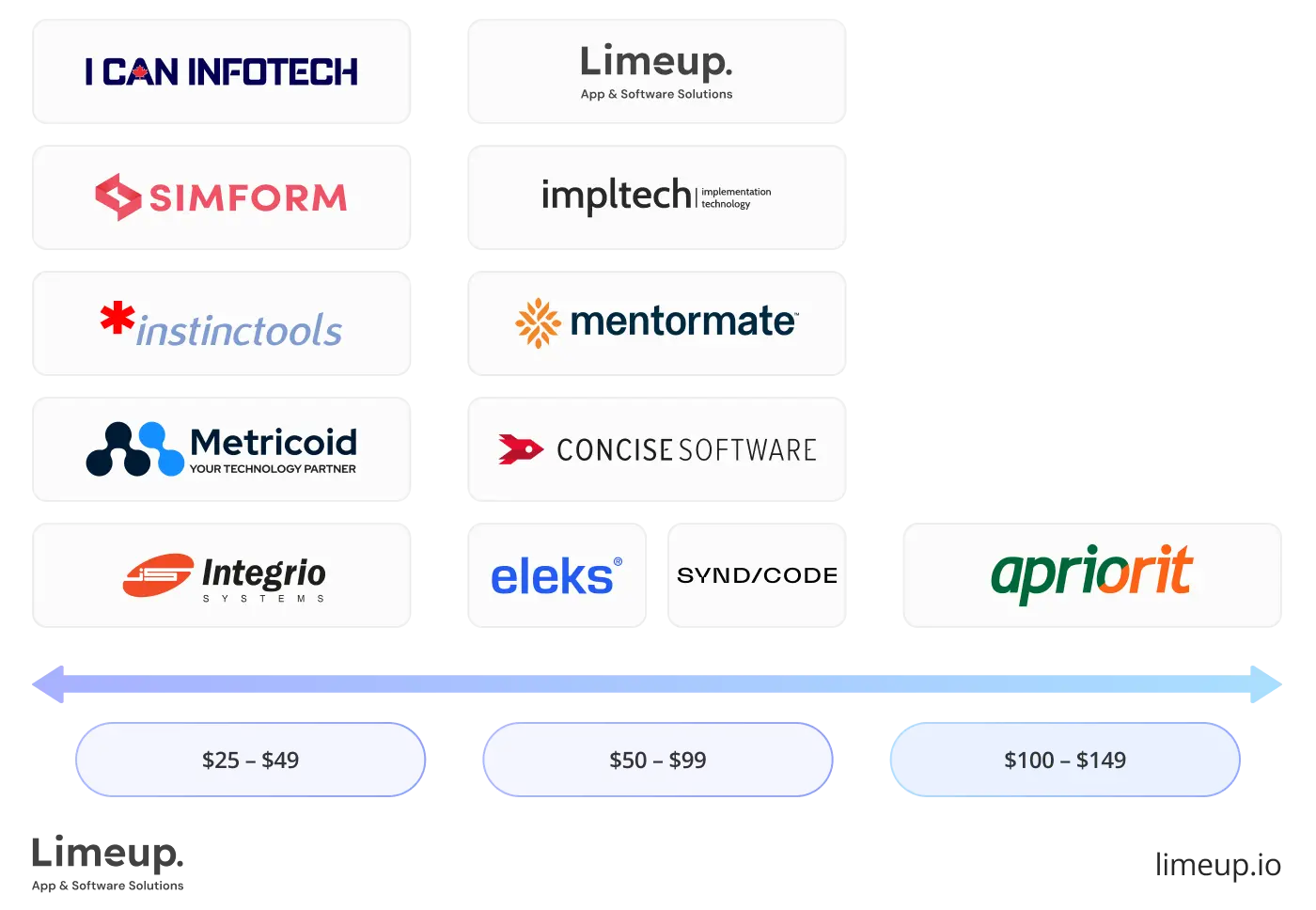

Hourly rates

We couldn’t help but lay down hourly wages. We took all the details from the open sources so they can vary from the actual state of things. The determinants, which make a world of difference in terms of outlays, include locations, specializations, experience in the industry and recognition.

Ratings

Of course, the picture couldn’t be complete without specifying the scores the distributor got from their customers. Our list consists entirely of respectable and reliable organizations with testimonials and ranks on independent websites.

The more you know about system architects, the easier it is to build lasting partnership to realize your venture.

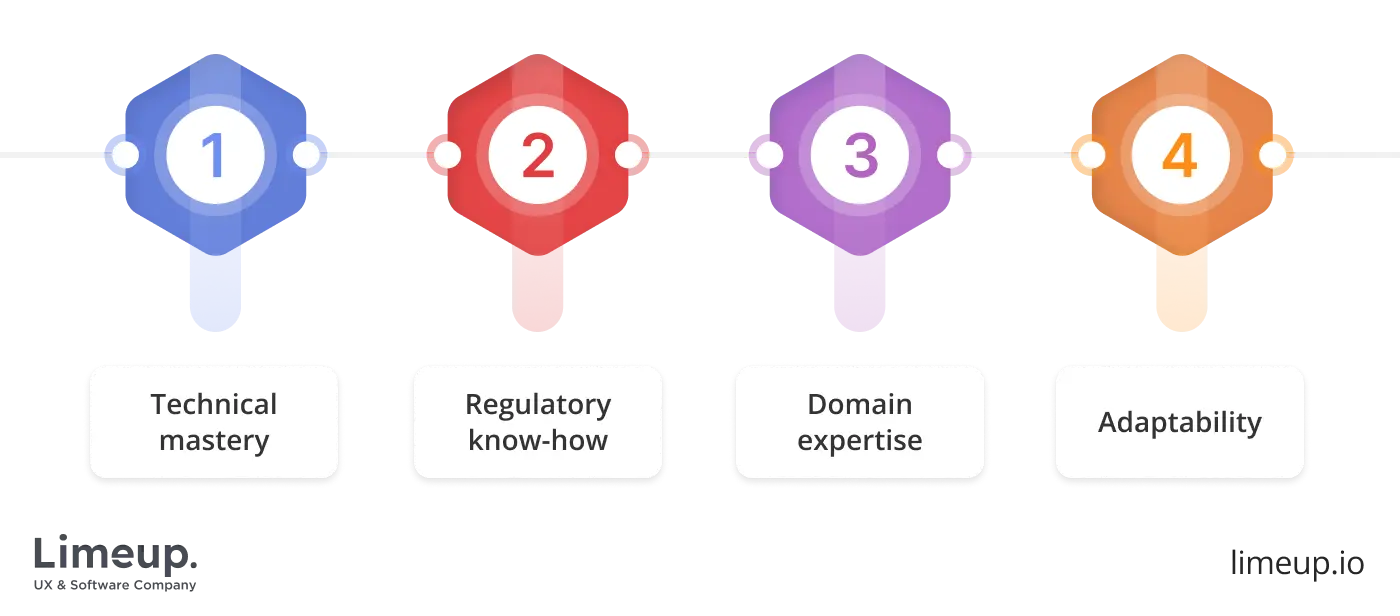

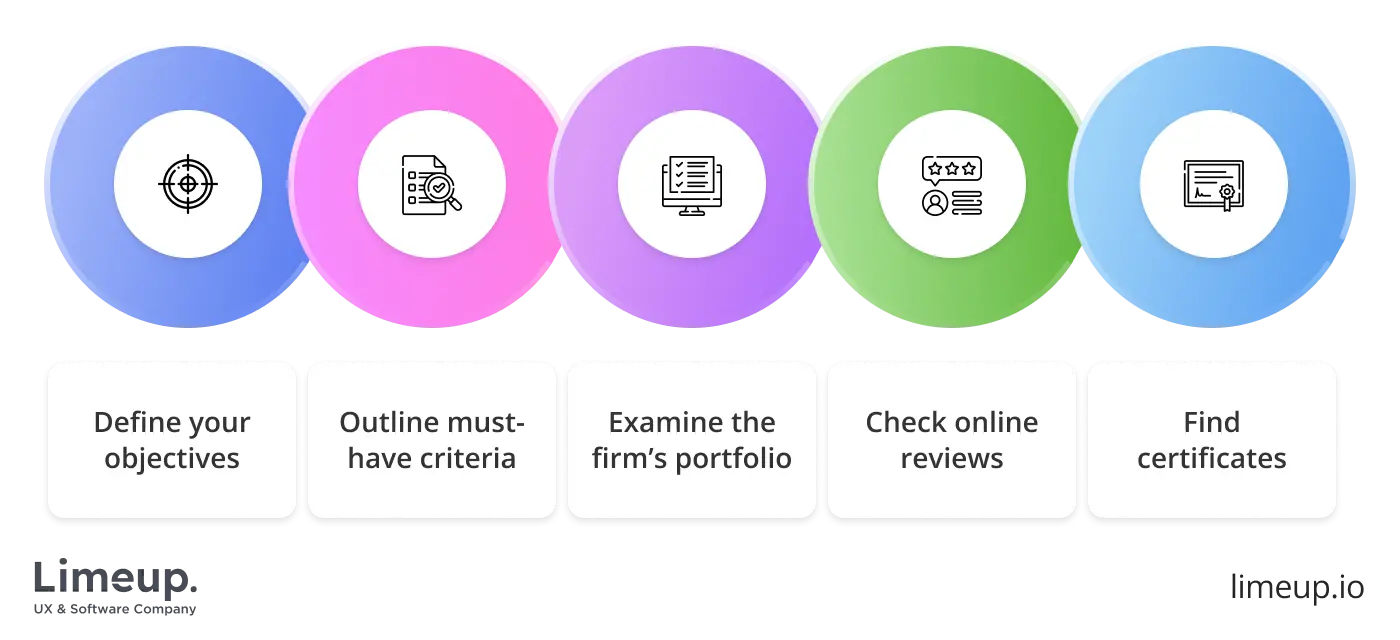

How to select a fintech development company?

To make sure you obtain the best vendor for your criteria, there is undoubtedly a technique you may adhere to. We’ll go over some of the most important pointers that will aid you in your quest here.

— Define your objectives.

First and foremost, you have to settle down on the entire list of aims for your project to present them to the vendor. Proper documentation of your goals, needs and expectations will enable the firm to provide a comprehensive time and budget overview of the venture and plan the construction process faster.

On the contrary, overseeing this step may lead to misaligning the studio’s capabilities to the targets of your carry-out. For example, they won’t have enough experience constructing cross-platform utilities or haven’t mastered the AI and ML tools. It will require you to look for additional support and allocate more resources. The number of digital payment marker users is expected to reach 4.8B in 2028, so if you want to cater to a large audience, the team should fit.

— Outline must-have criteria.

There are many fintech software development companies. Finding one capable of meeting all your demands isn’t a tough challenge if you specify them. It is essential to outline the professional mighties of programmers, such as adeptness at building core banking systems, multi-currency wallets or policy management programs.

However, the administrative facet of cooperation is another point to consider. For instance, you can decide on preferable payment methods, whether you are more interested in hourly rates or a retainer approach. Also, pay attention to the frameworks they adopt — Agile, Waterfall or Lean engineering. The tech suite is as crucial as the right way to leverage it.

— Examine the firm’s portfolio.

Begin evaluating the tech visionaries by going through their portfolio of works. These are typically labeled as “Case Studies” or other related names on the corporate website and each highlight is a detailed description of the project.

What you want to pay attention to are the challenges that were present at the beginning of work, how the team overcame them and what results were achieved once the strategies were implemented.

— Check online reviews and testimonials.

Reputation is one of the cornerstones of the success of a financial software development company, so be sure to check out what former clients have to say about any given supplier. You can turn to online review websites. In addition, it won’t hurt to see what people say about a vendor on LinkedIn.

These findings will hint at the strengths the distributors have — if they are especially good at communicating or possess unique knowledge of the industry and can write code for distinctive programs. They will shed light on their weaknesses as well. If squads previously violated agreements, featured low-quality outputs or were rude, you can locate such detail fast after googling their names.

— Find certificates and accreditation.

One of the ways software development companies in London and elsewhere can prove their qualifications is by proudly showcasing their registration information. For example, you can check whether an agency is an AWS partner or has received any awards from independent entities.

These are some basic principles you can operate on when you single out collectives of fintech software developers. By diligently following our tips, you can make a judgment of the distributor before agreeing to an interview.

The adoption of online payment means is increasing. S&P Global surveyed a group of adults in the USA, and about 83% of respondents stated that they use at least one transaction app, while around one-third of the people gave their preferences to several utilities.

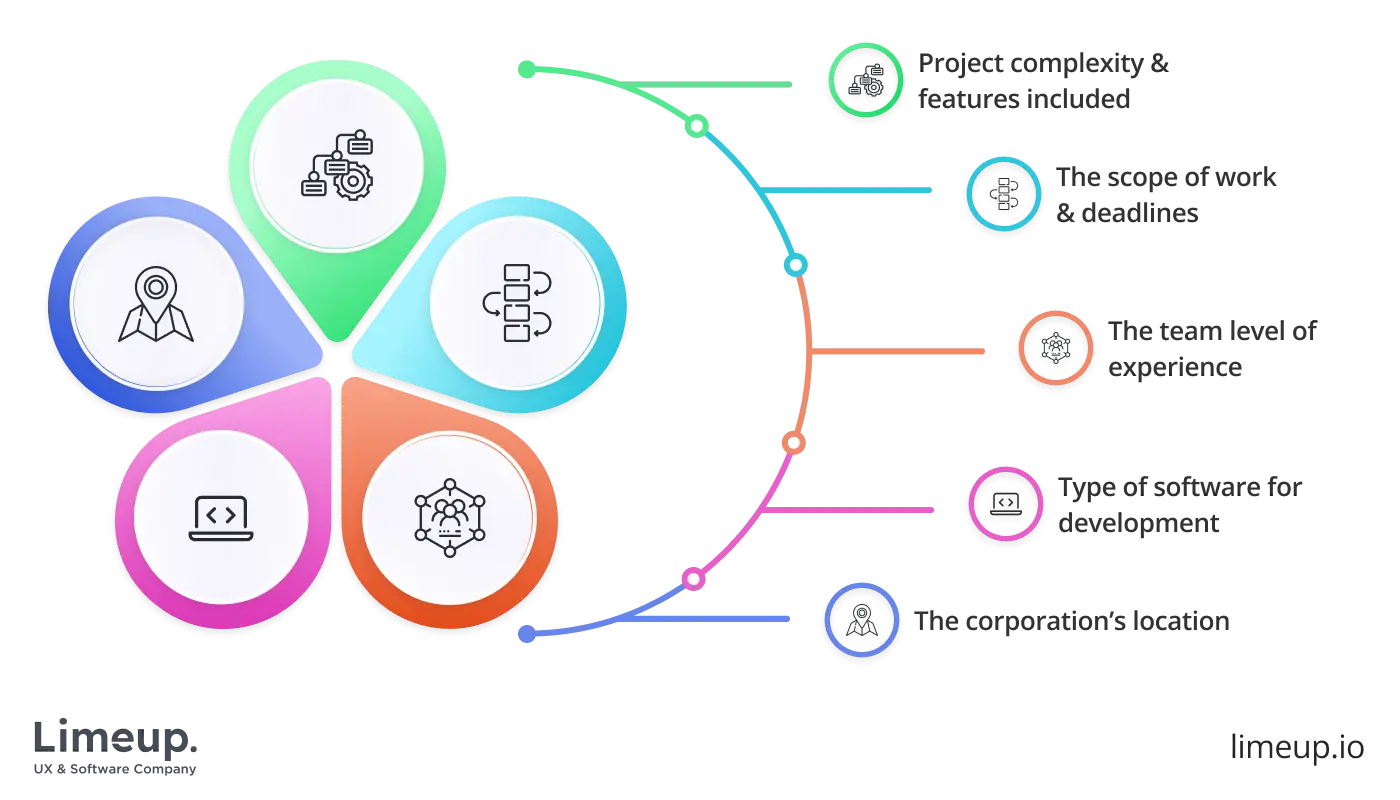

How much do financial software development companies charge?

In the last section, we will review a critical aspect of selecting tech troubleshooters, which is pricing. Since you will be paying for the services you receive, you need to have an understanding of what determines the budget and what kind of models you can expect to run into.

It is impossible to calculate the final cost of fintech app development without consulting with an executor since its scale, functionalities and configurations are not defined, and only with a full list will it be possible to get particular figures. So, to go beyond estimations and into concrete numbers, reach out to the best fintech software development services providers.

With that out of the way, we can say that the expenditure plan primarily forms based on the amount of work that needs to be done, i.e., the scope of the project. Large applications and platforms with many tailored features will inevitably cost more than simple solutions.

Other factors that affect expenses are the level of experience of the team, the corporation’s location, the deadlines and more.

As for the models, the most popular approach is a per-hour fee, where you pay for the time the financial software development company works on your project. The second most common structure is a fixed-price venture when the expert estimates the amount and presents you with a quote for the completion of the entire undertaking.

You can also encounter hybrid variations, which are agreed upon directly between the client and the firm. In any case, be sure to get a detailed explanation of what goes into the price when considering signing a contract with a corporation.

Besides the previously mentioned ones there is another important determinant influencing the outlay for fintech software development services — the technology stack needed for your project. As is often the case, when we’re dealing with state-of-the-art technologies like AI, blockchain or machine learning, this goes with a premium because you need highly specialized expertise to work with those.

Additionally, if your endeavor needs to comply with industry rules such as GDPR or PCI DSS, you may increase the allocation by 10 to 15% to make certain that all security and data protection standards are fulfilled.

Another cost driver is the longevity of the post-delivery support period required after launch. Regular updates (every 6 months), bug patches (every month), and the integration of new functions are typically included in the agreement, which ranges from 20% to 25% of the annual production spending.

The subscription is usually highly popular because many businesses choose to pay a set monthly charge for ongoing support — depending on the level of help they will receive from coders, this fee might range from $1,000 to $5,000 per month.

Last but not least, employing expert project managers may result in an extra 5–10%, but in the long term, this investment will prevent delays and overruns for a program that works perfectly.

Hourly tariffs of fintech software developers

Further, you’ll find a brief with average fees that are counted in accordance with the tier of executors’ proficiency:

| Degree of expertise | Key responsibilities | Wages |

| Junior | Leverages basic elements of the interface, performs light third-party integrations, conducts simple validation examination. | $30 – $60 |

| Middle | Engineers key components, forms multiple connections with external sources (SWIFT, Plaid, and so on), implements protection mechanisms, and ensures data encryption and optimized code. | $60 – $100 |

| Senior | Forms the architecture of the program, makes crucial decisions and outlines strategies, creates means for disaster recovery, ascertains that deliveries follow requirements of regulatory institutions and checks the work of the other team members. | $100+ |

What to ask a finance software development company before hiring?

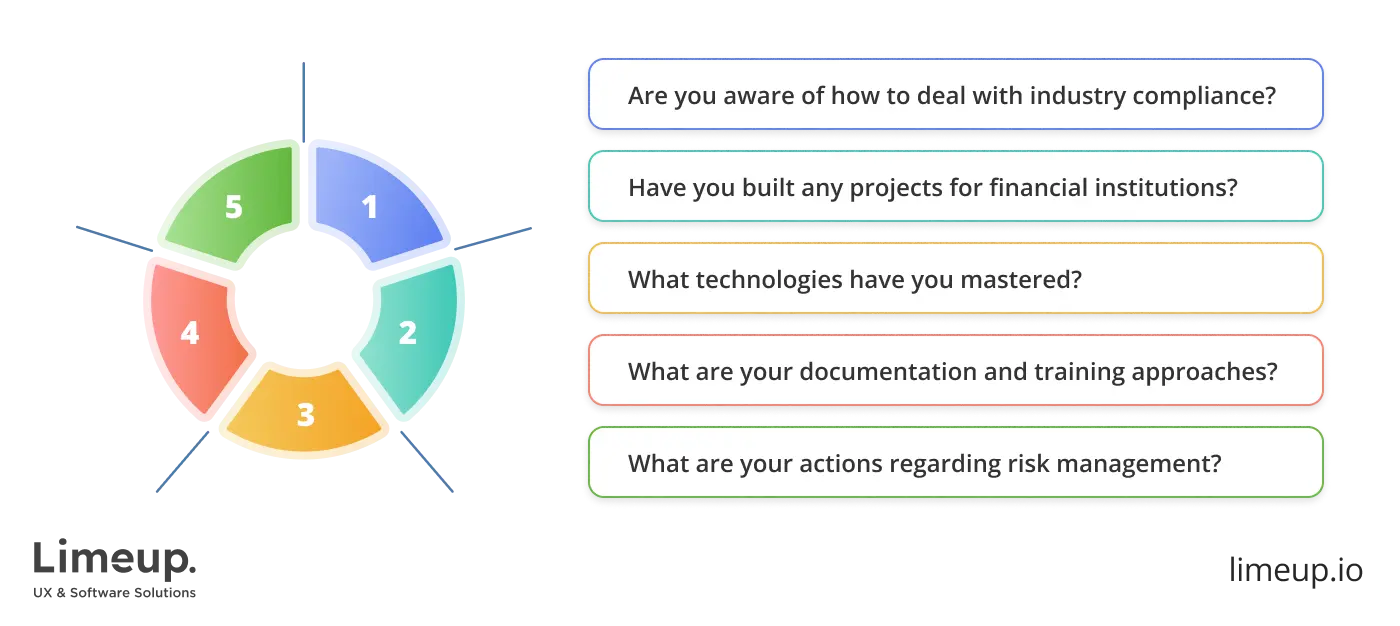

By contacting studios, you close multiple potential issues that can appear in the future. Suppose you think one vendor is good and that their website looks professional. What can probably go wrong? But when you reach out to them, you spot a lack of confidence or necessary expertise. Look at the points below that need clarification:

- Are you aware of how to deal with industry compliance?

Meeting legal and standards obligations in the money-related sphere is as crucial as designing stunning initiative visuals and embedding next-gen features. That’s why expounding the previous experience and capabilities of a financial services software development agency is your top priority. What is the use of a program if your prospects don’t approach it because it wasn’t accepted by regulators?

- Have you built any projects for financial institutions?

We deliberated on the importance of case study assessment, which is a really effective way to make an informed decision. However, it is important to take into account that a plethora of suppliers don’t disclose the entire collection of the works they have done because in many cases they sign NDA agreements and are not allowed to publish details of cooperation. If you find someone’s workflow interesting but don’t see similar undertakings, ask about them.

- What technologies have you mastered?

Building systems is a complex process consisting of many steps. The adeptness of coders must encompass distinctive knowledge of programming languages, such as Java and Python for the server-side and JavaScript, HTML5 and CSS for the client interface. If your goal of synergizing with fintech software companies is to create a mobile version, they should be proficient in Kotlin, Xamarin, or React Native.

- What are your documentation and training approaches?

The difference between true professionals and amateurs is that the former category is capable of explaining their actions and deliverables. Every program has descriptions for major and minor details like implemented security mechanisms, connected APIs, and diagrams with the structures. They are supplied with guides to empower a user to quickly grasp the essence of the functions, whether it is a target user or a worker.

- What are your actions regarding risk management?

One bug in a finance tech tool can lead to colossal losses if the private information of customers is compromised or in situations where confidential data becomes public. Various aspects can cause negative drawbacks, even such moments as delays, compliance failures, etc. Inquiring about this matter, you will know that they have a special course of actions and ascertain that real experts will handle your carry-out.

This short list of questions will help you test their communication skills and shed light on their weaknesses and strengths.

Looking for a fintech solutions software development company?

As you can now clearly see, with such a myriad of choices when it comes to picking a reliable, innovative partner to trust the fate of your digital transformation, it can be easy to get lost. You have to analyze each candidate from a different country and know what sets them apart, making them top providers.

Hopefully, by reviewing our list of 10 teams of tech savants that can handle scalable projects and make them stand out, you will find an agency worthy of your attention. Partnering with a seasoned custom software development company in the UK ensures you get access to tailored solutions, compliance-ready architectures, and long-term technical support for your fintech projects.

After all, now you are equipped with valuable knowledge of what criteria to pay extra attention to when gathering vendors.

If you want to select a custom financial software development company with a decade of experience and a proven track record of profitable carry-outs, reach out to Limeup. We will schedule a consultation and discuss how to achieve your business goals together.