Digital Wallet Development: Complete Guide for Businesses

Looking into digital wallet development in 2026? You are at the right address. This guideline offers a clear and focused summary of what it takes to build a competitive product. Whether it comes to basic functions or purchase recommendations and strategic positioning, we will go over the fundamentals without getting lost in technical terms.

Would you like to create a digital wallet that is more than a money box? One that can be trusted, provide frictionless experiences, and is configured in response to real-world needs?

eWallet development means juggling design, compliance, tech stacks, and user experience, all at once. We will take you through the entire process and show what does or does not inflate the cost and what can make some solutions remarkable in a cut-throat market. Just hold on, we can do better than that; it is not all theory to us.

What is a digital wallet?

A digital wallet is an online application that holds payment data, login info, and in some cases, digital currencies in a safe and encrypted place. It is a substitute for physical wallets in daily transactions, making cards, passes, and credentials available with just one tap.

The mobile wallet app development of this technology has already begun to change the habits of people in the real world: in the UK, 11% of adults, which is one in nine, frequently go out carrying only a digital wallet, and the number is even higher among those aged 35 to 44 as it reaches 29%.

The mobile-first trend is spreading, and phones are taking over the role that was traditionally meant for cash and cards — no more heavy pockets, speedy checkouts, and no reason to fumble around.

Types of digital wallets

Digital wallets may be divided by the way money is kept in them and which stores they can be used in. These types have various business models and requirements of the users.

- Closed wallets. These are wallets that are provided by a dedicated firm, and can only be utilized within its universe (e.g., Apple, Amazon).

- Semi-closed wallets. Used between multiple merchants on an established network or partners.

- Open wallets. These are linked to banks and can perform a wide variety of transactions including withdrawal of money via an ATM.

- Crypto wallets. Cryptocurrency digital wallets include coins such as Bitcoin or Ethereum and access to blockchain transactions.

Deciding on the appropriate type requires understanding your service range, transaction framework, and financial integration, insights provided by a skilled eWallet app development agency.

How do digital wallets work?

Digital wallets utilize a combination of encryption, tokenization, and secure authentication methods to process payments safely.

During digital wallet implementation, when a user adds a payment card or bank account, sensitive information is encrypted and stored securely on the user’s device or in the cloud. Preventing direct access to actual payment details greatly reduces the risk of fraud.

Main technological advancements that have made it possible for digital wallets to exist are as follows:

- Encryption to protect payment data at rest and in transit

- Tokenization to replace card details with temporary, useless tokens

- Biometric and multi-factor authentication to confirm user identity

During a transaction, the wallet never shares actual card numbers with the merchant. Instead, it generates a one-time or limited-use token that travels through payment networks, completes the payment, and expires immediately. Intercepting it leads nowhere — wrong key, wrong door.

A typical payment flow looks like this:

- The user initiates a payment in the wallet

- The wallet creates a secure token

- The payment network validates the request with the issuing bank

- Approval or decline returns within seconds

Most digital wallets do not just limit their functionalities to payments. When you build a digital wallet, it can act as a mini financial hub by storing loyalty cards, tickets, IDs, and digital assets. APIs enable seamless communication with banks, merchants, and third-party services, ensuring operations without disruptions.

Internally, PCI DSS compliance along with secure hardware, operating system protections and the like keeps the process smooth. It is effortless for the user. For the tech stack, it is a disciplined orchestra playing at full speed — no notes missed.

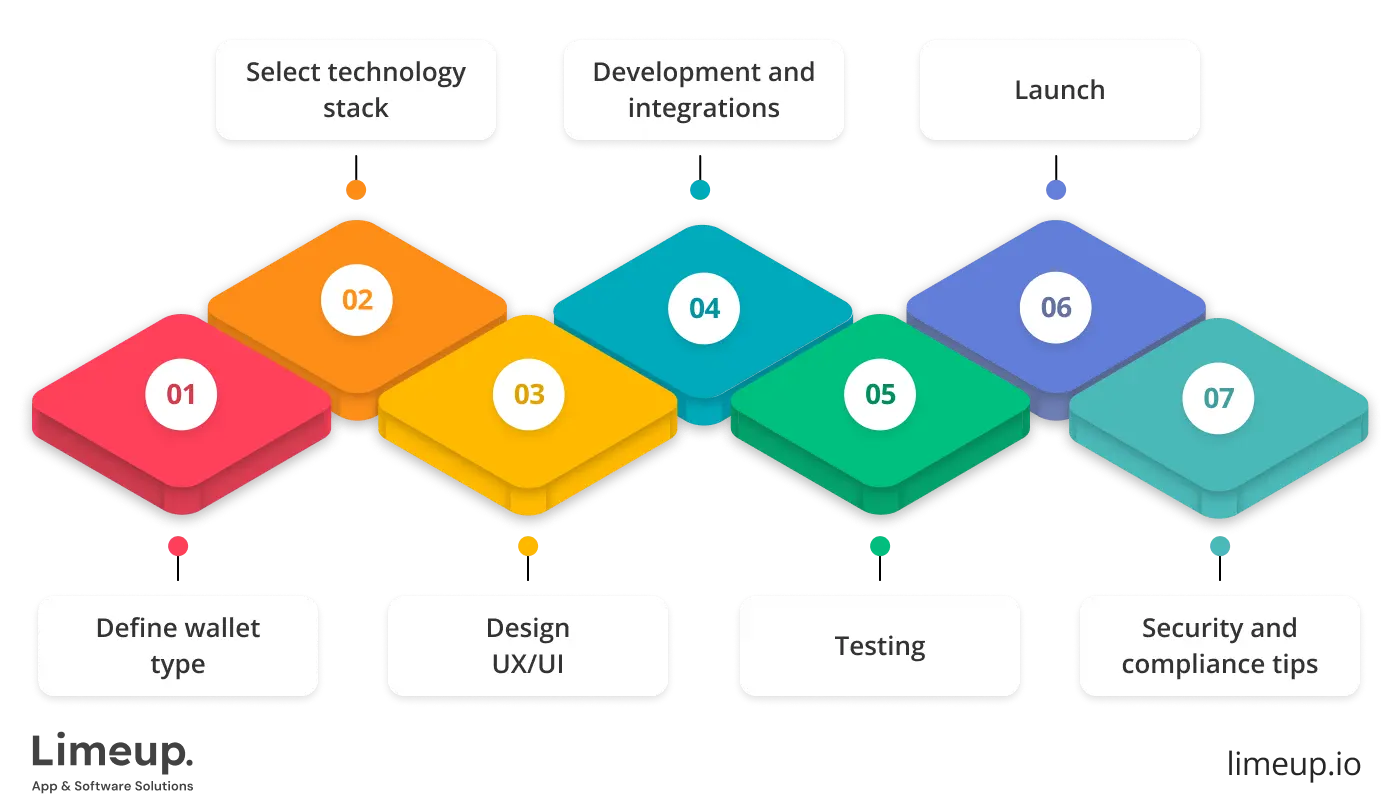

How to сreate a digital wallet?

Creation of an eWallet app is a process that needs a good strategy, a robust technical groundwork, and utmost attention to security. Each phase has its specific function, and not following the process can often result in costly rework. What follows is a well-defined route that ensures the development is both grounded and ready for the future.

A jump from $7.42 billion in 2022 to $51.5 billion by 2030 puts the mobile wallet market on a steep climb. That 28.3% CAGR points straight to the need for teams who can build with intent, not guesswork.

Define wallet type

The very first thing to do in eWallet app development is to choose the type of wallet. Whether it be mobile payments, online transactions, cryptocurrency storage, or a closed system for a particular platform, it is up to you to decide the focus of the product. Each of these affects the functionality, legal area, and user expectation differently.

Here, user scenarios play an important role. A consumer wallet for daily payments needs to be fast and user-friendly, while a crypto wallet will have the demand for private key handling as well as transparency.

At the end of 2026, the number of global digital wallet users is projected to be more than $5.2 billion which will be around 60% of the total population of the world. Clearly defining your goals before you create an eWallet app will help prevent feature creep and ensure development aligns with your business objectives.

Select technology stack

The tech stack mostly determines the performance, scalability, and maintenance costs. For instance, the majority of the mobile wallets depend on Swift for iPhone and Kotlin for Android, while the delivery process is accelerated by using cross-platform frameworks such as Flutter or React Native.

For example, React Native allows almost 90% of the same code to be reused across platforms, thus cutting down the total development time and costs significantly as compared to the case of using native languages for development. Back-end systems are generally developed using Node.js, Python, or Java together with a scalable cloud infrastructure.

Databases, APIs, and payment processors constitute the core of the system’s architecture. It is vital to select providers offering excellent documentation and worldwide accessibility. When learning how to create an eWallet, focus on building a convenient user experience.

You will need front-end technologies commonly used in the industry, such as React or Angular, to deliver smooth, responsive interfaces that make the wallet intuitive and user-friendly.

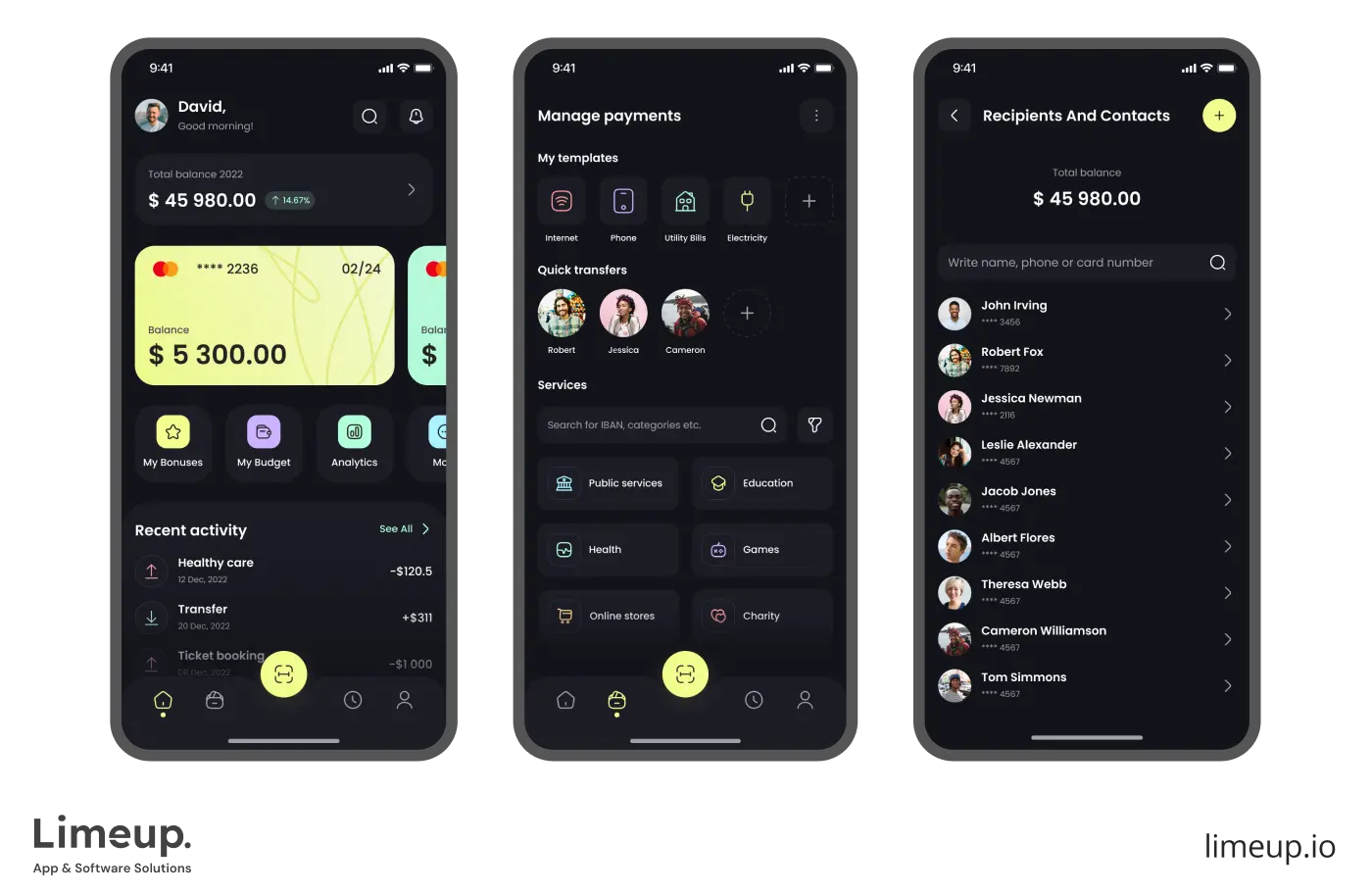

Design UX/UI

UX/UI design defines adoption rates. A digital wallet lives or dies by ease of use, especially during onboarding and payments. Interfaces must feel intuitive, with clear flows for adding cards, authorizing payments, and tracking transactions.

Consistency across screens builds trust. Visual clarity, readable typography, and thoughtful microinteractions reduce friction. Users expect speed and confidence, not a puzzle box disguised as finance.

Development and integrations

Development starts with core features such as user authentication, payment processing, and transaction history. APIs connect the wallet to banks, card networks, and third-party services. Clean architecture supports future updates without breaking existing flows.

Integrations require close attention. Payment gateways, KYC services, and notification systems must work together seamlessly. Strong documentation and version control keep teams in sync during this phase.

Furthermore, the convenience of connection with a variety of payment networks and third-party services to create an eWallet should also be stressed in terms of interoperability and end-user comfort.

Testing

Thinking about how to develop a digital wallet, try to focus on how the platform performs and functions in a usable yet reliable manner. There are necessary actions to be taken, such as testing, monitoring and updates.

Functional testing checks features, while performance testing ensures stability during traffic spikes. Security testing targets vulnerabilities like data leaks or unauthorized access.

Real-device testing matters for mobile wallets. Simulators miss edge cases that appear on actual hardware. Catching issues early saves time, money, and public apologies later.

Launch

A controlled launch reduces risk when you build a digital wallet. Start with a limited release to monitor performance, gather feedback, and fine-tune features. App store optimization, clear onboarding guides, and responsive support teams smooth the first impression.

Post-launch monitoring tracks crashes, transaction failures, and user behavior. Early insights guide rapid improvements and keep momentum strong. Rapid industry changes necessitate continual improvements in digital wallets to incorporate the latest tech and legal requirements. Software development companies oversee persistent monitoring and routine fault assessments.

Security and compliance tips

Creating a digital wallet is a regulatory compliance effort assuring that the app is in tune with data privacy laws, anti-money laundering (AML) requirements, and standards of payment protection like PCI DSS. This, of course, adds to legal legitimacy and confidence within a tightly regulated financial environment.

Conformity with standards such as PCI DSS and local financial regulations is still very important. Good privacy policies and clear data handling practices instill user trust. In digital finance, trust is more powerful than any advertising campaign, and once it is gone, it is very hard to regain.

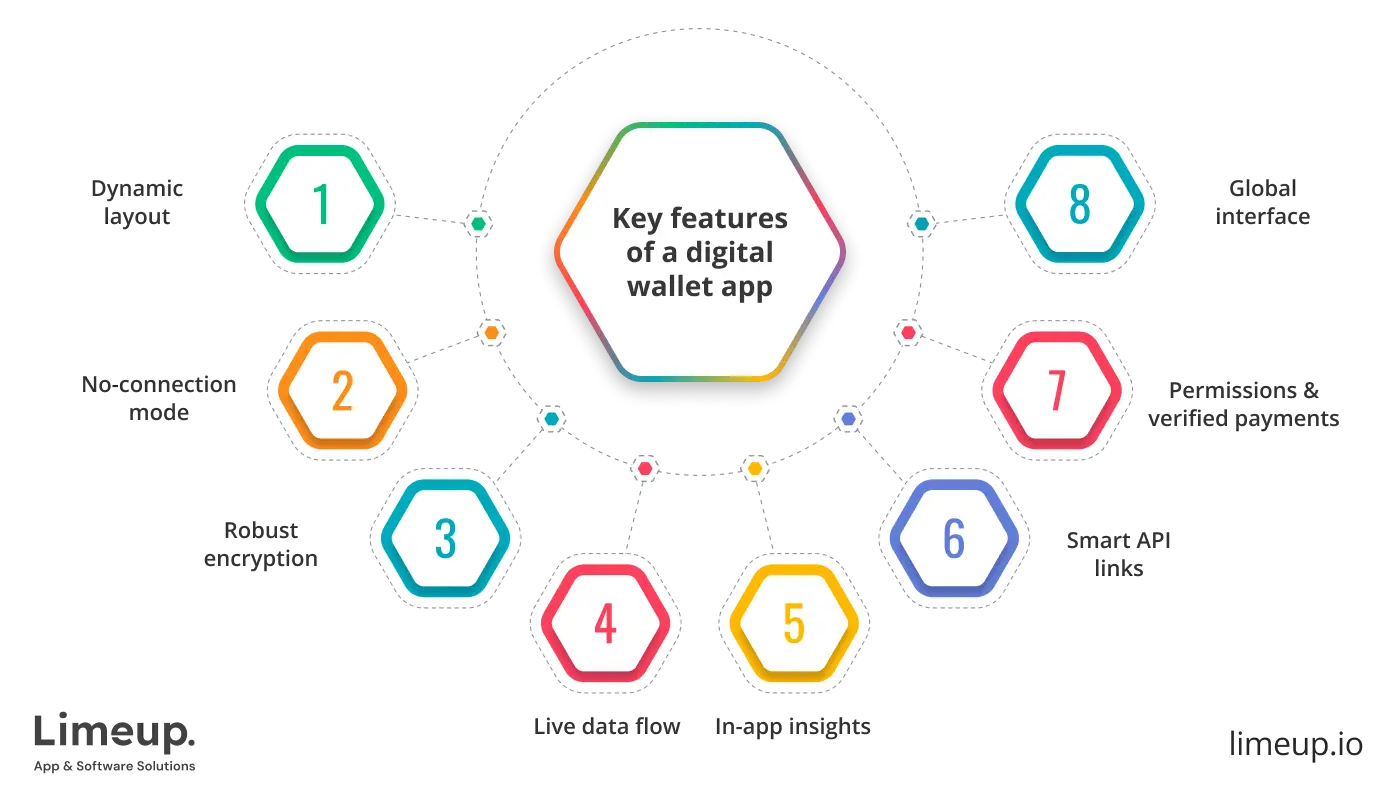

Key features of a digital wallet app

Mobile wallet application development involves choosing the appropriate modules that may produce a safe, enjoyable, and convenient experience. These characteristics ascertain the level of effectiveness of the wallet in real life.

- Dynamic layout. Interfaces are real-time responsive to the size of the screen, usage, and volumes of content to remain seamless and device-agnostic.

- No-connection mode. Critical operations such as the transaction history and QR payment continue to be available even in a situation where the internet goes on a break.

- Robust encryption. End-to-end data protection encrypts sensitive data behind walls of military strength and it gets harder to breach that data than theory.

- Live data flow. Your balance and transactions are automatically kept up to date via immediate syncing of users, banks, and payment systems.

- In-app insights. Spending habits, balance estimates, and behavioral nudges are presented right in the app and do not require tab switching or making assumptions.

- Smart API links. The third-party services integrate without friction, loyalty platform to payment gateway, and with high reliability.

- Permission settings. To understand how to develop a digital wallet, implement permission settings that give users and admins role-based control over actions.

- Verified payment flow. All transactions are verified and validated at each step that reduces the threat of mistakes and fraud without creating friction.

- Global interface. Multi-language support, multi-currency, and regulation-sensitive design provide the feeling of native-ness, regardless of the jurisdiction in which the wallet is opened.

An excellent illustration of these principles is Traders.One, which was Limeup’s creation. This platform for cryptocurrency trading joins real-time syncing, robust security, and a superbly user-friendly UI/UX together to produce seamless transactions.

Over 70 web and 50 mobile screens were made by our team, each featuring functions such as live trading updates, account management, and safe asset storage, streaming the wallet-like experience for traders that is equal in performance, trust, and usability.

Any high-performing wallet app is based on strong features. They are flexible and allow them to trust and engage in long-term development, as your client base increases.

How much does digital wallet development cost?

The creation expenses correlate with the depth of features and protection mechanisms integrated. More sophisticated designs demand greater time and funding. British software companies, for example, may have different pricing structures compared to firms in other regions.

A considerable cost might also be incurred that arises from customization such as security measures, the payment gateway used and the design of user interfaces.

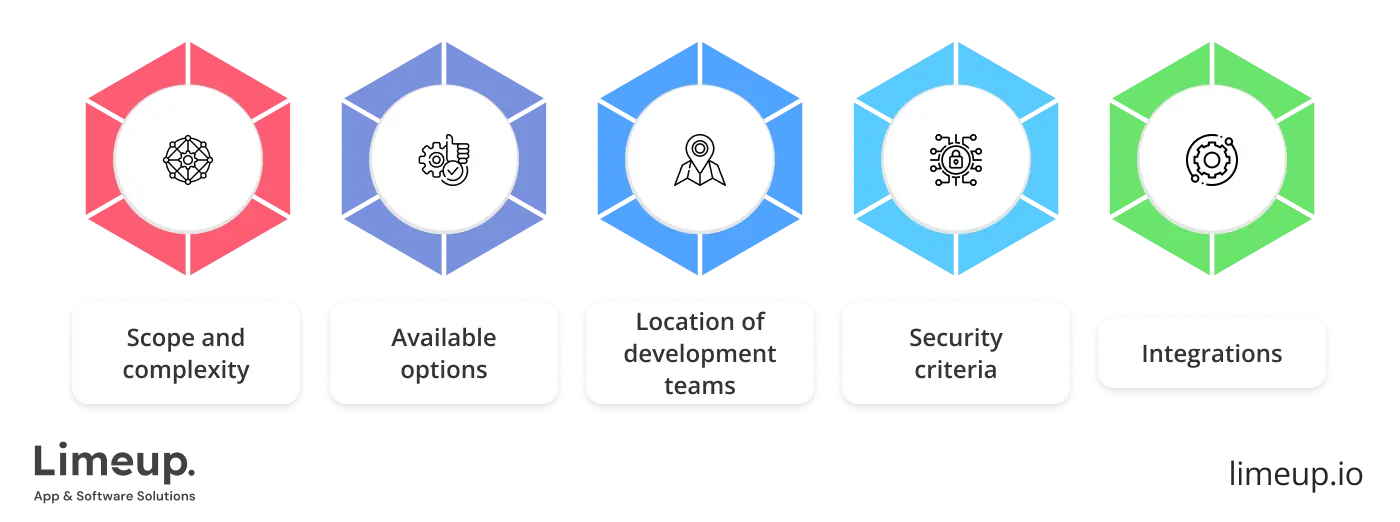

Factors affecting cost

There is a pool of interlinked drivers that define the total cost of setting up a digital wallet. From key features to your technical execution partner’s location, every decision made during the planning and creation phase affects the budget.

- Scope and complexity. Basic applications are cheaper; real-time synchronization and role management, as well as multi-currency capability, are additional features of an advanced wallet that require a larger budget.

- Available options. A key part of understanding how to create a mobile wallet app is evaluating available features like NFC payments, QR scanning, or crypto transferring, which could tremendously alter cost.

- Location of development teams. Prices vary in different parts of the globe. A group within North America or Western Europe would cost more as compared to one within Eastern Europe or Asia.

- Security criteria. Fortifying data with advanced encryption, biometric signing in and cross-checking all increase the time and monetary investment.

- Integrations. The more systems your wallet integrates with: banks, PSPs, analytics tools, the more difficult the production will be.

The price for a basic digital wallet app development will cost you from $20,000 to $50,000 but it has the bare essentials functionality-wise — tracking balances, saving payment methods and enabling money transfers.

Thankfully this is a very straight-up simple entry point into the digital wallet space for potential adopters who have not really been ready to take the plunge but are interested in exploring the option.

Want to set up a digital wallet on a very advanced level? The application possesses a lot of high-tech features like NFC payments, multi-currency support, full high-end encryption, advanced safety measures and in addition smooth interactions with many payment gateways.

Building such apps cost anywhere between $50,000 and $150,000, showing that excellence is always expensive and you have to pay top bucks to remain cutting-edge.

An enterprise-grade digital wallet is usually viewed as the ultimate in fintech because of its security, flexibility and scalability, and such high-end features are typically reflected in costs — it will not be cheap.

Some of those characteristics include enhanced fraud detection, peer-to-peer transfers, QR code payments and cryptocurrency support. Their costs range from $150,000 to about $500,000 or even higher, demonstrating that great quality does not just happen that easily.

As you move up the scale, expect enhanced capabilities and greater costs, but also a wallet built to meet the demands of a growing user base and evolving fintech landscape, especially when working with a full-stack dev team that can handle both frontend and backend development seamlessly.

Cost by region

eWallets’ development expenses are highly inconsistent based on your team’s geographical position. The rates of labor, the standards of the local market, and the presence or absence of the necessary technical know-how are the main factors affecting the total budget. Below is a glimpse of the situation:

| Region | Average hourly rates | Pros |

| North America & Western Europe | $100–$200+ | Access to top-tier expertise Strong project management Compliance knowledge |

| Eastern Europe | $45–$85 | Skilled developers at lower cost Good quality, flexible collaboration |

| Asia | $25–$60 | Affordable, strong technical skills Large talent pool |

Key takeaways:

- When figuring out how to make an eWallet, selecting North American or Western European developers guarantees a balance of compliance, quality, and technical sophistication.

- However, if you are looking for a good quality product at a low price, Eastern Europe would be the right place to start because this region is mostly chosen by startups and mid-size companies.

- On the other hand, Asia provides the most inexpensive development, but still, it is going to take some extra effort in project management to keep the timelines and communication flowing smoothly.

Choosing the correct location is not only a matter of minimizing costs but also ensuring that the team’s capability aligns with the project’s intricacy, schedule, and standards. In fact, a well-considered placement can lead to both budget and results being favored for your mobile payment app creation.

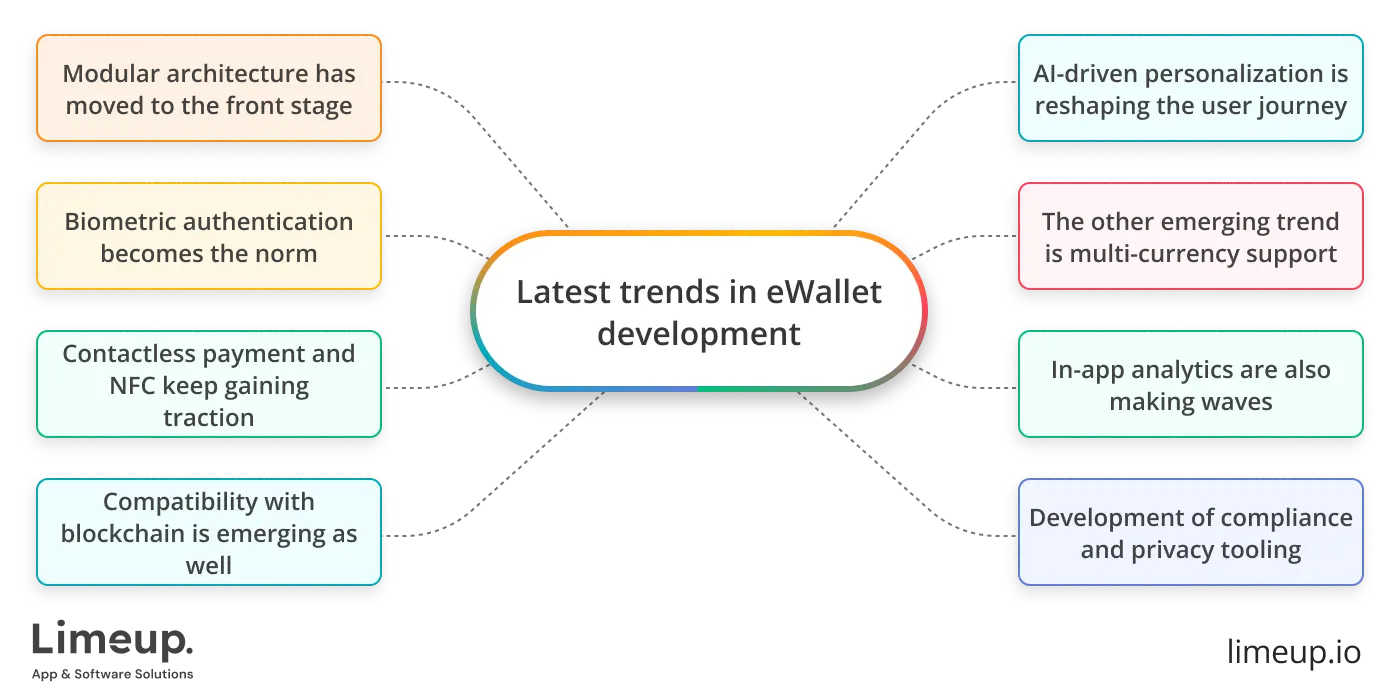

Latest trends in eWallet development

Digital wallets are rapidly changing. What was effective five years ago just will not work anymore and keeping up to date means fresh ideas and radical technical steps.

The market is now characterized by altered consumer behavior, increased regulation, and soaring advances in payment technology, which companies such as programmers, product owners and fintech entrepreneurs have to reckon with.

— Modular architecture has moved to the front stage

Dev teams are no longer opting to construct massive monolith apps; instead, they are attracted to constructing structures out of smaller, more manageable modules. When developing a digital wallet, it will reduce the time of updates and will enable swapping out or adding features without friction. It keeps wallets readily movable, high-scaling as a user base grows, and adapts to market changes without significant restructuring.

— Biometric authentication becomes the norm

Passwords will no longer apply in most wallets which use fingerprint scans and face recognition. The tools provide an additional protection level and streamline everyday transactions and make them smoother.

As users become increasingly aware of online security, the existence of these features can determine whether they use an app regularly and stick with it or leave it without using it at all.

— Contactless payment and NFC keep gaining traction

The rise of contactless payments since 2020 has put the spotlight on every digital wallet development company capable of creating wallets that support near-field communication. These solutions are increasingly found in transit systems and retail environments alike.

— Compatibility with blockchain is emerging as well

Not all users are trading in crypto, but there is rising interest in wallets that feature storage of tokens, checking blockchain IDs, or having Web3. The wallets are popular among technically savvy users and present opportunities with regard to decentralized finance, gaming, and international remittance.

— User journey is changing with the help of AI-driven personalization

Machine learning has begun to be applied by wallets to make personalized predictions, warn about fraud, and notify users of applicable deals. To wire in this kind of smart behavior, companies hire dedicated experts who can calibrate machine learning models like a precision instrument.

— The other emerging trend is multi-currency support

eCommerce across borders and digital nomadism has necessitated the need to have multiple currencies to be used on one platform through wallets. How to create a digital wallet app that handles multi-currency use hinges on solid infrastructure and partnerships with neobanks or exchange services.

— In-app analytical dashboards are also causing ripples

Digital wallets, instead of merely keeping money, allow users to see their habits, weekly trends in their spending habits, categories, and alerts on financial targets. These tools render the app more than utility. It turns into something that one cannot spend a day without.

— Development of compliance and privacy tooling

As the world gets more regulated, code wizards are integrating the privacy-first features into wallet architecture itself. Data minimization, opt-in permissions, and consent flows are no longer an option.

The writing of digital wallets is well underway in clear well-defined increments. Those teams pursuing these trends are not after buzz; they are reacting to an actual change in the way people deal with money. The next layer, be it the biometric login or blockchain support, introduces one more dimension to the capabilities of a wallet, as well as to the expectations of its users.

Ready to build your own digital wallet?

Now that we’ve dissected the blocks of building a digital wallet, where we tried to break down every important point for you, including what it involves to the timelines, feature sets, and real-world architecture behind it.

We explored wallet types, drilled into the anatomy of a functional app, examined smart security protocols, and spotlighted emerging trends that are reshaping the fintech map.

If you have any concerns or questions left in your pockets, just contact us! Whether the issue is simple or complex, our team will review your request and provide clear, practical guidance at every stage.

FAQ about how to build a digital wallet

How long does it take to develop an eWallet?

Different factors such as the difficulty and number of features determine the timeline. An elementary eWallet could be ready in 8-12 weeks, while a sophisticated or enterprise-level wallet with features like multi-currency support, NFC payments, and integrations could easily require 4-6 months or more for completion, with testing and security validation included.

What technologies are used to make a digital wallet?

If you’re exploring how to make a digital wallet, start by choosing mobile frameworks like Swift (iOS), Kotlin (Android), or cross-platform tools such as Flutter and React Native. Backend development typically relies on Node.js, Python, or Java, along with secure databases, payment gateway APIs, and encryption protocols like AES and SSL/TLS to ensure safety and reliability.

Can a digital wallet support multiple currencies and payments?

Absolutely. Advanced eWallets manage not only numerous cryptocurrencies and fiat currencies but also different types of payment methods. This, however, necessitates the right connections with banking institutions, PSPs, and crypto exchanges, as well as the aforementioned off-the-shelf solutions, plus adhering to international regulations.

Is it possible to scale a digital wallet after launch?

Indeed so. Digital wallets can grow to support more users, transactions, and additional features all thanks to a smartly constructed backend, cloud infrastructure, and modular design. Digital wallet development services ensure that gradual expansion aligns with user needs through continuous updates, security improvements, and monitoring.