How to Develop a Banking Software: All-In Review

Rapid transformation of the digital landscape set strict standards for banking software development. In order to satisfy your audience’s long-term needs for advanced banking solutions, it’s vital to be in the loop of the latest changes. We prepared a thorough synopsis covering all the bases for building the most effective custom programs.

Creating banking software solves any problems related to protecting data, enhancing user interactions and bringing innovations to the sphere. In our review we take a deep dive into the key steps necessary to develop a bank digital system, outline the core features, pricing information and the factors that influence your voice of the company for its formation.

Partnering with a seasoned custom software development company in the UK ensures that your banking solution is tailored to business needs while maintaining compliance and scalability.

After reading our comprehensive material, you’ll be in the know of software development for banking aspects, find out instructions on how to make your financial application attractive to potential customers and familiarize yourself with the current trends in fintech services that dominate in the niche.

What is banking software?

Online banking software solutions have become an indispensable part of financial operations. Apart from only storing money, they enable users to manage their expenses more effectively, automate all processes and significantly remove the necessity of paperwork. By using an online banking app, a user can effortlessly check the balance, get reports and make a transaction.

The initial web banking era started with the spread of ATMs in the ’60s-’80s, which made it possible to withdraw money 24/7. This significant event was followed by centralization of banking data and rise of technologies that facilitated transnational transactions. Interesting fact: the first ATM was presented in England in 1967. Since then, companies from the UK still remain groundbreakers.

In the ‘90s software development in banking turned a new leaf in history. Like everything else, financial organizations took new shapes by relocating online. The most notable event of that time was the foundation of the first online bank that operated exclusively on the Internet. James H. Mahan III opened SFNB in 1995 and his trailblazing ideas greatly influenced the flow of banking sphere development.

Web applications for computers gradually lost their supremacy to mobile programs in the ‘00s-’10s. Unfortunately, the advancement of technologies brought not only possibilities but also numerous hacker attacks and fraud attempts that motivated developers to find ways how to develop banking software, secure and resistant to any cyber threats.

Noting the later changes that touch our time, it’s wise to separate the topic into two different branches — traditional online banking and neobanks. As for banks, they have to compete with neobanks that provide customers with a high level of personalization, give access to contactless payments, ensure decent protection and implement new functionalities based on AI. You probably heard of or even used Monzo or Revolut, didn’t you?

Since you are looking for adjustments that will be applicable in a few years, not only now, let’s cover the topic that is the main concern of an abundance of banks around the world. The answer to the question about what banking software is and will be is in blockchain systems, enhancing the defense of the software, AI instruments, accelerating the operations and decision-making process and cryptocurrencies, showing consistent growth.

We’ll study all the crucial fundamentals, but for now, let’s dive into the development process.

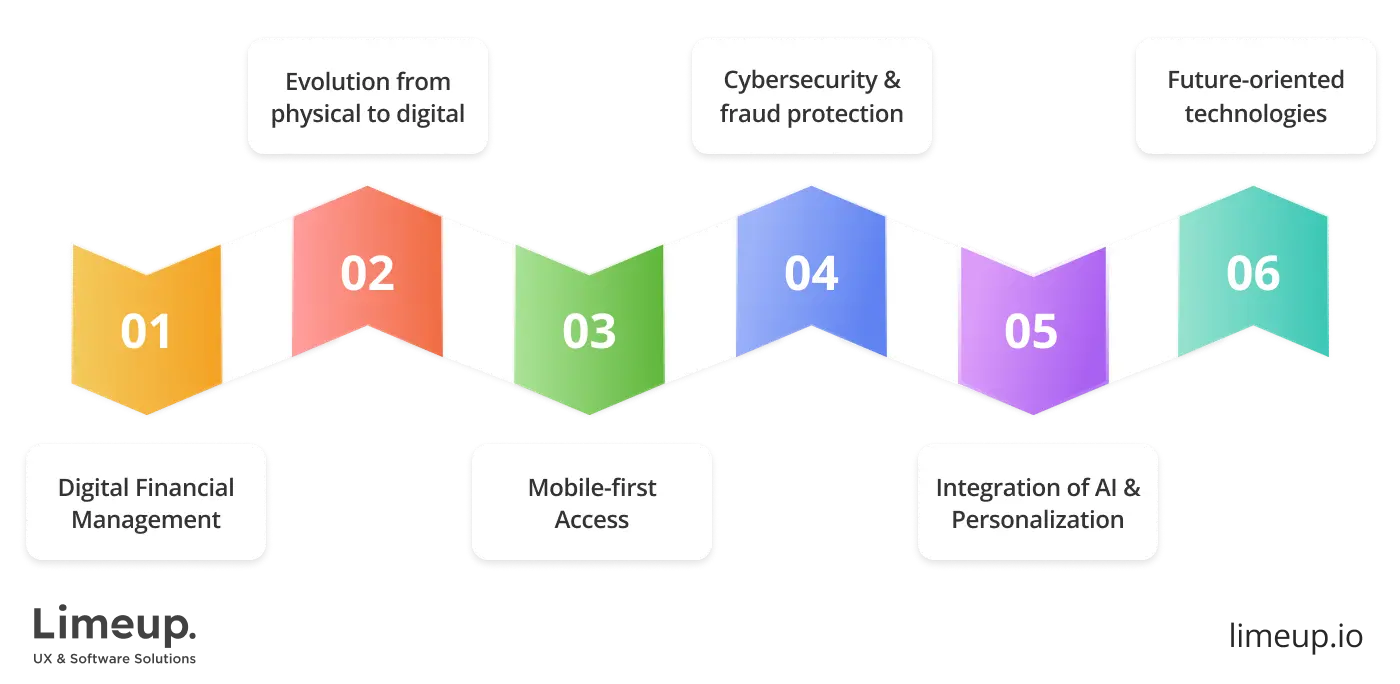

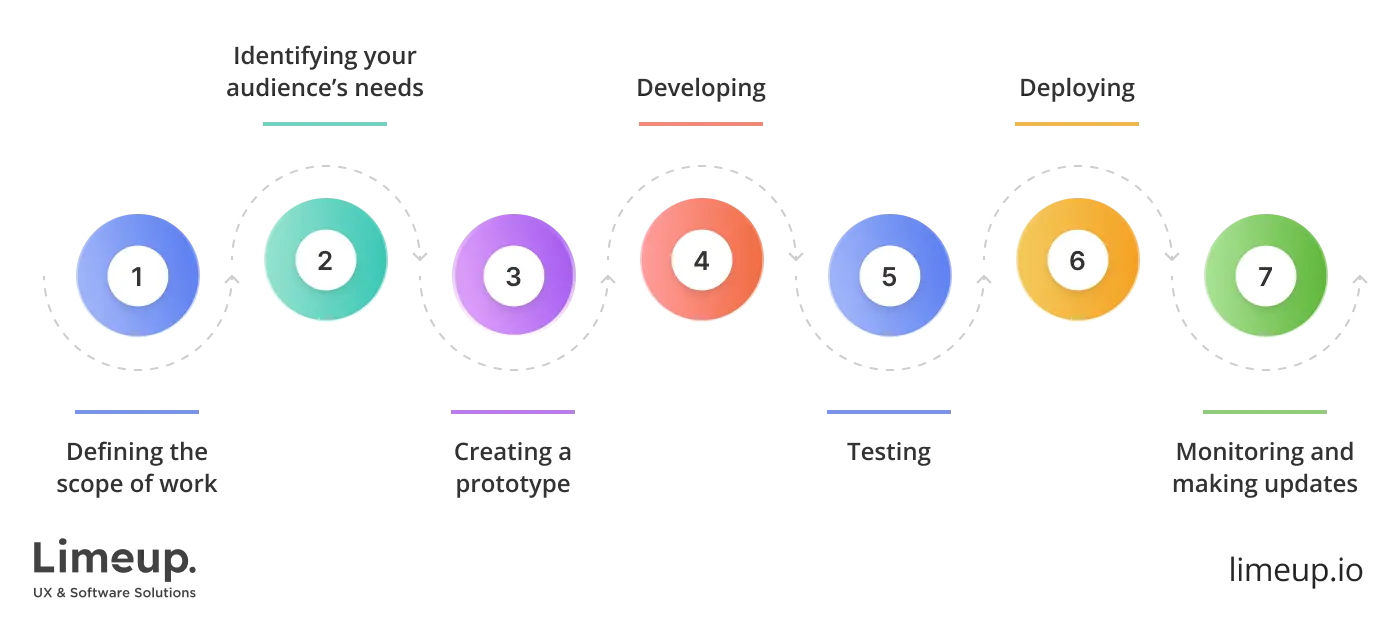

What are the key steps in banking software development?

Explore the workflow of banking soft engineering in detail:

Step 1. Defining the scope of work

What do you expect from your venture? What functions should be available? Don’t repeat a mistake that was made multiple times by other business owners before, get a good grasp of the topic. Study the core elements of a needed software, answer the abovementioned questions, set the budget limits. Gathering your project’s profile reduces the number of modifications that, for its part, carry out resource allocation.

Step 2. Identifying your audience’s needs

Launching a new digital product demands careful planning and thorough market investigation. Staying relevant in the competitive landscape is possible only when you provide something new to the public or remarkably update outdated software. It’s essential to deliver the value. Competent banking software developers know the importance of information and usually a great deal of them offer market research in addition to the main services.

Step 3. Creating a prototype

Then engineers approach the stage of drafting a prototype. It’s a kind of clickable simulation whose main benefit is in giving a business an opportunity to see whether the software is a hit with users. The list of deliveries you’ll be able to witness in action encompasses UI/UX designs and core functions. Having a prototype of your digital product ready, you’ll get the chance to add some fixes to the initial phase of custom banking software development.

Step 4. Developing

According to the goals and objectives, developers select the stack (from languages to tools they will use) and prepare the architecture documentation. Then it’s time to proceed to the coding. Initially, work starts with back-end and front-end engineering, then it’s a turn to integrate the APIs, after that, comes the time to embed data safety mechanisms, and, lately, double-check abidance by industry requirements.

Step 5. Testing

Meticulous evaluation of the outputs produced is non-bypassable anytime, however, in the matter of fintech software development it is vital. Any of the overlooked errors will lead to loss of customer loyalty that’s impossible to restore. Conducting security, functionality, practicality as well as speed and overall performance tests and quality assurance prevent a great deal of difficulties in the future.

Step 6. Deploying

Once the software is tried and tested, digital banking software development finally enters the release stage. It means, the end-user gets access to the program and leaves feedback. During this phase, the coders are tasked to move the system to the new, operational environment.

Step 7. Monitoring and making updates

From now on, the core responsibilities of engineers are to maintain the software. They fix the bugs that appear, provide regular system updates that ensure the safety and relevance of the banking product, and upgrade it in line with new emerging regulations in the field.

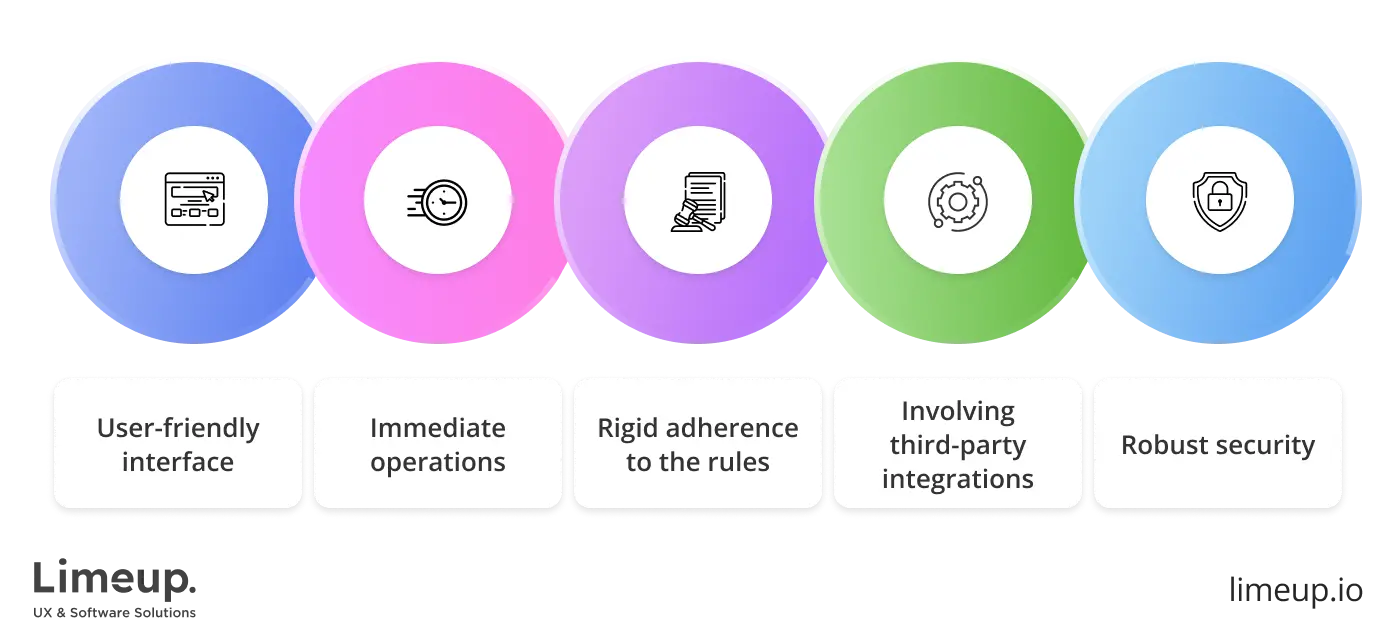

What are the core features of creating banking software?

Aside from coming up with something unique that will differentiate your proposition in the market, consider the characteristics that have already become the field requirements by default. If you want to impress your customers, don’t underestimate any of the outlined attributes.

We collected only basic points (there are even more), so if you want your software to be the number one in its category on Play Market, App Store and on the web itself, convey your expectations to one of the trustworthy banking software development companies. Now, let’s proceed to the examination:

User-friendly interface. No matter what your target audience is, intuitivity and accessibility stand first in online banking software development. To make sure that the user that comes across your application will stay with you, the program must be easy to navigate with the most usable buttons in the reach. It shouldn’t possess any superfluous elements or texts.

Immediate operations. What probably describes a great deal of customers of any age is that nobody likes waiting. Clients expect to get instant credit and loan decisions, send and receive payments in seconds, be connected to support in a blink of an eye and avoid any bureaucracy.

Rigid adherence to the rules. Despite the fact that governments all around the world have strict regulations attributed to bank software development that must be flawlessly followed by banks, for customers your program’s conformity to the rules is one of the signs of reliability. There are different standards in every country: in the European Union, you have to deal with PSD2, and GDPR, in the United States — AML, KYC, CFPB and FINRA.

Involving third-party integrations. Connection of different banking systems within the software and with public or partner interfaces is facilitated by a series of APIs and, of course, multilayered banking software with plenty of functions necessitates external services to run smoothly. Actually, thanks to them, banks are able to offer customers the opportunity to get notifications, manage their finances and be introduced to new offerings.

Robust security. We have emphasized this point several times in our brief since when you build banking software, there shouldn’t be any compromising steps regarding data protection. It includes encryption at every stage of data transmission, ongoing monitoring, APIs with good safety settings and secure engineering flow.

As you can see, only merging responsive and user-friendly design with the system that processes operations fast, corresponds to the law and protection requirements and integrates with the right third-party platforms will provide you with anticipated outcomes.

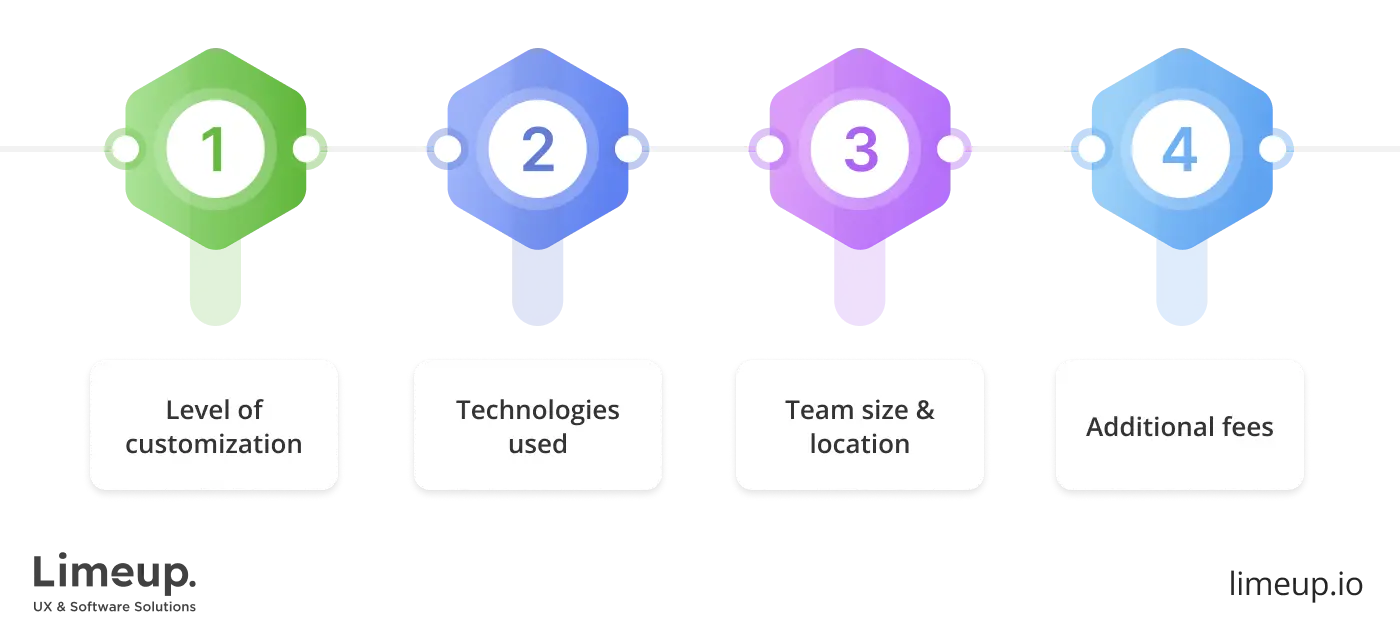

How much does banking & financial software development cost?

There’s no straightforward answer to the question like that. The price-formation process is multifaceted and depends on a number of factors: first, the complexity of an undertaking, second, the location of a provider, third, the technology stack and fourth, the scale of customizations needed.

Now, let’s begin with the approximate tariffs, classified according to scales of banking development projects to find out approximate price it takes to hire software developers:

| Type of software | Includes | Price range |

| Basic solutions | Small-scale databases, limited APIs, simple design. | From $5,000 to $30,000 |

| Advanced deliverables | A higher number of APIs, stronger protective measures (multi-factor authentication), more complex design decisions. | From $30,000 to $200,000 |

| Enterprise-level systems | The highest level of data security, complete compliance with the existing standards regarding building banking software, the best instruments that automate workflow and enable to manage information in real-time. | From $200,000+ |

Find more about software development cost. Take a look at how the other characteristics affect the price for:

- Where is your developer? With the salary rate varying from country to country, it is expected that in certain regions you might be charged more only based on this criterion. However, comparing the markets in the USA and Asia, the difference is not always colossal. Therefore, we advise you not to consider price as a decisive matter since there are more important aspects — proven experience and abilities.

- What technologies are used? Some specific tools for financial & banking software development services like those provided by IBM or Oracle require getting licenses, which, of course, increase the budget as well as involving rare types of developers, such as DeFi or Quant Dev to the project.

- What is the level of customized adjustments? It’s not a secret that suppliers are able to use some pre-build frameworks. Using those means streamlines the processes, reduces the costs and simplifies the maintenance. On the contrary, if your top priorities incorporate full control over the deliverables, ownership and adding numerous tailored features, you’ll have to pay more.

As for the final recommendation, we suggest you choose an optimal pricing model. Although methods of paying for a banking software developer’s work don’t have the same impact on expenses as points brought up, we couldn’t help but outline them since the selection is predicated on the project parameters.

Hourly rate is the best choice for short-term undertakings with predicted timeline, project-based method is perfect for an accomplishment with only a few revisions. Regarding long-term projects, the most beneficial pick available is the retainer model. Having decided to stick to this plan, you’ll be able to divide the sum into equal parts and pay monthly.

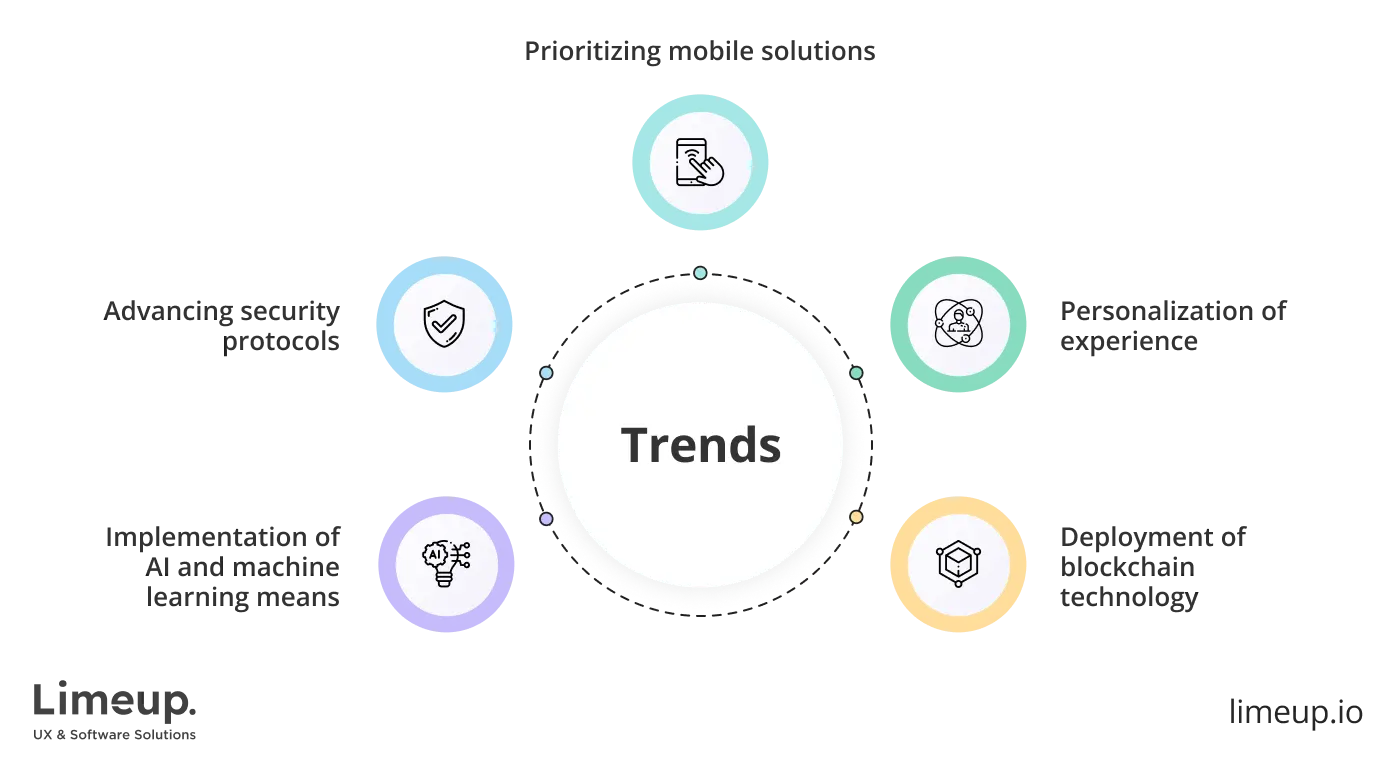

What are the trends in custom banking software development?

See the tendencies that occupy the industry at the moment:

— Implementation of AI and machine learning means

Automation of routine and repetitive tasks, optimization of the cost of banking software development solutions and increase of productivity are outcomes that first come to mind in regard to AI technologies. There are three core components: ML, standing for Machine Learning, NLP, Natural Language Processing and RPA, Robotic Process Automation.

Leveraging ML, banks train algorithms to provide appropriate support to customers and make faster decisions based on data. NLP powered chatbots are able to pick the best solutions possible relying on the tone and information the clients input. With RPA, financial organizations are given the ability to process data without mistakes and make faster updates.

— Advancing security protocols

The main feature of a trustworthy financial solution is its protection, that’s why this trend in e-banking software development we can call timeless. Despite that, in the time of uncertainty and amplified level of cyberattacks and fraud attempts, ensuring invulnerability of sensitive data and operations grows in significance.

Currently, banks are integrating AI systems that allow them to detect anomalies. They also are exploiting no-password authorization means such as one-time codes or biometric to prevent access of third parties to their customers’ accounts.

— Prioritizing mobile solutions

Due to the 2024 Cardholder Dispute Index featured by Chargeback911, about 75% of the Gen Z audience follows the principle “mobile-first.” Owing to this, if by producing banking software you aim to be popular with younger customers, then you definitely must think of how to make use of knowledge.

Over and above that, what is really important to elevate the practicability of your application is to provide decent training to users. To be acquainted with the process of building such apps, study the steps of fintech software development too.

— Personalization of experience

It’s difficult to imagine development of banking software systems without ranking user experience first. Features such as switching moods, arranging, choosing the looks and names of widgets are must-haves in modern programs, however, the range in reality goes far beyond the points that have been previously cited.

Personalization can touch different facets including the financial side in the form of regular reports and analytics, AI-powered support, special offers that help customers reach their goals, preferred security settings and even tutorials. Be mindful of the benefits you can provide to your audience.

— Deployment of blockchain technology

How to make banking software that will be called “next generation”? The answer is in blockchain. Everything from streamlining dealings, improving credit services security and customer experience enhancement is possible by implementing digital ledger technology.

Specialists from different financial institutions like MasterCard, Lloyds Banking Group alongside advisors from Frontiers claim that there is a wide range of opportunities opened by adopting chains of blocks. The activities employed by banks in relation to blockchain include asset tokenization, creating stablecoins and advancing cross-border transactions.

How to choose a banking software development company?

Finding the synergetic ally to engineer your banking software requires a choice that establishes or destroys your entire financial product.

First, battle-tested expertise trumps empty assurances. Success of a firm in handling fintech work represents an essential directive to achieve rather than an optional feature. The development of banking software goes beyond creating run-of-the-mill applications since it demands extremely secure systems which follow all statutory obligations plus robust infrastructure that supports large transaction volumes without any performance issues.

Seek out vendors that create banking software while adhering to security regulations such as PCI DSS and GDPR and other financial industry prerequisites.

Second, staying ahead in technology requires more than just following the latest trends. True innovation lies in the ability to foresee industry shifts and implement solutions that set new standards rather than simply meeting existing ones.

Organizations deploy AI for fraud protection and blockchain capabilities to construct safety measures and stay advanced rather than outdated by one year. Ask them how they approach future-proofing their software. If their answer sounds like a sales pitch rather than a well-thought-out strategy, consider it a red flag.

Third, dialogue functions as either a pathway for trouble-free customer journeys or as a roadblock to obstacles. Avoid working with developers who make their explanations confusing by refusing to provide details about technical matters. A dependable supplier has competence in how to build banking software and maintain open discourse by using simple language to detail technical choices and offer constructive alternatives to proposed solutions.

Your business depends entirely on banking software serving as its fundamental organizational structure. The well-suited group should approach such programs delivery with dedication instead of treating it as a typical project. In financial technology fields you must never doubt as there’s no room for second-guessing.

How can Limup support your software development needs in banking?

To sum it all up, software or app creation for banking is undeniably a demanding matter requiring thorough preparation and comprehensive understanding of a plethora of procedures and ways of advancement. Still, flawless execution of the engineering roadmap, running quality and functionality checks and strict abidance by the rules generate countless prospects for financial institutions to raise a bar.

No matter how complicated it might seem, joining forces with a reliable and experienced crew of developers will significantly ease your burden and even bring more solid industry-specific insights.

Are you interested in partnering with experts who are able to develop banking software that totally meets your objectives and is capable of addressing all aforementioned issues? At Limeup we are guided by the following principles: delivering centric-focused outputs, conducting any level of customization and full commitment to quality. Contact us and we help you push any boundaries.

Choosing a reliable banking software development company in the UK gives you access to domain expertise, advanced security practices, and long-term support tailored to the financial sector.