What is Real Estate Tokenization?

Real estate tokenization is an emerging technology that sparks a lot of discussion among businesses within the niche as it warrants significant opportunities and growth prospects. Many predict this process to revolutionize the current state of buying and selling property shares. Still, to a vast number of people, the topic of tokenization remains complex and unexplored.

Operating on a blockchain-based technology, tokenized real estate offers an unprecedented level of liquidity to an otherwise constrained industry. Not to mention enhanced transparency and immutability that draw a variety of sponsors and investors to switch from traditional options to the process of tokenization.

In our exploration of what is real estate tokenization, we will cover everything you need to know about this phenomenon, how it operates, its benefits and challenges, and many more crucial points. This will give you a comprehensive understanding of navigating the legal landscape and what the future holds for this type of technology. Let’s get started.

What is real estate tokenization?

As we step further into the era of digitalization, the market of real estate is not being left behind. Tokenizing real estate assets has become a trendy topic for discussion in recent years. However, a lot of businesses are still unsure of what it means and how it works. For this reason, we are here to offer an explanation of every crucial aspect, starting with the definition itself.

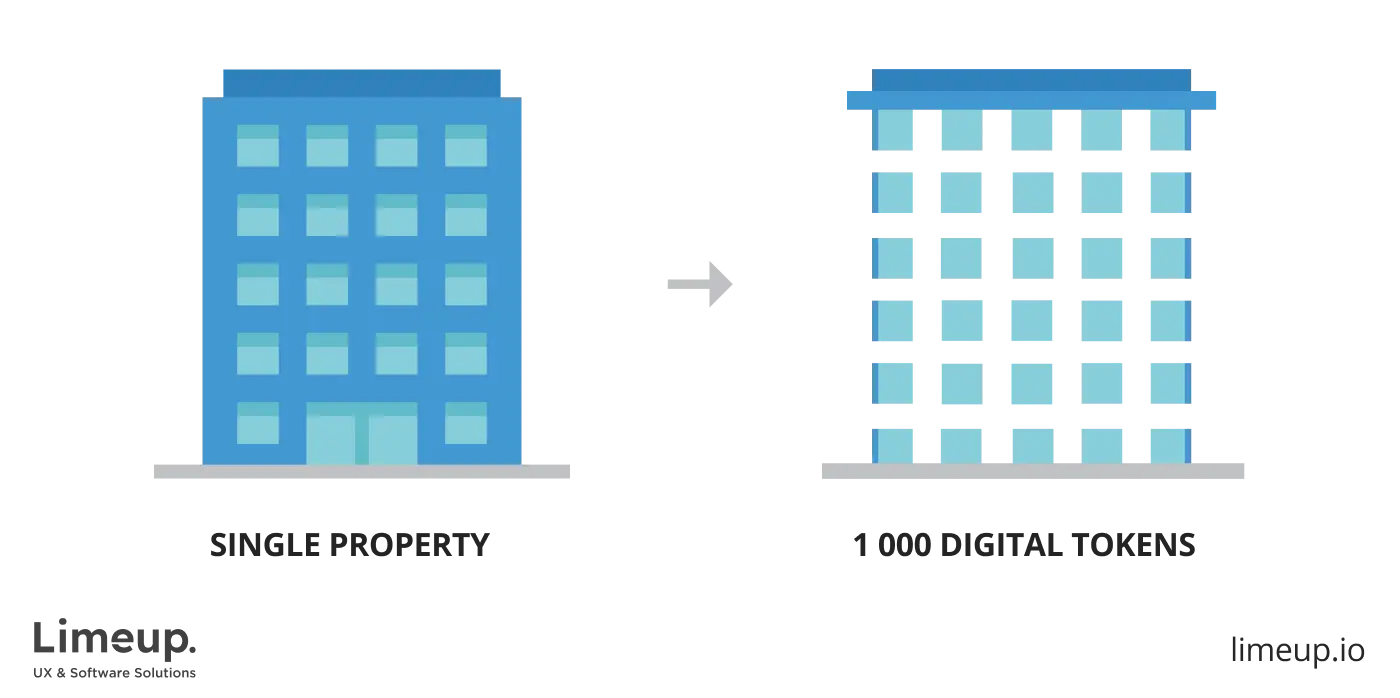

Tokenization of real estate entails representing property shares as non-fungible tokens (NFTs) or fungible tokens using blockchain technology to allow for digital ownership. In simpler words, real estate is referred to as being tokenized when a piece of property is broken up into digital tokens that reflect the underlying asset with all of its rights and liabilities

Unlike Real Estate Investment Trusts (REITs), which allow relative liquidity by trading shares on the stock exchange, tokenized shares of property are recorded on a blockchain. This, in turn, allows for increased liquidity and overall efficiency of trade, which was seen as not an existing option until recently.

Many have praised tokenization for its approach to democratizing investment in real estate as it provides investors with an opportunity to choose how much they want to invest, diversifying their portfolio of assets. Subsequently, the flexibility of the amount of investment and fractional ownership has the ability to draw a diverse scope of individuals to a particular real estate.

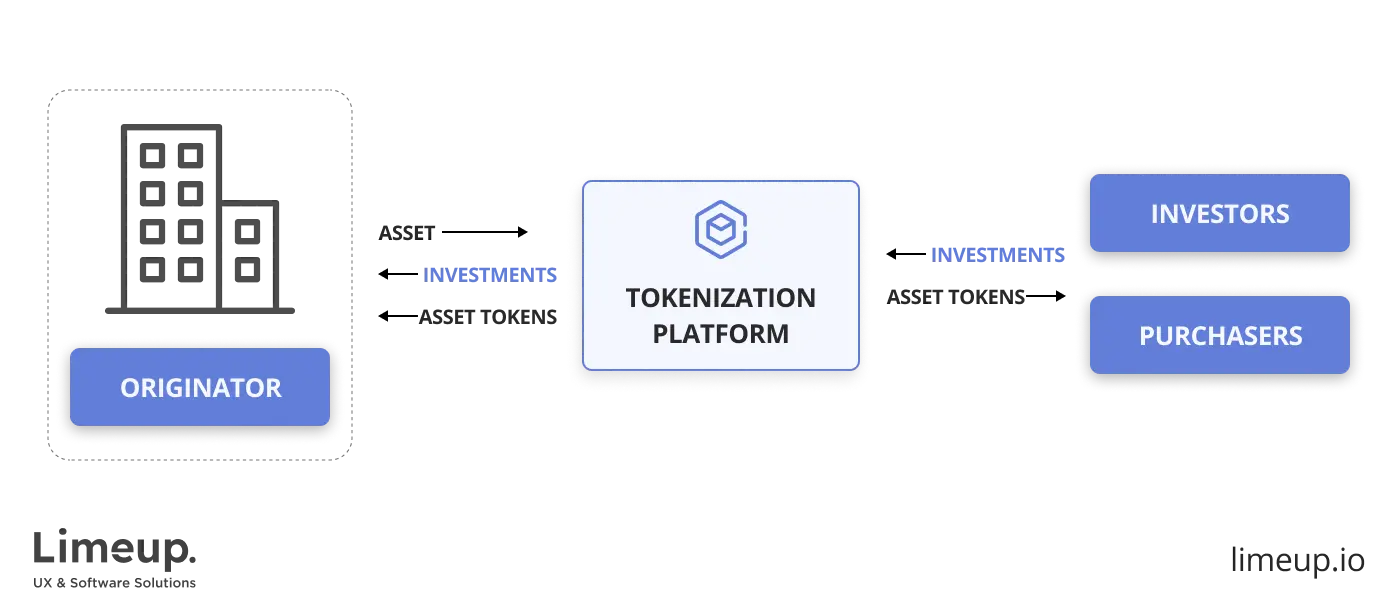

On the surface, the system of tokenization may seem simple enough. Property shares are divided into tokens that can be fairly easily traded. However, what are the entities behind the system and how is it enforced? As you can see, there are more nuances associated with making the theoretical approach work in practice. Let’s move forward with discussing how

Among general audiences, the tokenization of properties is an obscure and often misunderstood subject. Luckily, we are here to make this process clear in understandable terms. The first thing you need to know is that the structure that allows real estate tokenization to work is enabled by several crucial elements.

Investing in real estate requires special purpose vehicles (SPVs) that are typically organized as limited liability companies (LLCs). These entities are factual owners of the real estate that is granted for tokenization. The purpose they serve is to protect the interests of the investors and manage operations, like issuing tokens, according to the regulations.

It is worth mentioning that not every country or jurisdiction supports this system. The particular form is determined case-by-case and depends on the local real estate ownership laws and restrictions against double taxation. To circumvent this obstacle, it is possible to create a holding company that will either directly own real estate in your country or own a corporation there that does.

A decentralized network is essential and acts as a foundation for such operations since it offers complete transparency. Using blockchain-based technology, investors can be assured that all procedures are secure and immutable.

One of the guarantees of security is enforced through modern smart contracts. These are self-executing agreements that operate on predetermined conditions and rules based on regulations and compliances. Smart contracts are completely automatized, meaning that the execution of transfers and storage of tokens does not require a manual approach or third-party involvement.

The bottom line is that the process is fairly simple to wrap your mind around and offers a wide range of advantages, which we will discuss next. Businesses that are interested in entering this niche can greatly benefit from this technology and become pioneers, leading the tokenization system to see further growth.

To get started, entities like SPVs will require qualified real estate software development services that will build fully functional software to begin conducting operations. The legal council will also be necessary to ensure your business falls under jurisdictional regulations and promotes a secure environment. This will be a point of discussion later in the article.

Benefits of tokenized real estate

There are a multitude of reasons why the market of tokenizing real estate is slowly gaining momentum and attracting more investors. While some advantages can be more obvious to a trained eye, others may be oblivious to the opportunities they provide. The most widely recognized benefits of this system are the following:

The traditional way of buying and selling real estate properties is notoriously illiquid due to complicated and often costly processes. Tokenization, on the other hand, offers a much more hassle-free process of buying and selling shares of properties. This advantage is typically referred to as increased or elevated liquidity.

By eliminating excessive third parties and intermediaries, investment opportunities become significantly more attractive to investors. Not to mention, the price associated with buying a piece of real estate property goes down immensely, as well as the entire process of a purchase is greatly simplified.

Traditionally, investing in real estate is thought of as a business for investors with large pockets, leaving smaller-scale investors on the sidelines. With tokenization real estate, you enable turning large assets into small fractions, which ultimately offers an opportunity to attract a bigger pool of investors, as they no longer need to buy expensive and sizable property shares from the get-go.

In addition, tokenizing real estate gives a possibility to access the global market since such a system is not limited by geographical constraints. A decentralized financial system provides a more streamlined experience and encourages equal opportunity for investors of all kinds.

The division of real estate assets into small fractions makes the business of property purchasing more accessible and lowers the entry barrier for newcomers. This is achieved by giving investors the opportunity to buy as much or as little shares as they see fit.

On the side of the stakeholders, this system is beneficial as they can market and grow their sales by attracting investors of any scale. Since the fractionalized type of ownership is seen as more attractive, sponsors can largely increase the exposure to their project.

One of the biggest appeals of tokenizing real estate is that the associated risk of fraudulent activities is reduced by a big margin. A key element that allows the minimization of security risks using blockchain-based technology is smart contracts. By automating the process of buying and selling shares, the chain of transactions becomes much shorter and more traceable.

The transparency associated with tokenization is achieved due to decentralization and elimination of intermediaries, significantly reducing the counterparty risk. Since smart contracts automatically adhere to regulations, details about the property and transactions cannot be manipulated. Thus building greater trust among investors.

While tokenization does not affect the actual cost of the real estate property, this system does have a direct impact on the costs and fees associated with purchasing and selling assets. With the automation of smart contracts, those who wish to buy property shares no longer need to seek out the services of third-party providers, like lawyers, escrow services, and other intermediaries.

Moreover, efficiency is improved since no lengthy and time-consuming paperwork is involved during the purchase of tokens. Because the system is not tied to working hours like banks are, the waiting times also significantly decreased.

Challenges of tokenization of real estate

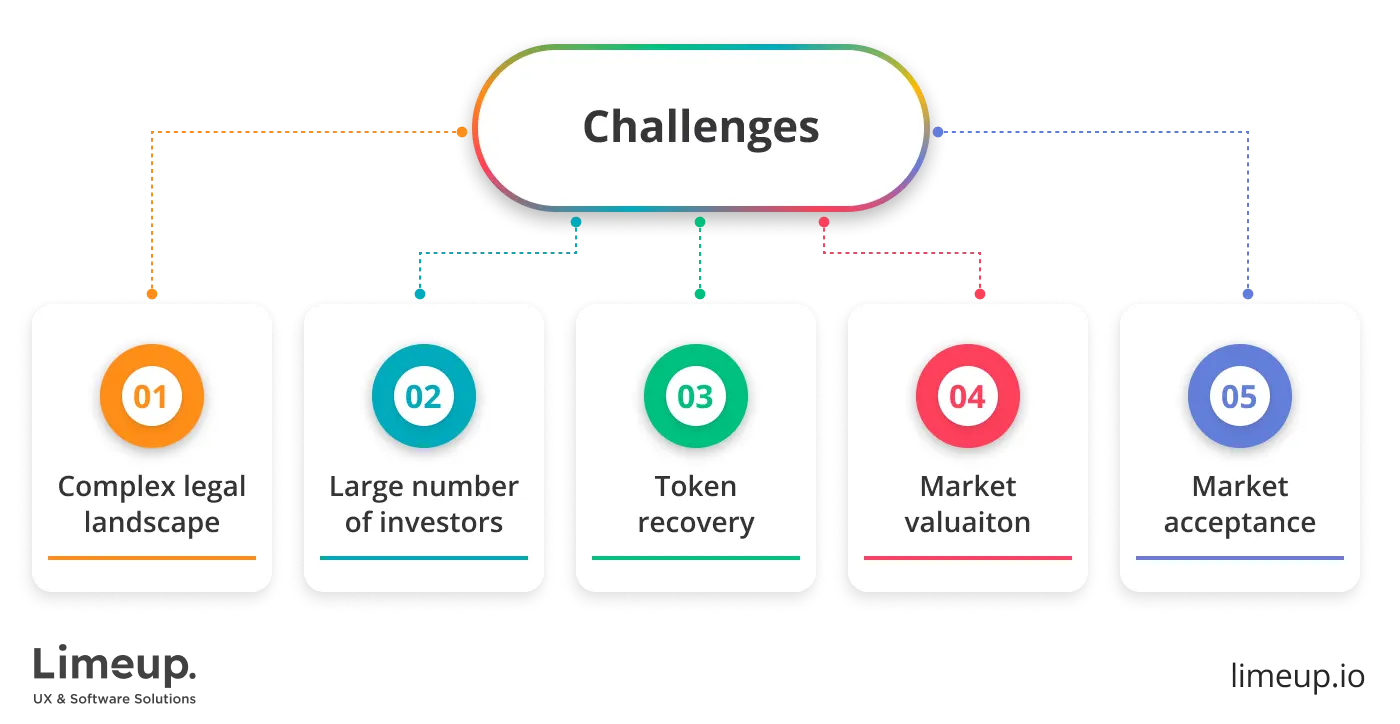

It wouldn’t be a complete picture if we only discussed the benefits of the system. As with any business, there are a number of downsides, and tokenization is no exception. Here is the list of the main challenges to consider:

Taking into consideration that tokenized real estate is an emerging technology, operating a complex and intricate legal landscape can become a true headache in the beginning. Before entering such a niche, one must be able to get to the bottom of local jurisdictions associated with blockchain-based transactions. It can come as a surprise that some regions’ laws may be harder to navigate and pose a problem to the development of such a system.

While there are undeniable benefits to decentralization, there could be issues in enforcing and regulating smart contracts. Based on existing compliances, conflict resolution and property rights can be affected as well.

As we mentioned previously, fractional ownership opens stakeholders to an opportunity to attract a wider range of investors. Since there is no set amount a person has to invest in purchasing a property share, it also means a large number of people could potentially become interested in such operations.

This can ultimately lead to a vast number of investors being involved in a single project, leading sponsors to manage sizable amounts of people. For some, this is not an issue. However, others may find it daunting to find ways of communication with each shareholder.

Unlike in traditional real estate, where a centralized entity, such as the government, oversees operations, tokenization is open to a major vulnerability – token recovery. Since investors use digital wallets to purchase tokens, they are not immune to losing or forgetting a password and ultimately losing their access to the tokens.

In such a case, you must navigate a complex framework to figure out which entity has the authority to grant and reissue property shares in events of fraud or simple misfortune. This can further complicate things in terms of who decides which particular person or entity is the true owner of the purchased assets.

Since traditional ways of real estate valuation may not be applicable to tokenized assets, there could be potential challenges regarding a standardized approach. After all, the price of a specific cryptocurrency is prone to fluctuation in the market while ultimately not reflecting on the value of the property, which can become problematic.

Awareness and education within the real estate sector is another factor of concern. This can deter initial investors from participating as they lack nuanced and full knowledge of how this system operates and what they can expect from it.

While this challenge is more subjective, it is fair to say that the market can be slow to adapt to the new system of tokenization. It is no secret that investors may have reasonable doubts regarding a standardized approach to regulations and the level of security of blockchain-based technology like smart contracts.

As with any new advancements in technology, it could take time for the market to accept and adjust the system, which would elevate doubts and make the tokenization of properties more accessible and encouraged.

5 types of properties that can be tokenized

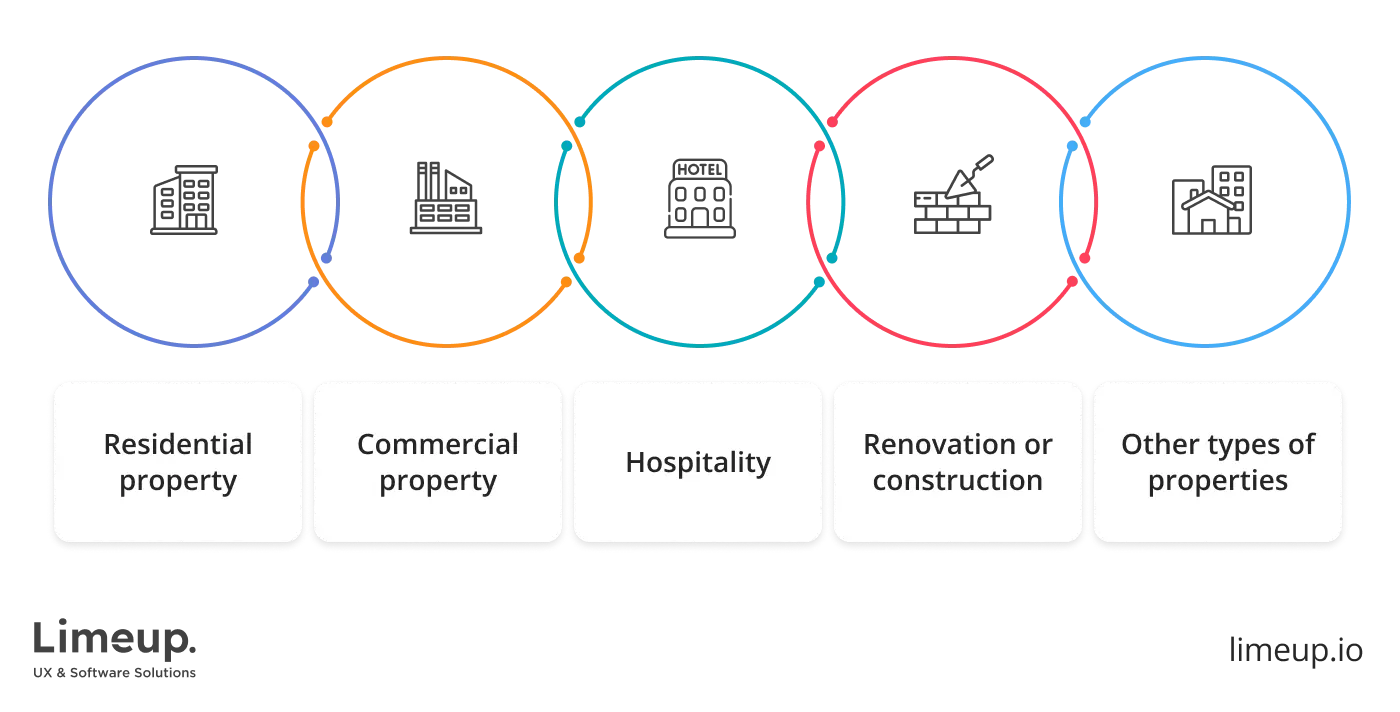

With everything that we have learned so far, you may be asking yourself the question of exactly what kinds of real estate you can tokenize. The simple answer is almost any. However, there is still nuance in such variety. Below, we have outlined several types of properties that can be tokenized.

1. Residential property.

One of the most widespread types of property eligible for tokenization in real estate is residential. Properties like apartment complexes, which are extensive multi-story housings that include multiple units, can be fractionalized. The same goes for condominiums and single-family houses.

While tokenization of properties like student housing, which includes bindings for students near universities and other educational institutions, is less common, they are also eligible for this type of real estate system.

2. Commercial property.

Commercial real estate is highly popular for tokenization nowadays as well. These typically include retail spaces, like shopping malls or centers, and other properties suitable for retail. Office buildings can also be a great source of income through the tokenization of multiple units.

In addition, warehouses and manufacturing facilities can fall under the commercial umbrella and be sold in a fractionalized manner. However, their popularity against other commercial types may not be as significant.

3. Hospitality.

In general, real estate in the sector of hospitality involves high-end or boutique hotels and resorts. These can be excellent opportunities to tokenize such properties in case they have a steady income and predictable flow of guest reservations. However, we can see that separate rental housing designated for vacations is growing in popularity and has the potential for tokenization.

In theory, restaurants and bars can be tokenized as well, as they are included in the hospitality niche. Although, there could be a number of potential challenges regarding the fractionalization of such properties.

4. Renovation or construction properties.

Tokenizing real estate that is undergoing renovations or is under construction is a great way to secure investor funding for projects under development. For investors, such projects that carry a lot of profitable potential can be an opportunity to grow their return on investment exponentially.

This is due to the assets of ambitious projects that are still in development being typically less costly as opposed to when they are finished. Still, there are always risks associated with the final project not meeting the financial expectations.

5. Other types of properties.

In theory, there are lots more types of properties that could be considered eligible for tokenization. For example, undeveloped or agricultural land can seem attractive to some investors. Luxury and trophy items, like historic buildings, may possibly find their investor audience as well.

With that being said, some varieties of real estate are more practical on paper than in real life. This is a result of the complex process of regulating operations of tokenizing specific properties. Therefore, it is more realistic to fractionalize shares in more standard real estate.

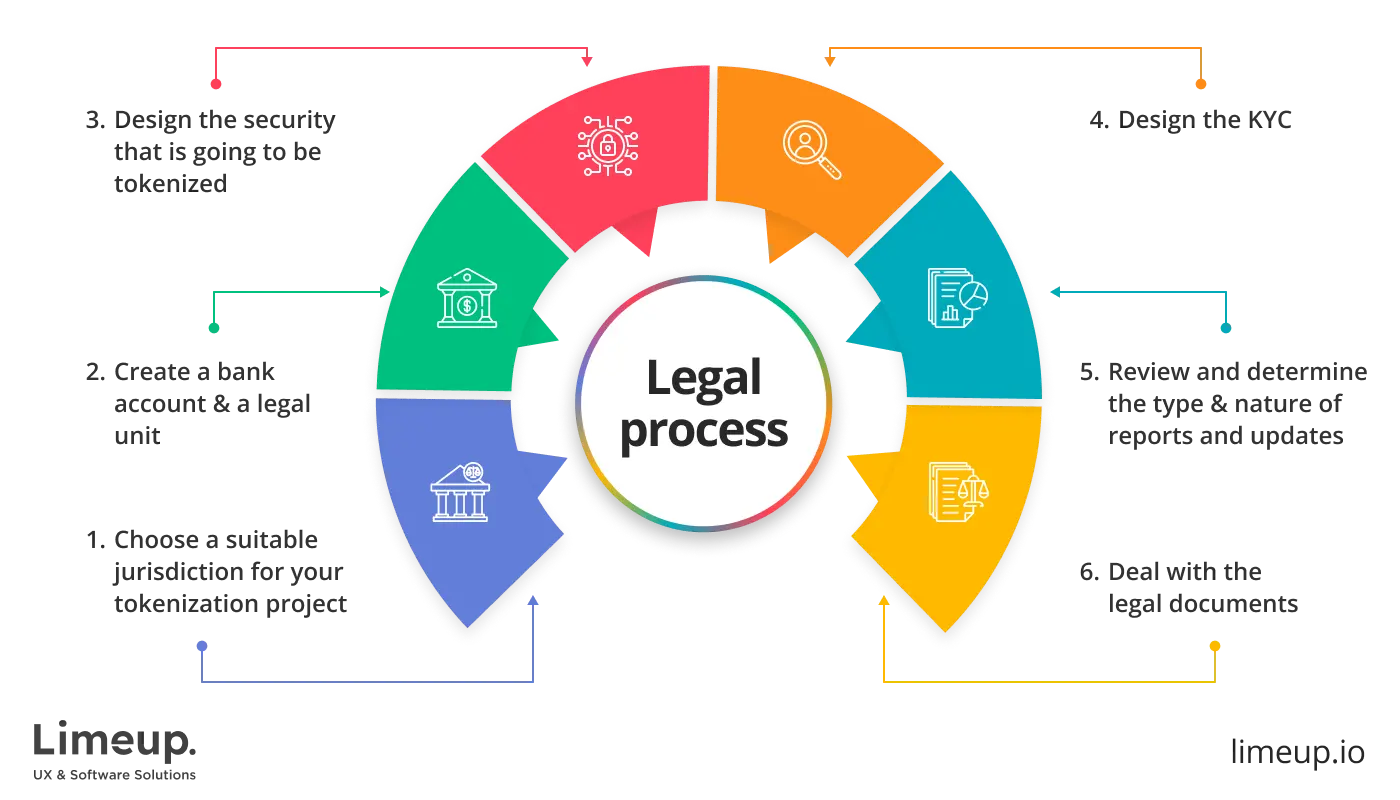

The legal framework of tokenized real estate

Getting to the bottom of how the tokenization of real estate is regulated and the various compliances such a system has to follow can be the biggest headache. There are several crucial elements and steps involved in ensuring the process has a solid legal foundation and adheres to established compliance.

Initially, you will prepare offering memorandum documents that serve as extensive explanations of the investment projects. These typically include information about the property, its type, valuation, strategy for investment, and more. Additionally, it will list the rights and obligations delegated to the investors to ensure they have a complete understanding of the deal.

It is essential that your tokenization system rightfully follows compliances like Know Your Customer (KYC) laws and Anti-Money Laundering (AML) policies. These regulations protect your businesses from fraudulent activities by verifying the identities of the investors and enforcing procedures that help detect and prevent suspicious activity.

As we mentioned in the beginning, Special Purpose Vehicles (SPVs) are necessary to run operations related to the tokenization of property shares. Such entities are responsible for keeping and managing the tokens, serving as the reliable link that protects the interests of investors. To establish the right structure for an SPV, you will require a council of experienced legal professionals who have knowledge regarding this specific industry.

Since smart contracts are self-executing agreements between sponsors and investors, you are going to need help from software companies to develop them accordingly. However, first, you and your legal team must draft these token-purchasing agreements, ensuring they are jurisdictionally appropriate in regard to your locality.

Among other legal frameworks that need to be accounted for are terms of use and privacy policies. The first one will represent a set of rules between the users registering on the tokenization platforms and the platform itself to specify rules and obligations and protect both parties from liabilities. While the latter is especially important when conducting operations digitally. There are certain data protection laws that the platform must follow, and such policies showcase how sensitive personal data will be stored and collected.

It is necessary to stress how important it is to work with qualified legal representatives, especially when dealing with such a regulatory-sensitive niche. At the end of the day, you want to protect yourself and the investors you will be eventually partnering with from liabilities and legal issues, fostering a secure and transparent environment within the community.

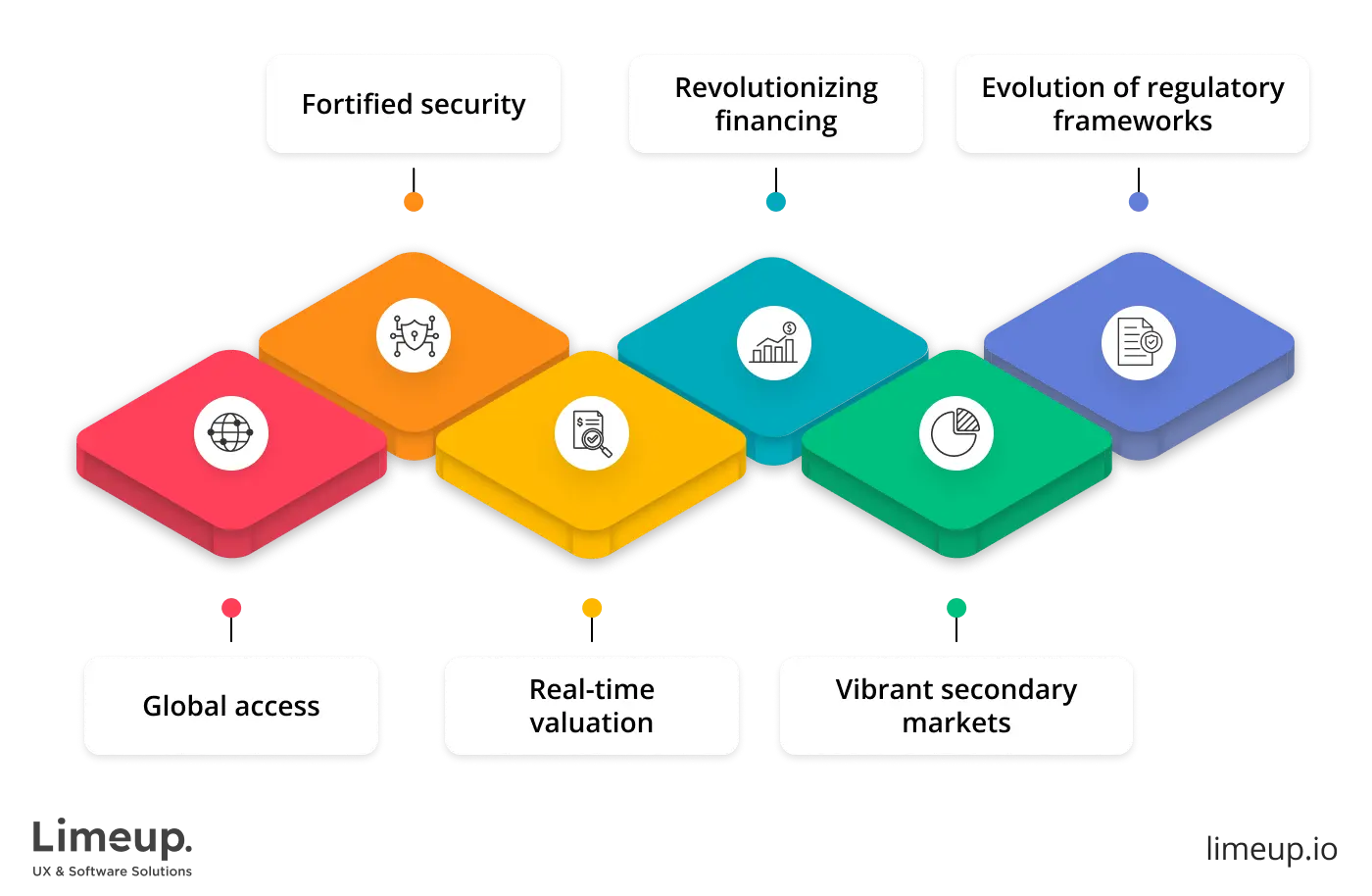

The future of tokenization in real estate

At its current state, the system of tokenizing real estate is still in bloom and not as commonly widespread as it could potentially become. However, with the world moving steadily in the direction of digitalization, this investment option has every chance of becoming the new mainstream.

While it is too early to say whether tokenization would challenge traditional real estate investments and compete as the go-to option for investors, we can already see its growth in numbers. Research shows that in 2022, the tokenization market was valued at $2.7 billion and is expected to grow in size up to $18.2 billion by 2032, showing a CAGR of 19.8%.

Projections like these instill trust that entering this niche early could bear great results in the future, as tokenization is demonstrating notable growth potential. After all, one of the biggest appeals of fractionalizing real estate using blockchain technology is that a market that was once quite unreachable to some segments of investors now strips those boundaries.

The liquidity and accessibility that tokenization offers are not the only advantages that compel investors to turn their attention to this system. With the implementation of smart contracts and automatization, excessive numbers of intermediaries are no longer required, which further increases the level of efficiency and transparency.

As more businesses are looking to tokenize real estate, it should also be made clear that a set of challenges is present that will require resolution going forward. Possibly the largest complexity that hinders tokenization from developing and transforming the industry faster is the uncertain regulatory landscape.

For the time being, existing legal compliances are not capable of adequately regulating the system that tokenizing assets provides. The concerns regarding the security of shares undeniably become the main drawback, pushing investors away from engaging with this system.

With that being said, every time a new innovation within a particular sector emerges, the market is quick to follow by evolving the institutional structures and approaches. So, it is safe to say that, over time, the real estate industry will shift to accommodate the needs of tokenization and create reasonable and reliable regulations. The only question is how fast these changes will take place.

Another thing that is certain is that the demand for qualified real estate tokenization services is rising. More and more real estate companies and organizations are interested in capitalizing on the current success of tokenization, and it is obvious this trend is here to stay.

Need help with real estate tokenization?

Leveraging technologies of the blockchain, the real estate market is faced with an unprecedented level of accessibility for investors of any size and background. Tokenization promises to make investments in real estate properties transparent, efficient, and accessible regardless of geographical barriers. However, there are always two sides of the coin to any innovation, and tokenization is not exempt from the rule.

In our in-depth exploration, we have demystified the definition of real estate tokenization, how it works, its pros and cons, the complex legal framework, and touched on other vital aspects as well. With all of the information presented so far, it is easy to see that there is a viable future for this approach, although not without its obstacles.

If you need any help getting started with tokenizing real estate, don’t hesitate to contact us anytime. Our experienced team will reach out to you to schedule a primary consultation and answer any answer any remaining questions you might have.