Top 10 Insurance App Development Companies in 2026

You need to be thorough when picking an insurance app development company. The competition is fierce with promises louder than ever. To help businesses decide wisely, Limeup experts conducted a careful assessment of leading vendors in the field. We gathered a list of companies that are dependable receive many good reviews.

Each member of our lineup provides insurance-related services that are shaped around the real pressures of the market. The listed insurance app development companies cover customer-centered apps, insurer-centered solutions, connections to old technology and tools for managing claims, underwriting and support.

The landscape has shifted, and working with an insurtech app development company brings new levels of adaptability. They bring code and context together, building utilities that cut through noise, simplify the process, and clear the path for growth. A well-matched partner blends into the business rhythm, turning short-term wins into long-term impact.

List of insurance app development agencies

Founded: 2017

Headquarters: London, United Kingdom

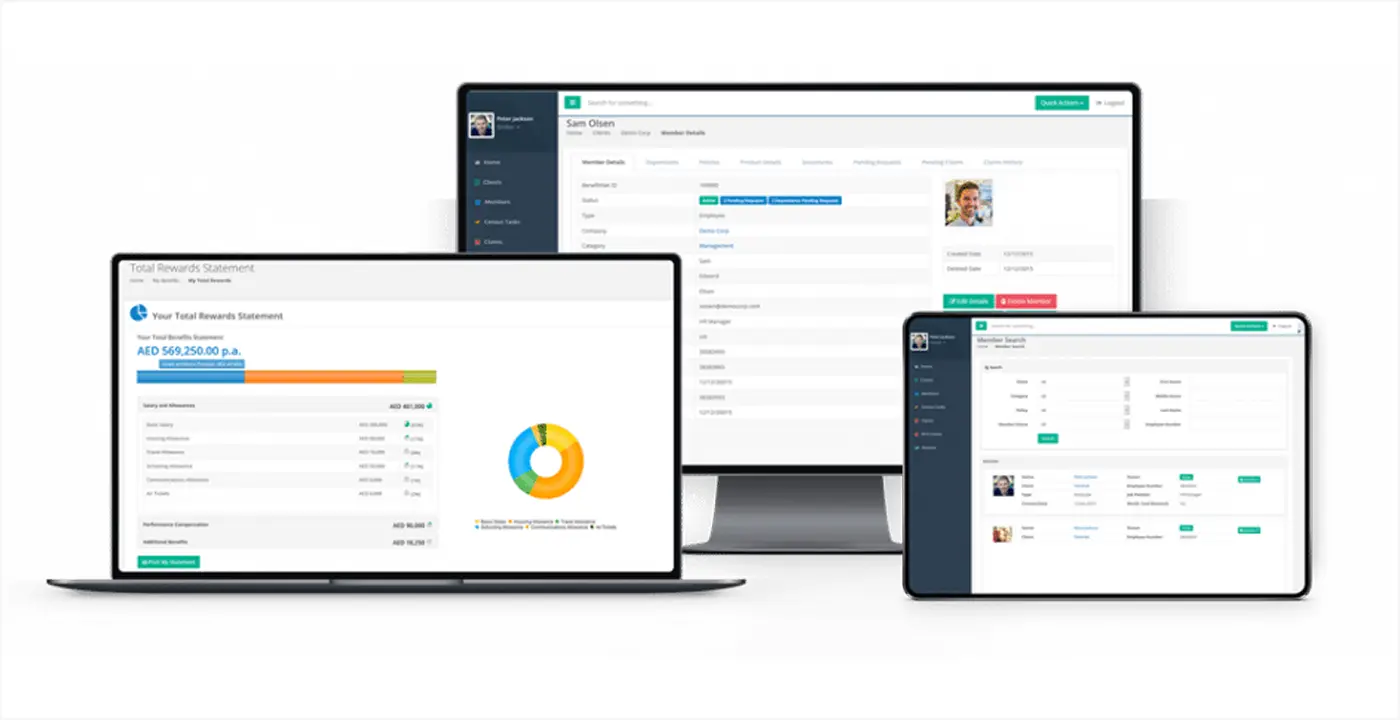

Limeup, as a professional insurance app development company, creates client-focused coverage applications that tighten up tasks, make claims easier and help you engage customers better. Our team of over 80 designers, developers, analysts in London brings complex insurance processes to life on the Internet in easy-to-use ways.

We have worked with organizations from over 40 different countries, including both new insurtech enterprises and recognized carriers. No matter if the work is new or simply changing existing systems, our field veterans have provided over 200+ mobile and web solutions meant to save on operations, boost loyalty and aid growth.

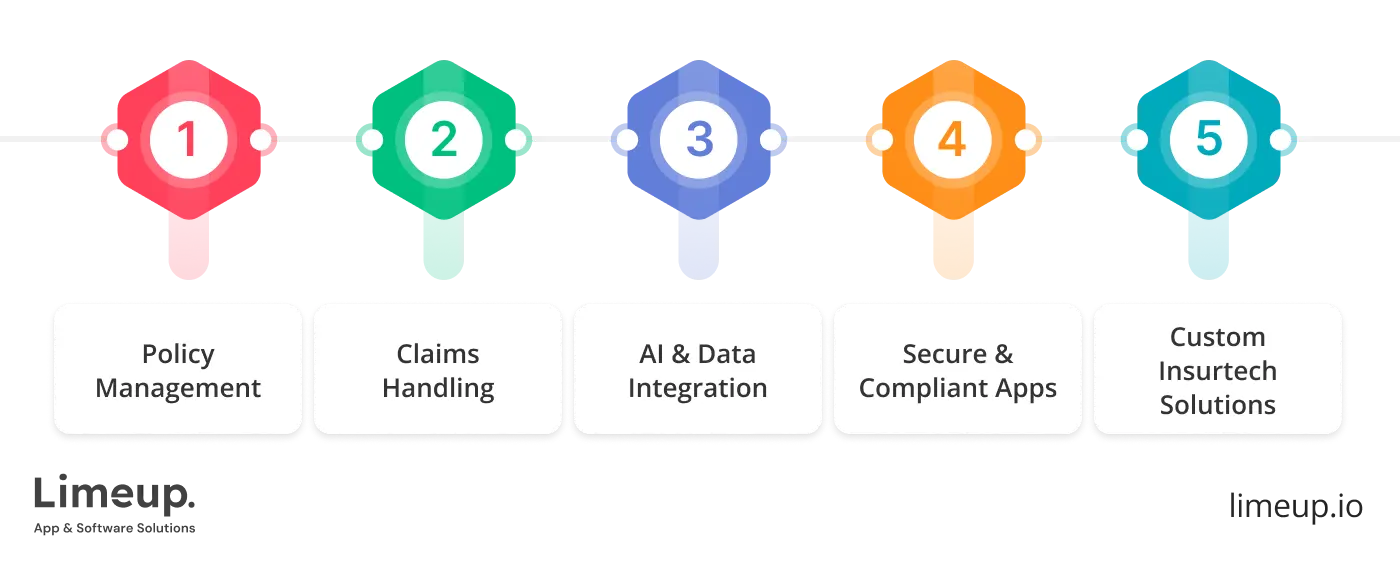

Key services:

Industries:

- Real Estate

- Manufacturing

- Finance

- Healthcare and more.

Why choose us:

Our team designs software that addresses the specific needs of policyholders, agents and underwriters. Users are provided with advanced logic for generating quotations and managing underwriting, along with secure, intuitive document handling. Multilingual functionality and easy API integrations with CRMs, ERPs, and other systems.

Select case studies:

- We helped MedFlux by designing and developing a pair of solutions: one for business planning by doctors and another for hospitals’ patients. It took just 16 weeks to complete and these days, the platform carries out over 1,500 video appointments a day with an almost perfect record of uptime.

- CoreSphere approached us as a German manufacturing firm hoping to remove a group of unsuitable and tired tools. The company saw a 30% drop in delays and a 25% decrease in storage costs.

- Take a look at what we do: success stories.

Founded: 2017

Headquarters: Berlin, Germany

impltech manufactures mobile and web-based solutions that clear the clutter, nail the accuracy in architecture and deliver a thorough understanding of the life safety net industry. This award-winning insurance app development company offers digital tools that let agents act more quickly and intelligently, simplify duties for underwriters, and speak the language of policyholders.

Every feature, from multilingual client portals and intelligent document routing to digital claim filing and intelligent policy changes, is designed with a specific goal in mind. The crew rides the tech waves effortlessly, glueing compliance platforms, CRMs, and ERPs together while fortifying user trust with top-notch security protocols.

Key services:

Industries:

- Fintech

- Real Estate

- Healthcare

- Pharmaceutical and more

Why choose them:

Not only do they develop software, but they also help you move forward as a team. Brainstorms are something impltech seeks out, not just happens to us. Clients step into a spot where creativity, honesty and commercial knowledge meet.

With awards earned and constant high reviews, the company applies both skill and care to build apps that people pay attention to and use.

Select case studies:

- A fully developed system was built for ReFuture: it included a corporate site, over 40 web pages designed for different screen sizes and over 50 application screens, all optimized for easy and safe handling of assets. The site was designed for easy views, simple navigation and the automation of paper-loaded procedures.

- As an international telecom integrator from Switzerland, Connect44 was using spreadsheets as part of their old workflow and wanted to improve it. The goal was to automate fieldwork and design a digital system for conveniently logging infrastructure efforts.

- Explore further case stories.

Binary Studio

Founded: 2005

Headquarters: Lviv, Ukraine

Depth of knowledge allows this insurance mobile application development company to create software for agents and end-users alike. It’s obvious why they do what they do — offer quick, simple and straightforward services on every device. To accomplish this, they use a fine process, skilled engineers and two decades of experience with the market.

Key services: Custom insurance app development, Android & iOS app development, UI/UX design, API integration, ongoing support.

Industries: Insurance, fintech, eCommerce, healthtech, logistics.

Why choose them:

Recruiting developers is only one aspect of what Binary Studio does — they handpick teams made up of the skilled tech talent seen globally at their annual academy. Within the first 3 weeks of gaining approval, the crew starts development by using a formal Inception phase to define the project’s scope, determine the roadmap and decide who will be part of the squad.

Select case studies:

Standout financial safety apps from the over 200 digital projects they’ve done include case studies that are mobile-native and those built on a single codebase. Clients who started small often return: many relationships span 10–15 years.

JP Loft

Founded: 2013

Headquarters: Denver, CO, USA

The insurance mobile app development company designs safe and easily scalable applications for policyholders, agents and big enterprises. By creating products for easy insurance use and solid back-end architecture, JP Loft introduces the industry to the present-day digital world, more rapidly, wisely and conveniently.

Key services: Custom insurance app development, wearable app building, PWA creation, AR/VR app engineering.

Industries: Insurance, fintech, real estate, education, travel, electric vehicles.

Why choose them:

JPLoft has more than 130 experts around the world and has achieved over 1100 projects, they can apply both technical and commercial knowledge. Because of their expertise in AI, IoT blockchain and generative tech, they introduce added innovation to coverage practices that are often slow and not very flexible.

Select case studies:

Examples from their portfolio of works include updating apps that simplify brokers’ activities and embedding support in the end-user portal.

Robosoft Technologies

Founded: 1996

Headquarters: San-Francisco, CA, USA

The Robosoft Technologies insurance app development agency builds solutions that are safe and meet the needs of users. Having 25+ years of experience and having provided 2,000+ digital products, they have the depth to work in any industry and the skills to build platforms that improve the claims process and bring legacy systems into the modern era.

Key services: End-to-end product strategy, native and cross-platform app development, legacy system modernization, UX/UI design.

Industries: Banking, insurance, media, news & entertainment, retail & consumer services, travel, tourism & leisure, edTech & learning.

Why choose them:

Global companies like HSBC Asset Management, ICICI Prudential Life Insurance and Nippon Life Insurance trust Robosoft as their strategic digital partner. Besides, they’ve joined forces to roll out a fintech lifestyle platform serving 45M+ people and created one of Asia’s leading multi-currency wallets.

Select case studies:

Because there are more than 200 engineers, designers and analysts involved, they go from new ideas to completed work very quickly and can offer tailored engagement models to help with growth.

Tridhya Tech

Founded: 2018

Headquarters: Brampton, Canada

At Tridhya Tech, insurance app developers build secure systems that handle agent, policyholder and industry-related company needs professionally. With their “Innovate. Disrupt. Thrive.” mantra, they create applications that improve filing claims, attract more clients and lift the UX using leading-edge technologies.

Key services: Insurance app development, Android & iOS mobile apps, B2B/B2C portals, UI/UX design, digital commerce platforms.

Industries: Insurance, transport and logistics, retail and eCommerce, manufacturing

Why choose them:

While some companies count, Tridhya Tech is changing the way technology works in enterprise insurance. Their staff of more than 600 people, the 300+ projects they have completed and the fact that 70% of their clients work with them again prove they deliver quality skills around the world.

Select case studies:

An example worth highlighting is an Indian insurance provider that improved the way premiums were managed and allowed more quotes to be created quickly than with the previous system. For more project highlights, you may check their page dedicated to that.

DICEUS

Founded: 2011

Headquarters: Hellerup, Denmark

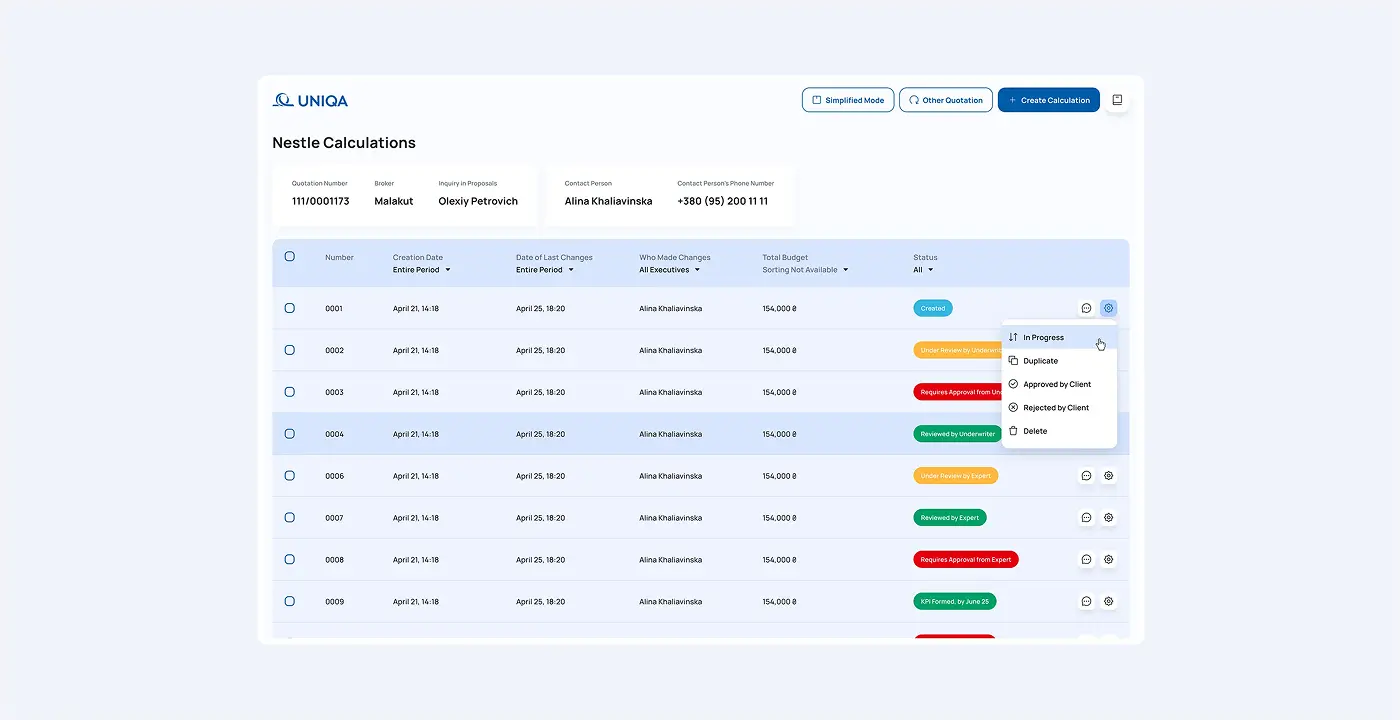

DICEUS, an app developer for insurance, produces unique apps that modernize how policyholders work and speed up digital change in the industry. Knowing that their clients are waiting, they remain agile, make everything transparent and use frequent demonstrations to finish products as fast as possible.

Key services: Data analytics, risk management, automation, fraud detection, underwriting, mobile app development, testing and QA.

Industries: Insurtech, human resources, eCommerce.

Why choose them:

Using its knowledge of insurance and up-to-date technology, DICEUS helps carriers keep up with the trend towards digital growth. Over 150 IT projects and working with clients such as UNIQA, Fadata, WTW and BriteCore have taught the firm many lessons which have been used to great effect.

Select case studies:

Throughout the industry, DICEUS has produced a number of success stories. Their case studies demonstrate how custom-built digital solutions have improved client experiences, expedited policy administration, and boosted claims processing.

APPTech Mobile Solution

Founded: 2014

Headquarters: Sydney, Australia

An application developer for insurance called APPTech Mobile Solution makes mobile apps that help insurers engage better with customers and quickly move the industry toward digital transformation. Insurers that collaborate with APPTech put a lot of effort into providing smooth user experiences and more efficient operations.

They offer policy, claim and payment processing services shielded by advanced defence and technology which keeps their systems safe and dependable.

Key services: Web and mobile development, fintech, CRM/ERP creation, Artificial Intelligence, blockchain.

Industries: Insurance, taxi booking, hotel booking, salon and SPA, travel, restaurant, vehicle rental, eCommerce.

Why choose them:

APPTech Mobile Solution takes advantage of deep understanding of the sphere and the latest technologies to support businesses in upgrading their procedures. APPTech promotes openness and frequent updates as its team delivers protected, rich and cross-platform apps. With constant support, their clients’ apps avoid going down and keep running smoothly.

Select case studies:

Apps from this firm help insurers improve speed, avoid mistakes and get useful insights from the data available. Get acquainted with their work stories to find out more details.

Brights

Founded: 2011

Headquarters: Warszawa, Poland

This insurance app development firm makes digital products to make liability coverage easier to understand and manage. Companies no longer deal with messy systems or use old workarounds — Brights’s industry-aligned tools help make tasks optimized, ensure compliance and give policyholders more control anytime using a mobile device.

Key services: MVP development, web and mobile development, cloud & DevOps, custom AI engineering, UI/UX design, dedicated team.

Industries: Finance and banking, insurance, supply chain and logistics, eCommerce, entertainment and media, hospitality.

Why choose them:

For the past 11 years, Brights has specialized in producing customized software for a safety net. What they do includes mobile platforms for claims, systems for compliance in the back office and systems supported by artificial intelligence for providing auto quotes. This squad is ISO/IEC 27001:2013 certified and approaches data protection as if it were sacred.

Select case studies:

Belonging to the venture dossier, Arsenal Insurance worked with Brights to revamp all their online services, from the main website to a mobile app that uses AI.

Muteki Group

Founded: 2015

Headquarters: Kharkiv, Ukraine

Using its expertise in modern underwriting services, the Muteki Group makes tools for mobile devices that make assurance less confusing. The insurtech app development company says goodbye to outdated systems and hello to fast, secure, custom-built apps that make policy management, claims, reporting feel effortless for both insurers and their clients.

Key services: Web/mobile development, product software engineering, CTO as a service, tech consulting for women, automotive solutions, IoT.

Why choose them:

Since 2015, Muteki Group has helped drive the development of insurance technology. More than 80 experts on the collective carry out activities from seven representative centers to develop solutions that stick to regulations and actually perform in use.

Select case studies:

Familiarize yourself with their case samples on their official web page to find out more about what they have done.

What is an insurance app development company?

A mobile app development company in the UK designs software that matches the needs of the loss protection segment. By constructing applications, these firms improve the way policies are managed, claims are handled and customers interact.

In their work, they rely on artificial intelligence, data tools and cloud platforms to meet insurers’ and their clients’ particular needs.

In 2025, more than 60% of people chose to access their coverage policies by using mobile applications. This change shows that the industry is moving towards digitalization, making being convenient and available key priorities.

The protection service industry is gearing up for explosive growth, with projections showing it could surge from $116.16 billion in 2025 to a whopping $207.52 billion by 2030. That’s a solid annual growth rate of 12.3%.

To deal with this demand, risk shield app architects make sure the apps are safe, easy to use, support rules, so policyholders can use the services whenever and wherever they wish.

Limeup has greatly helped advance this industry by providing expert services in building applications for changing needs. The initiatives we start clearly reflect the importance of such platforms in the industry’s move to digital.

Because developers of such apps customize their work for insurers, the second one can operate in a better and more customer-satisfying manner.

Trust-first businesses eager to remain ahead of the competition should consider partnering with an insurance (insurtech) app development company. These kinds of efforts produce tools that are both compliant and more enjoyable for the customer.

As the field keeps advancing, the help from these development firms will be essential to keep firms relevant and coming up with new solutions.

How to select an insurance app development agency?

Not every tech partner understands the heartbeat of the loss protection industry. Some deliver code; others deliver clarity. Their systems orchestrate structured user journeys while meeting every compliance standard. To hire app developers with this level of domain fluency is to unlock digital tools that actually move the needle.

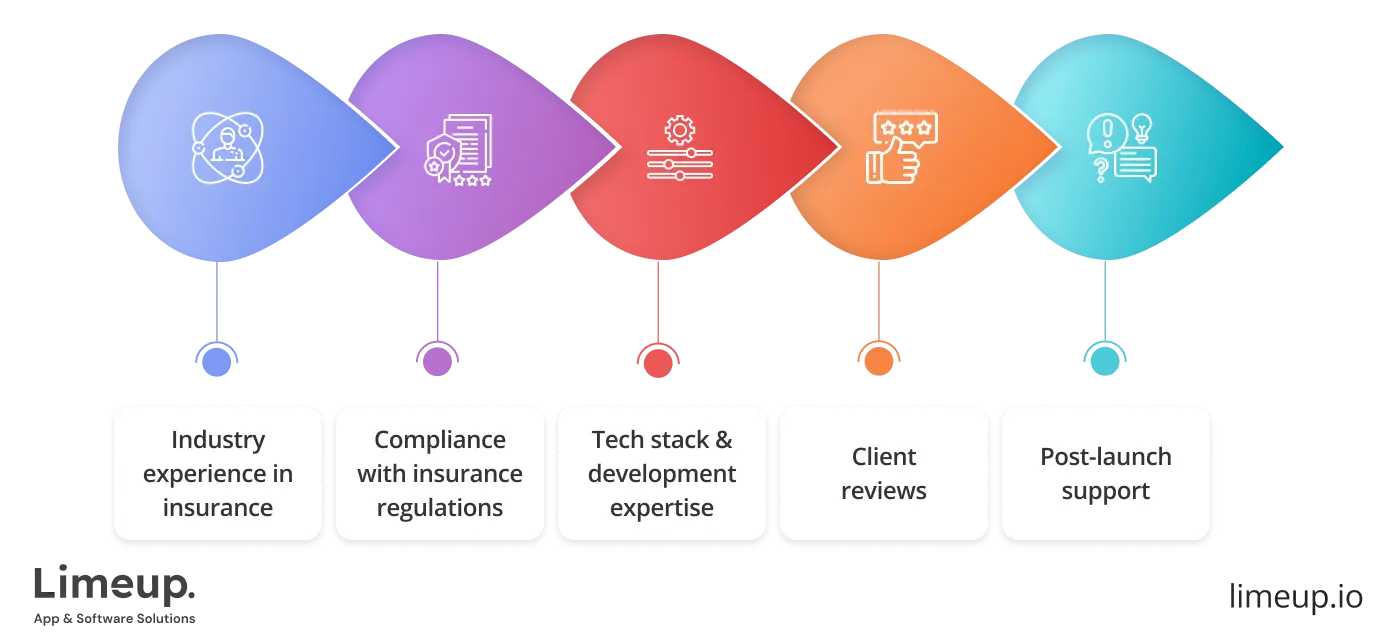

We gathered some pieces of advice to look for when choosing amidst the top insurance app development companies. The criteria you will find below provide a roadmap for distinguishing capable providers when comparing their offers.

Industry experience in insurance

The general development credentials do not usually apply to insurance situations. In the list our experts made you can find agencies that are aware of unique operational realities of this sector, moreover, they are familiar with the importance of user acceptability testing, value-based features and other nuances.

Another point to pay attention to here is to ensure the tech partner accommodates actuarial logic, risk assessment protocols, requirements for documentation (and not ignoring it), etc. Here are the nuances advisable to check out when evaluating insurtech app development companies:

- Recognizable cases

- Policy administration platforms knowledge

- Customer-centric app creation

Compliance with insurance regulations

Insurance applications handle sensitive data subject to multiple regulatory frameworks, amidst which is personal identifiable information (PII), financial and data details, behavioral and user data. On the other side, the vendor has to know the nitty-gritty behind HIPAA compliance for the healthcare area.

The agency has to confirm:

- Local information protection requirements

- State-level insurance data security mandates

- Industry-specific standards to meet

The pro tip to evaluate this category is to ask if the mobile app developer for insurance pre-built compliance into their engineering approach and not treat it like a late-stage process.

Technology stack and development expertise

The tech stack for your application is more than programming languages and frameworks listed but a decision that includes scalability needs, integrations required etc. As for the core requirements, we recommend paying attention to:

- Supporting cloud platforms like AWS and Azure

- Performance optimization for high-demand applications

- API development

- Third-party services integration

- Mobile-native and cross-platform expertise

An insurance app development company has to present a reliable selection of technologies that are useful for your particular idea but backed by a proven track record.

Client reviews

You will definitely look at the offer presented on corporate website but testimonials from real customers will reveal nuances that sales cannot. It is preferable to evaluate reviews on sources like Clutch or G2 and other directories where you can see not only a few words from a CEO or manager, but also results, challenges and more.

Here is a short list of what you can focus on when checking on the testimonials:

- The quality of communication and responsiveness

- Adherence to deadlines and pre-defined budgets

- Problem-solving mindset and activity

- Tech competence in building functionality

If you find long-term cooperations and clients that come back for more services, it is a signal that the insurance app development services provider can engage customers and deliver top-tier solutions.

Post-launch support

Deployment is the finish of the creation and the start of ongoing maintenance which is vital since the regulations evolve for this market, end-users’ problems to be solved with your app may change or expand, or your business will scale up and so will your product.

As for the support components that have to be included in the ongoing support, there are the following:

- Well-defined SLA (Service Level Agreement)

- Performance monitoring and immediate response

- Regular security patch updates

- Functions expansions

- Transparent prices for this offer

Selecting and comparing agencies has to be a rigorous process for you to be sure the investment in an insurance application will be successful. Following the steps we outlined above, you prioritize tech partners with reliable experience and verified feedback from clients who can definitely deliver the solution for your needs.

How much do insurance app development services cost?

In the insurtech space, success hinges on feature-rich functionality, airtight security protocols, and interoperability with sector-specific technologies. You won’t see these as just simple apps with unchanging information.

Usually, projects conducted by the best insurance app development companies feature complex tools that manage policies, automate claim processing and allow information to flow in real time with current systems. Because of this, the amount charged depends on the details necessary to make sure both performance and compliance are achieved.

By 2025, liability cover businesses will feel the need to update their customer service. During research, we found that out of executives, a large majority look to invest more in digital growth, putting mobile app development at the top of their plans.

As companies try to follow quickly changing expectations from buyers, many are updating their pricing structures at a fast rate.

Outsourcing your venture to a top-tier insurance app development company like Limeup helps you keep your budget aimed at outcomes. As an offshore mobile app development agency, we bring clean code alongside design precision, security foresight, regulatory expertise, each integrated into every phase of the build.

What kind of money are you likely to spend? Most of the time agencies estimate the price using the project’s features, programming, design and safety requirements. When applications need to be adjusted for different consumers and can handle more users, the cost will increase.

An app providing customers with policy search and a claims form may be built for $60,000 to $90,000. You can expect to pay upwards of $250,000 for a mobile solution that features AI-powered chat, multi-tier dashboards for clients, back-end access and third-party integration.

Average rate for insurance app developers

Take a peek at how programmers’ fees vary across locations before building your net coverage app:

| Region | Hourly Rate (USD) | Project Range (USD) | Comments |

| North America | $120 – $180 | $150,000 – $300,000 | Strong enterprise expertise and compliance support |

| Western Europe | $100 – $160 | $100,000 – $250,000 | Secure infrastructure, well-regulated practices |

| Eastern Europe | $40 – $80 | $60,000 – $150,000 | Reliable development with competitive pricing |

| South Asia | $25 – $60 | $40,000 – $120,000 | Cost-effective, but consistency may vary |

| UK-based agencies | $90 – $150 | $90,000 – $200,000 | Skilled in user experience and flows |

The data presented is the result of the latest research carried out at global software agencies and freelancer networks. Just keep in mind that you’ll need to pay more for extras like discovery workshops, auditing UI and UX designs, following regulations or continued support.

Factors affecting insurance app development cost

How a team is formed can have a big impact on the pricing decision. A business that uses focused teams of PMs, QA, Devs, DevOps and compliance is usually more expensive, yet you get a stable product. You aren’t limited to code, because with a contract, you also pay for helping everyone be on the same page and for lasting quality.

The price of a coverage app is influenced by more than the time it takes to develop it. Here are the most common factors impacting the final price of insurance app development solutions:

- App complexity and scope of work

- Platform choice (Android, iOS, cross-platform)

- UI/UX design needs

- Infrastructure

- Tech stack (advanced technologies cost more)

- Data migration challenges

- Strict deadlines

- Scalability and growth expenses

Good financial app development companies will calculate the budget to design products that fit your business objectives, so that you can contact them for an initial call to discuss your custom needs.

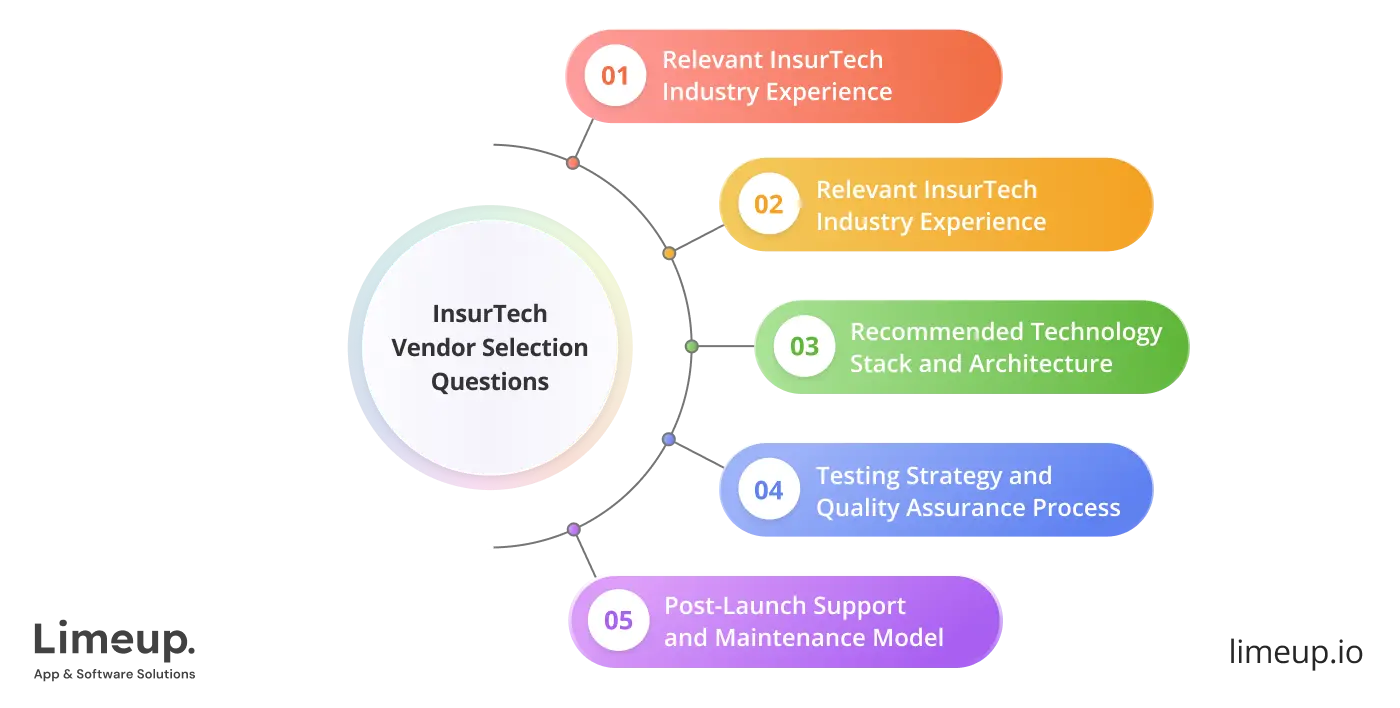

What to ask when selecting an insurtech app development company?

It takes more than just portfolio comparison to decide on the proper InsurTech development partner. The technology of insurance deals with complicated regulatory systems and out-of-date frameworks that not even the best generalist firms are aware of.

By asking these pointed questions, the chief technology officers can determine in a methodical manner if a supplier is capable of providing real business value.

— Can you provide real-world work in the insurtech industry?

It can sound wider, like, “Please, give clear and specific instances that relate to identification of problems through the use of technology in the claims handling process, underwriting procedures or management systems.”

Assess whether they are acquainted with the compliance-oriented approach for insurance mobile app development where the documentation requirements and the audit implications influence every decision regarding the architectural design.

— How do you ensure data security and regulatory compliance for this market?

Verify adherence to standards like GDPR, ISO 27001, SOC 2 through certifications and third-party audits. Probe their implementation of secure authentication, encryption protocols, and comprehensive audit logging that support compliance investigations, so that you can ensure any delays will be avoided.

— What technologies and architecture would you recommend for my application?

Observe carefully the method an insurance app developer uses for legacy system integration. The ones who ignore the problems of mainframe connectivity have a tendency to be unsuccessful during the deployment of the enterprise.

Discuss trending cloud infrastructure, scaling strategies for enrollment surges, API-first design principles that can bring more benefits to your end-users and you as an owner since these trends, powered by a battle-tested tech stack, will build the top-tier product.

— What is your testing approach and post-launch strategy?

Request the details about an insurance application development company’s test (manual and automated), security audits to prevent data loss and penetrations, checking on the validation across compliance.

It is also preferable to ask about ongoing maintenance as your application will need support after going live, from updates to solving any bugs and so on. It is commonly charged as additional service, so you are able to discuss it in advance.

Opting for fintech developers for hire who are proficient in the insurance industry requires your efforts to evaluate the candidates’ expertise, capabilities, background, other factors that can make or break your project.

Using the list of questions above, you will ensure that the vendor of your choice will have a proven track record, knowledge of regulations for the security side of your app, etc.

Looking for custom insurance app development solutions?

For intelligent insurers, keeping up isn’t enough; they lead the way. With growth in the global assurance app market each year, those who prefer custom solutions enjoy more than an attractive interface. They help solve painful paperwork, earn their customers’ trust and achieve growth without constantly worrying about security or rules.

Should you choose simplicity over confusion and aspire to be ahead in digital technology, don’t hesitate to talk to Limeup about insurtech app development services.

Our team has learned the rules and mastered the challenges involved in navigating regulations. Get in touch with Limeup and let’s take your insurance idea and make it into an app people depend on.

FAQ (choosing & comparing)

What does an InsurTech app development partner do?

An insurtech development partner will accompany your project from the very beginning idea to the launch then comes the ongoing support phase. They will take care of the strategic and technical parts of your platform’s construction by having ideation workshops, interface design, coding, and ongoing maintenance.

What is the typical timeline for building an InsurTech application?

Developing a minimum viable product usually involves a period of three to six months, while the creation of a full application with all its features could demand a timeline ranging from nine months to one year or even more. This duration is affected by level of complexity, number of integrations, compliance.

How do insurance app development firms ensure data security?

Trustworthy vendors adopt layered security strategies that include among others end-to-end encryption, multi-factor authentication, strict access controls. They create infrastructures to comply with very rigorous regulations such as GDPR and even HIPAA when necessary.

What services do InsurTech-focused agencies provide?

Usually, the programmers that are working on these projects will be professionals having a wide range of skills in mobile apps development, web portals, back-end infrastructure. They are also able to create:

- connections through APIs with insurance carriers,

- payment processors,

- analytics platforms.