How to Build an Insurance App: Brief Overview

Building a surety mobile app is tough nut to crack, but with the right mindset, it can be as easy as pie. Our brilliant collective is all set to open the curtain on insurance mobile app development and provide you with an overview of the process. From defining the target audience to creating glitch-free functionality, we’ll highlight the primary elements that transform your concept into a polished product.

Without a doubt, at first, the challenge to build an insurance application seems as intricate as a game of chess, but once you strategize, the winning moves emerge. A well-built app thrives on the integration of crucial services like claims management, policy tracking and customer personalization.

Insurance app development is a whole lot simpler with the perfect-fit ally leading the way. A rock-solid team in a company like Limeup turns construction of coverage mobile tools into an art. Our union of competence and ingenuity in the insurance solutions field fuels steady evolution and a strong market foothold.

What is an insurance application?

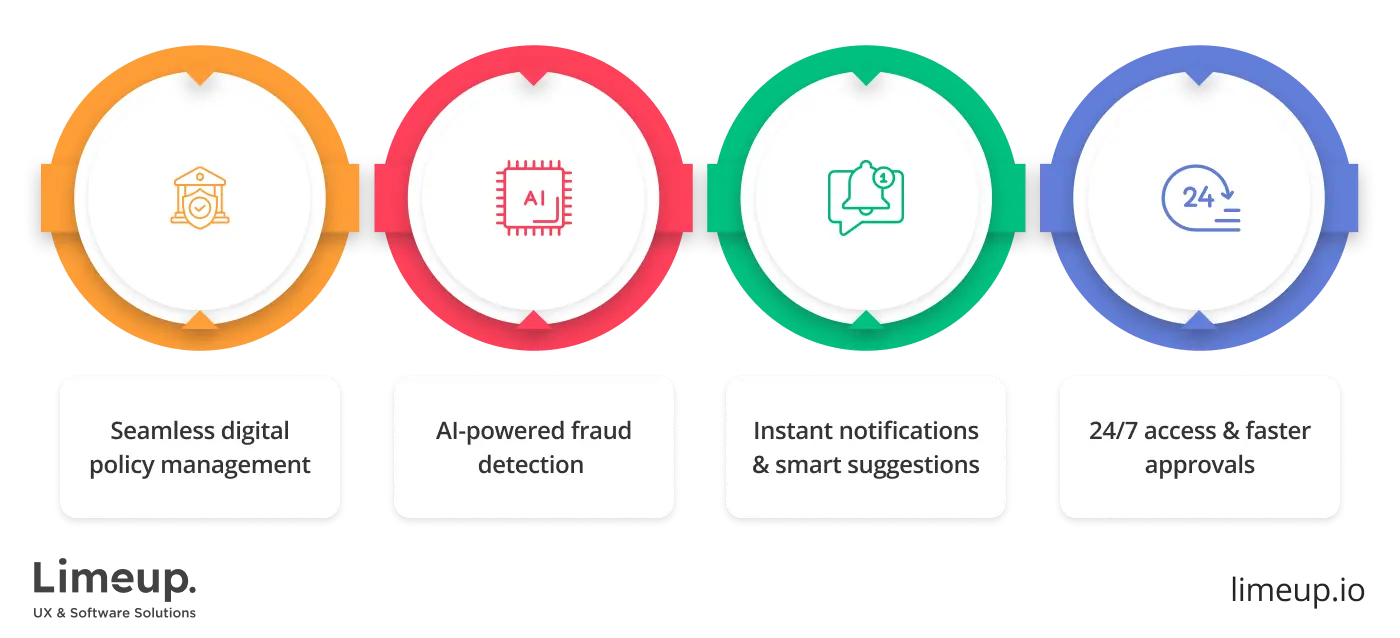

Risk assessment tool is a digital solution that allows users to manage policies, file claims and access support without dealing with paperwork or long wait times. Ever thought dealing with insurance could be as easy as grabbing a coffee? Well, it actually may be! Those old ways of doing things are fading fast and with about 71% of customers now preferring online options, it’s clear that mobile apps aren’t just a nice-to-have, they’re a must.

These platforms let policyholders update their info on the fly, get instant notifications and even receive smart suggestions thanks to AI. The digital shift is altering the playing field in fintech software development, transforming how users access policy services.

Insurance app development solutions are not covering the basics anymore; they’re using machine learning for spotting fraud, automating underwriting, and applying predictive analytics to evaluate risks more accurately.

It’s pretty impressive as research shows that digitizing the petition submission may cut settlement times in half, which is a big win for customer satisfaction. Moving to digital is revolutionary, it simplifies processes, eliminates the usual stress, makes protection more affordable and accessible for everyone.

In fact, research shows that companies with strong digital platforms enjoy about a 30% boost in customer engagement compared to those that stick to traditional methods. Having 24/7 access, secure transactions, quick policy approvals totally changes the experience, making everything faster, safer and more efficient.

In an era where speed and individualization rule, no one enjoys dealing with endless paperwork and waiting on hold, right? So why put up with it? A first-rate app is the foundation of today’s assurance experience. Organizations that accept such software are set for success, while those who hesitate might fall behind.

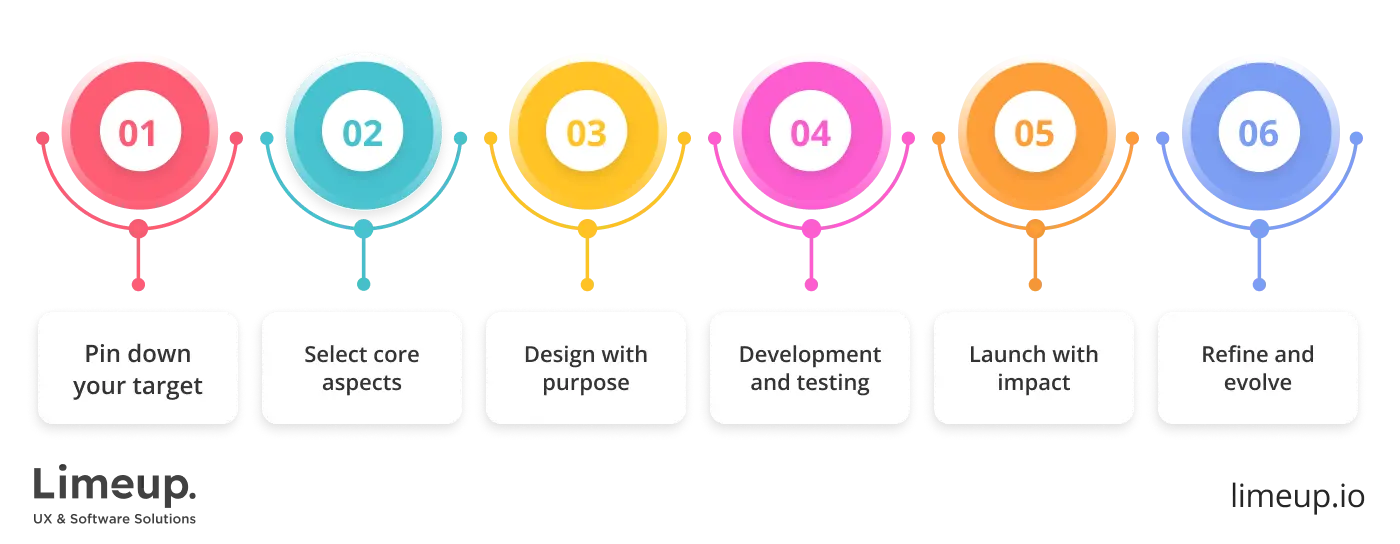

What are the steps for insurance mobile app development?

Creating such mobile system is kind of like piecing together a puzzle — you need to make sure all the parts fit together perfectly. Want to know the steps? We at Limeup got you covered to ensure your software launches successfully and meets all your goals.

Step 1: pin down your target. Before diving into coding or design, think about who you’re creating this for: individuals or businesses. Are your users tech-savvy, or do they need something super user-friendly? It’s kind of like mapping out a road trip, get your bearings right and the rest will fall into place.

Bear in mind that coverage app is beyond a way to provide services; it’s about building trust, ensuring accessibility and facilitating uninterrupted flow for users. From claims management to easy policy access, focusing on user satisfaction should be your constant aim.

Step 2: select core aspects. Now that you’ve nailed your audience and goals, it’s time to decide what features to include in your insurance application development procedure. Appeals filing, straightforward policy tracking, convenient premium payments, personal recommendations are your chance to shine: what unique angle may you bring to set your program apart from the competition?

Don’t forget about the behind-the-scenes essentials. Security is important, especially when you’re dealing with sensitive information. Consider incorporating features like two-factor authentication or encryption. These additions are able to go a long way in making your users feel safe and secure.

Step 3: design with purpose. The look and feel of your app may considerably affect user interactions. A clean, organized interface can make the experience trouble-free, ensuring users don’t feel lost. Partnering with a reputable insurance app development services supplier helps you create an intuitive, user-friendly platform that eases the routing of inquiries and policy details — nobody wants to deal with a confusing process.

Here’s a quick tip: use buttons that are easy to tap, fonts that are easy to read and colors that are comfortable for the eyes. Create solution that users will want to use, not one they’ll avoid.

Step 4: development and testing. Here’s where the excitement really kicks in — our mobile system is finally starting to take shape! But before you get too eager to hit that “launch” button, let’s make sure you’ve given it a thorough run-through. No one wants to deal with an app riddled with bugs that crash or features that just won’t play nice. Imagine the frustration of trying to lodge complaint on a glitchy program; it would be a real headache, wouldn’t it?

Beta testing during custom insurance mobile app development services may be your best friend here. Think of it as getting a little extra feedback before you go live. It may really save you a lot of trouble eventually.

Step 5: launch with impact. The moment of truth is here — your software is live! But hold your horses; launching isn’t the finish line. It’s just the beginning. A successful launch includes creating awareness. You want to get your target audience excited about your app and the best way to do that is through well-thought-out marketing campaigns.

Create buzz through social media, email campaigns, or even partnerships with industry influencers. After all, the platform might be amazing, but if no one knows about it, it’s like throwing a party without sending out the invites.

Step 6: refine and evolve. Releasing your system isn’t the finish line. Insurance mobile app development is constant process. Keep an eye on user feedback, monitor app performance, roll out updates to maintain freshness. New features? Bug fixes? User-requested changes? It’s all part of the journey.

Interested in complaint management platform engineering? Explore app development companies in the UK who are mastering the art of insurance software production.

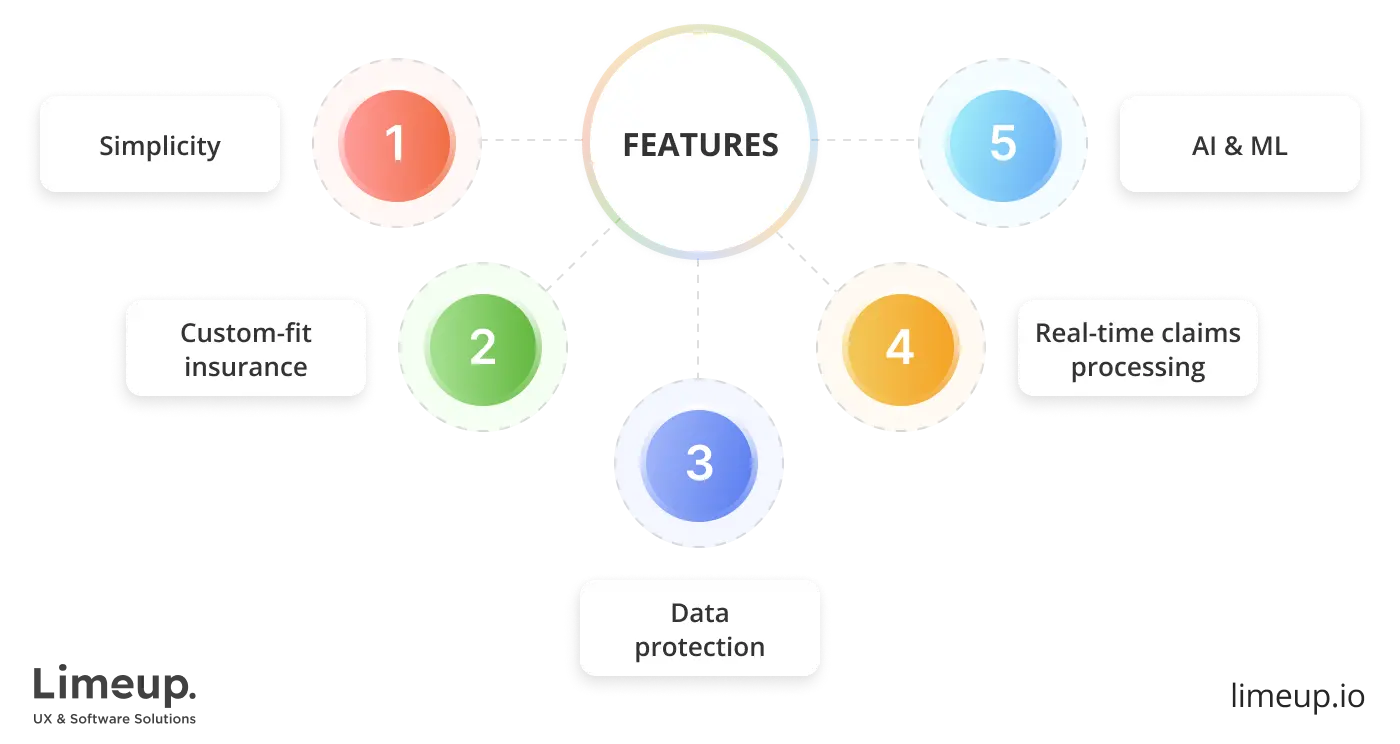

What are the key features of creating insurtech app?

Picture this: a tool that brings indemnification into the modern world clarifies procedures and releases a whole new range of possibilities. Sounds like a dream? It’s not — it’s the future of insurtech. In cut-throat digital world, engineering such product is like hitting the jackpot for both users and insurers. So, what are the notable attributes that could turn this app into a must-have? Buckle up because we’re diving in!

- Simplicity at its best: UX without the headaches

Dealing with coverage often feels like getting lost in a maze of red tape and complicated jargon. If you’ve ever tried to figure out an indemnity policy, you know the struggle: endless forms, terminology that seems like a foreign language and painful waiting times. But what if we could change all of that? Goal of insurance application development should be to create an experience that’s as easy and enjoyable as a stroll in the park.

With a sleek, user-friendly interface, users are able to quickly access everything from policies to reports and quotes — all just a tap away. Sounds great, right? That’s the essence of excellent user experience.

- Custom-fit insurance: insurance that knows you best

Cookie-cutter approach? Yeah, that’s old news. Today, personal touch is the name of the game. Your program should feel like a smart, adaptable tool that learns and grows with you. Need to adjust your coverage? Easy! The app is designed to anticipate your needs.

Looking for a quote? It’s right there when you need it, with no waiting required. Thanks to intelligent algorithms and a strong focus on user experience, your software evolves with each interaction, ensuring everything feels designed for you.

- Fortress-like protection: keeping your data under lock

When handling sensitive information, security is important for building trust. Users will only feel comfortable sharing financial details if they know that ironclad security is in place.

Multi-layered encryption, biometric logins, foolproof data protection protocols are indispensable in this regard of custom insurance mobile app development. The trust they instill helps drive user engagement. Users who believe their data is safe are much more likely to interact with your program and place trust in your services.

- Real-time claims processing: no waiting, no worries

The assertion submission procedure often feels like waiting in line at a busy coffee shop — forever. Why not turn things around? With an insurtech solution, handling allegations may be super quick. Just imagine: you send in a request from your phone, snap a few pictures of the damage and get an update in just a few minutes.

This not only makes things easier, but it also builds trust. People will appreciate how fast and straightforward the course is, which will keep them coming back for more. Let’s be honest, everyone wants things done fast these days.

- AI and Machine Learning: smarter than ever

If you’re thinking about where insurance is headed, you can’t ignore the newest trends. These technologies are able to help the app assess risks, create flexible pricing and guide users to make better choices. Want your premiums to change based on your driving habits or health info? AI is the answer.

The best part about machine learning is that it just keeps getting smarter, like a private assistant who knows exactly what you need. Plus, better algorithms mean fairer pricing and more accurate risk assessments, which is a win for everyone.

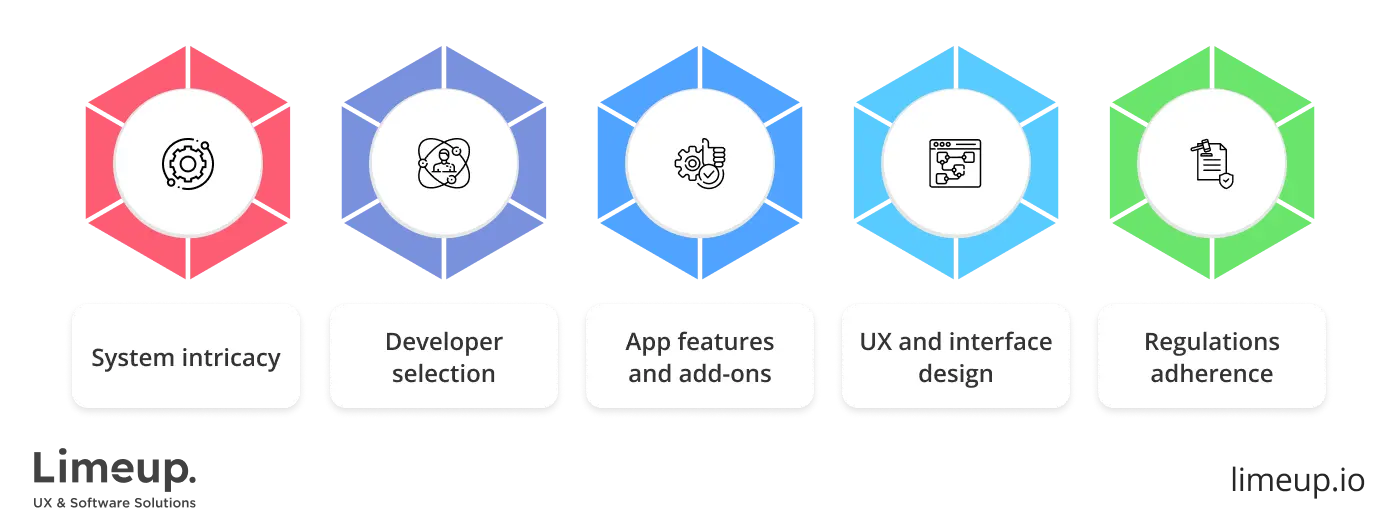

How much does insurance app development cost?

Building a coverage portal demands some smart planning and a budget that reflects that. The final cost hinges on the range of features, depth of security and caliber of professionals shaping the product. Much like crafting a bespoke suit, every refined element and high-end finish adds to the investment.

The price tag: what’s in the mix?

Before diving into numbers, take a closer look at what influences the overall cost. The price of insurance mobile app development services is determined by various aspects, from technical complexity to compliance requirements.

System intricacy. The final cost decreases when it includes basic features as opposed to complex elements such as artificial intelligence and live analytics and blockchain security.

Developer selection. Are you hiring local agency, freelance coder or offshore team? Each comes with a different price tag.

App features and add-ons. The inclusion of advanced options like AI chatbots, fraud detection, frictionless API integrations raises the price.

UX and interface design. An elegant, intuitive design enhances the user experience, but bringing it to life through talented designers costs more.

Regulations adherence and security. The protection industry’s stringent directives demand constant attention and investing in unbreakable guard measures is non-negotiable.

Decoding expenses

Below is an approximate estimate of how much insurance app developers charge for your review:

- Basic MVP (Minimal Viable Product): $30,000 – $60,000

- Mid-range (more features & integrations): $60,000 – $150,000

- High-end, AI-driven: $150,000 – $500,000+

It’s not just about upfront costs. Keeping your program up-to-date and utilizing cloud storage adds to costs in the long run. While skimping on development might save money initially, a subpar app often results in higher expenses down the road.

| Cost factor | Description | Estimated price |

| Back-end infrastructure | Your hosting, databases, and cloud storage shape long-term expenses. Opting for on-premise servers or cloud options like AWS or Azure influences both costs and scalability. | 5,000 – $50,000+ |

| Third-party services | When you integrate outside APIs for things like payments, user verification, or policy management, you often face licensing fees or pay-per-use charges. | $1,000 – $20,000 annually |

| Scalability and load handling | To handle more users in the future, invest in robust architecture and stress-test your system to prevent crashes during peak times. Cutting corners now leads to costly fixes later. | $10,000 – $100,000+ |

| AI and automation | It’s a bit of extra work upfront, but using machine learning for fraud detection, claim automation, recommendations triggers faster, more efficient process in the end. | $20,000 – $150,000+ |

| Legal consulting | To make sure you meet legal standards like GDPR or HIPAA, you’ll need expert advice, legal documents and regular compliance checks. | $5,000 – $50,000+ |

| Marketing | Getting users onboard is the real challenge. A launch strategy with digital ads, app store optimization, and referral programs drives adoption. | $10,000 – $100,000+ |

How to get the highest return for your expenditure?

Thinking of going all in? Take a step back. Do you need a full-fledged product from day one or do you want to start with an MVP and scale up? Prioritizing essential features and adding advanced functionalities later may help keep initial costs in check.

When deciding to hire app developers, make sure to evaluate their experience and track record. Working with veteran software creators always pays off. A skilled squad may cost more upfront, but they’ll save you from costly mistakes. Plus, a well-built software attracts more users, leading to better ROI.

So, are you ready to take the plunge, or still weighing your options? One thing’s for sure — the future of insurance is digital and getting ahead now might just be the smartest investment you make.

How to choose an insurance app development company?

Well, you’ve decided to leap into the world of the creation of coverage system — great choice! The potential to improve efficiency, enhance user experiences, drive your assurance business forward is enormous. But before you dive in headfirst, there’s a step you can’t afford to miss: choosing the amidst fintech software development companies. After all, this is the companion who will help shape your vision and picking the wrong one could make or break your success.

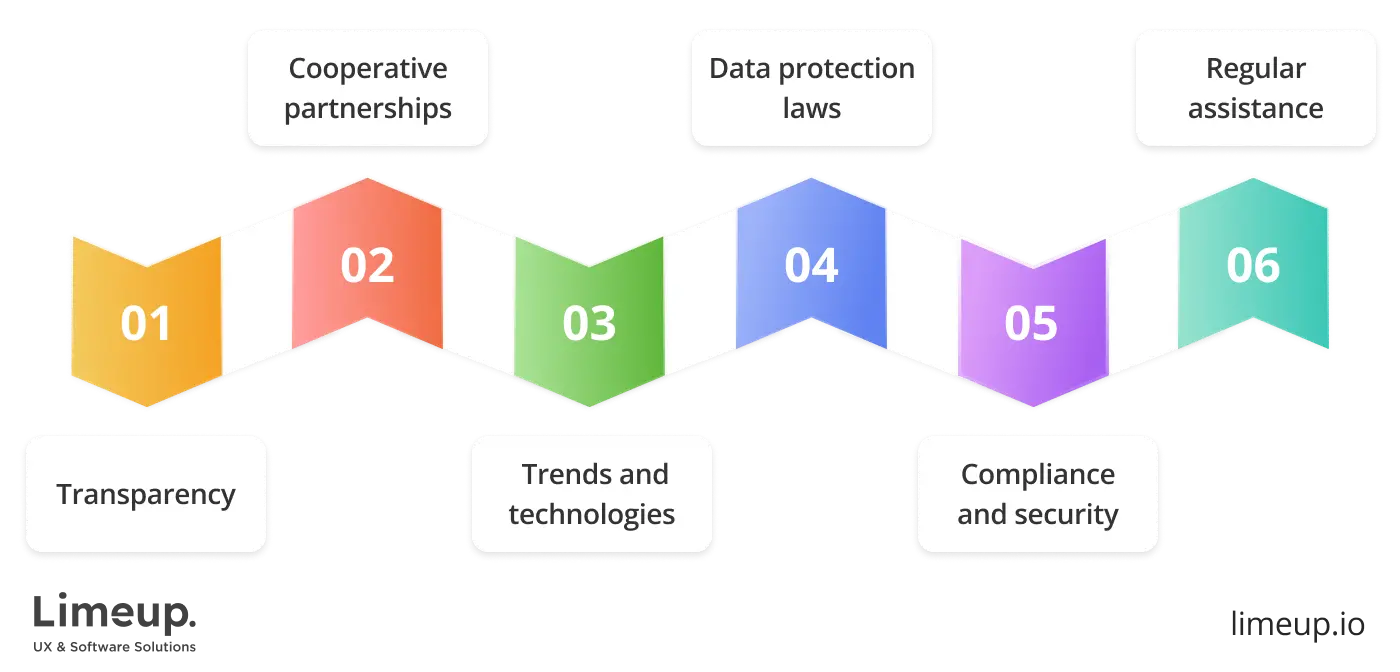

Pick a crew that fosters transparency and encourages cooperative partnerships. You want insurance mobile app developers who will keep you updated throughout the way, not just when it’s time to present the finished product. Ask about their production sequence — how do they handle feedback? Will you have a clear line of communication throughout the project?

Innovation in the policy industry is moving fast and you’ll need tech gurus that have capacity to keep up. When you hire battle-tested programmers, you’re buying a service and investing in a future-proof solution. Make sure the company you choose is familiar with the latest trends and technologies in insurance app development, from artificial intelligence and blockchain to machine learning and cybersecurity.

Does the team have a deep understanding of data protection laws and the regulatory landscape? If not, you could be opening a can of worms that’s better left closed. Compliance and security are as critical as your app’s features. So, ensure that your tech gurus have technical prowess and understand the legal landscape surrounding sensitive data.

As we have already mentioned, the work doesn’t stop after release. In fact, that’s when the real fun begins. You’ll need insurance mobile app development company that offers regular assistance and system care to ensure that your program continues to perform well, adapt to new technologies, stay in line with any supervisory changes. After all, when it runs well, your users stay happy and your business keeps moving forward.

The right workforce will be there, keeping things running, providing updates, helping you tweak the app as needed. Look for agency that treats the launch as just the beginning of your journey together, not the end.

Hunting for a reliable companion may seem like a tall order but with a little research and patience, you’ll find a collective ready to help you turn your ideas into reality. We believe this guide has set you on the right path and given you a clearer idea of what to expect. Don’t rush, take your time, ask critical questions and assess every potential partner with care.

To conclude

Producing a long-lasting liability mobile solution needs careful planning, industry knowledge, innovation. Limeup combines all three, with a team of experts ready to transform your ideas into a user-friendly, practical platform. Limeup is there for you every step of the way, from concept of insurance app development to commercialization.

Our proficiency guarantees that your product includes essential features like swift benefit disbursement, immediate coverage alterations and hassle-free dashboard control. Limeup unites extensive market knowledge with abilities in technology to produce an app with dependable performance and responsive UI.

Looking to refine claims or keep users in the loop with up-to-the-minute updates? Limeup’s the technical associate who may convert these ideas into functional elements, creating a smooth sailing experience for your users from start to finish. Reach out to our specialists to weave our magic and mold your coverage app into a must-have resource clients may count on.