How to Build a Trading Platform: Full Overview

Looking for a guide on trading platform development? Unsurprisingly, creating one of the most profitable businesses that allows traders to automate processes and improve their trading performance is no small feat. Creation of custom platforms involves complex and interconnected steps that require expert knowledge and it will be better to delegate these tasks to real code whisperers.

With the rise of cryptocurrency dealing, any fintech business is increasingly interested in building portals for stocks and digital assets. Developing a trading platform with scalability in mind gives a company the upper hand when addressing customer demands in the crypto and equity space.

You might have noticed that cryptocurrency has surged in popularity as a go-to investment option, attracting attention from old-hand investors and curious newcomers. Think like a trader, engineer like a pro — that’s the mantra behind effective trading software development. Success depends on picking services that align with your ambition to launch a high-impact trading solution.

prepped and waiting.

What is a trading platform and how does it work?

It is a process of designing, ideating, testing and producing a new crypto trading portal. A custom trading platform development provider may take one to several months to construct such product, depending on the scope of work, timing, and budget (we’ll unpack this in more depth as we go through the overview). During this period, all envisioned and designed features must remain up-to-date and be helpful for traders.

Your team should clearly understand how to develop your own trading platform, how modules are connected, and how to provide the ultimate level of security to keep the system and user assets from being exploited.

When we talk about the crypto market hitting $2.53 trillion in 2026, we’re not tossing around buzzwords, we’re talking about market capitalization in action. As per Investopedia, market cap is the total value of an asset, like a cryptocurrency, calculated by multiplying its current price by the total number of coins in circulation.

Government bodies are increasingly engaging with the crypto market, implementing comprehensive regulations at both the national and state levels.

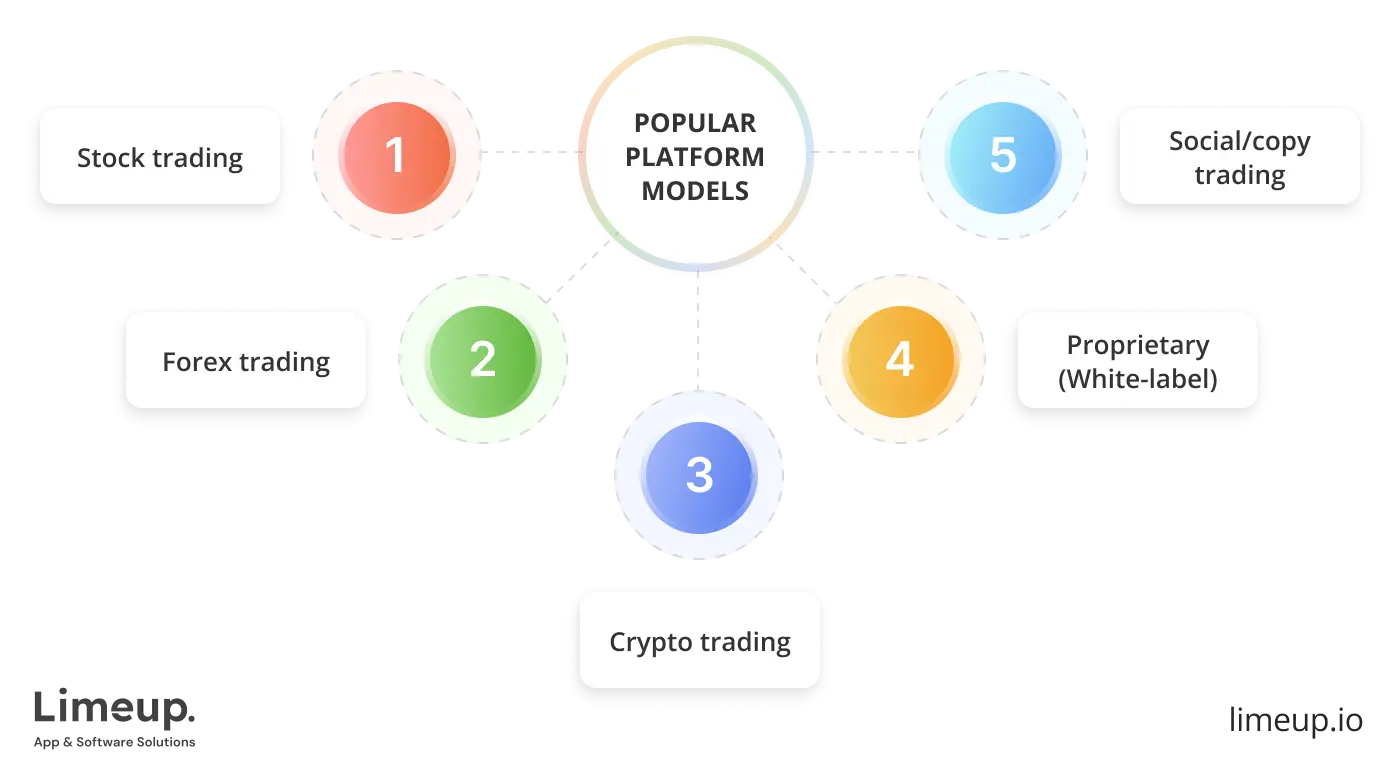

Popular types of trading platforms

Behind every successful stock trading software development lies a core model, and here’s a quick tour through the main types engineers build around.

-

Stock trading platforms open up access to equity markets, giving users possibility to execute trades in real time with a single click. Thanks to trading platform development services, they are designed with powerful data analytics, in-the-moment charting and instant news feeds, arming traders with the insights they need to respond quickly to market shifts.

- Forex trading portals allow users to juggle on-the-spot currency pairs, tight spreads and leverage tools. Precision and split-second execution are critical here, as forex traders operate in a fast-moving, high-volume environment. Such systems often come equipped with sophisticated technical analysis tools, economic calendars, and news integration, helping traders stay ahead of global events that impact currency values.

-

Cryptocurrency marketplaces cater to the round-the-clock chaos of digital assets, offering users the ability to trade cryptocurrencies across various exchanges. Supporting a wide range of coins, tokens, and often DeFi features, crypto products balance volatility with innovation in a fast-paced user interface.

Traders are able to access advanced charting, staking, and yield farming features, taking advantage of the high-risk, high-reward environment of digital currency markets.

-

Proprietary (White-label) systems are custom-built by trading software developers, often referred to as “off-the-shelf” solutions that businesses can rebrand and personalize. These ready-made systems give freedom to launch faster without starting from scratch, while still allowing plenty of room for customization.

Such an approach helps businesses get to market faster with a proven system, while also offering flexibility in adapting the engine to their unique requirements.

-

Copy trading and social frameworks offer a chance for individuals to mirror the moves of expert traders, making them an excellent choice for novices entering the market. These systems merge live trading with a social element, giving less-experienced traders access to professional strategies, boosting their decision-making abilities.

Interactive features like rankings, trade-sharing, and social interactions further enhance the collaborative environment, helping users grow together.

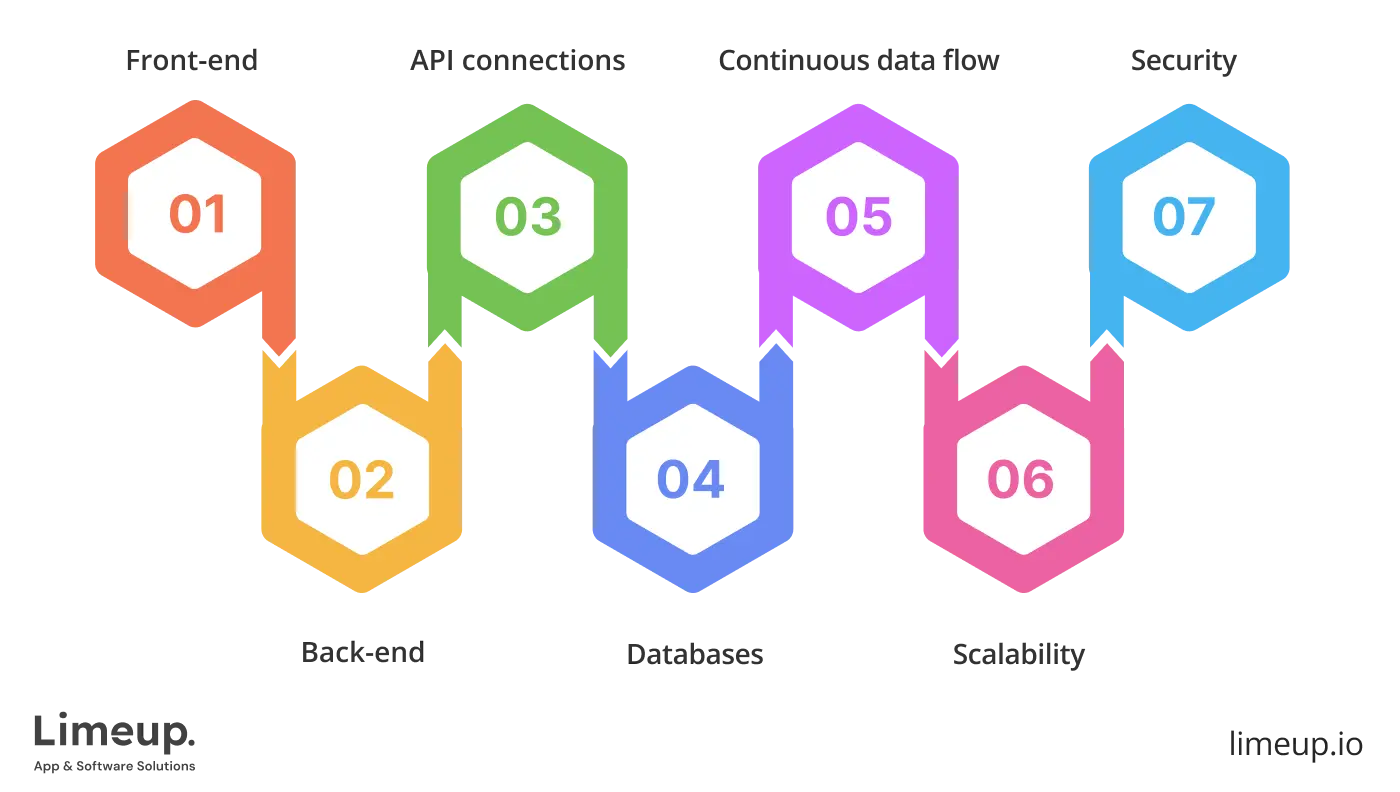

Trading platform architecture

Behind every reliable custom trading software is a well-calculated architecture that ensures the engine moves regardless of the load. We as one of the most reliable fintech software development companies understand how the whole machine goes:

- Front-end is the dashboard the traders live on, where they click, scroll, analyze and make a reaction. Smooth experience for users, clear visuals, and quick rendering define a good environment from a frustrating one.

- Back-end is the brain of the operation. It takes care of the order execution, management of users, permissions and all the decision-making under the hood.

- API connections — in trading platform development, a trading system cannot be isolated. APIs connect it to other services outside: payment gateways, identity verification (KYC/AML), liquidity providers, and banking systems.

- Databases are a must as all actions of users, transactions, the history of trade, personal data must be reliably stored and accessible in time. Structure is important and so is speed.

- Continuous data flow — for this, technologies such as WebSocket are used by trading platforms to deliver quotes and order book changes immediately. Milliseconds make a difference when prices rise or fall violently.

- Scalability is very advisable as application should grow the same way the users do. With cloud-native solutions such as AWS or GCP teamed up with microservices, it ensures that it can scale up while it does not collapse.

- Security starts with multi-factor authentication, includes encrypted data, rate limiting and API access control — each layer must be built like a vault. A trading software developer knows that one loose bolt can cost millions.

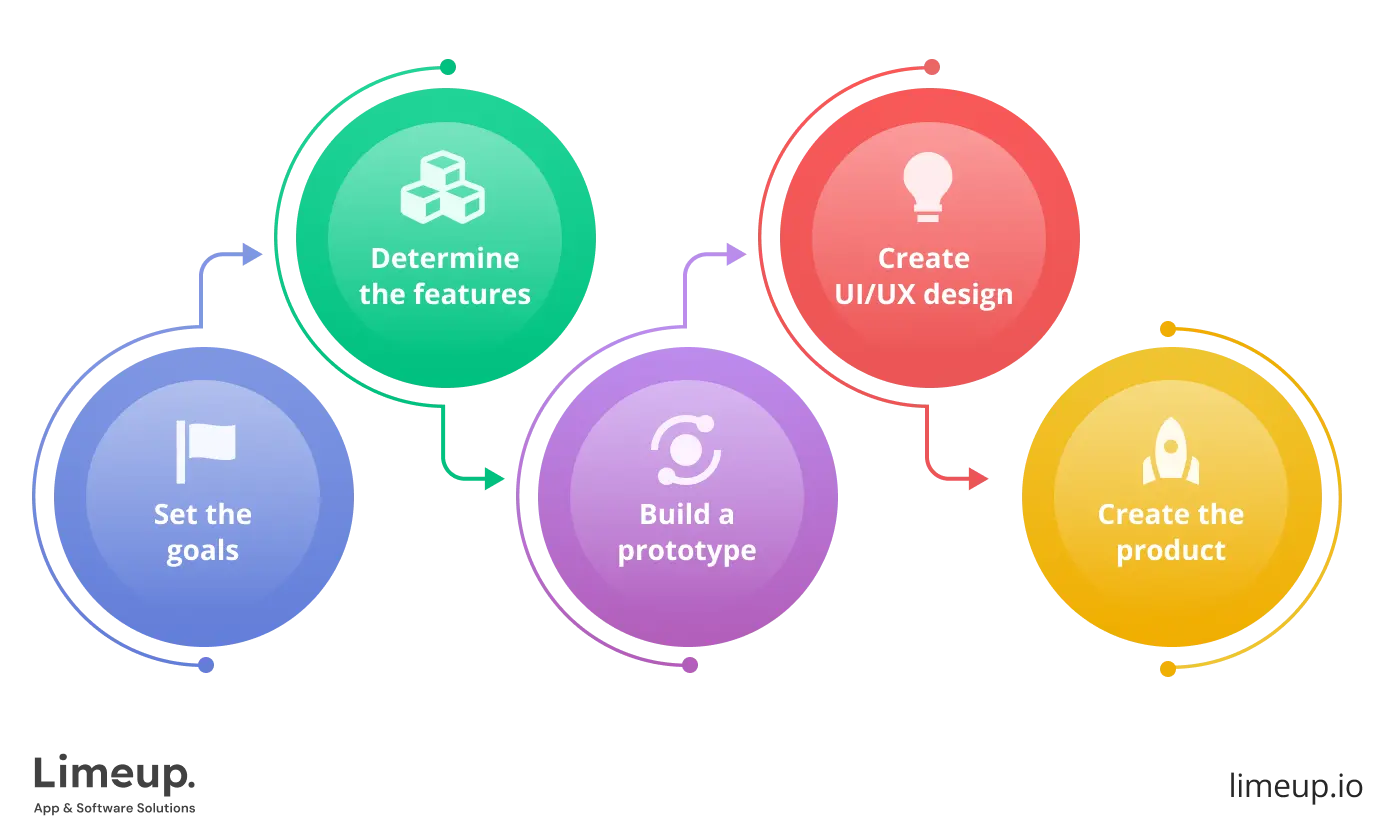

How to create a trading platform in 5 steps?

Considering all of this, we’d suggest you explore the opportunity to hire a company to engineer a blockchain-driven investment network and cover all your business needs. Signing a contract with full stack development firm gives you guarantee of the on-time delivery of the stock trading app, along with impeccable quality and clear-cut support.

Step 1: Set the goals. You must start from the very beginning and consider traders’ pain points and challenges to understand how to build a stock trading platform properly. Then, think about how you can address them with the help of your stock trading product. It allows you to determine the goals your team is willing to achieve by developing an online investment app.

At Limeup, we recommend considering the following peculiarities when setting business goals:

- The speed at which the order is placed and closed. It allows brokerage clients to enter the trading market and close a position with an up-to-date price.

- Current and past market conditions analysis. When defining the project goals, consider usability and how you want users to interact with your UI. Based on our experience, excellent data visualization will be a plus.

- Trading fees. It would help if you did deep market research before creating a trading platform to understand what trading fees may be bearable for users. High costs are one of the reasons why many experienced investors switch to other stock trading apps.

- Automatic trading. It’s not a surprise that traders cannot buy/sell 24/7. In this case, you must rely on stock trading bots to place orders immediately and close them for profit. For example, self-made indicators may signal that market conditions match entry point requirements to help them make the final choice.

- Alarms and notifications. It will be beneficial if a brokerage app has a dedicated feature to notify high-frequency players on mobile apps with push notifications when important economic events occur.

Step 2: Determine the features. Layouts should be crisp, actions should be instinctive, and numbers should speak for themselves. Fast setup, smart visual cues and trading bots ready to roll all help form a system that complements their rhythm.

A modern portal must also keep up with at-the-moment demands. Custom alerts, filtered newsfeeds, all-in-one knowledge solutions keep traders informed without information overload. Security can’t be an afterthought either — investors need to see clear signs of API protection and compliance standards at work.

Add in frictionless payments and full access across devices and you’ve got the bones of a system that won’t buckle under pressure. Partnering with a custom trading platform development company ensures your product isn’t missing the bells and whistles they consider non-negotiable.

Step 3: Build a prototype. We know that clickable product prototypes for a brokerage solution give you the chance to test your ideas before the engineering phase and market introduction. Real professionals should employ Figma or Axure to create prototype models that display both operational logic and capability sustenance.

Feedback is critical to success because it shows users that their opinions matter. Application design often can’t address traders’ struggles and pain points. A feature may look good and should be helpful, but actual users don’t always think so. Ideally, it has to be updated to fit people’s expectations.

Step 4: Create UI/UX design. After ideating, prototyping, and testing the user interface with all usability options, you are able to move to the design stage and receive feedback from actual market movers. A savvy trading platform development company will help you avoid reinventing the cockpit, enhancing usability without confusing experienced dealmakers.

Step 5: Create the product. The last steps in our process are product development and launch. Depending on the software engineering services, your team setup, and the time frame, it’s feasible to design, construct and launch a product in at least one month.

If you’re wondering how to develop a trading platform that runs smoothly on Android, look for tech-savvy pros who know Java, Ruby, and Python. We recommend requesting their portfolio to check if they fit your stock trading project tasks.

Your team also needs JavaScript engineers for the front-end works and testers who will point out bugs, if there are any. Qualified squads, such as Limeup, will assist you in swiftly and accurately designing a stock exchange interface that fits the preferences of your users and achieves your organizational goals.

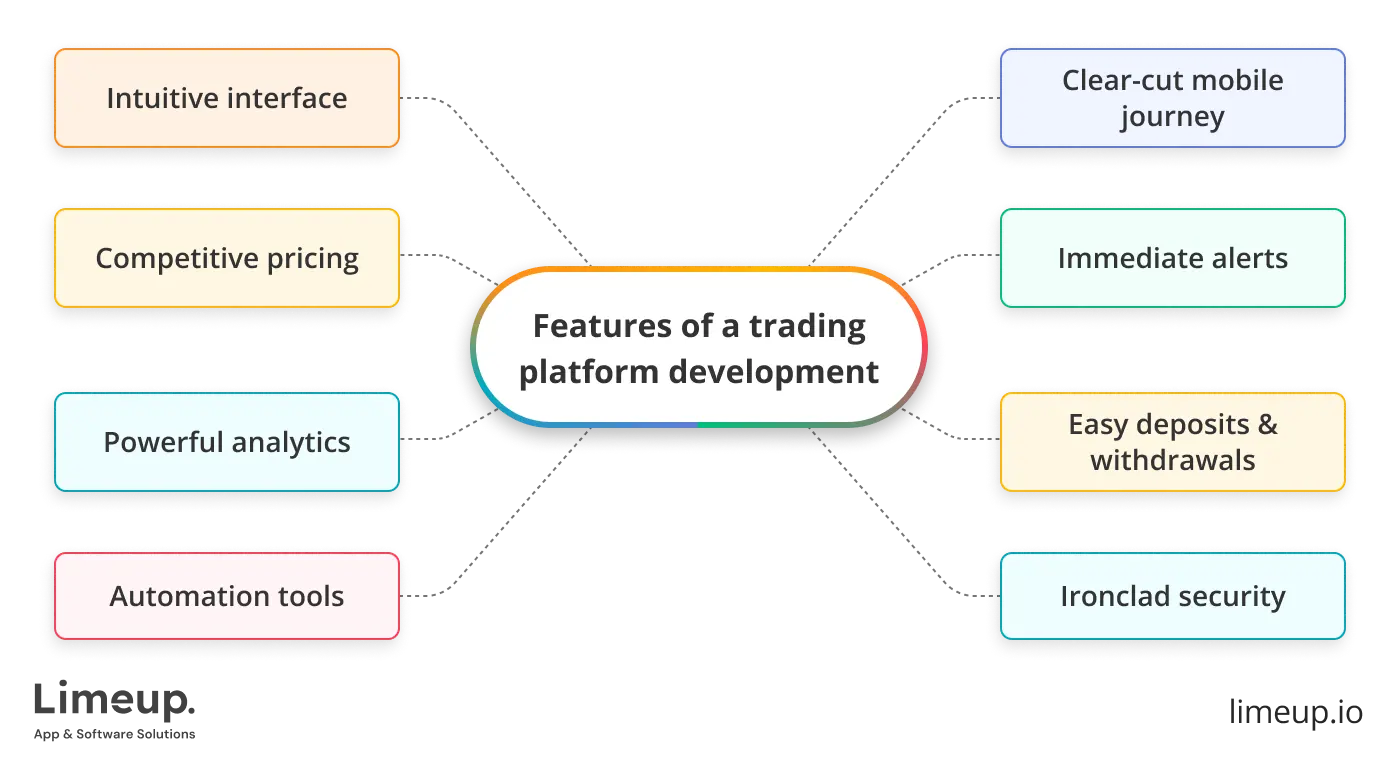

What are the features of a trading platform development?

Setting up a digital trading solution calls for more than functionality. It’s about creating a landscape that welcomes everyone, first-timers looking for guidance and veterans scanning for emerging patterns alike, while offering a smooth, intuitive flow at every turn.

With smart design and purposeful resources, ecosystem matures over time from a basic tool into a trusted companion in the world of digital finance.

In the chapter about steps, we have already mentioned 12 functionalities, but what else makes one product shine while others fade into the background?

- Intuitive interface (because no one likes getting lost)

The importance of a simple and functional design cannot be overstated. Users must be able to navigate easily, execute trades smoothly, and stay on top of the latest market trends with up-to-the-minute updates. A clear interface, flexible dashboard options, and immediate access to data are the key ingredients.

- Competitive pricing (yes, every penny counts)

Nobody likes hidden fees lurking in the fine print. Leveraging top-tier trading platform development services allows you to design fee structures that are as transparent as glass, ideal for detail-obsessed users watching every decimal like a hawk.

- Powerful analytics (for the strategy junkies)

Your users want more than just price charts, they want smart tools to analyze trends, compare assets, and forecast movements. Add heatmaps, interactive graphs, historical data, and AI-driven insights, and suddenly your system becomes a strategist’s best friend.

- Automation tools (let the bots do the heavy lifting)

Watching the market 24/7 isn’t realistic for most so smart automation fills the gap. In trading platforms development, offering coverage for trading bots, custom strategies and conditional orders may give users the flexibility they need without staying glued to their screens.

- Clear-cut mobile journey (because trading happens everywhere)

With mobile-first usage on the rise, your investment operations tool needs to shine on smaller screens. Native apps with full trading functionality, smart notifications and biometric login may turn a casual scroll into a confident trade.

- Immediate alerts (timing is everything)

The market doesn’t send polite reminders, real-time alerts for price shifts, order changes, or fresh news to keep your traders ready to pounce. When volatility hits, those split-second notifications become the difference between capitalizing on an opportunity or watching it vanish in the rear-view mirror. Give them the intel they need, fast, sharp and right on cue.

- Easy deposits & withdrawals (make it effortless)

Users shouldn’t feel like they’re climbing a mountain just to move their funds. A smooth, fast, and transparent transaction process(supporting major currencies and payment systems) is key to keeping them coming back.

- Ironclad security (no room for compromise)

Trust is earned, not given. Use end-to-end encryption, two-factor authentication, and API key controls to protect user data and funds. Bonus points if you communicate those safeguards clearly as confidence grows when users know you’ve got their back.

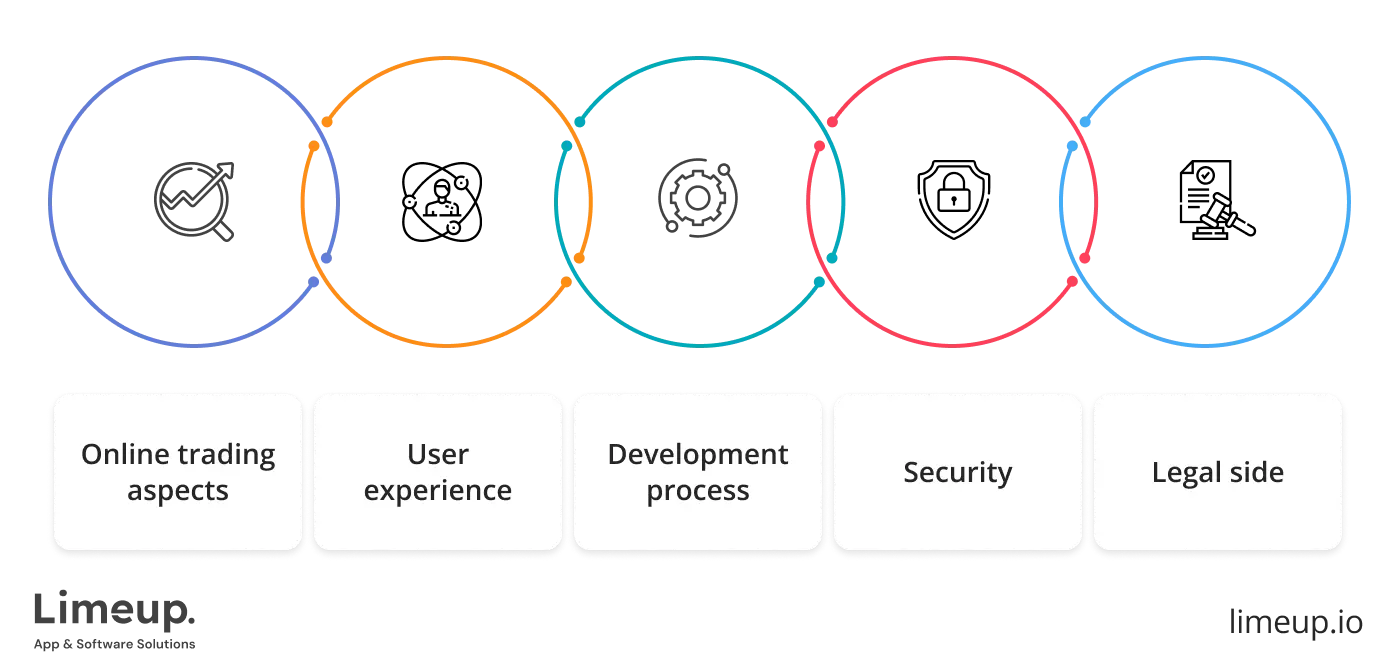

5 Tips for developing a trading platform

In the previous paragraph, we have explained how we approach, plan, and craft a fintech trading dashboard at Limeup. It’s usually a resource-heavy and time-consuming process that involves backend, frontend, engineering, user experience, and product design experts.

We involve a team of specialists to ensure we don’t miss out on product, design, and development details. In this paragraph, we’ll highlight a few critical points to consider when working on a new fintech solution for trading. Considering that there are many similar solutions on the market, the following peculiarities will help you to find out how to make a trading platform that consumers will like to use.

Online trading aspects

We’ve briefly touched upon this topic earlier in the article, but we’d like to add a few more basic points. Limeup knows how luring it may be to launch trading platforms with multiple options for users.

Yet, this approach is often misguided. Complex investor’s dashboard with different features will consume trading platform developers’ time and budget. Furthermore, many companies don’t even consider whether users need those specifications. They build them because they imply every solid trading system has them.

User experience

Good UX involves intuitive navigation, easy-to-follow interface design, and a clear copy. Even though designing with users in mind should be imperative when you are going to develop a trading platform, many design studios still take it for granted.

It results in creating mediocre approaches that serve users in the short term. When more advanced and user-friendly solutions are built by digital product development agencies, users switch, leaving business owners puzzled about what to do next.

We recommend taking the following principles into account while thinking about the UX of your product:

- All design decisions should be data-driven.

- User experience interviews with your TA will help discover users’ problems that competitors don’t resolve.

- Test design methods before trading software development. It will help you save dev time and resources.

- Conduct UX research and product design to discover where users misunderstand your online brokerage hub.

- Start developing a mobile market interface when you have a validated layout plan.

- Give priority to the development of functional elements within the tool based on business relevance.

- Ensure the necessary features are accessible in a maximum of three clicks.

The development process

Trading platforms development is challenging because it requires a specific tech stack, skills, and experience that not every product team has. Depending on your requirements and the scope of work, we recommend partnering with product development experts skilled in your niche and with relevant former background developing similar products.

Limeup has years of banking competence and worked at BNP Paribas and Deutsche Bank. Our tech stack covers the following:

- Back-end: Java, Python, Node.js, Go, C++

- Front-end: Vu.js, Java Script

- Mobile: React Native, Flutter, Kotlin, Swift, Objective C

- Cloud: Amazon, Azure, Google Cloud, Kubernetes, Docker

Having practical experience in 6+ market development industries, including fintech, Limeup knows how to design architecture and build secure trading apps.

Security

Users’ personal data protection and secure browsing are paramount when discussing custom trading platform development. How can you enhance the protection of your investment portal’s user data?

- Consider creating a two-factor authentication feature for web versions and mobile phones.

- Use a Secure Socket Layer (SSL) for web applications.

- Consider a SET (secure electronic transactions) approach. It helps authenticate merchants or cardholders while ensuring the confidentiality of payment data.

- Consider creating a billing address verification feature. It helps verify whether the billing address that a card’s user provides matches the one linked to the card.

Users will store, trade, and withdraw their assets using your stock market toolset. Therefore, ensuring their money is protected and won’t disappear is non-negotiable.

The legal side

Before finalizing trading interface development and releasing your product, ensure you have an appropriate license to operate in the countries you plan to run. Suppose you create a trading platform or an app up to date for users from the USA.

In that case, you must ensure all sensitive user data is encrypted by following the Financial Industry Regulatory Authority (FINRA) rules and the Securities Investor Protection Corporation (SIPC).

If you target a European market, ensure your digital product complies with the General Data Protection Regulation (GDPR). Besides, decide what regulatory body will monitor your business, such as the Securities and Exchange Commission in the USA.

The following table outlines the primary regulatory institutions and legal obligations across key financial jurisdictions:

| Region | Regulatory Authorities | Key Requirements |

| USA | FINRA, SEC, SIPC | KYC/AML compliance, user data encryption, registration |

| EU | ESMA, GDPR | Data protection, licensing, API access regulation |

| UK | FCA | Specific rules for CFD trading and retail investor protection |

How long does trading software development take?

Let’s be honest: everyone wants a clear deadline, but building trading software isn’t a cookie-cutter process. The timeline depends on several factors, from complexity to compliance demands. Still, we can sketch out a realistic roadmap to help you understand what to expect.

On average, a well-rounded investment takes software outsourcing company 4 to 9 months to build. But before a single line of code is written, there’s groundwork to be done. The planning stage of online trading platform development, which includes requirements gathering, market research, competitor analysis and selecting the core aspects, usually takes a few weeks. Skipping this step is like skipping breakfast before a big day: not advisable.

Once the strategy is set, the actual development begins. Basic portals with standard capabilities like on-the-fly pricing, simple dashboards and user onboarding might take 3–5 months. If you’re aiming for something more advanced, think automated trading bots, custom indicators, analytics dashboards and multi-device functionality. These typically take 6–9 months or more.

Also have not to be overlooked: thorough testing and rigorous compliance checks. Trading platforms are expected to uphold strong security and reliability standards. QA teams need time to run stress tests, audit the codebase, and simulate real-world use cases. Add another month or so to make sure everything runs smoothly under pressure.

Another factor that may speed things up (or slow you down) is your trading platform developer’s availability and decision-making pace. Quick feedback and clear direction can shave weeks off the timeline. On the flip side, constant backtracking or feature creep will drag things out longer than planned.

A good development team won’t just give you a random number. They’ll break the project down into milestones and help you track progress step by step. Transparency is key.

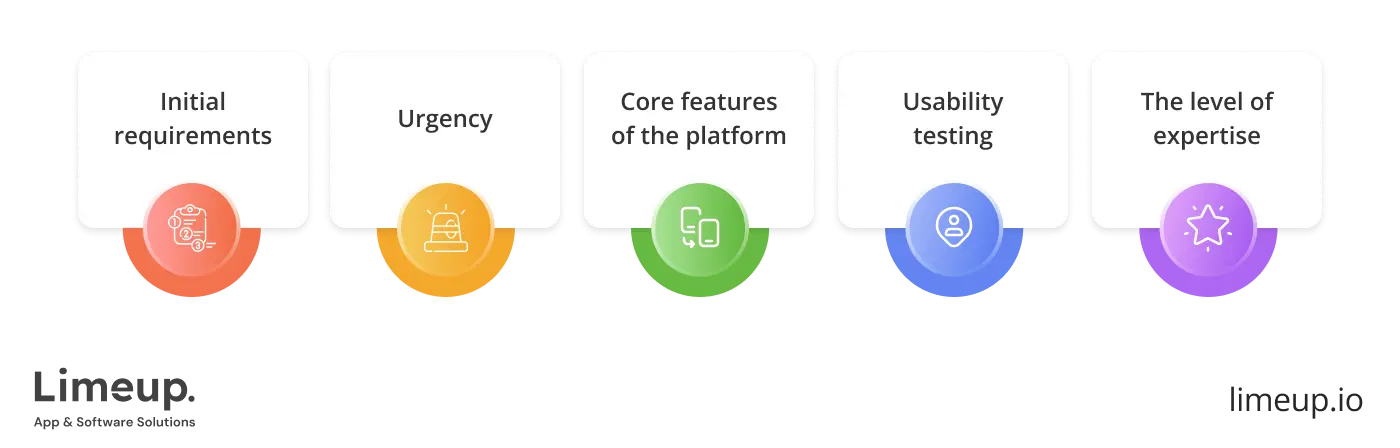

How much does trading platform software development cost?

“What is the price for trading system creation?” This is the main issue that future automated trading website owners are concerned about. The charges for creating trading software depends on several factors, including:

| Factor | Impact on pricing | Estimated price impact |

| E-trading system | Impacts the system’s intricacy and the choice of technologies. | $20,000 – $80,000 |

| Payment systems | Increases integration expenses. | $10,000 – $30,000 |

| Security features | Adds to production and QA expenditure. | $15,000 – $50,000 |

| Mobile optimization | Requires additional budget allocation for resources. | $10,000 – $40,000 |

| License type | Influences compliance-related outlay. | $5,000 – $25,000 |

| Team competence | Senior developers raise the investment, but ensure high quality. | $50 – $200/hour per developer |

If you need to check how much it costs, contact Limeup right away. Our experts will make a free individual estimation, considering all the variables of your business plan. Don’t worry if you don’t know how to create a business plan and design a mobile version of your stock market system.

Here are a few more must-have inputs that influence their own outlay for crafting a brokerage application:

- Initial requirements. If you want to design mobile trading apps from scratch, we recommend developing and launching an MVP first. It’s the fastest way to enter the market, introduce your solution, and monetize your product. Meanwhile, prioritizing features will help you focus on the primary elements first.

- Urgency. A faster stock market solution often means more experts should be involved in product development. You can allocate additional resources in-house or hire a trading platform developer for extra help.

- Core features. As soon as you decide on the goals and your TA, it’s integral to determine what features you will build first. While brainstorming and prioritizing features, remember your users’ pain points and needs.

- Usability testing. Hire dedicated programmers for this process. A smart technique to uncover what confuses and frustrates users, while guiding you to make the right tweaks and changes to ensure smooth sailing through every step.

- The level of expertise. The costs will differ depending on their level of expertise. Junior specialists are usually cheaper. However, their knowledge and skills may not be enough to develop an excellent product. Unexpected errors may occur, which you’ll have to fix in-house or hire dedicated specialists for an extra fee. Middle and senior experts are the go-to solution to create your own trading platform with complex functionalities.

Based on our experience, a trading app project’s product design and development phase may start from $50,000, depending on the complexity of the investment hub, the team size, and the number of requested features.

The fees that trading platform developers charge

The caliber of the coder you select may greatly affect the building phase of your system. Below is an overview of various programming proficiency ranks and their price implications:

| Developer type | Hourly rate estimate | Key strengths | When to hire |

| Junior developer | $50 – $100/hour | Basic coding skills, cost-effective | For simple tasks, proof of concept, or MVPs |

| Mid-level developer | $100 – $150/hour | Solid experience, reliable | For more advanced features, system integration |

| Senior developer | $150 – $200/hour | Expertise in complex solutions, strategic approach | For high-level tasks, complex algorithms and optimization |

Junior developers are perfect for minor features or prototype work, but to create a fully-featured, secure, and high-performing stock exchange interface, mid-level or senior developers are a must.

The experience of these companies provides traders with stability and scalability and strong security measures. It may seem convenient to choose the cheapest option yet hidden problems will likely manifest into additional expenses in the future.

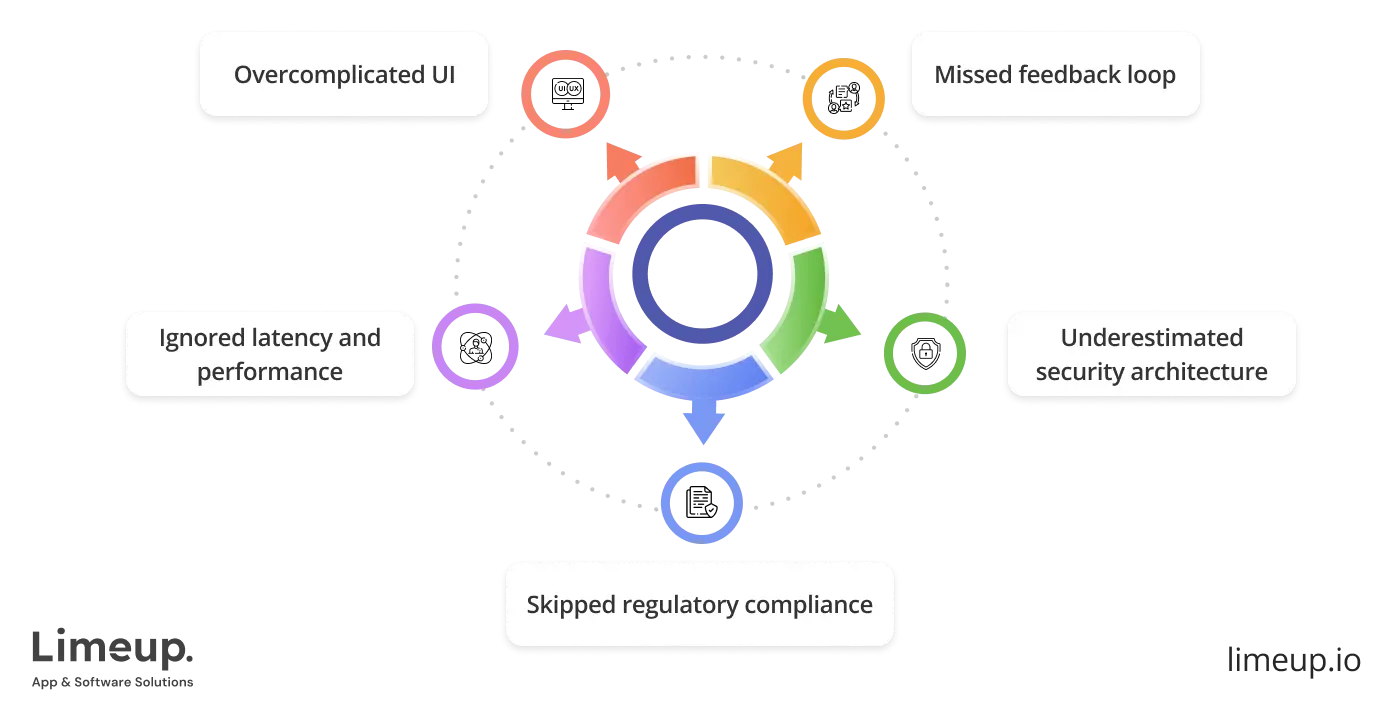

5 mistakes to avoid when building a trading platform

In a nutshell, the path towards the completion of high performance trading system is littered with riches and landmines. Let’s take note of the top 5 mistakes that may see your online brokerage solution plummet to its crash ahead of its first rollout.

Overcomplicated UI. Complex trading platforms don’t mean clever. One of such traps is loading the UI with lots of bells and whistles hoping that having more does not automatically make them work better. Traders, especially those who are under pressure, need an interface that’s clean and responsive, where functions are without a second guess and data is simple to consume.

And if users require a manual just in order to make an order, you’ve already lost them. The aim is flow and not friction. Have design serve the purpose and not ego.

Ignored latency and performance. The time factor is the money in trading. If your products slow down during hours of peak, it will lead to mass exodus. Late order execution, slow charts or jammed dashboards transform keen traders into hostile critics. Performance is not a tech spec, though. It’s a dealbreaker.

Optimize every millisecond. During trading platforms development we recommend employing a scalable infrastructure, asynchronous processing of data, and smart caching to keep the engine cool under the pressure. As in this space, slow kills.

Skipped regulatory compliance. Avoiding financial regulations is like dancing on a minefield with eyes closed. It takes one slip-up and your app may be hit with penalties, takedowns, or the worst of all, permanent bans.

Each region has its own set of rules which range from KYC/AML processes to capital needs. It’s not red tape that you baked in compliance with your project from the beginning — it’s survival instinct. Collaborate with legal consultants who understand the territory and are two steps ahead of any policy change.

Underestimated security architecture. Providers of custom trading platform development services know that such systems are the main targets of cyberattacks. They’re vaults in digital clothing — one weak link, and the whole chain snaps. Secure it before someone else tests the hinges.

Without end-to-end encryption, MFA, IP filters, and API rate limits, your trading system’s foundation starts to crack. Construct your defense posture the way it were a fortress, and audit it as if someone were trying to bust in.

Missed feedback loop. The presumption that you know what users want is the surest way of being irrelevant. A lot of dashboards enter the market as a vacuum, designed in the assumptions of the programmer and not based on the actual usage.

Skip user interviews, forget about beta testing, and you are not going to catch the signals that could’ve saved you months of rework. Hiring remote developers who can adapt quickly and react to real input puts you ahead of the curve. Traders know the score, just ask them.

Avoiding these five mistakes will not make you successful, but will prevent you from learning the things the hard way. Call them launch-day landmines, sidestep with care and you won’t blow up your timeline.

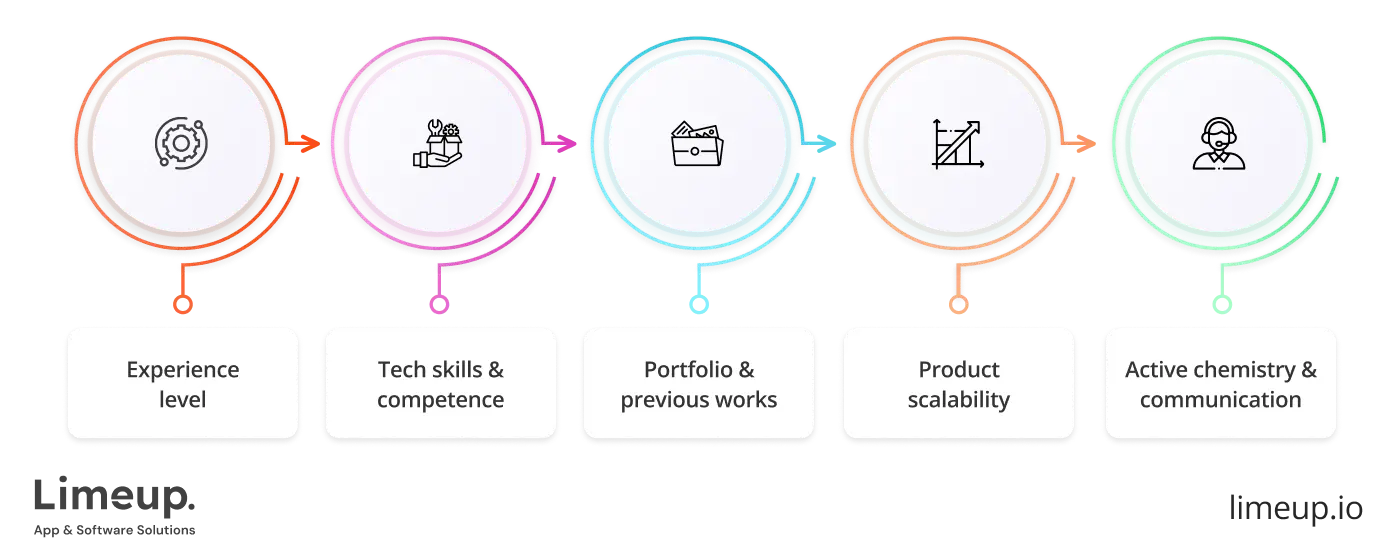

How to select a provider for trading platform software development?

Finding the perfect back-end developer for hire for your digital asset hub rests on finding someone who has handled turbulent situations in the past while being familiar with the entire route and staying alert for every critical moment.

Your choice must begin with providers who have plenty of experience. A company delivering trading platforms within the fintech sector is what you should seek when making your selection. The best candidates will demonstrate acumen in digital asset exchanges together with custom trading software development work.

They’ll be familiar with the tricky bits like regulatory compliance, trading logic and ironclad security. Adoption of standard tools in legal conformity combined with instant trading functions and secure solutions must already be known to the vendor.

Next up: technical muscle meets industry brainpower. A skilled dev team should definitely be part of your project while ensuring their technical expertise extends into financial terminology. It is wasteful to use project time demonstrating what a candlestick chart represents. The key quality an ideal ally should possess includes understanding the trading habits of users along with market dynamics and expertise in delivering intuitive interfaces from complicated tools.

Don’t forget to check the fine print and we’re not just talking contracts. Peek at past projects, ask about their fintech platform development process, request demos and don’t shy away from talking to previous clients.

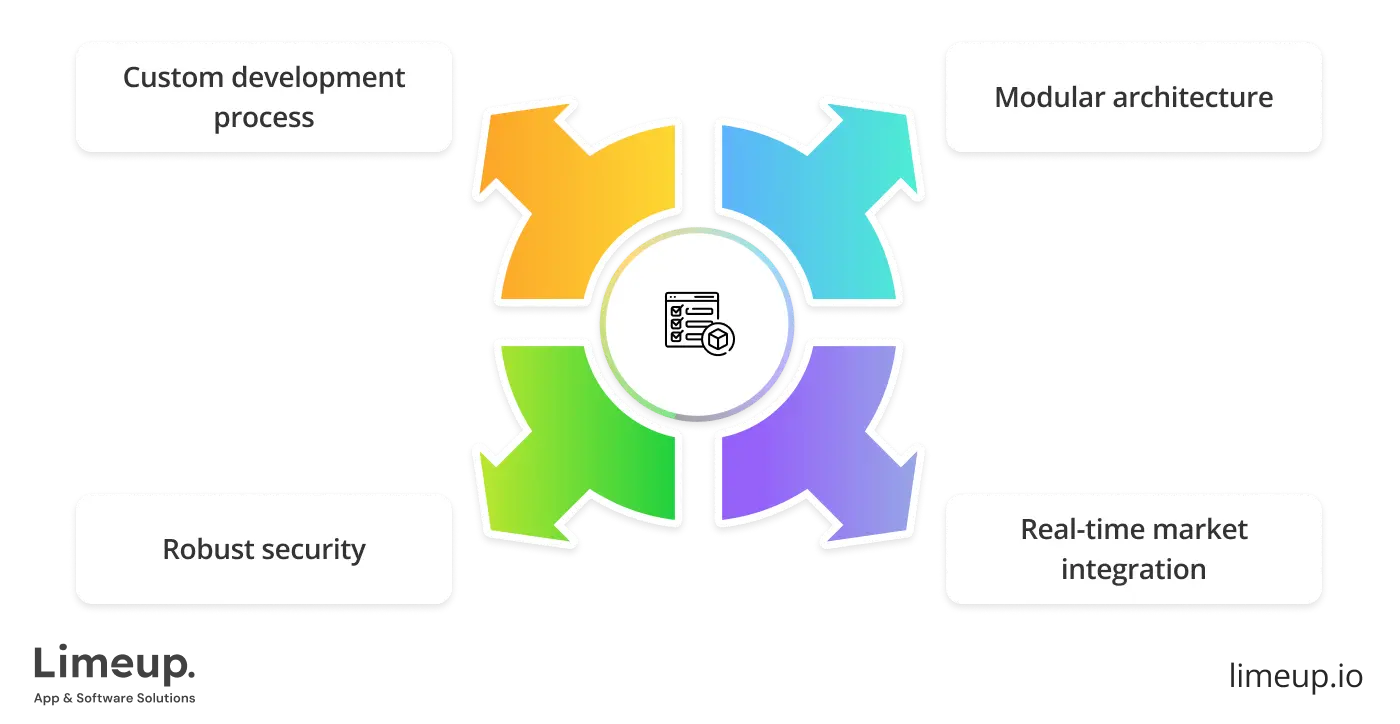

Scalability needs attention during your early project creation phase. Your current MVP will potentially evolve into an exchange that processes millions of transactions per day. A forward-thinking team will build your own trading platform with growth in mind — modular architecture, cloud infrastructure and integration flexibility should be baked in from day one.

The engineering needs active chemistry between all stakeholders. Timeframes get shorter while new elements emerge so excellent communication drives the entire project forward. Pick a team that gets your vision, responds fast and works with you like an extension of your own crew.

In short: pick a partner, not just a vendor. That decision can make or break the journey from concept to launch and beyond.

Why сhoose Limeup to build a high-performing trading platform?

Production-ready trading systems require precision, focus, and a strong grasp of market behavior. Each design choice and architectural decision shapes the way users interact with the product. When speed and reliability are built in, the solution becomes a natural extension of a trader’s routine.

No blueprint can account for every market shift or user expectation. Hence, the demand for custom-built online brokerage solutions continues to grow. Teams experienced in fintech understand how to align functionality with user behavior, market trends and compliance.

Contact Limeup if you want a co-creator to design and build a trading platform. We have 80+ experts with extensive backgrounds in different industries working with companies worldwide and are ready to create a customized stock trading app fitting your goals and requirements.