How to Choose a Fintech App Development Company in 2026?

The success of a financial product depends on the choice of a fintech app development company that combines technical expertise with regulatory knowledge, UX design, and scalability planning. In this guide, we gathered detailed reviews evaluating client testimonials, case studies and industry reports to help you make a smart decision while choosing.

Our experts thoroughly compared the fintech app development services vendors across leading agencies, estimating key dimensions like hourly costs, team size, experience and engagement models.

Below, you’ll find a list of the top 12 fintech app development companies, handpicked for their ability to deliver secure, scalable products in 2026. We invite you to compare their strengths, review their track record and choose the partner that matches your ambitions.

List of fintech app development companies

Founded: 2017

Headquarters: London, United Kingdom

We are a financial app development company with 10+ years of experience in delivering cost-effective and rich-in-feature apps for startups and SMEs that want to be in the driver’s seat of the financial sector. You are able to receive full-fledged cooperation where we take on every tech-related task and meticulously support your solution through the whole lifecycle.

You can leverage our knowledge and background of bringing x3 revenue to customers, as well as earning the №1 position in the Play Market and App Store in the first two weeks, which brought more launches.

Why choose us:

Your project will be run by the top 1% of coders, powered by a collaborative approach so that you receive constant check-ins and the ability to make changes at every stage. Our team is proficient in iOS, Android, and cross-platform development, covering your custom needs.

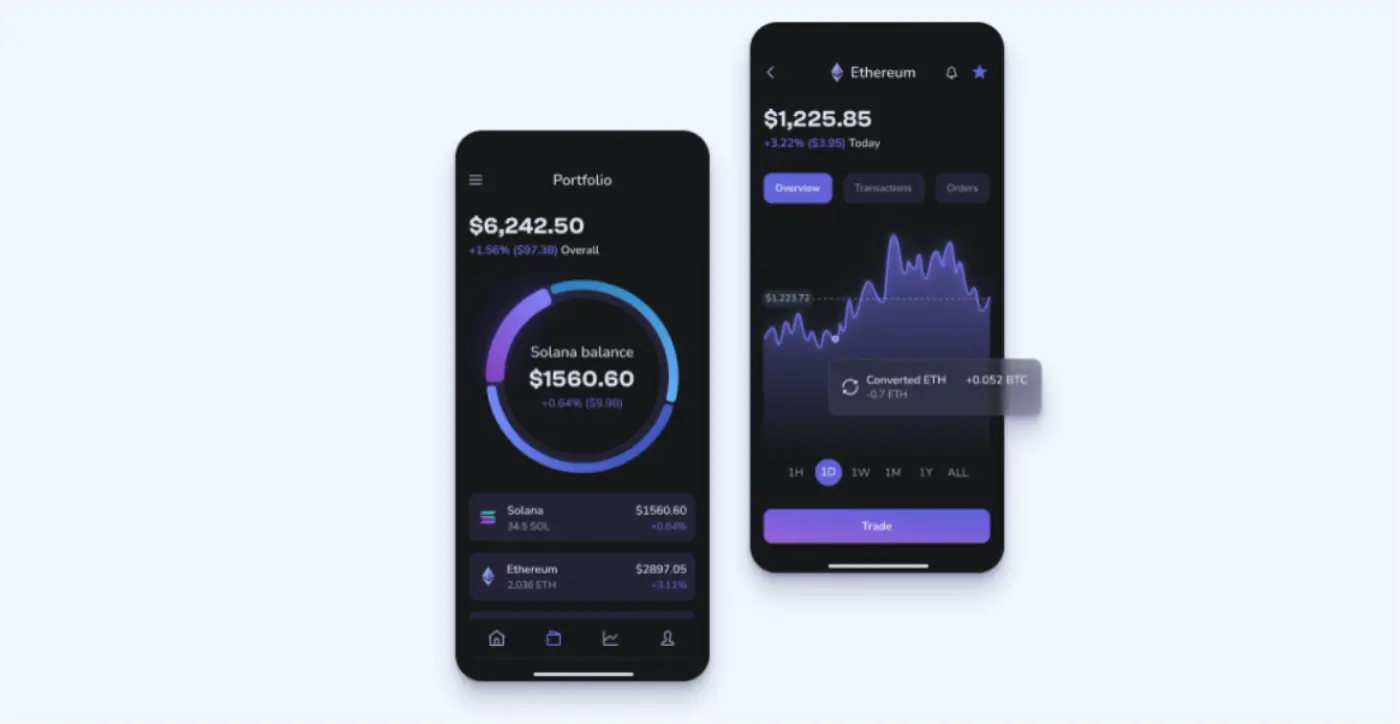

Select case studies:

- i88 was our consumer for a product creation related to the trading platform with a user-friendly interface and ground-up features, so we compiled it in 22 weeks.

- With the request to build a secure solution, Trading Finance tasked us with the buildout of a trading app that includes a customized dashboard, enhanced functionality, and security.

- Investigate more case studies.

Founded: 2017

Headquarters: Berlin, Germany

impltech has no limits on innovations that drive the financial growth for companies that trust their domain knowledge in application building and improving existing ones. From banking to custom eMoney software, this vendor helps organizations to gain advantages with scalable and user-friendly products.

Key services:

Industries:

Why choose them:

This fintech application development services provider has an in-depth understanding and background of working with governance regulations, fraud prevention practices, KYC, and more. For those who would like to get a revenue-driving solution, impltech is the starting point, with a crew of professionals who have at least 5 years of experience.

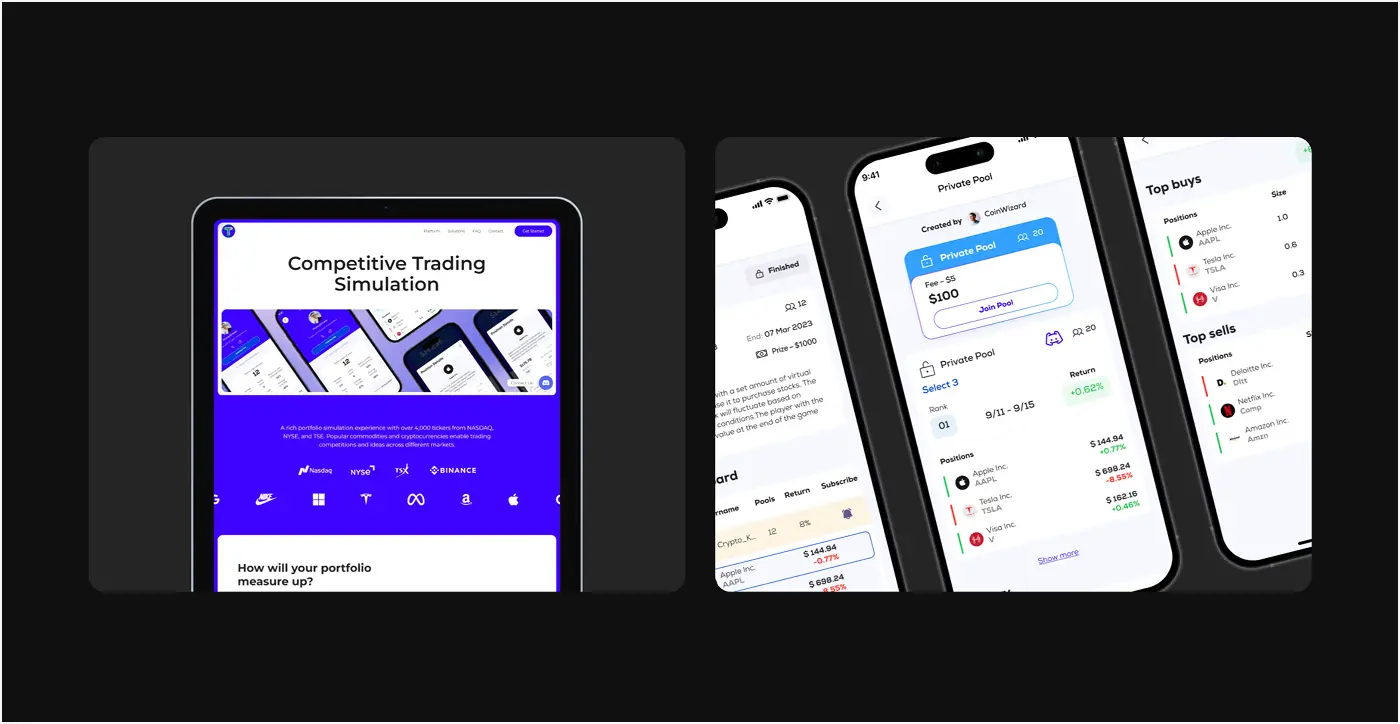

Select case studies:

- Traders.One applied for mobile app creation to receive a program that focuses on seamless transactions, safe data storage, account management, and more. impltech crafted such a resolution with unmatched speed, delivering an intuitive interface and cross-functional system.

- Considering complex projects, Trading Platform was a challenge where the company had to allocate the most skilled developers as well as security architects to ensure extra information protection.

- See more in the catalog of works.

Itexus

Founded: 2013

Headquarters: Warszawa, Poland

To put it briefly, 4 partners got together and decided to combine their experience of working in IT giants, leveraging all they knew about fintech app development solutions to start their firm — Itexus — which has grown to 100 developers and many other tech and design-related professionals.

The vendor offers 3 cooperation models: fixed price, outstaffing and agile-based, all for customers’ convenience and capabilities so that the IT supplier can cover more pain points of its target audience.

Services: Mobile apps development, fintech development, mobile banking development, UI/UX design, etc.

Industries: Fintech, eCommerce, real estate, healthcare, etc.

Why choose them:

Itexus is a group of engineers who established an efficient journey from 3 steps, which require less time from customers yet cover essentials across receiving an idea, estimating the needs and proposing an offer, and kicking off the building.

Select case studies:

Many companies have hired Itexus, as shown in suсcess stories across collaborations with an American entrepreneur, a Silicon Valley-based consumer, and others.

Shakuro

Founded: 2006

Headquarters: Lewes, DE, USA

If visitors were wondering whether there is a finance app development company with a diverse workforce, Shakuro has 150+ experts to present, with a motto that theory clients find them “when it’s time for a key change.”

As the brand says on the website, web & mobile creation is its core strength, with all the nuances like testing.

Services: Mobile app development, web development, identity & branding, etc.

Industries: Fintech, healthcare, Web3, eCommerce, real estate, etc.

Why choose them:

Shakuro’s staff uses a well-known modern stack: Node.js for backend logic, Swift and Kotlin for mobile, React and Vue for the web, and secure cloud infrastructure suited for dependable products.

Select case studies:

The agency is recognized by case studies which include working on Zad, a Shariah-compliant investment app with both robo-advisor and trading capabilities or Solio, a Gen-Z-focused trading platform built for the South Korean market.

Artkai

Founded: 2014

Headquarters: Gliwice County, Silesian Voivodeship, Poland

Kos Chekanov as the CEO, Egor Shakala as COO, they believe that there is no “maybe” and “game of luck” when it comes to the creation of successful resolutions, that’s why they invest in a team of more than a hundred financial app developers which crafted many projects, 60% of which are dedicated to fintech and enterprise.

The firm provides solutions that make sense, combined with technologies, business objectives and values, available resources, and what customers really need in order to cover their pain points.

Services: Software development, modernization & redesign, team scaling, design, ideation & strategy.

Industries: Fintech, Web3, automotive, proptech, banking, etc.

Why choose them:

Artkai has a unique determination of what success means and one of the points comes from financial outcomes as higher conversion and cost savings, driving leads in the market to gain competitive advantage, and improving the overall product usability.

Select case studies:

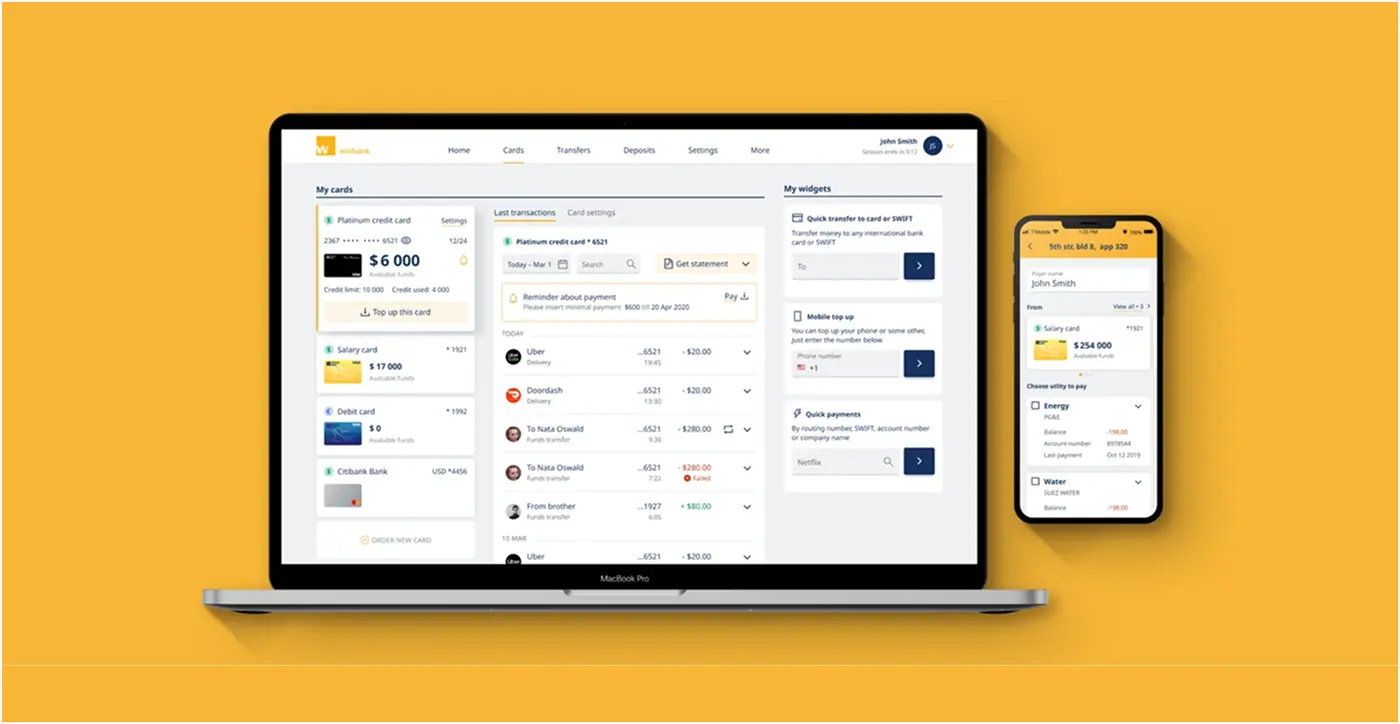

Considering project spotlights, there are mobile apps for Winbank as a representative of neobanking, ProCredit, Red Rocks Credit Union, which received an iOS application, and more.

Hedgehog Lab

Founded: 2007

Headquarters: Newcastle upon Tyne, UK

The partner of Contentful, Shopline and Netlify, these fintech application developers want to drive more valuable projects, leveraging its expertise across cooperations with worldwide brands. At the core of its digital heart is the motto of building what resonates with users, as it drives them through two decades of background.

Sarat Pediredla as co-founder and CEO, has a priceless ambition of making his team the head and he leads them to this goal with passion, inspiring other leaders, one of them is Malcolm Seagrave, a managing director.

Services: Product & platform build, product discovery, support & maintenance, data & AI strategy, etc.

Industries: Financial services, government public sector, health & life sciences, retail, etc.

Why choose them:

As for the financial-related offers, there is mobile app creation that brings into the play a makeshift perspective for every project it takes on, from platforms to manage investments to administration systems with native or cross-platform approaches.

Select case studies:

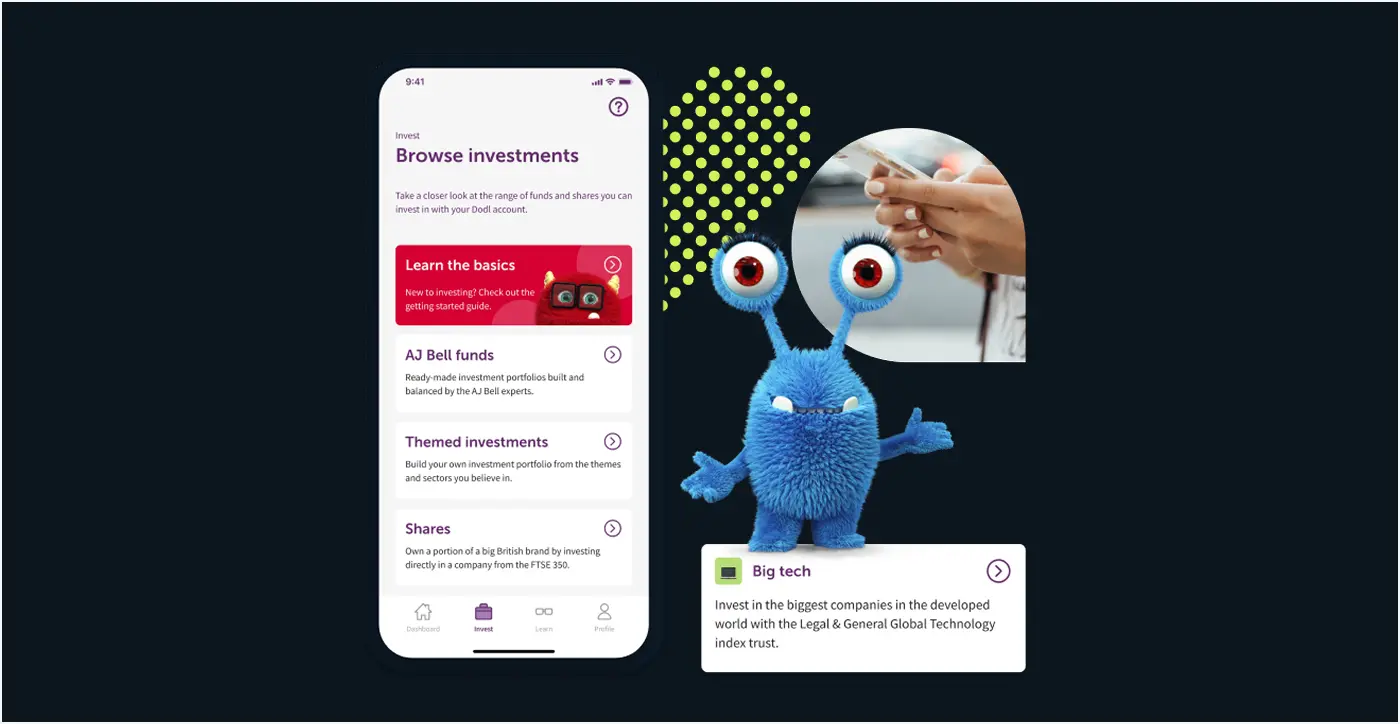

Praised for its tech know-how, Hedgehog Lab represents project highlights that include wealth management for AJ Bell, solution for Wombat, which wanted to expand banking for millennials.

EB Pearls

Founded: 2004

Headquarters: Surry Hills, NSW, Australia

The team of over 320 engineers and other specialists is run by 4 co-founders: Suman Katwal, Manish Kumar, Rupak Shakya, and Akash Shakya, who met at a technical conference and built a strong company.

With empiricism at the core of everything it does, EB Pearls implements agile to deliver cutting-edge resolutions based on transparency and enhanced communication. The firm believes clients’ success is theirs as well, dedicating every part of the creation to reaching the set goals.

Services: Mobile application, progressive web application, websites, staff augmentation.

Industries: Finance, education, retail, marketplace, corporate, etc.

Why choose them:

EB Pearls is recognized in the niche, having received 72+ awards for the applications it compiled. The financial app development services vendor offers to build an app from scratch, augmenting an existing crew and providing a group of well-tested experts.

Select case studies:

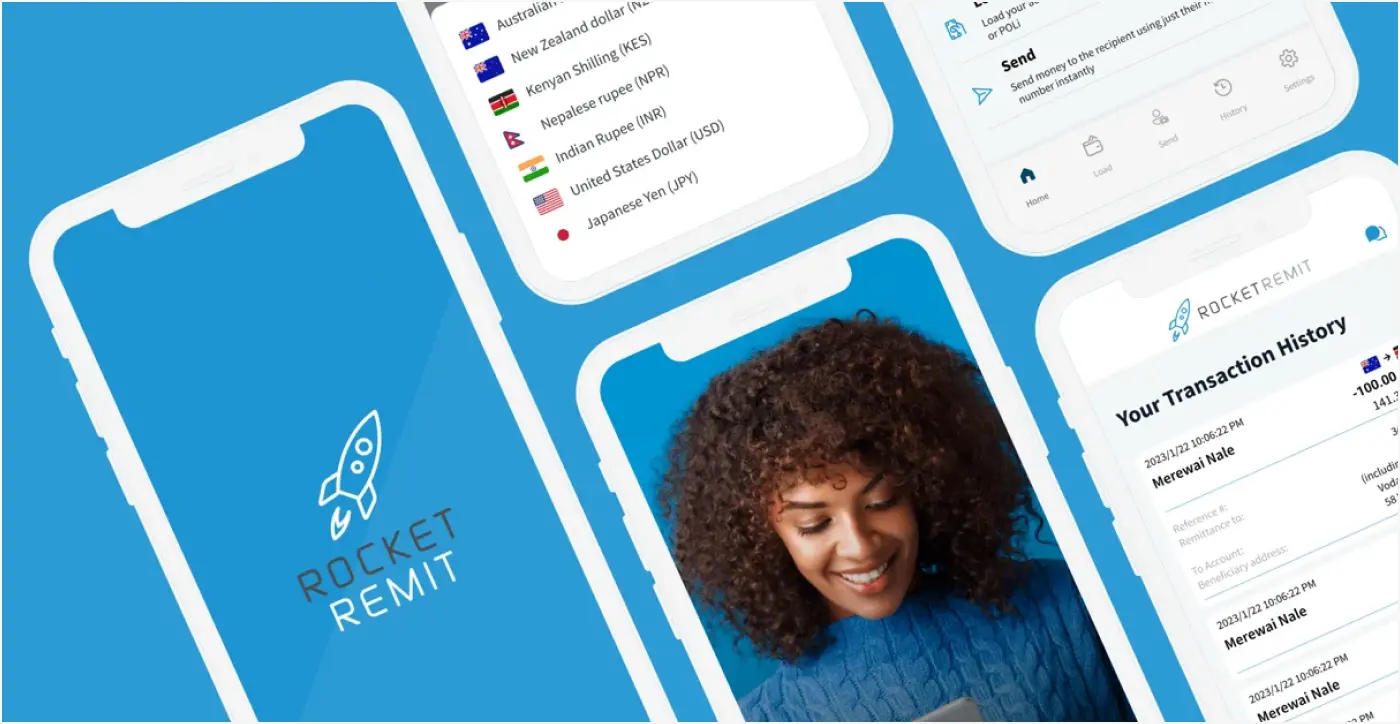

In terms of its project portfolio EB Pearls has taken over collaborations with Rocket Remit, Kapstream Capital, etc.

instinctools

Founded: 2000

Headquarters: Potomac, MD, USA

The logo of *instinctools, it symbolizes its principles: development, responsibility, teamwork, effective usefulness, freedom, and individuality. The seniority level is 33%, with 39% of middle coders and experts, representing a robust crew.

Consumers are able to choose amidst a dedicated team model, IT staff augmentation, offshore creation center, and innovation consulting according to their demands, still, in each of them, they will receive full-fledged support.

Services: Mobile development, custom software development, AI agents, UX and design, etc.

Industries: Fintech, healthcare, manufacturing, eCommerce, logistics, etc.

Why choose them:

*instinctools are finance app developers that are ready to get the ball rolling even tomorrow if the business owner has pre-defined requirements and can agree on the budget, which is made for the convenience of both sides and is a match for rapid development.

Select case studies:

*instinctools was hired for a plethora of various projects as it’s shown in the catalog of works: expanse tracker, crypto platform, and more.

Robots & Pencils

Founded: 2009

Headquarters: Chagrin Falls, OH, USA

Starting its digital journey 16 years ago, Robots & Pencils entrusted its efforts to the belief that the mobile area can be more transformative — that was a good move that allowed it to become one of the leaders in our list and worldwide.

Investigating its page on LinkedIn, our experts found out that the provider shares its experience and work completed, as well as conducts events dedicated to building various platforms, and more.

Services: Mobile, Salesforce, UX + design, web, AI + data science, etc.

Industries: Financial services, education, healthcare, high tech, retail & consumer goods.

Why choose them:

The team behind this fintech app development company is proficient in modern technologies, simultaneously combining it with a passionate attitude, being led by Daniel Dargham, Tyler Klein, Brad Fagan, and Lara Aranador.

Select case studies:

The vendor is helping companies across financial technology as it’s revealed in success stories, for instance, the mobile-only banking platform for Varo.

Miquido

Founded: 2011

Headquarters: Kraków, Poland

End-to-end software is served here, at Miquido, which offers a full-fledged creation cycle and ongoing support for every customer, promising to deliver an MVP in 3 months. Within the 150+ solutions conducted, it gained engineering know-how in building for Android and iOS platforms.

The IT supplier keeps the finger on the pulse of fintech, examining its impact on various niches, for example, the revolution in music, ensuring to stay ahead of the trends. Consumers can also receive AI-powered engagement for chatbots (customer support) or else.

Services: Mobile app development, UX design, product strategy, AI, etc.

Industries: Fintech, entertainment, eCommerce, education, etc.

Why choose them:

Miquido is a battle-tested financial mobile app development company that gathers together innovators who are not scared of challenges in the tech area, demonstrating adaptability to ever-evolving requirements and suggesting enhancements for every part that can be improved.

Select case studies:

Clients represented across real-world cases indicated that Miquido has a robust proficiency, creating solutions for banking needs, personal finance, CRM apps, and more.

Empat

Founded: 2013

Headquarters: Kyiv, Ukraine

Empat may boast 92% of the staff have C1 in English, removing any barriers for effective cooperation and transparent communication that is appreciated by 100% of buyers. Each staff member genuinely cares about every task and release, as the team follows an ownership-driven delivery approach.

Services: Mobile app development, IT outstaffing, product development, fintech software development, etc.

Industries: Fintech, healthcare, education, social networks, etc.

Why choose them:

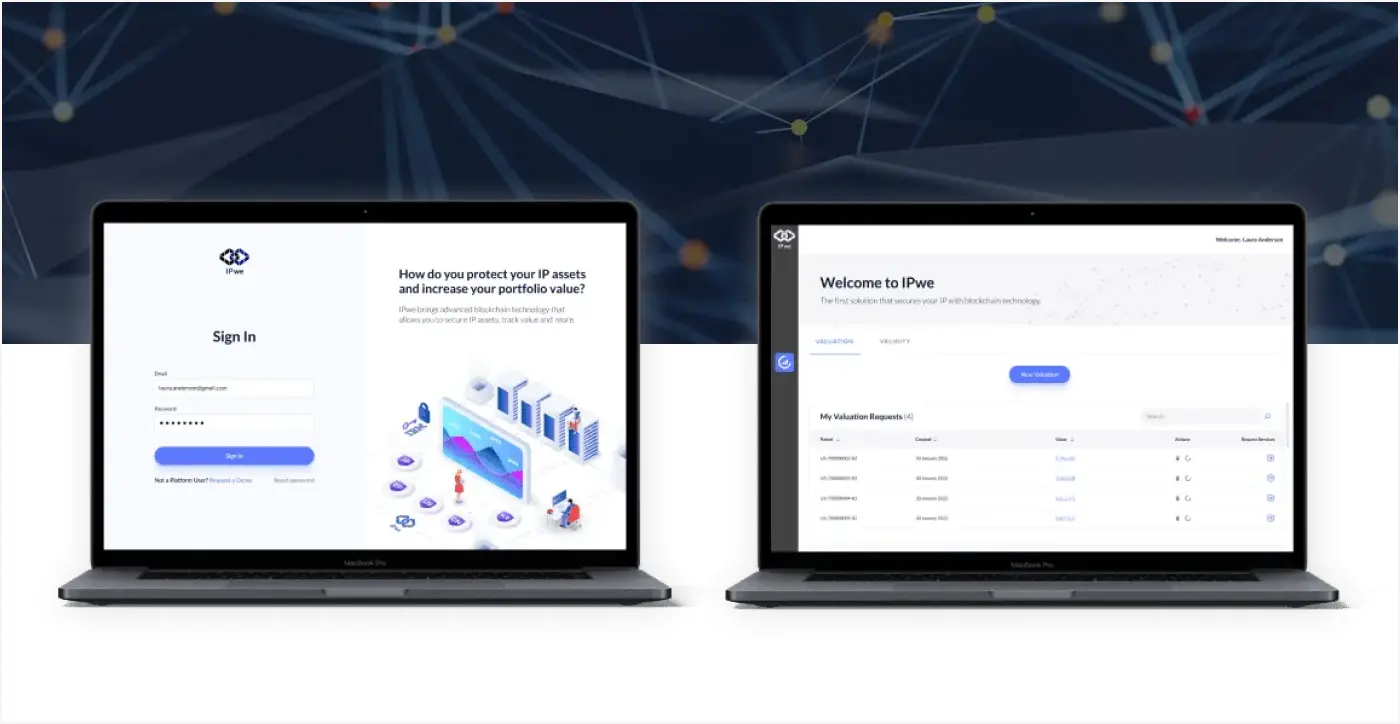

This fintech app development agency appeals to businesses seeking a reliable partner with solid technical education and real fintech experience, demonstrated by their work on on-chain expense platforms, modular payout solutions, and B2B financial SDKs powered by Python, TypeScript, modern frontend frameworks and blockchain tools.

Select case studies:

Many professional companies applied for its offers as it appears in the creative folio within Trigga and FuelFinance.

Ailleron

Founded: 2011

Headquarters: Kraków, Poland

Rafał Styczeń as the CEO has also founded some leading companies in Europe, then bringing his experience to Ailleron together with Grzegorz Młynarczyk and Piotr Piątosa as vice presidents.

Ailleron dedicated over 20 years to financial technologies and their implementation, hiring top-tier talents who are capable of delivering end-to-end apps with value for businesses.

Services: Fintech software development, data analysis & AI/ML, banking chatbots, UX design, etc.

Industries: Fintech.

Why choose them:

Finnoscore 2022 study named this top fintech app development company as a “trusted software partner for 3 out of 10 world’s most digitally mature banks,” and no wonder as its workforce of 1,500+ specialists is always ready to dive into the project.

Select case studies:

To reveal the in-depth insights within the work showcase we need many hours so let’s focus on some of them like a firm for digital banking, the usage of Kotlin Multiplatform framework, and more.

What is a fintech application development company?

If you are struggling with leveraging or building your fintech-related solution, then an IT supplier becomes a reliable route to hassle-free and straightforward product creation backed by clear technical execution.

In other words, the best fintech app development company is a system integrator with proven competence, capable of delivering end-to-end development for a wide range of applications. including banking, trading, investment platforms, digital wallets, and other tailored financial solutions. Some are strong in:

- banking systems and payment rails

- investment tools

- trading platforms

- digital wallets

- embedded finance

In terms of the fintech app development, a proper vendor will ensure that deliverables will:

- meet your business requirements,

- accommodate cutting-edge technology and trends,

- remain future-proof in a fast-paced financial market with ever-evolving needs.

You’ll also find firms focused on security-heavy and regulation-driven products. This variety helps you select a partner aligned with your product’s technical direction.

Comparing financial app development companies

With the fintech market expected to reach $644.6 billion by 2029, comparing mobile app creation agencies carefully ensures your business partners with the right team for speed, compliance, and long-term growth.

All the top fintech app development companies outlined by our experts in this article have contrasting statements, so your choice will depend on your needs. For example, if you are a startup runner looking for a simple digital wallet, it’s not vital to apply for cooperation with a provider who works with enterprises. Keeping that in mind, let’s dive deeper into the breakdown.

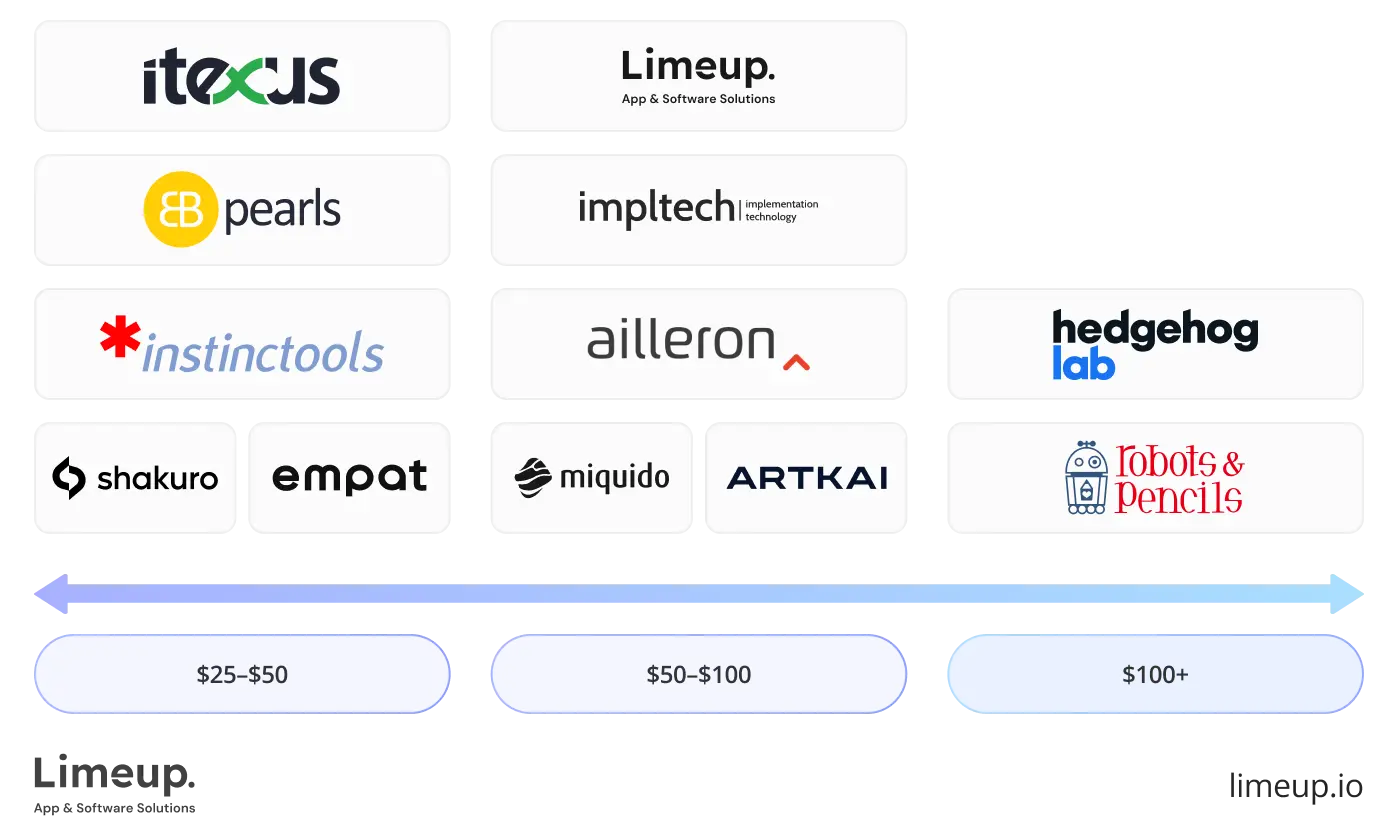

Cost

As the offers differ in prices, here’s information from public sources where brands provided reliable information (as well as for the size of their workforce below). Note that it can vary in agreement with the fintech mobile app development services you need.

- $25 – $50/hour. Budget-friendly options, usually suitable for MVPs, simple apps, or startups seeking cost-effective development.

- $50 – $100/hour. Mid-range suppliers with traditional security and rule adherence elements that can create quite complex applications.

- $100+/hour. High-end finance apps, sophisticated integrations, regulatory compliance knowledge and full-feature development are all provided by premium providers.

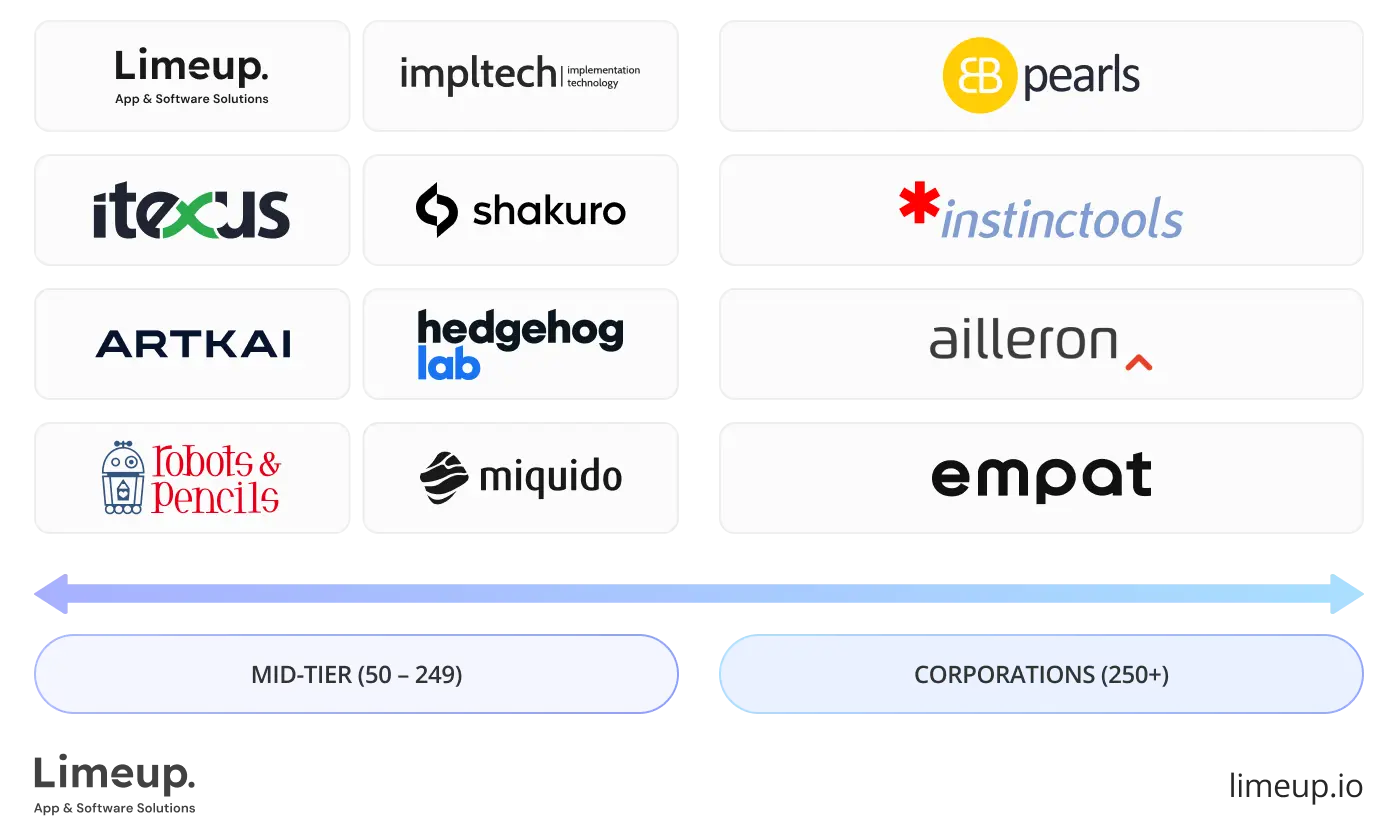

Team size

All companies in our list are either medium-scale or large, with none employing fewer than 50 staff.

- Mid-sized teams (50–249 employees) bring agility and closer collaboration

- Larger firms (250+ employees) provide more resources, deeper specialization, and higher scalability.

This standpoint is widely represented in our article about app development companies in the UK which can be useful for you as well.

Ratings

Reviews of independent resources, such as Clutch, offer an insight into project quality, delivery dependability, and client happiness. Fintech app development businesses can be objectively compared by using ratings as a criterion. To provide a brief summary of perceived performance, we categorized vendors according to their average client scores.

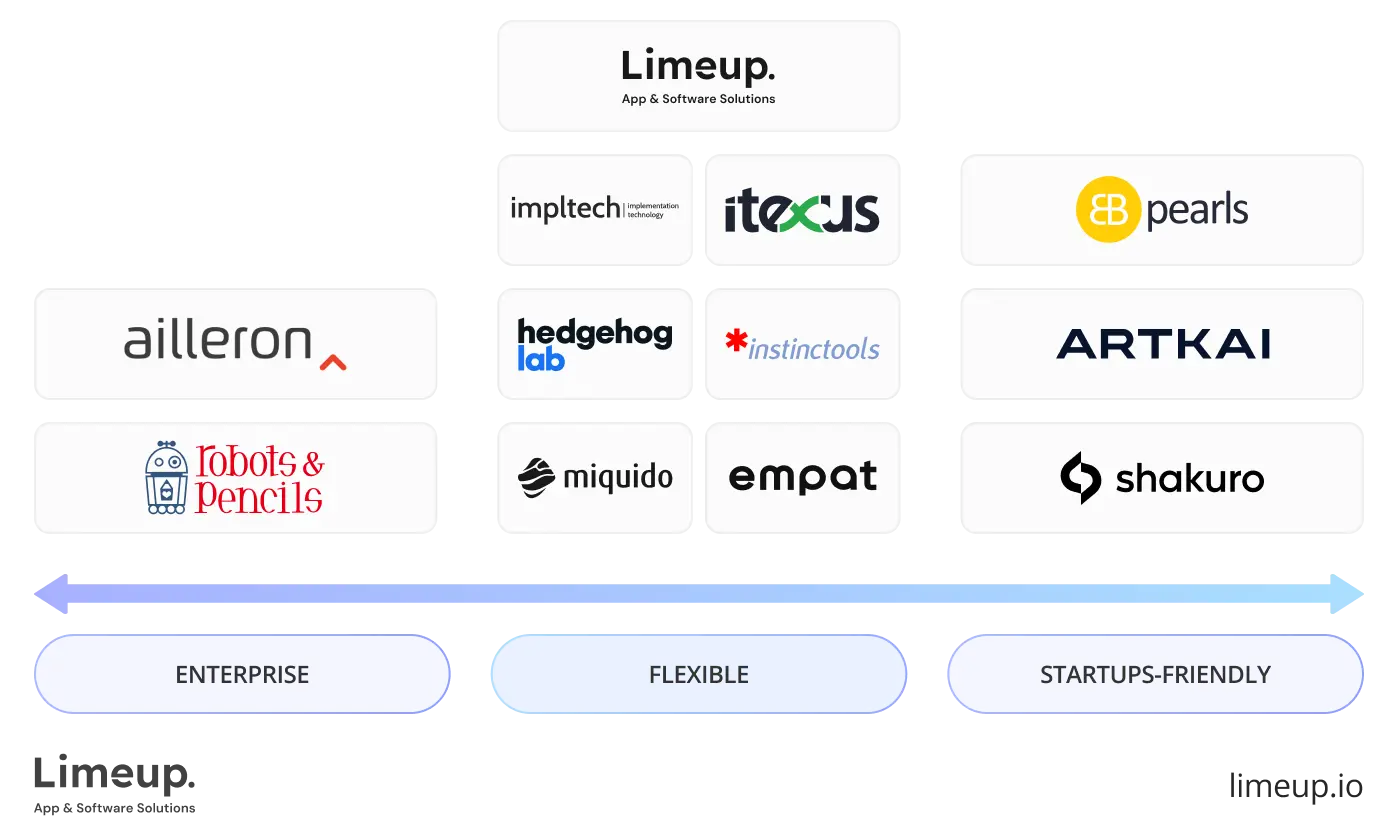

Engagement models

As it determines how you will participate in the project with a fintech application development company and is determined by your needs, we think it’s essential to examine suitable propositions.

- Enterprise. Full-service options for massive, regulated projects. Compliance, testing, and long-term support are handled by committed staff.

- Adaptable. Workforce that is scalable for moderately sized initiatives or changing needs. enables feature extension and iterative delivery.

- Startup-friendly. Agile, economical crews that prioritize speed without compromising quality for MVPs or early-stage products.

Our experts have analyzed and categorized the best fintech app developers across pricing, team size, ratings, and engagement models. The result is a practical guide for selecting the financial mobile solutions provider best suited to your financial product.

How to select a fintech mobile app development company?

How you go about singling out development firms is entirely up to you. However, there are some established best practices that can aid you in making the right decision. Below, we go over some of the steps we recommend you take to facilitate the most productive research process.

Define your fintech product requirements

Any successful fintech initiative starts with the crystal-clear requirements. Describe the main characteristics of your application: the types of users, flow of transactions, and security requirements and compliance with regulations. A properly documented scope makes you weed out vendors who do not have a real picture of what you need.

A fintech mobile app development company that understands your long-term vision will give better estimates, come up with a solid architecture, and offer solutions that will work without collapsing under regulatory or user pressure.

Assess the company’s tech stack

The complexity of fintech is not something that every development firm can handle. Inquire about their experience in native iOS/Android development, cross-platform system, and backend architecture (e.g., Node.js, .NET). Inquire about their cloud infrastructure as well and their performance assurance in real-time.

The issue of security and scalability must not be compromised. Best practices like CI/CD pipelines, automated testing and DevOps processes should be adhered to by a good fintech provider.

Check portfolio

The fintech world is quite distinct compared to consumer applications and, hence, solid portfolio of financial applications is a significant advantage. Find case studies where a vendor has addressed issues such as identity checking, fraud control or compliance.

Pay attention to the logic behind their solutions. Did they implement features like identity verification, fraud detection, or instant transactions? Answers to such questions show the company’s grip on real-world fintech architecture rather than theory alone.

Validate communication style

Smooth collaboration saves both time and sanity. Observe how the team interacts during early calls: do they ask precise questions, give clear explanations, and adjust to your pace? An engineering group that communicates well early on usually handles complex fintech discussions without turning every meeting into a detective interrogation.

Check their transparency regarding risks, timelines and limitations. Teams that flag issues proactively avoid unpleasant surprises later. Healthy dialogue sets a stable rhythm, making development feel less like firefighting and more like a coordinated launch.

Evaluate long-term support options

Fintech apps evolve constantly, because regulations shift, user expectations climb, and market pressures never take a day off. Choose an app development company in the UK or other region that provides post-launch maintenance, performance monitoring, bug fixes, and feature enhancements.

When evaluating a development partner, ask for concrete SLAs, release cadence, and update processes. A reliable vendor might commit to bi‑annual security audits, monthly bug triage, and quarterly feature reviews.

As highlighted in published reports, ongoing maintenance costs for a fintech app included $3,000–$6,000/year for security updates plus $18,000/year for performance and bug fixes as part of a $33,600–$45,600 total maintenance budget.

All of these tips are valuable at the beginning stages when you gather up potential candidates. Going through this list does not require you to immediately contact any provider and hire app developers, leaving you free to evaluate their competency just by going off the information they feature on their website and third-party resources.

How much do fintech app development services cost?

Budgets swing widely because the market runs on different engines: team location, security demands, product depth, and the level of polish you expect all play their part. As the saying goes in tech circles, “the code never lies,” and the same goes for your costs: the deeper the logic, the steeper the investment.

Factors that influence fintech development pricing

A quick breakdown helps you understand which areas typically drive costs upward and why they matter in long-term product planning, especially when you compare how each financial app development company structures its pricing and expertise focus.

| Factor | What it impacts | Why does it raise costs |

| App complexity & features | Development hours, architecture, testing | Real-time payments, trading tools, analytics, API integrations, QA |

| Security & compliance | Security layer, audits, documentation | Encryption, MFA, KYC/AML checks, PCI-DSS, GDPRP, penetration testing |

| Design & user experience | UI/UX workload, accessibility, device optimisation | Advanced flows, multi-platform responsiveness, accessibility adherence, more design cycles and iterations |

| Development approach & team structure | Team composition, delivery model, coordination | Agile setups, dedicated developers, DevOps, in-house QA increase scope |

| Maintenance & ongoing support | Long-term budget, server load, compliance updates | Continuous fixes, regulation and feature upgrades, monitoring |

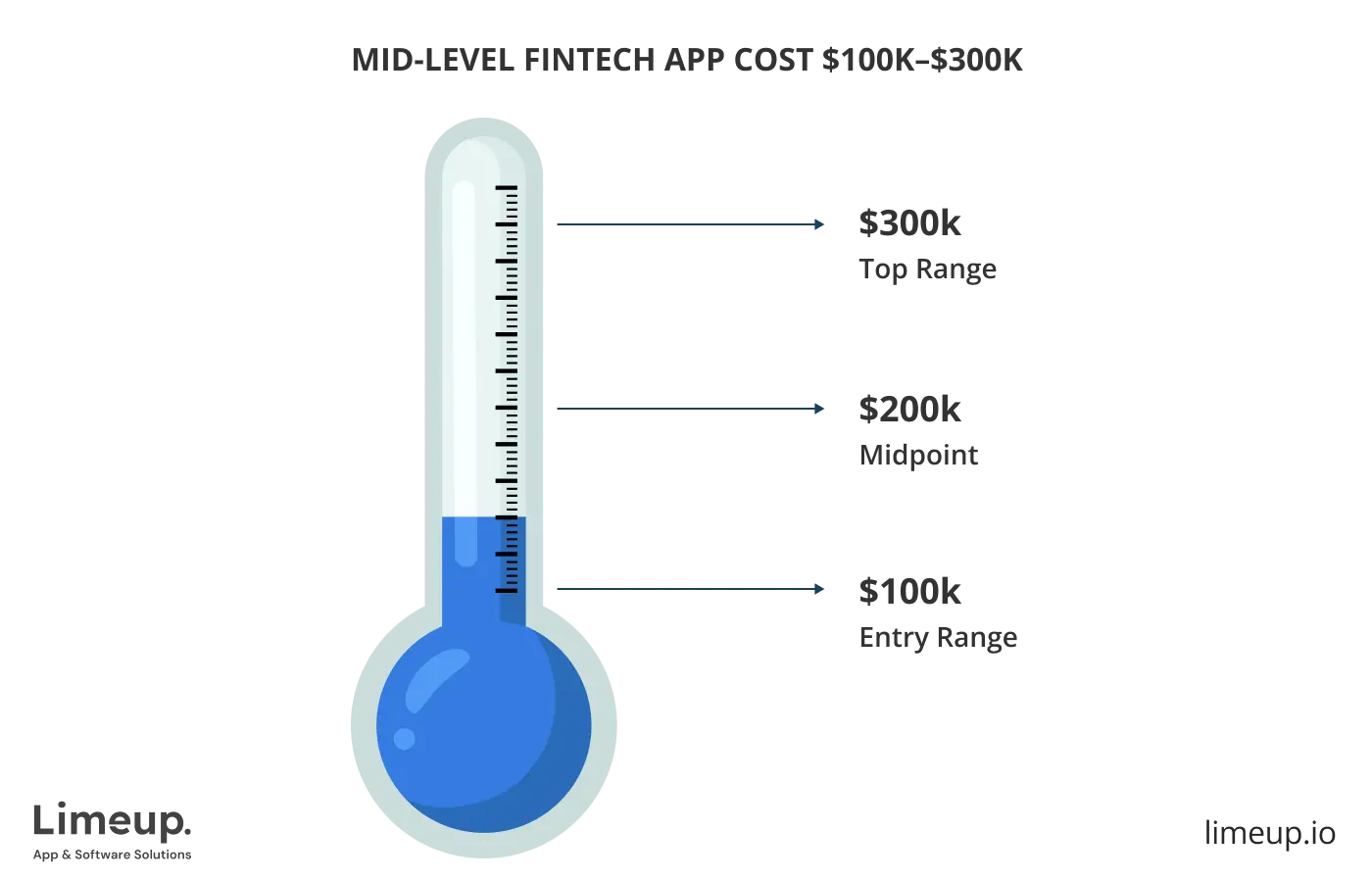

Surveys of the industry suggest that even low-level MVPs of fintech tend to cost between $30,000 and $80,000, whereas more complex investment or banking projects can easily cost more than $300,000, based on their complexity and regulatory requirements.

| Type of solution | Cost $ | Example |

| Basic | $30,000 – $79,999 | Expenses tracker with limited features |

| Mid-level | $80,000 – $299,999 | Trading platform |

| Enterprise | $300,000+ | AI-powered banking application |

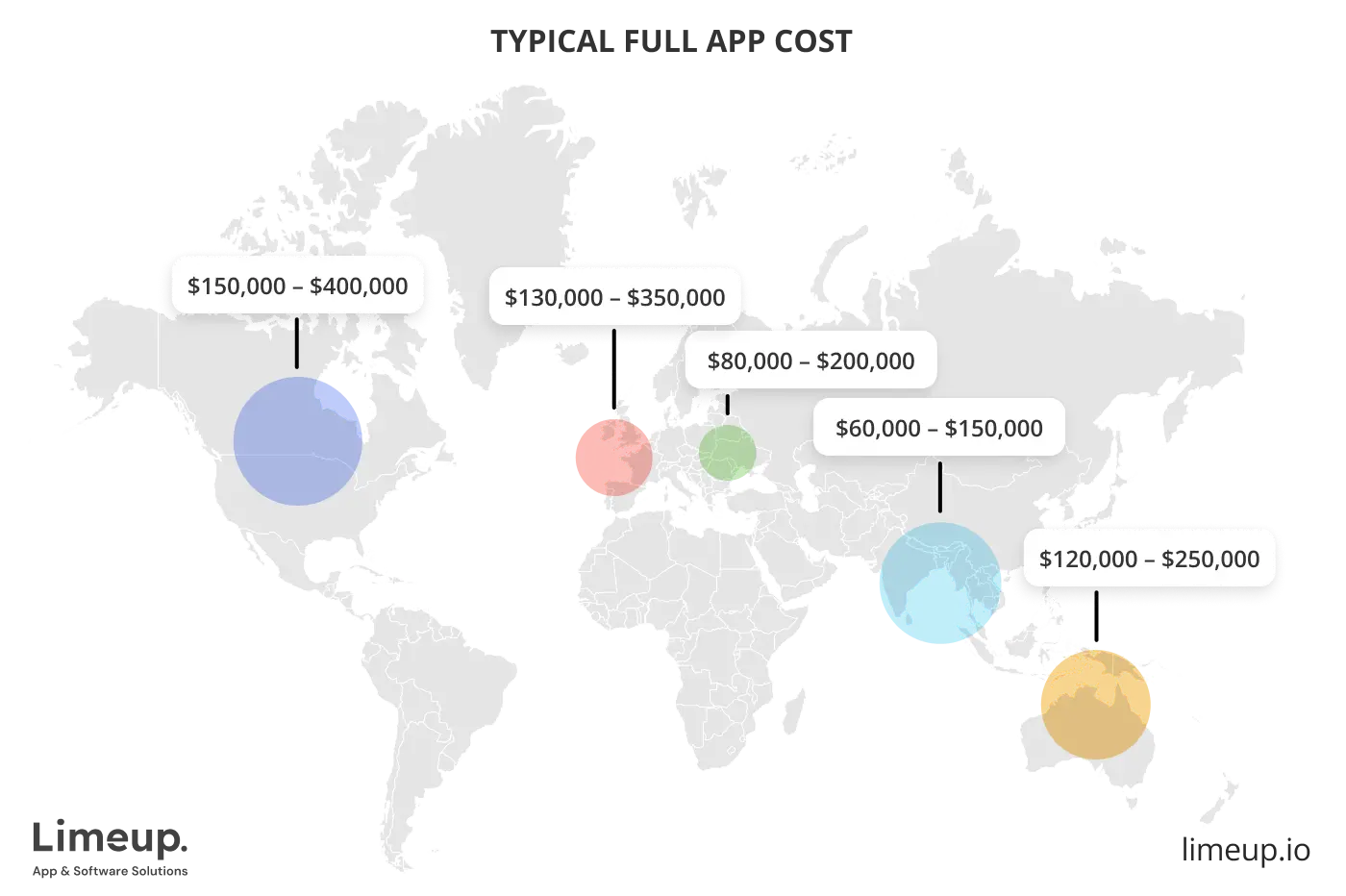

Cost breakdown by region

The development team location will have a great influence in terms of pricing because of labor expenses and market rates:

- North America. $150 – $300/hour is common to hire fintech developers from the US and Canada. Normal full-feature fintech applications will range between $150,000 and $400,000.

Western Europe. Rates range from $100 – $200/hour. Countries such as the UK, Germany and the Netherlands are a mix of skilled developers and regulatory experience, so mid to high end apps cost almost the same as in North America. - Eastern Europe. In Poland, Ukraine, and Romania, it will range between $35 – $70/hour. Numerous fintech startups take advantage of this region to develop the high-quality products at reduced rates.

- Asia (India, Vietnam, Philippines). $20 – $50/hour. Asian financial app development companies can deliver full-feature fintech apps at roughly $60,000–$150,000, although regulatory knowledge and experience with Western compliance standards may vary.

- Australia and New Zealand. $120 – $180/hour. They are geographically remote, yet the teams provide high-quality output with good knowledge of English, and excellent regulatory experience making apps in the $120,000 – $250,000 range.

Regional choice tends to be a trade-off between cost savings, expertise, regulatory understanding, and communication clarity. Many teams mitigate these trade-offs by pairing onshore project leads with offshore development resources.

Regional cost comparisons reveal how pricing reflects skill levels, compliance experience, and operational style. The right decision comes from weighing these differences to secure both quality and value.

What to ask when choosing a fintech app development firm?

The most effective way to select a financial technology app company is by coming in with the questions. Powerful responses show the manner in which the crew manages security, due dates, budget preparation, and the actual financial strapping. Astute interrogation aids you in reducing polished marketing discussion and competency.

Questions about security

The credibility of any fintech product is determined by security and this is where the conversation should begin. API and web‑app attacks in financial institutions are rising rapidly, with one review reporting a 65% year-over-year increase, highlighting the importance of asking about real defenses, not just policies.

Security checkpoints to cover:

- What is your encryption process and data storage?

- Do you carry out routine security checks and penetration testing?

- What authentication procedures do you approve of?

- What do you do to make sure that you comply with AML, PCI-DSS, and GDPR?

In order to keep your fintech app safe in a constantly changing threat landscape, these concerns concentrate on the most prevalent and expensive vulnerabilities, such as improperly configured APIs and inadequate authentication.

Questions about project timeline

A professional team will clarify the timelines and demonstrate how they are to manage the risks, testing cycles, and incremental releases. The manner in which a firm can talk about delivery speed is usually a major indicator of the real maturity within the company.

Questions that can be helpful to use include:

- How long should it take a project such as mine?

- What are the phases in which you divide the work?

- What do you do when there is a delay or change in requirements?

- How many release/sprint cycles do you have?

The majority of fintech apps take several months to develop and MVPs typically take 4-6 months with more sophisticated platforms going up to 6-12 months. Teams which provide realistic estimates, rather than optimistic guesses, tend to provide smoother results.

Questions about budgeting

Budget transparency makes the whole collaboration stable. The transparent partner will clarify the motivation behind the cost, how they come up with estimates and what happens once new requirements emerge. A fuzzy budget initially can easily become a nightmare in the middle of the process of development.

- The important questions involved in budgeting are:

- Please can you give a cost breakdown?

- What are the expenses that I will incur after launch?

- What do you do at the cost of third-party services such as KYC or payment gateways?

- Are there any contingency buffers in relation to unforeseeable risks?

According to the forecast, in 2026, a standard mid-level fintech app will cost between 100,000 and 300,000, and the cost of maintenance is likely to be 15-25% of your original investment.

The right questions reveal the strengths and weaknesses of any fintech development team. Comparing their answers helps you choose a partner that can execute your project securely, efficiently, and predictably.

Looking for fintech app developers?

As we have discovered the nitty-gritty behind the intricacies of the best fintech app development companies, considering nuances about services, financial technology niche, years of experience, offices worldwide, and more.

In other words, you are fully armed to step into the collaboration with a vendor of your choice, accessing markets and premier resolutions for projects of any complexity.

The comparison part is the vital one as we have gathered leaders here, and divided them into a few groups so that you can evaluate which one suits your project according to the team members, hourly rates, and others.

If you would like to simplify the searching process and jump right into the free consultation with a top-tier company from this rundown, don’t hesitate to reach out to Limeup. You are able to schedule a complimentary consultation and receive full-fledged support from the first conversation.

FAQ (Choosing & Comparing)

Which criteria matter most when comparing fintech app development vendors?

The tone is determined by experience with financial products, since fintech depends on accurate engineering and good understanding of regulations. The best comparison criterion should be:

- Technical expertise

- Security standards

- Relevant portfolio

- Clear communication

- Transparent pricing

These aspects indicate the level of competence with which a team uses complicated financial applications.

How important is industry compliance when selecting a fintech partner?

Adherence is the very heart of any serious fintech product, since financial apps are controlled with a fine needle. Engineers conversant with GDPR, PCI DSS, AML, and KYC will save you time, stress and expensive redundancy. Good developers do not consider compliance as an afterthought.

What are the red flags when selecting financial app developers?

Key warning signs include:

- No security clarity

- No fintech case studies

- Vague budgeting

- Slow communication

- Instant quotes without understanding your scope

These indicators imply that the team might be unable to address fintech reliably.

How long does it take to build a fintech app with a development team?

The timelines depend on the level of complexity, but the majority of functional fintech applications take several months of systematic building. Bank integrations, support of payment processors or verification services introduce additional time. An organized team will not provide you with a magic timeline, but a realistic one.