How to Develop Financial Software: Detailed Guide

The surge of financial software development is shaped by the increasing demand for digitalization and managing finances online. Within our synopsis, you will find out the meaning behind the term, associated costs, current industry trends, how to choose a partner to get a custom product, and more.

While building financial software may seem like a deep forest of unknown phenomena, in reality, wrapping your head around this niche is not much of a headache.

We come in handy as a company with the expertise to explain everything you need to know. In fact, partnering with a seasoned software development company in the UK can help businesses navigate complexities, ensure compliance, and deliver secure financial products tailored to the market.

From the article, you will learn what software development for financial services entails and why you should pick Limeup developers in the industry of finance to get help in reaching your business goals, so let’s get straight to it.

What is financial software development?

To build software for your financial company means to apply for services that are right up their alley in planning, managing, designing, engineering and testing solutions which fit your needs in this industry. The goals and walks of life of each corporation are distinct so the fintech software development agencies available on the market should have the proper credentials to handle your projects.

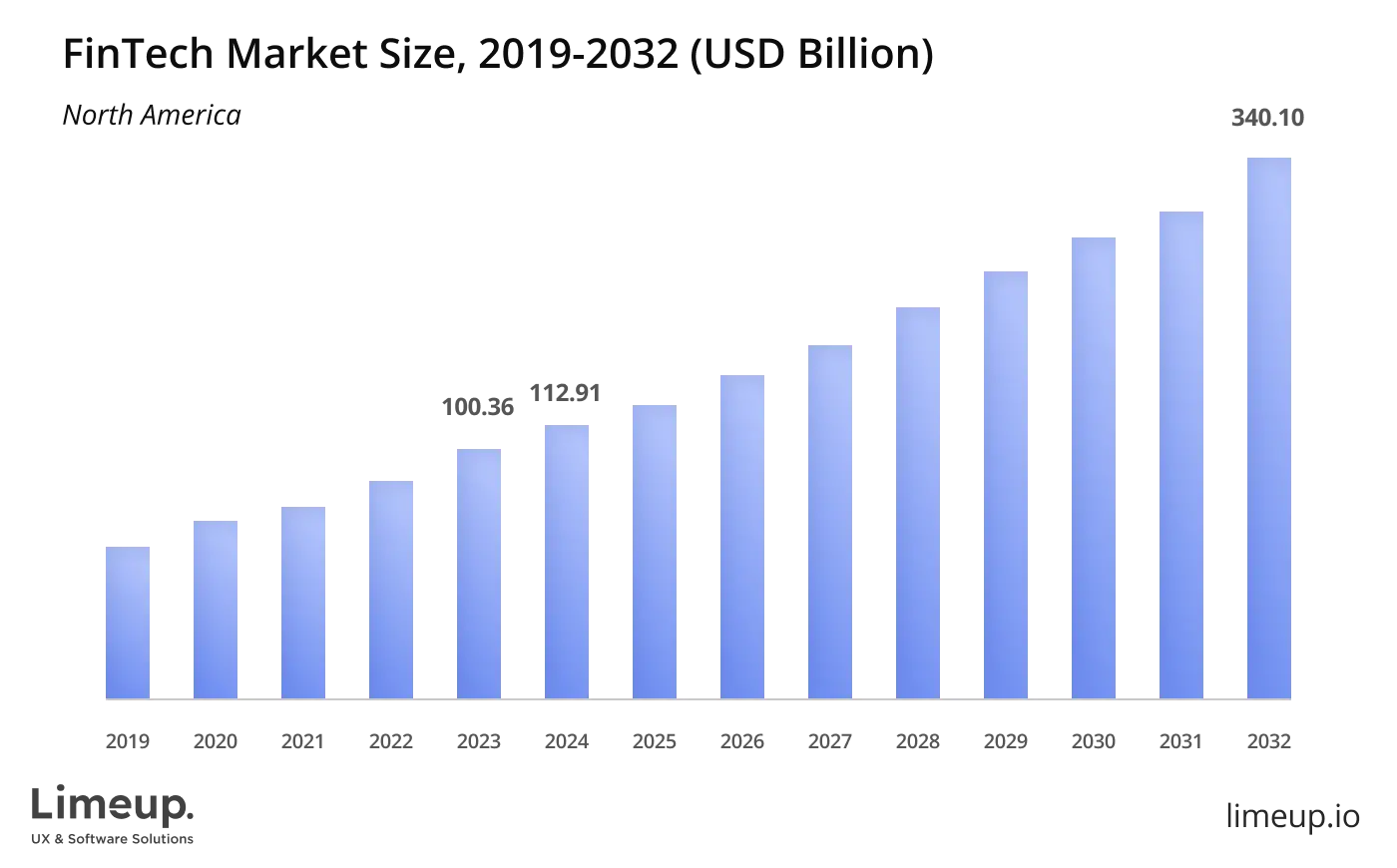

The peak of interest in developing financial software is hard to deny, especially when looking at the forecasts of Fortune Business Insights from 2026, where the market value of this niche is estimated to be around $394.88 billion, with a compound annual growth rate (CAGR) of 16.2% by year 2032.

Certainly, the popularization of such services has been marked by the pandemic when users were unable to reach finance operations offline, turning the tide for increasing demand in online banking and other resources.

With such projections for the financial industry software development, it is not rocket science to see why so many businesses are jumping on the train to ride the wave of fintech. What should be noted, however, is that there are many types of software to keep an eye out for, which we will discuss next.

Types of financial software

In many ways, fintech construction is an umbrella term that fosters quite a few unique and effective solutions, whether aimed within the business’s operation or tailored to the consumers’ demands. Among these services, you can pick whichever fits your objectives the most and fine-tune the creation process to meet your expectations 100%.

Let’s examine closely some of the most prominent directions of this approach.

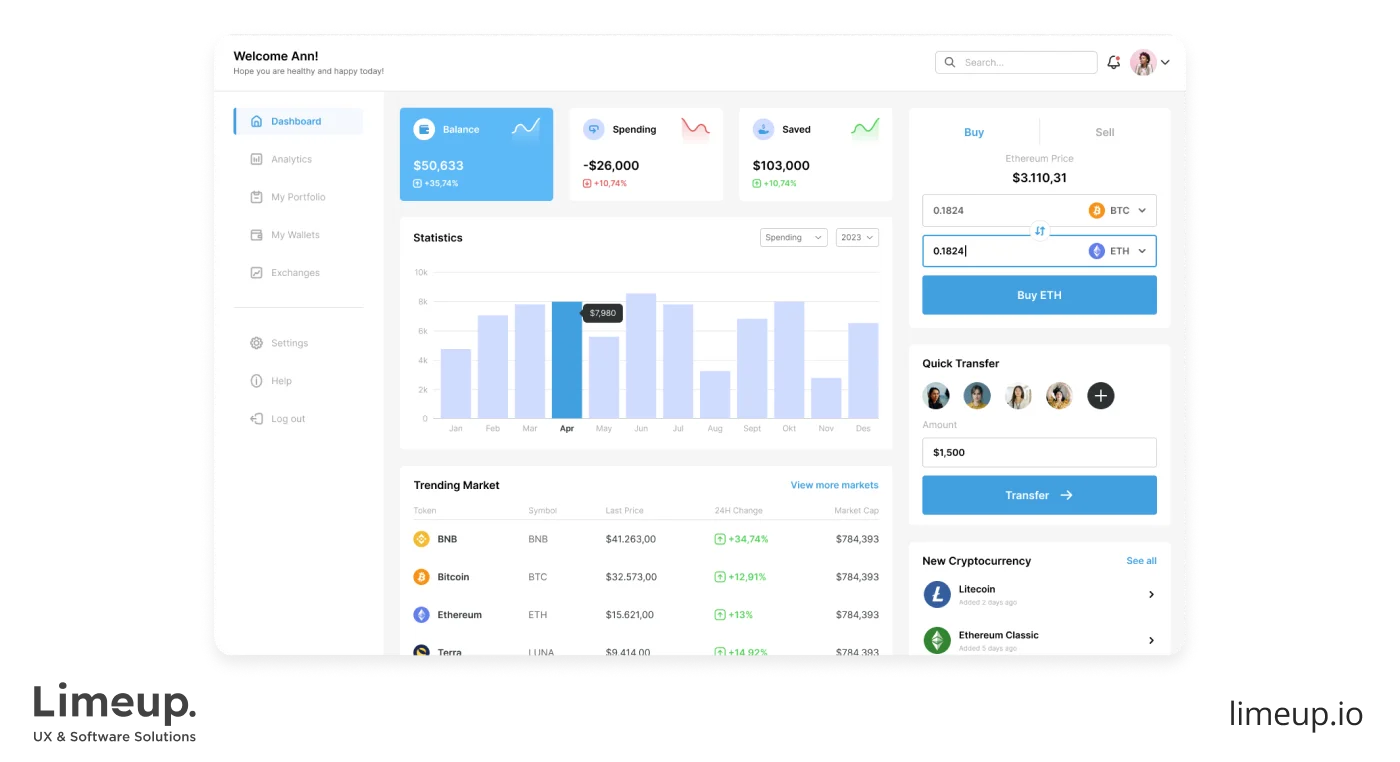

- Trading platforms

Trading platforms have been a cornerstone of monetary system creation as they help businesses and regular users to manage their stocks, such as buying and selling them as well as tracking the operations. Platforms for trading cryptocurrencies have been on the rise due to their ability to deliver the highest level of security and cover real-time data.

These platforms enable customers to use trading features right from their preferred device with a user-friendly navigation no matter if they are beginners or seasoned traders.

- Banking software

Banking solutions encompass a variety of opportunities to build financial software which can include websites, web applications and mobile applications tailored to the needs of consumers. Such software powers users to manage their finances through intuitive dashboards, conduct effortless transfers and even allow them to fill out loan applications.

Online banking solutions are not a new kid on the block and have proved their efficiency by accumulating large audiences, compelling them with secure transactions and accessibility.

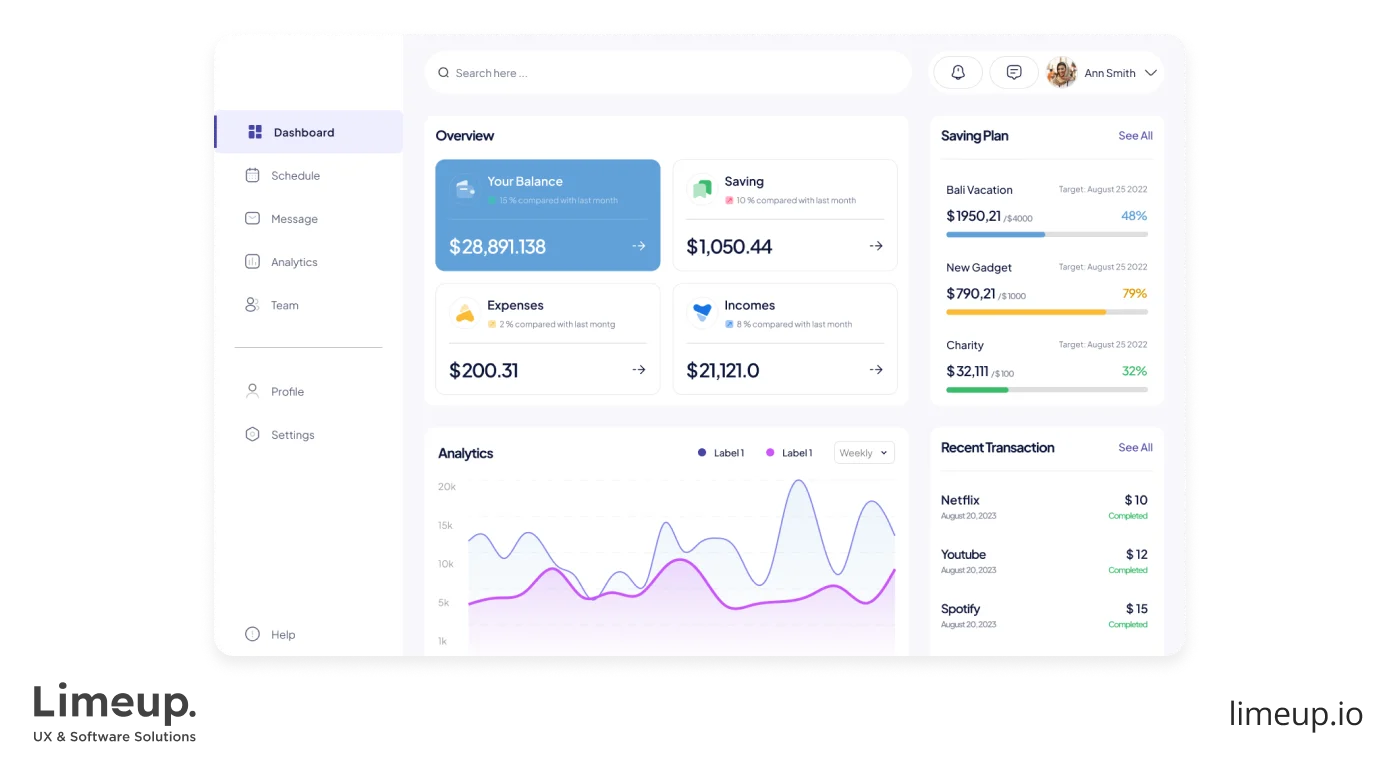

- Financial Planning and Analysis (FP&A) Software

Financial planning and analysis drives the data-driven decision-making process of businesses in this field with carefully gathered and examined insights. With such programs financial enterprises can manage their budgets, monitor cash flow, analyze performance, forecast trends in the future and so on to help maintain a high competitive edge.

On top of that, FP&A software keeps all of the necessary and crucial data in one place to avoid using multiple programs and get all the information in a structured, accurate method.

- Accounting software

The struggle of manual accounting for fintech corporations may finally be over with specialized app that automates invoices, tracks income, manages expenses and more. Leveraging financial software development services you are capable of streamlining record keeping as well as driving the possibility of human error to a minimum.

Moreover, a fully functional accounting systems system lets you access any data at any point in time whenever you need to overview the financial details of your company.

- Risk management software

The sole purpose of financial risk management programs is to keep your business afloat by analyzing and assessing any potential risk exposures as well as modeling out any hazardous event and how you can steer clear of them. Such suite is able to identify risks in the future using predictive programming, aiding you in mitigating dangers in various areas, such as market, operational and so on.

Typically, risk management framework is an incredibly useful tool for financial institutions like fintech and insurance corporations, banks and other entities.

- Payment processing software creation

Last but not the least popular type of financial custom software development is the payment processing solution which can integrate with a plethora of widespread payment gateways. These enable users to conduct monetary transactional operations, set up recurring payments, manage refunds and so much more within a single application.

This type of engineering can be compatible with operations on PC as well as mobile devices, paving the way for one-click payments that shape the financial landscape of today.

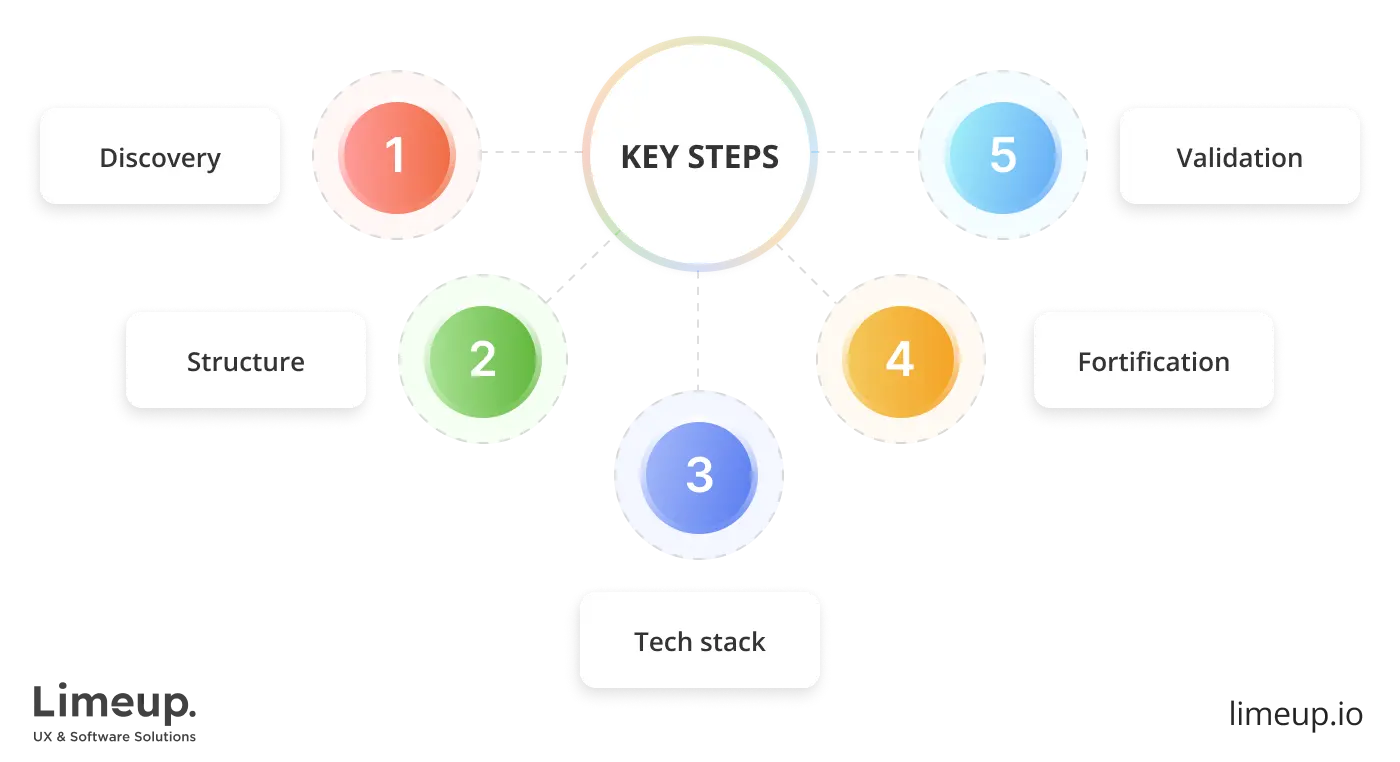

What are the key steps in building financial software?

Assembling financial technology is a journey that requires precision, expertise and a deep understanding of the intricacies of the field. Our clients have gained successful solutions through customized production which adjusts to market standards of the current fast pace while cementing the path to continued prosperity.

Below are the essential steps needed for finance app development to attain its maximum potential when beginning in this field. Ready? Let’s dive in.

Step1. Discovery. The beginning of creation demands full comprehension of the examined issue. Taking enough time to clarify the objectives stands as a fundamental need. Assess the main issue this tool addresses through the question “What challenge is this software solving?”

Productivity improvements stem from defined goals because these guidelines facilitate cooperation between team members while highlighting possible problems and creating a systematic direction. After establishing clearly defined objectives through your haystack search, the rest of your project path will reveal itself more clearly.

Step 2. Structure. The second step to create financial software involves designing the architecture, similar to the process of constructing a house foundation. Weak groundwork generates dangers for the entire built structure. The same goes for financial software. A resilient architecture system enables future updates by providing both horizontal and vertical scalability features with necessary security measures that protect the system.

Pick a design system which fulfills present requirements yet maintains the ability to scale up. At this stage process focuses on implementing measures to shield the application for extended usage.

Step 3. Tech stack. The moment when success happens through selecting appropriate tools and technologies. All technician decisions, starting from programming languages and databases foster distinct impacts on project advancement.

The selection of technology elements should match the software application’s role while also using the team’s expertise and providing support to maintain the system. Wrong early decision of technologies may trap you in unworkable positions because your choice establishes the entire project bedrock.

Step 4. Fortification. No compromise exists in terms of security in the economic sector. It entails more than encryption because it requires developers to establish well-protected systems which serve as defensive fortresses for sensitive information. All stages of financial app development need to incorporate multiple methods since they manage high-level sensitive transactions.

Advanced authentication systems, firewalls, GDPR and PCI DSS compliance regulations should be implemented. Limeup upholds its reputation as a security expert by developing program that guarantees secure operations while delivering optimal functionality.

Step 5. Validation. Testing represents the critical point through which many projects achieve their excellence or results in their downfall. Financial app testing requires exceptional importance because the stakes are elevated in this domain.

Your product must pass through multiple testing scenarios and environments to find problems which could develop into critical system issues before release. It builds success or fails entirely during these phases. Post-launch problems can be avoided only through scrupulous testing before deployment.

What tech stack is needed for finance software development?

The assembly of tools needed to complete a fintech project can vary significantly based on the type of software you set as your end goal. As you have already learned, at your disposal are websites, web apps, mobile applications and custom-made software, so each technology stack is carefully tailored to each type.

Proficient and experienced fintech vendors should have no difficulties picking the right programming languages, tools, frameworks, databases and the list goes on. Oftentimes, standard markup languages like HTML, CSS and JavaScript are omnipresent and go a long way in the development, while other instances, like creating cross-platform apps, require a more nuanced approach to the gathering of tech.

A case in point for mobile applications is that each platform you build the system for has its own set of, for example, whether you are programming an iOS app, an Android app or a hybrid type — they all necessitate unique tools and frameworks.

The best way to develop financial software with an appropriate composition of technologies is to talk directly with a provider and discuss the pros and cons of each option to reach an optimal solution.

Of course, it is better to be acknowledged and come prepared with the information about the stacks so we can give you a basic rundown of the typical tools used in financial app creation. Here is what is included in several layers.

| Technology stack layers | |||

| Front-end | Back-end | Databases | Libraries |

| HTML, CSS, React.js, Angular, Vue.js, etc. | Java, Python, PHP, Ruby, Kotlin, C#, etc. | MySQL, PostgreSQL, MongoDB, Oracle, etc. | Django, Flask, Ruby on Rails, Spring Boot, Laravel, etc. |

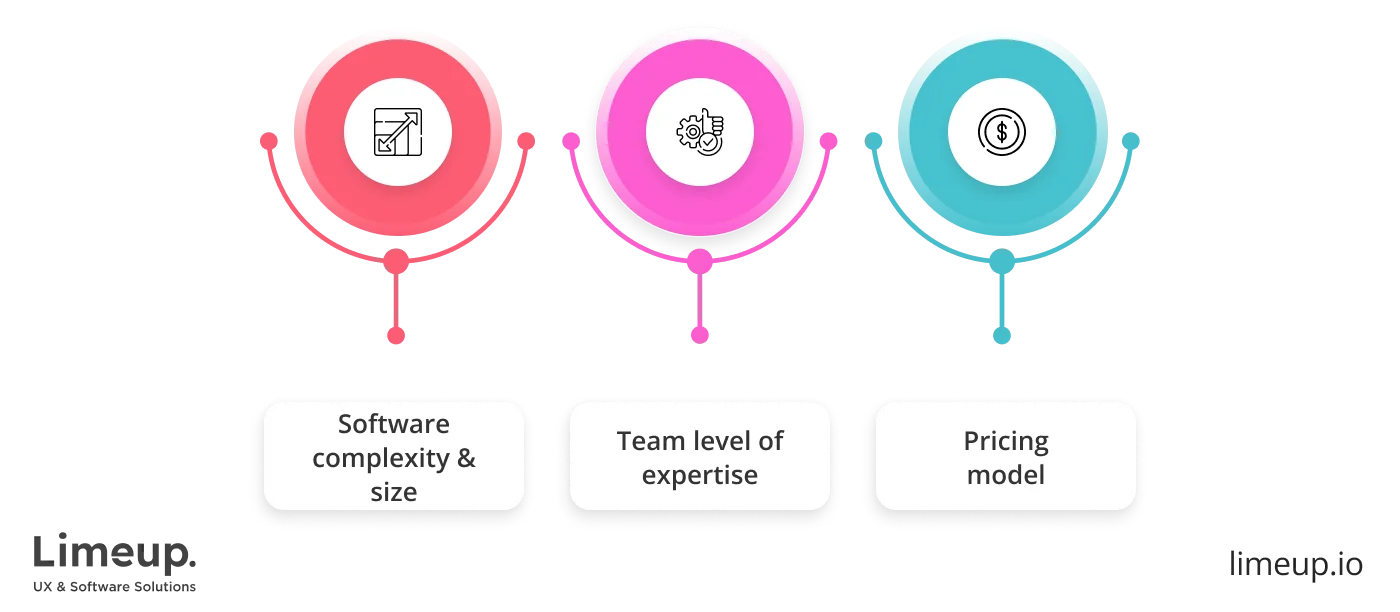

How much does software development for financial services cost?

How much money should you allocate to your budget when seeking to create software for finance? That is without a shadow of a doubt, a multilayered question with an even more nuanced answer that calls for a deep understanding of which factors go into the price formation.

We won’t leave you hanging in regard to the influences that shape the final quote you will receive at checkout but for now we can provide you with a table of costs, turning our attention to the kinds of software we have discussed previously to get you started on wrapping your head around average expenditures.

| Type of software | Average price range |

| Trading platforms | $90,000–$250,00 |

| Banking software | $200,000–$500,000 |

| FP&A | $150,000–$400,000 |

| Accounting software | $50,000–$150,000 |

| Risk management solution | $80,000–$200,000 |

| Payment processing | $100,000–$350,000 |

It should not go unsaid that the best way to get a precise estimation of costs for your solution and be certain this is a suitable range for you, you need to consult with a professional financial services software development company The table above serves as a preliminary assessment of how much you can be prepared to spend on the production while your specific project may fall outside of such ranges.

With this important note out of the way it is clear to see that fintech solutions can cost an arm and a leg yet bring extensive advantages to the corporations who invest in this kind of software. We will touch in more depth on the topic of how your business can benefit from finance tech a little later.

What is more pressing right now is that we have to get on the same page in terms of what aspects form such expenses to relieve any doubt regarding the price. These would be:

-

Complexity and size of the software. Just like with anything in life and in business the more you want, the more you are going to end up paying. And solution is no different since comprehensive and fully functional solutions take a toll on your and your banking & financial software development team’s resources like:

Customization is one of the primary drivers of cost because the programmers have to write the code manually to reach your personalization goals instead of using pre-made or low-code solutions which are more affordable but less flexible.

The number of features defines the size of your product which means if you want a lot of complex functionality with tailor-made features, it will reflect on your final quote.

Hours needed to complete your project are a two-sided coin situation since if you establish flexible deadlines the work hours can pile up if you are paying for an hour. On the other hand, requesting fast delivery times can additionally increase your budget because the team would need to prioritize your project above the rest.

-

Level of expertise of financial software developers. The option of picking whoever to build your project is not really on the table if you want quality results. The team must be specialized in the financial sector and have an appropriate level of knowledge suitable for your needs.

Junior specialists can be a great fit for smaller solutions that don’t require extensive customization or industry tailoring.

Middle coders can be of great help as a part of a more intricate project and can even take leading positions.

Senior programmers are the best fit for multilayered software, which calls for in-depth expertise and are irreplaceable for advanced solutions.

-

Pricing model. The approach you take to pay for the engineering services can also modify your budget, presenting several options for payment that may be the most suitable for your specific situation.

Hourly-based charges require you to pay for each hour of work of the specialists and can be a great model for moderate or basic program that doesn’t require large timelines.

The flat fee approach suits custom financial software development conditions where the provider extends a fixed cost for the entire creation and implementation.

The subscription model entails you paying a monthly charge for a set of services you receive which means if your project is going to span over several months or years, this model is a great fit.

How to choose a financial software development company?

The decision to pick one among fintech software development companies carries weight. Rather than just finding coders, you want to work with specialists who will build the infrastructure that powers your operations and this requires close attention to detail.

Begin by narrowing your search to companies that have mastered the financial sector. Constructing financial application is no jack-of-all-trades job and it demands dexterity in solving challenges like security, compliance, and scalability.

Communication is the linchpin of a successful financial technology software development process. The team must be able to explain technical concepts in a way that’s easy to understand, collaborate smoothly, and offer solutions that align with your business goals. A developer who listens attentively and asks the right questions will craft a product that’s built around your needs, not just a ticked-off task list.

We have talked about security as a must not once and any partner must take it seriously. Inquire about their approach to data protection, encryption, and adherence to regulatory standards. A bulletproof safety system is what you need to safeguard sensitive financial data and preserve the trust that customers place in you.

Finally, consider the company’s capacity for ongoing support and maintenance. As your business grows, your solution should adapt seamlessly to new requirements. Choose a financial services software development crew that may provide long-term collaboration, ensuring that your app evolves as your endeavor does.

For many enterprises, the safest bet is to collaborate with an experienced financial software development company in the UK, which combines regulatory expertise, fintech domain knowledge, and technical excellence to deliver sustainable solutions.

When you have the intention to hire software developers, look for a company with experience, expertise, and the ability to innovate. Working with Limeup guarantees that you’re investing in both a reliable solution and a trusted ally for the future. Ready to take the next step? Your perfect partner may be closer than you think.

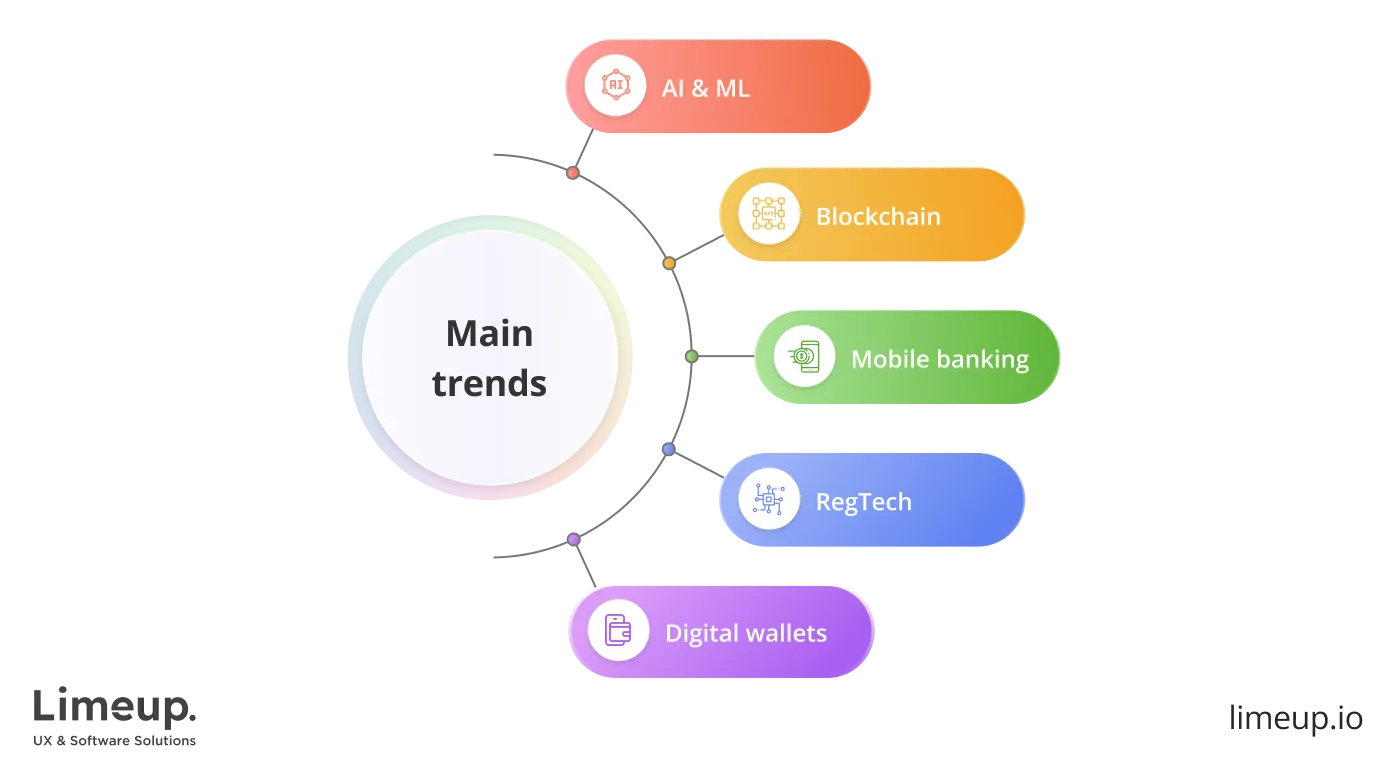

What are the trends in financial software engineering?

Keeping your hand on the pulse of the waves, especially in such a rapidly evolving and competitive industry, can become your bread and butter that will put your business on the map. The extent of emerging technologies and in-demand technical approaches is hard to grasp fully and will take a whole day to decipher one at a time.

So, our best bet is to look at the five inclinations that are dominating the financial market and help you equip all the necessary knowledge for top-of-the-line construction. These include

Artificial intelligence (AI) and machine learning (ML). These cutting-edge technologies have captured a multitude of markets, not leaving the financial sector behind. Moreover, driven by a 17.0% compound annual growth rate, the AI sector within Fintech is forecast to achieve $70.1 billion in revenue by 2033.

Talking to your financial software development consultants about which areas you are capable of implementing AI or machine learning technologies can substantially bump up your operations. Particularly, this applies in spheres that include automating repetitive tasks or setting up market predictions to help you jump onto changes in the niche more efficiently.

Blockchain. Although for some the topic of blockchain integration still seems like an undiscovered territory, a lot of businesses in the finance industry are already bearing the fruits of this trend. One of the primary causes of such uproar is the decentralized nature of blockchain technology that offers unparalleled security (which as you now know is among the biggest challenges.)

The choice in favor of blockchain can also alleviate other predicaments with the implementation of smart contracts and decentralized finance (DeFi) applications as well as a significant reduction of fraudulent activities.

Mobile banking. It comes as a no showstopper that the majority of the users in today’s world are preferring to use their mobile devices to take part in any kind of service. Taking a bet toward mobile banking, you can prioritize financial software application development and reach a wider net of potential customers.

A lot of countries around the world are moving forward with digitalizing the banking experience and already offering their users an experience of settling their financial operations using a mobile application.

Regulatory technology (RegTech). This phenomenon is relatively new and has emerged as a result of the growing demand for financial corporations to navigate the deep waters of the complex legal landscape that surrounds this industry. Leveraging technologies like machine learning, natural language processing, etc., RegTech providers guide such businesses to avoid falling into regulatory pitfalls and manage the risks effectively.

In a nutshell, it is a fairly easy way out of the depths of legal fortresses that keep the organization afloat and contained within the laws to protect their personal interests as well as keeping their customers safeguarded.

Digital wallets and multi-currency payment. The implementation of digital wallets as part of software development for finance has been around for quite some time but still makes a lot of difference for the satisfaction of consumers. With the rise of Apple Pay and Google Pay, more companies are looking to leverage contactless payments where each card can be easily stored and accessed.

On top of this trend is the increasing demand for multi-currency support which enables users to pay in their own currency with the capability of converting the payment in the process. This also applies to the cryptocurrency that is riding the wave of popularity within the audiences and is only going to reach new horizons in upcoming years, necessitating financial corporations to accommodate such tendencies.

To sum up

Crafting a solid finance solution from the ground up is a hefty endeavor that necessitates you to know all the ins and outs of the current state of the industry. With our fully detailed guide, you are now equipped with vital information about the types, tech stacks, budget expectations, pros and cons, etc., that will aid you going forward with partnering with finance software developers and bringing your project to a fruitful outcome.

Set your project on the path to success with Limeup. Don’t miss a chance to contact us, our veteran professionals are ready to bring your ideas to fruition with precision and creativity.