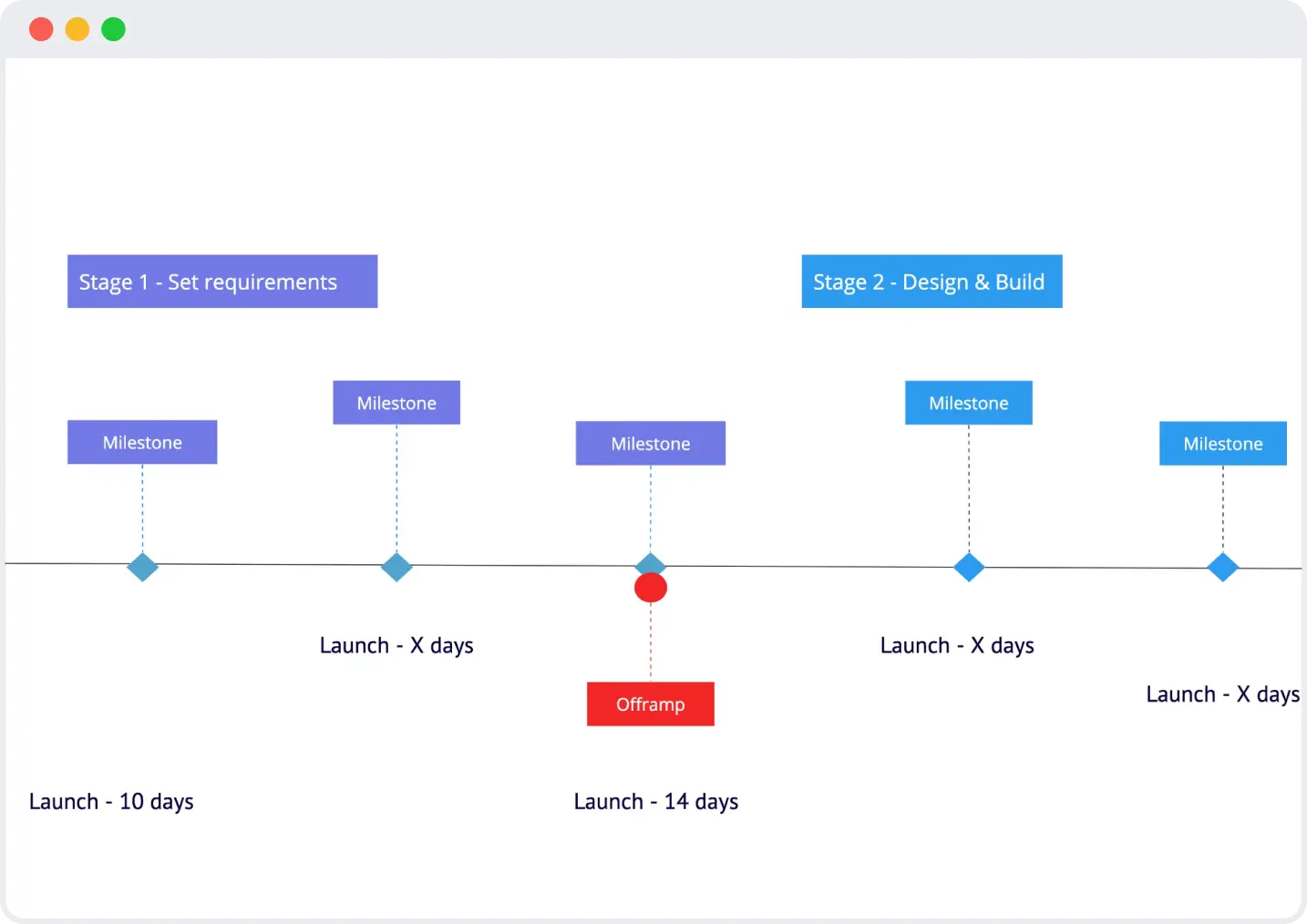

The development timeline depends on the complexity, features, and integration requirements of the project. A basic insurance application with standard functionalities may take between three to six months, while an advanced AI-powered platform with automation and analytics could require nine to twelve months or more.

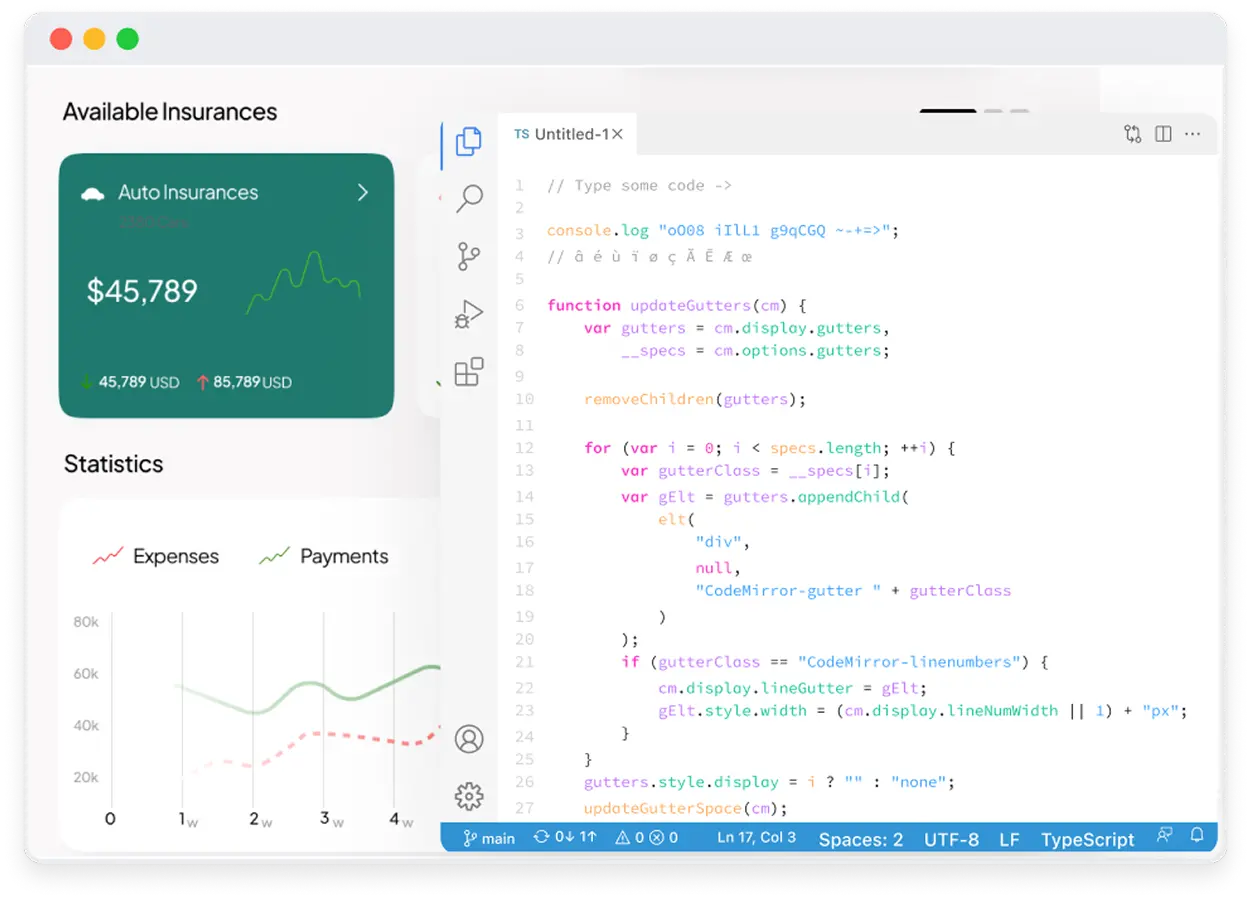

Project scope & complexity. Limeup assesses the project’s scope in detail to determine the required time frame. Simpler applications with predefined modules are completed faster, whereas enterprise-grade solutions with AI-driven underwriting, predictive analytics, and automation demand more extensive development cycles.

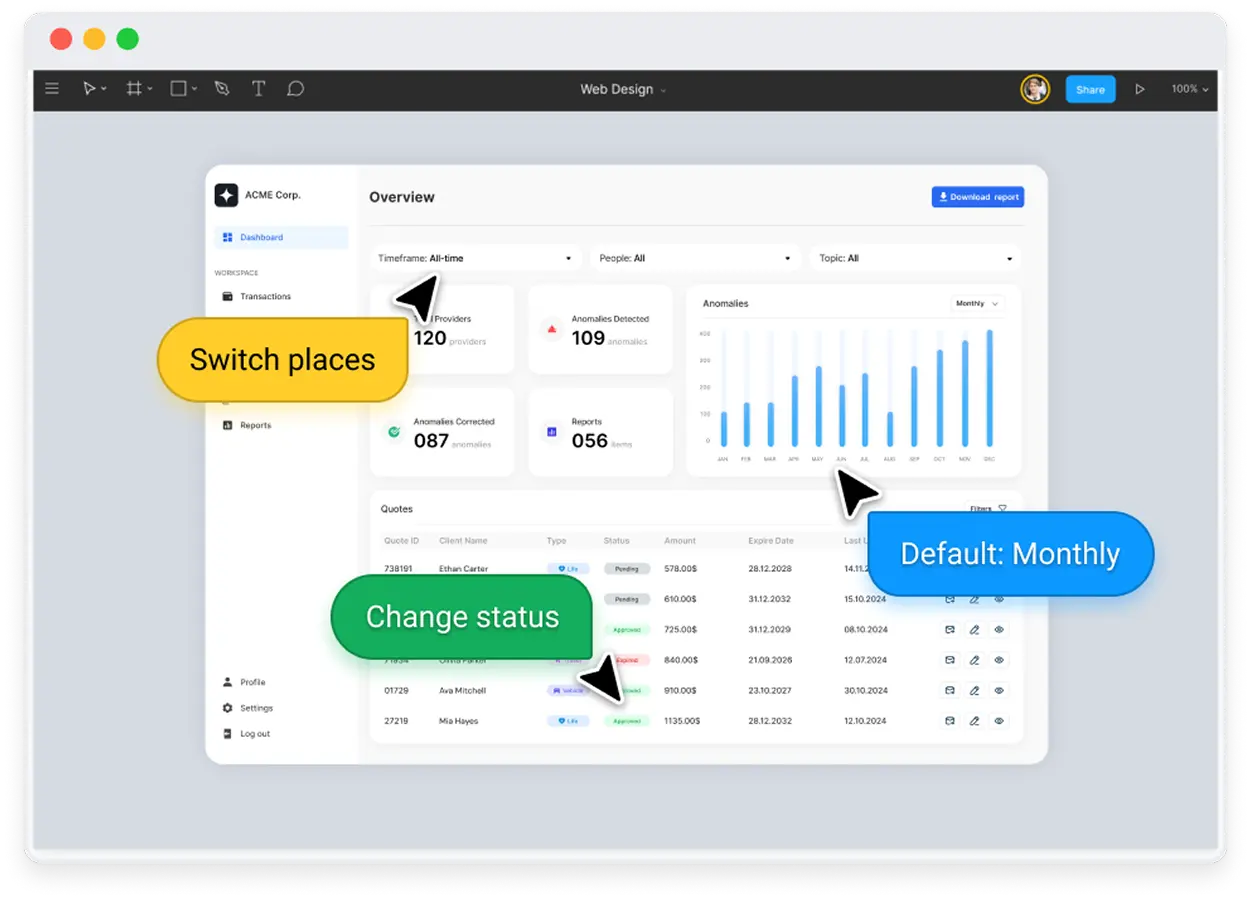

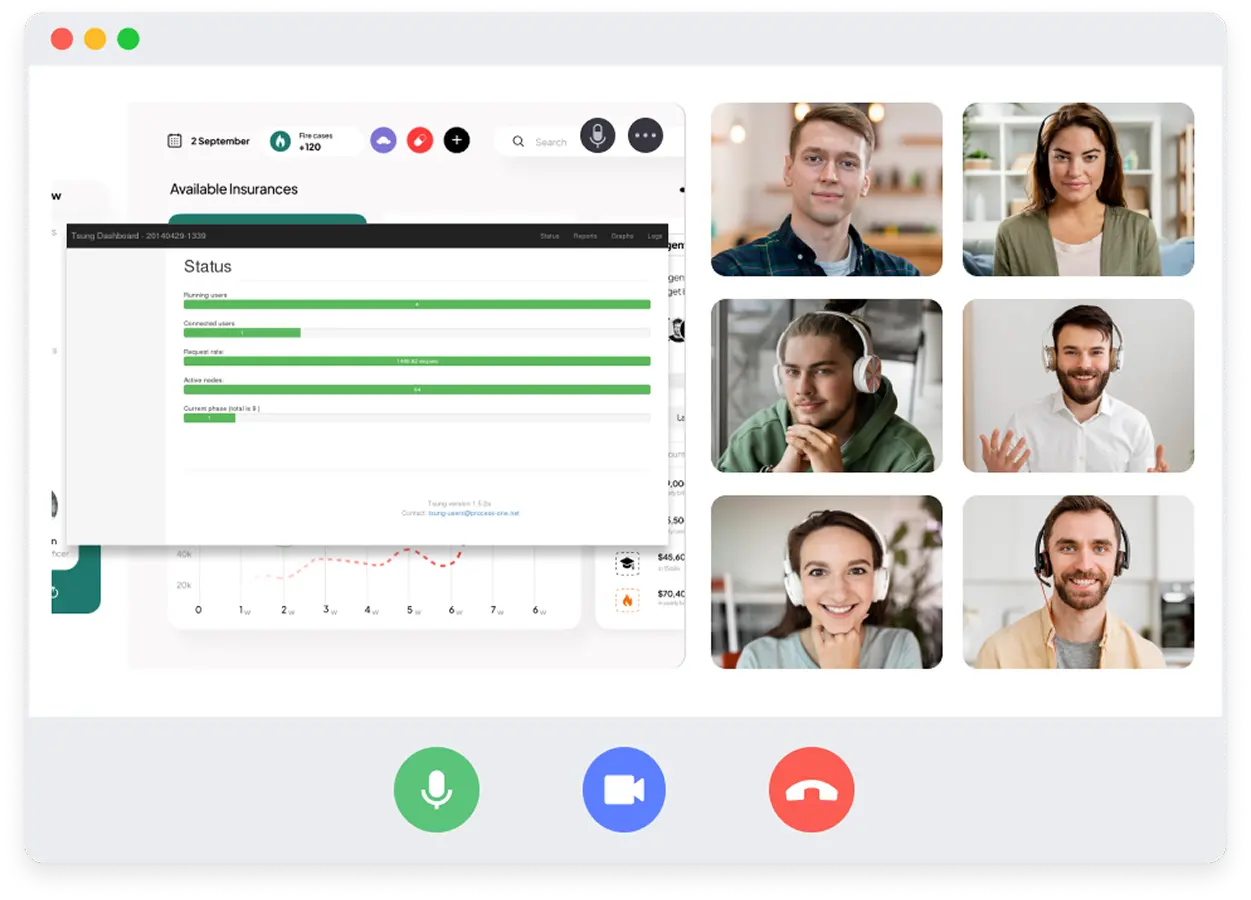

Agile development process. Our team follows an iterative development methodology, ensuring insurers can test and refine features throughout the process. Regular updates and continuous feedback loops enhance software quality and alignment with business needs.

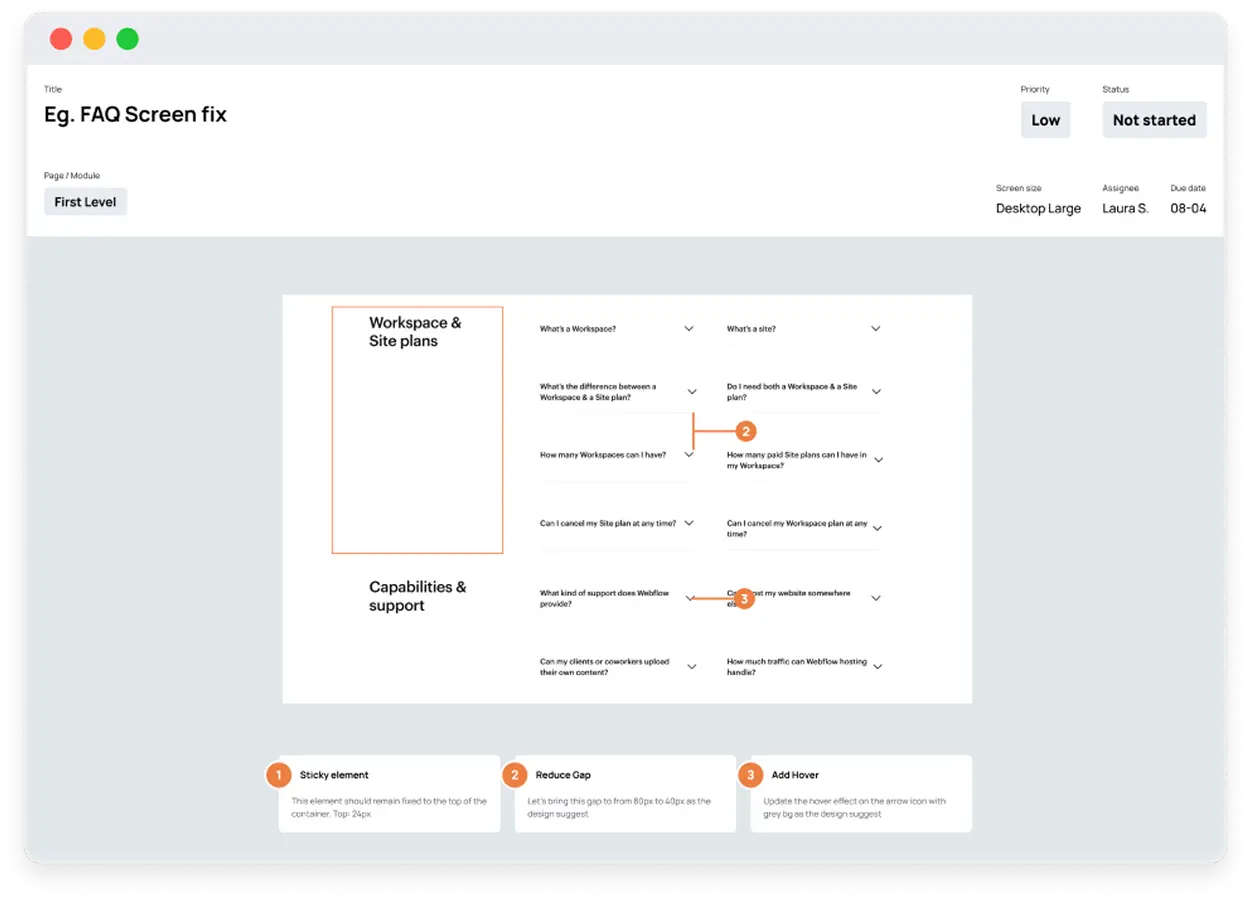

Discovery & planning. Thorough research and planning help define project goals, system architecture, and technical requirements. This stage ensures a structured approach, minimizing bottlenecks and streamlining development.

Compliance & security. Limeup prioritizes security and regulatory compliance, integrating rigorous testing protocols throughout the development cycle. Industry standards and data protection measures are upheld to deliver a reliable and legally compliant solution.

Transparency & collaboration. Open communication and proactive collaboration are integral to our process. We keep stakeholders informed at every phase, enabling efficient decision-making and a seamless path to launch.