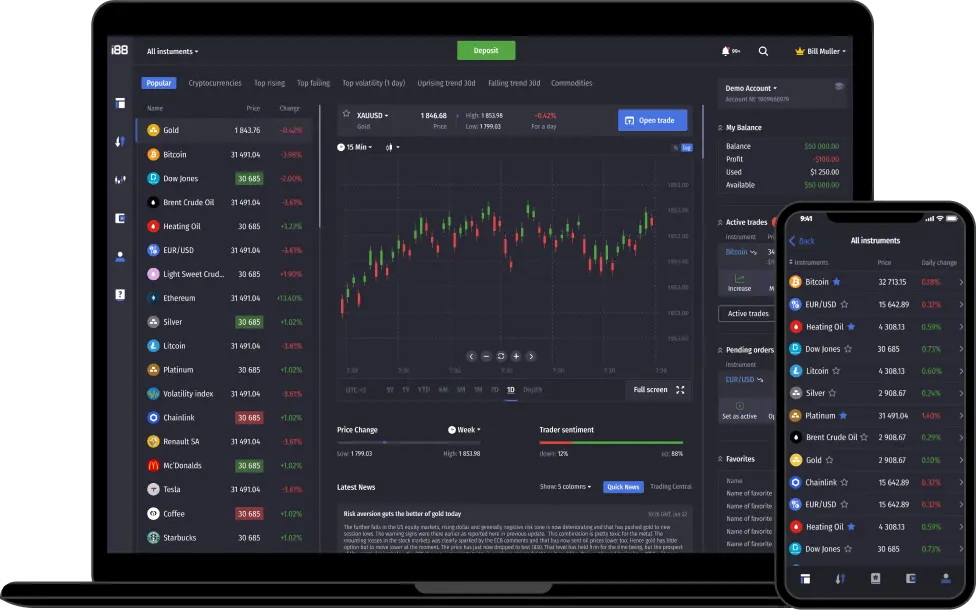

A decade of progress

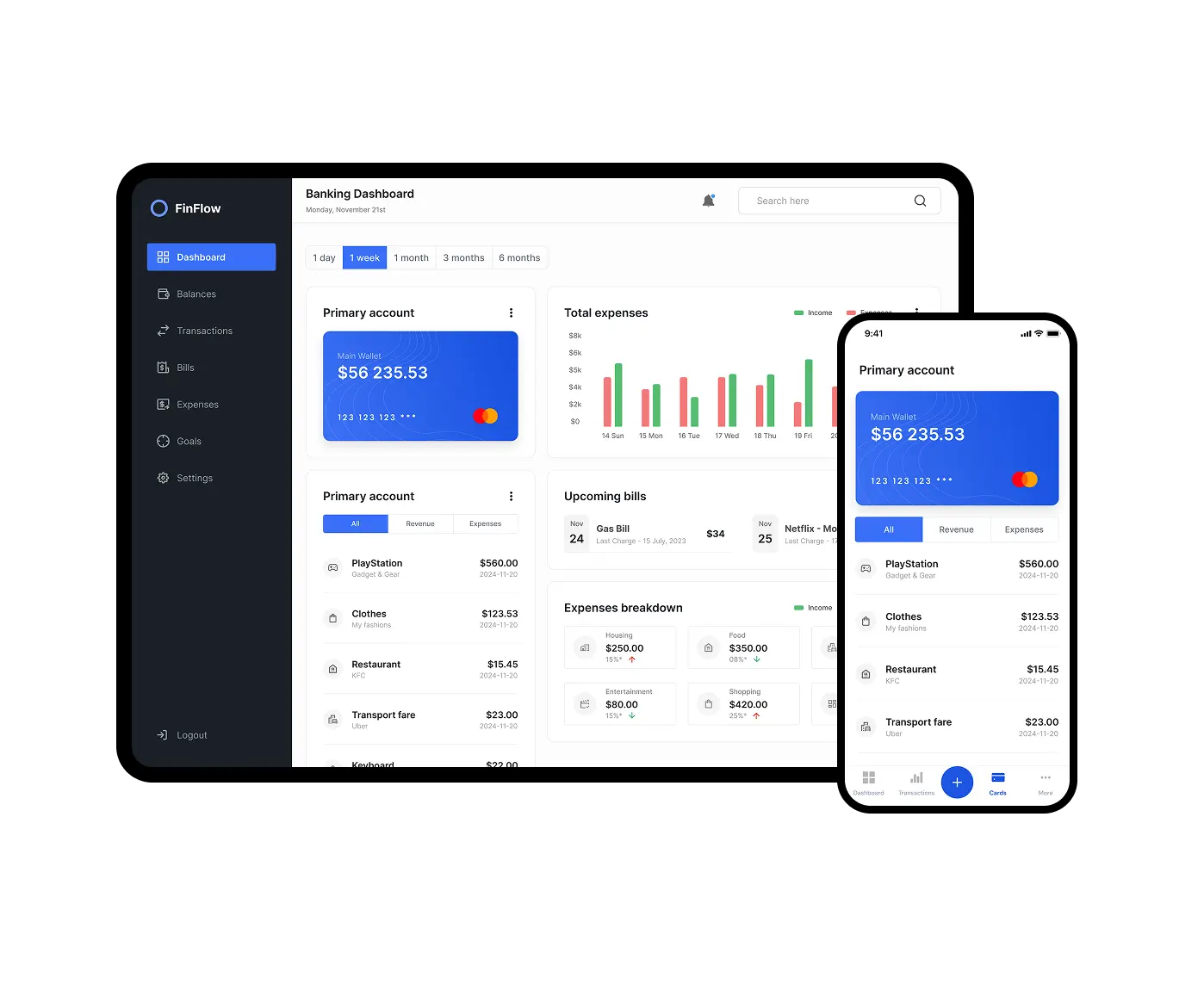

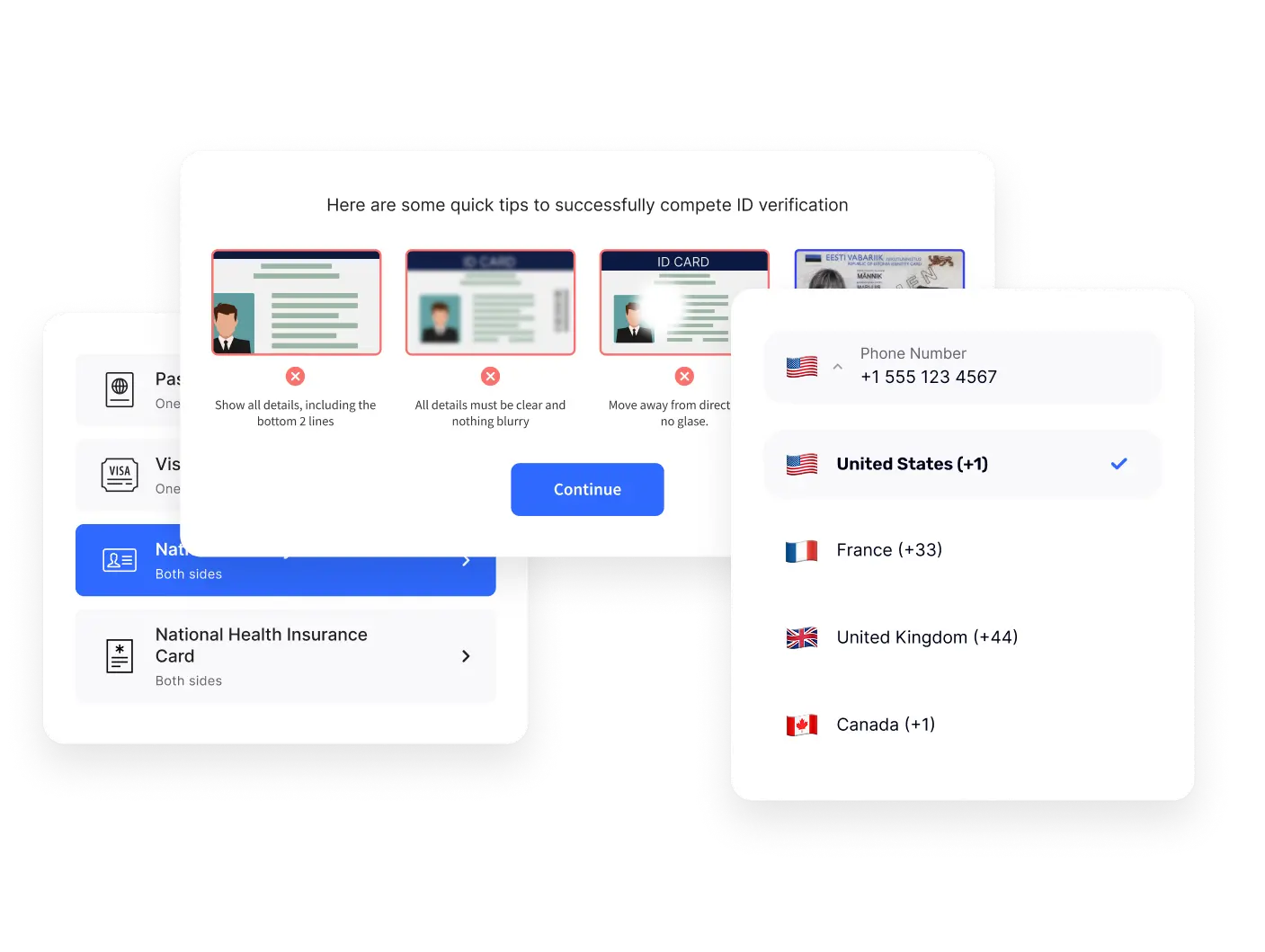

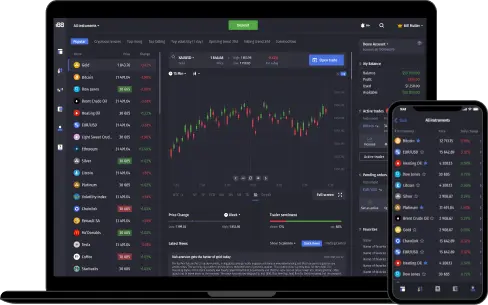

After 10 years of shaping the digital financial landscape, Limeup has mastered the art of building dynamic banking ecosystems that streamline international transactions, delivering fast, secure, and cost-efficient cross-border payments while providing real-time currency conversion.