How to Build a Fintech App: a Comprehensive Synopsis

Setting our sights on the research provided by Fortune Business Insights, we can witness that this sector is projected to reach a CAGR of 16.5% by 2032, which indicates that fintech app development is the way to expand your market reach. Moreover, it’s about enhancing financial efficiency, automating transactions, and satisfying customers. In this overview, we will explain core topic points.

What do you need to build a fintech app? Not just an average solution but the one that works toward your objectives, reduces overall cost, and streamlines operation? You will receive the answer after considering related services, steps, timeframes, costs, and trends.

After diving into mobile application development for fintech, you will be armed to remain competitive in an increasingly digital environment using fintech software services, leveraging our 10+ years of experience as a financial industry-related IT provider.

What is a fintech application?

Traditional financing is an old hat in the digital ocean of enhanced financial services that are accessible through mobile devices, simultaneously enriching customer experience and opportunities for new incomes for business owners.

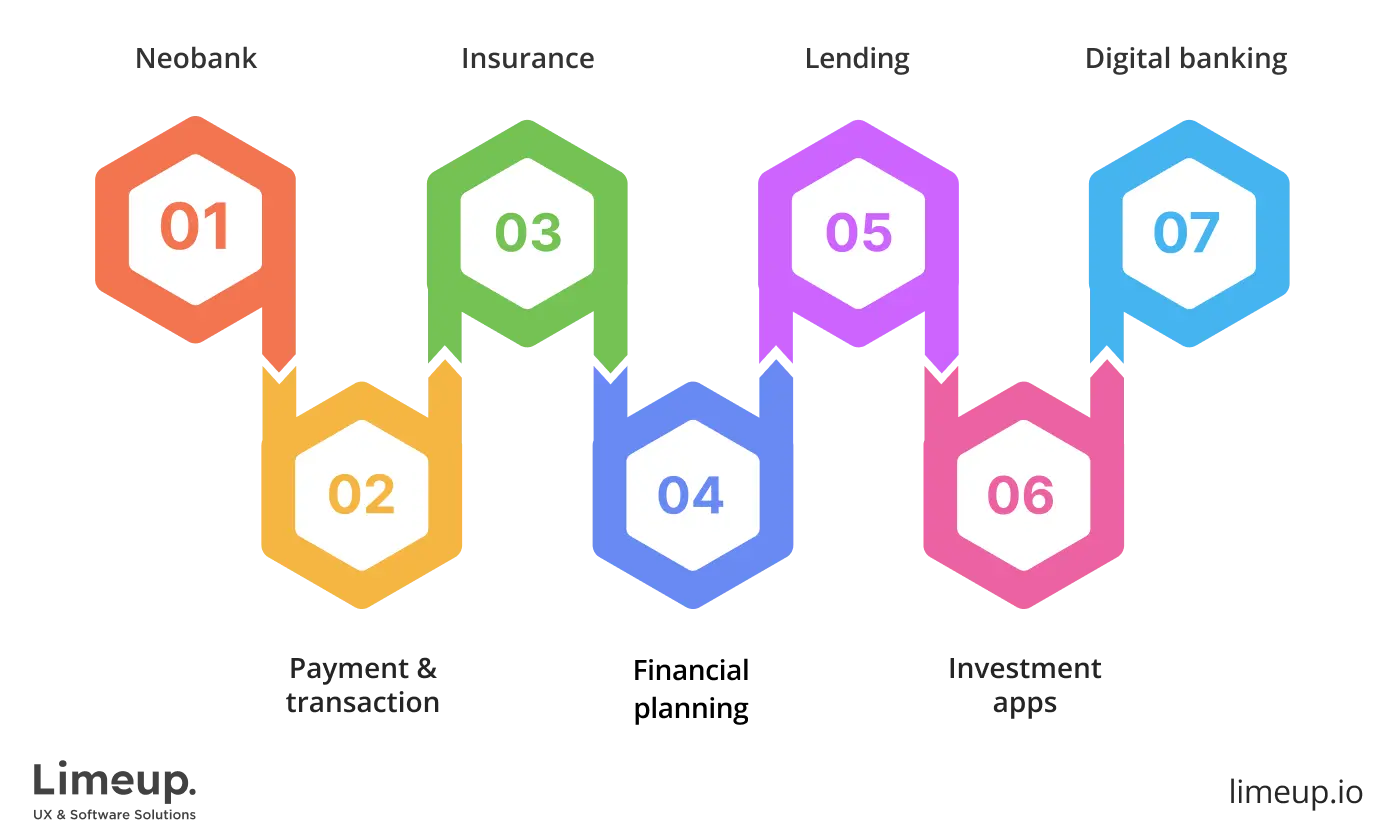

From money transferring to neobanking and asset management, there are no limits in this skyrocketing niche, allowing you to cover every tailored need — yours and your end-users. Owing to innovations, secure practices, and rich features, such solutions are trending amidst clients seeking more efficient ways to complete financial services, in other words, to reduce the time needed for such operations.

If we refer to IBM, the usage of fintech allows organizations to “offer certain 24/7 services” with the usage of chatbots, so for now, a fintech app is a comprehensive tool for stand-alone capital and monetary operations.

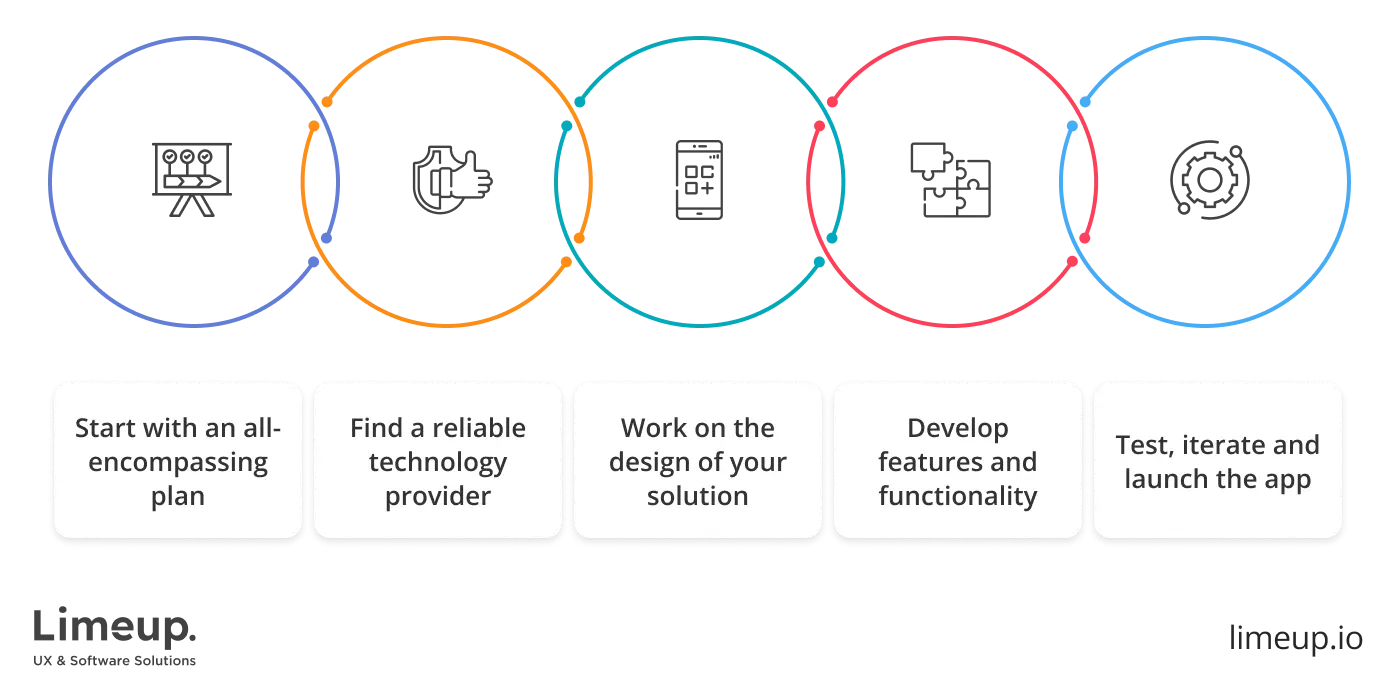

How to create a fintech app in 5 basic steps?

When you have made a decision to partner up with app development companies in the UK, it is better to come prepared with an understanding of what the process of creating an application typically looks like. No matter which kind of solution you settle on crafting, the progression of the stages is generally going to unfold in the same manner.

Getting familiar with the following steps of finance app development to create a solution will help you plan better for what lies ahead even if you have experience developing applications in the past. So let’s get to them one at a time.

— Step 1. Start with an all-encompassing plan.

All good initiatives start by carefully examining the market to probe for any gaps in the market that your solution can fill, identifying user problems and conceptualizing the app in a way that would address the aforementioned issues. Viability is crucial for any new type of task since you can run into the risk of developing something no one actually needs.

When your idea is fully defined, you can move forward with documenting your requirements, such as the number and type of features you would like to have within the app, what its core functionality will be, the vision for the design, etc. That way you will have an easier time both during the next step and throughout the entire implementation process.

— Step 2. Find a reliable technology provider.

The abundance of providers of financial apps development can seem scary to sort through but what you have to keep in mind is that discovering the right one for your proposal is not such a tremendous task. They need to be able to fit certain criteria which would be experience creating similar apps in the past and expertise in your particular niche to get the project right on the first try.

Failing to cooperate with a competent supplier can lead to costly reworks and time spending so put to good use your plan from the previous point to filter out the candidates.

— Step 3. Work on the design of your solution.

With a vendor secured by your side and the plan being comprehensively understood by both parties, you are capable of getting started with the design. This is further divided into building the user interface section in which the visual elements are put together, such as fonts, typography, icons, buttons and layouts.

The other section is represented by the user experience portion of the design where specialists come up with wireframes and prototypes that detail the user’s flow through the app, ensuring maximum usability and navigational friendliness. By building an intuitive information architecture, designers solidify that customers won’t be confused as to how to use the app and have a pleasant competence.

— Step 4. Develop features and functionality.

On the basis of a completed design, technical specialists begin writing code for the app that would present all of the functionality you have detailed in your plan. What you need to consider is that with fintech applications development you have two options: native and cross-platform. The former refers to crafting a solution for operating systems like Android and iOS with two separate sets of code.

The latter implies that you can use the same code to create an app on both platforms simultaneously which significantly reduces costs and development time but can be less performative than its counterpart. The choice should ultimately be made with your team depending on which route fits your end goals better.

— Step 5. Test, iterate and launch the app.

Once the app development for fintech has been finished and approved, the later stages of development come during which the team is going to conduct rigorous tests, like unit testing, compatibility testing and more, to warrant that the solution is working bug-free and as intended. Iterations are also a possibility if problems are identified at this point but by its completion you will be all set to release the application.

This would involve submitting the solution to the app stores, covering their guidelines and setting the date for the launch. Of course you shouldn’t forget about the ongoing maintenance and support of the app in the long run to introduce patch updates and monitor performance in order to remain competitive.

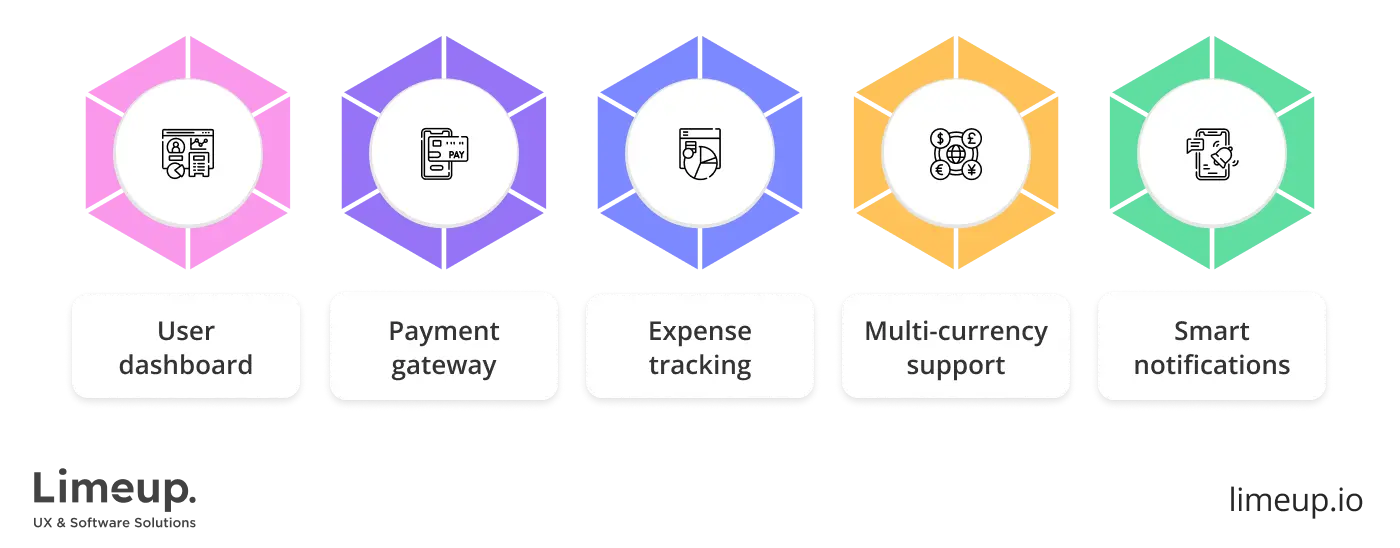

What are the key features of fintech app development?

How many and what kind of features you want in your application is entirely up to you yet some of the core functionalities should still be acknowledged to make sure you don’t miss the mark. Let’s swiftly talk about the foundation of your solution by looking at the key points.

— User dashboard

There is no other way for fintech app design and development without a comprehensive dashboard from which the user will start their journey. To get the maximum out of the user experience, the dashboard should be easy to follow at first glance, providing all of the key pathways to proceed through the app.

An intuitive layout here is vital as you want the customer to be able to easily navigate to other portions of the app without confusion or frustration.

— Payment gateway

A payment gateway integration is a must for financial apps that are going to handle secure transactions since it acts as a middleman between the user and the bank. Some of the popular options used in this type of enhancement are PayPal, Stripe, and others which take care of protecting the customer’s personal information as well as encrypting credit and debit card data.

— Expense tracking

If you want an application with all the bells and whistles, then having a feature for the history of transactions should be on your to-do list. You can also go a step further and deliver tracking of the expenses by categories, dates, and other filters to facilitate users to have a complete outlook on their finances.

During the financial app development process, request analytical tools to be added to the solution like real-time tracking and predictive analytics to enhance the app.

— Multi-currency support

In order to cast a wider net in terms of your audience, consider adding multi-currency support so that consumers across the globe can reap the benefits of your solution and expand your reach. Also, keep in mind that in today’s world, cryptocurrencies are prevalent, and it may not come as a surprise that some consumers would like to have accommodations for this type as well.

While integrating crypto into your application may take an extra toll on your development, such as time and budget, the returns on investment will prove to be worthy.

— Smart notifications

The inclusion of push notifications should go without saying, however, if you would like to take a step forward within the fintech apps development, think about adding smart notifications. In a nutshell, these alerts collect and use personal information of the user, such as their preferences and behaviors, to deliver specialized offers and reminders on top of regular messages.

Personalization has been a demand among consumers for many years now with the advancement of technology, so it could become a little but productive thing within a solution.

How long does financial application development take?

We can’t skip this question as it determines if your expectations in features will be met, as well as commitments and accountability, so valid you can feel intimidated. Talking about custom application development, it’s worth noting that terms impact the scope of tasks, cost pressure, legal risks (such as possible penalties), and more conflict in communication.

Therefore, to avoid the pitfalls and focus on success, our specialists conducted a survey across coders of our company and gathered their answers to provide you with valuable insights into the deadlines that can be set in building a fintech app efficiently. Let’s reveal the approximate timeframes:

- Due diligence in the workforce.

One customer asked us about the vital discovery step but they needed a more precise answer so we will provide our answer here. 37.1% of projects failed, as it’s said in the report from The Standish Group, and the causes are common: cost and time overruns. Therefore, we will pay more attention to this point which takes from several weeks to one month depending on the firm’s size.

It also includes analysis of your competitors, market, tech stack, work and communication strategy, and more.

For example: MVP creation is not that complex as you will receive basic functionality to test the idea, while an enterprise-level app is like a titan who needs to be investigated in order to provide a banking platform or solution based on cutting-edge technology like blockchain.

- Design and development.

Fintech app development solutions simply will not exist without these time-consuming phases, which can take from 3 to 6 months for basic one, up to one year for mid-sized, and from one year and more for enterprises, sometimes even two years.

No wonder as it requires working with UI/UX design for intuitive interface and useful elements, prototyping the future app, taking care of front-end and back-end, third-party apps and database integrations.

We have named a lot and additionally would like to say that you have to include testing as well, checking code lines as if it’s a foundation for your future house, Expect to spend additional time — from 2 weeks to one month.

- Launch.

Going live is an intricate moment that finalizes fintech application development, isn’t it? Yet, if you ensure that all policies of the App Store and/or Play Market are followed, and the QA crew has checked everything, you just have to upload your app and wait for approval to start receiving downloadings. It can take from one to few weeks, depending on the number of solutions waiting for moderation, etc.

Note: our experts deduced that seeking an one-all-fit answer is like looking for a needle in a haystack, so we would like to outline some factors affecting the final terms which you can consider before diving into the deployment.

- Specified features which mostly stand for large organizations can be added with more time required, for example, wealth tracking that involve more integrations and real-time data visualization.

-

Regulatory nuances are wide as you are providing complex services related to money transferring and storing, and you have to represent the compliance with KYC (Know Your Customer) which has different levels, from CIP to AML, some federal-based moments which include data security, licenses, and more.

Depending on the app type and countries you will operate in, you have to implement various practices and regulations, so take time to adhere to them, saving your time for further steps.

-

Team’s experience (if you are not a fintech app developer) will impact the deadline you would like to set as some proficient ones which have delivered hundreds of such solutions already have well-established tech journeys and can work efficiently as a crew. Choosing a reliable one, we recommend paying attention to real-world case studies.

For now you are armed with more than knowledge about stages of creation but how to avoid prolonged phases and enhance the overall quality of the work done. What if we move on to the question that looks like a shadow without an owner to many business runners?

How much do fintech app development services cost?

You have come all the way here, finding the price estimation that will be helpful whether you are a startup company with no staff or a large organization which has been operating on the market for years.

Let us begin with the fact that mainly the app development cost depends on the app type, for example, at Limeup, we offer digital wallets, trading platforms, insurance software creation, digital banking, and custom solutions that differ in features, purposes, scope of work, and more.

Here’s a brief breakdown of what amount of money you have to spend on average:

| App type | Cost $ | Overview |

| Basic | $50,000–$79,999 | Simple UI/UX design, elementary security (password) and payment capabilities. |

| Mid-sized | $80,000–$199,999 | Custom and interactive design with enhanced authentication (using 2FA), open banking opportunities. |

| Enterprise-grade | $200,000–$400,000+ | Real-time data visualization, regulations across KYC/AML, AI-powered tools for better analytics and customer support. |

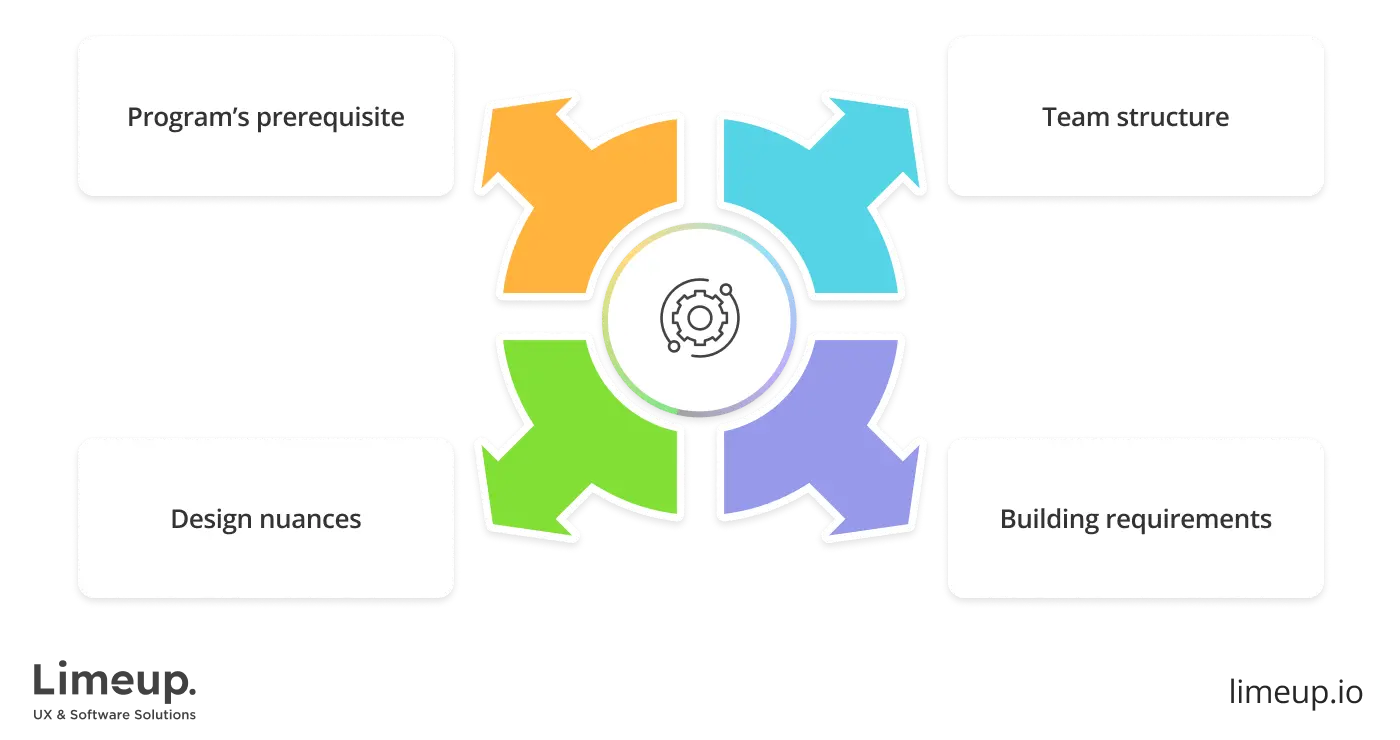

This story is not completed if we don’t consider what influences the overall cost, so we have gathered all the experience and background from previous implementations to outline these standpoints:

-

Program’s prerequisite in terms of finance mobile app development is familiar to you as we have considered it above while determining the terms, and here we go again as the number plus complexity of features are vital.

Let’s imagine that you decided to hire app developers who charge hourly, so you will pay according to the time spent, and the more complex the functionality is, the more you spend as a coder needs to dedicate more time and effort.

-

Design nuances at the first place are about your brand perception and user experience, so you have to consider basic layouts will cost less while custom ones with interactions, complex animations charge more, simultaneously, pre-built UI kits can save your budget as well.

In terms of fintech application development adaptive solutions are a must since you would definitely like to reach out to a wider audience which uses different screens, from tablets to mini iPhones and others.

-

Building requirements are about back-end and third-party apps integrations, for example, you would like to add Stripe for payment processing which will cost more. Moreover, you are able to implement PayPal or else, depending on the type of your product, all of them have various prices.

-

Team structure is lightly connected to the previous point as the more features you need, the more coders will be involved, for example, some of our small workarounds required 1-2 front-end and back-end experts although enterprise ones require software architects, DevOps, project managers, QA, and other specialists.

Whether you are applying for a mobile banking or investing product, the price varies from $50,000 to over $400,000. Summing up, your objectives are a core definition of the budget, still, you can save money by connecting a reliable provider with fintech app developers who can offer cost-effective platforms.

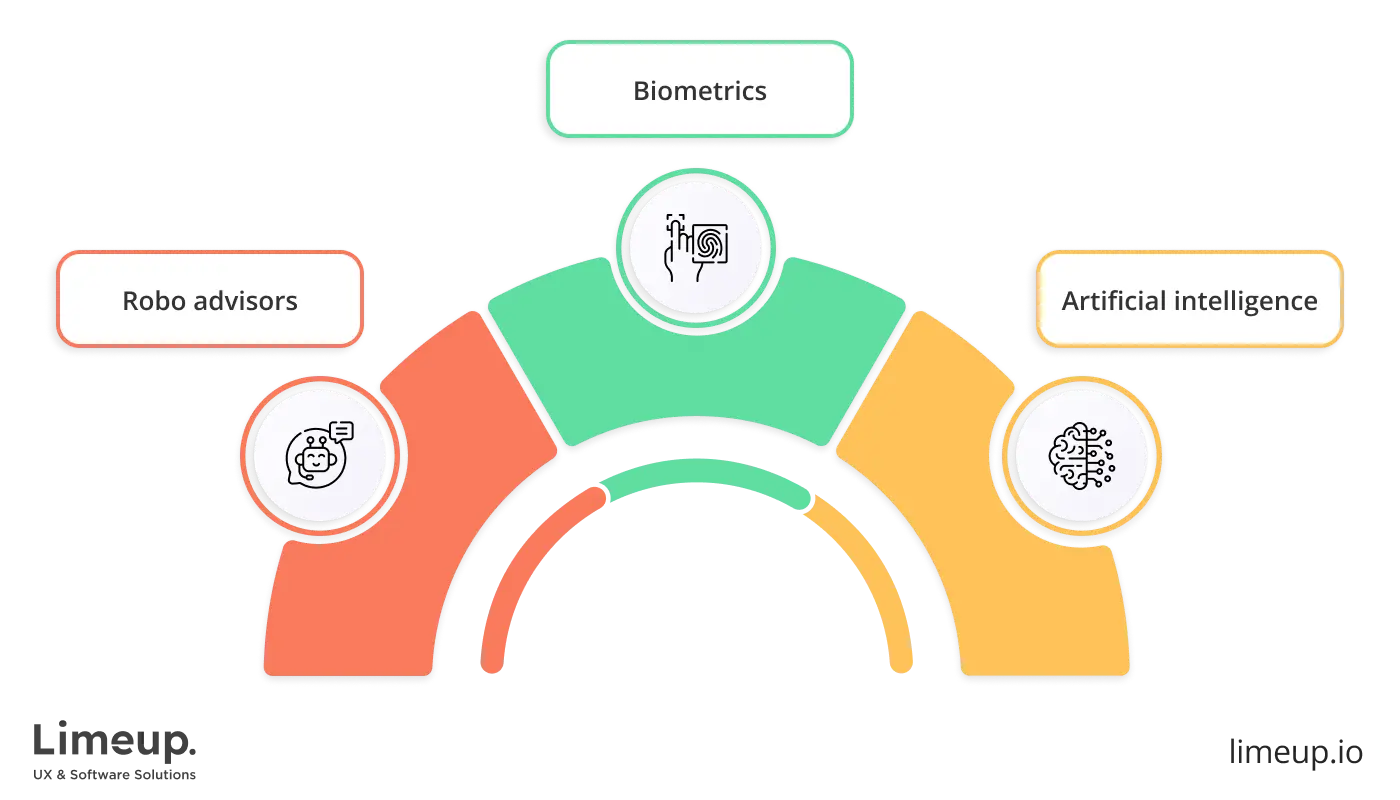

Trends in mobile application development for fintech industry

Getting to the finish line of our outline for financial tech creation we want to spend a little more time giving you ideas to refine your application and drive its competitive edge. For us to do so we have to discuss a few of the popular trends that are paving the way in this industry as we speak.

It should go without saying but you don’t need to implement every single trendy feature if there is no clear purpose or goal it serves aside from popularity. To prove our words, let’s refer to statistics that indicate that there are 26,000+ fintech-related startups all around the world, so you have to find the suitable tendency that will enhance your business.

Still, get acquainted with them for a better understanding of this sector.

-

Robo advisors. Acting as the users’ helping hand after the custom fintech app development, these robo advisors are capable of financial management and risk calculations using advanced mathematical algorithms that require little to no human assistance.

Typically, they are implemented within investment management apps aiding consumers in assessing their goals, opportunities and even portfolio creation. Robotic advisors are much more cost-efficient for users compared to their human counterparts and can begin operations via an initial personal survey.

-

Biometrics. Going back to the point of increasing demand for security in financial tech, the usage of biometrics as a way of identifying the user is hard to miss these days in fintech mobile app development services. Biometric data uses fingerprints, face recognition, voice identification, even iris scanning to verify the identity of a customer.

Such a simple addition to the application ultimately builds trust between the business and the consumer by minimizing the chances of fraud as well as providing an enhanced experience where customers won’t need to manually enter safety passwords and codes, using their biometric data instead.

-

Artificial intelligence. No matter where you look about how to develop a fintech app, the noise around artificial intelligence and machine learning will follow. That shouldn’t shock you since the technology has stepped so far that users demand it in their day-to-day activities.

The integration of AI into the application can come in various forms from fintech app development companies, from improved analytics and daily task automation to tailor-made financial advice. It is also a proven helper in credit score evaluation and loan assessment, freeing up the time for users to focus on more essential tasks.

There are certainly other trends in financial mobile app development to think about, such as chatbots, decentralized finance (DeFIi), regulation technology (RegTech) and so on. The best way to go about them is to focus on their intent within your solution, discussing the pros and cons with your team instead of blindly developing features you might not need in the end.

Wrapping up

In summary of this article we can point out that financial technology is akin to deep waters — you require careful preparation and expertise before dipping your toes. To our best ability, we hoped to give you a straightforward yet nuanced answer to what stands for this topic, back you up with a typical process of creation, the key features, security concerns and trends to look out for.

All of these pieces of information paint a clearer picture of what to expect and what to be wary of, stirring you away from common pitfalls and adjusting your roadmap toward a successful operation.

Now that you leave more educated on the topic, you won’t find it so cumbersome to navigate this industry and set clear objectives for your solution. If you would like to receive professional help with fintech mobile app development, be sure to contact us for a free consultation. We are dedicated to delivering exceptional projects with our extensive experience in this sector.