Build a Website that Accepts Payments: Boosts your Sales

Today, the skyrocketing demand for knowledge about what it takes to create a website with payment options has surged like never before as traditional offline segments unexpectedly find their footing online. Such a spike in popularity coincides with the rising proliferation of online transactions covering everything from making digital purchases to arranging mortgages remotely.

You should get well-versed in how to build a website that accepts payments if you are venturing into fintech or aiming to integrate an online payment system into your website. Mastering this skill will be the ticket to providing an error-free transaction process for your customers.

Being aware of how to create online payment website is a prerequisite for entering the booming world of online commerce. Having a dependable platform, like putting money on a deposit, is a surefire way to indicate excellent service for your clients while also securing your company’s growth.

What is a payment system?

A payment system is a network where payment organizations can be both local or international and carry out their activities on the territory across multiple countries, facilitating the transfer of funds within the limits of the network including cross-border transactions. An international payment system must handle the transfer of funds as a non-negotiable function. The most well-known players in this arena are VISA, Mastercard, American Express, UnionPay and JCB.

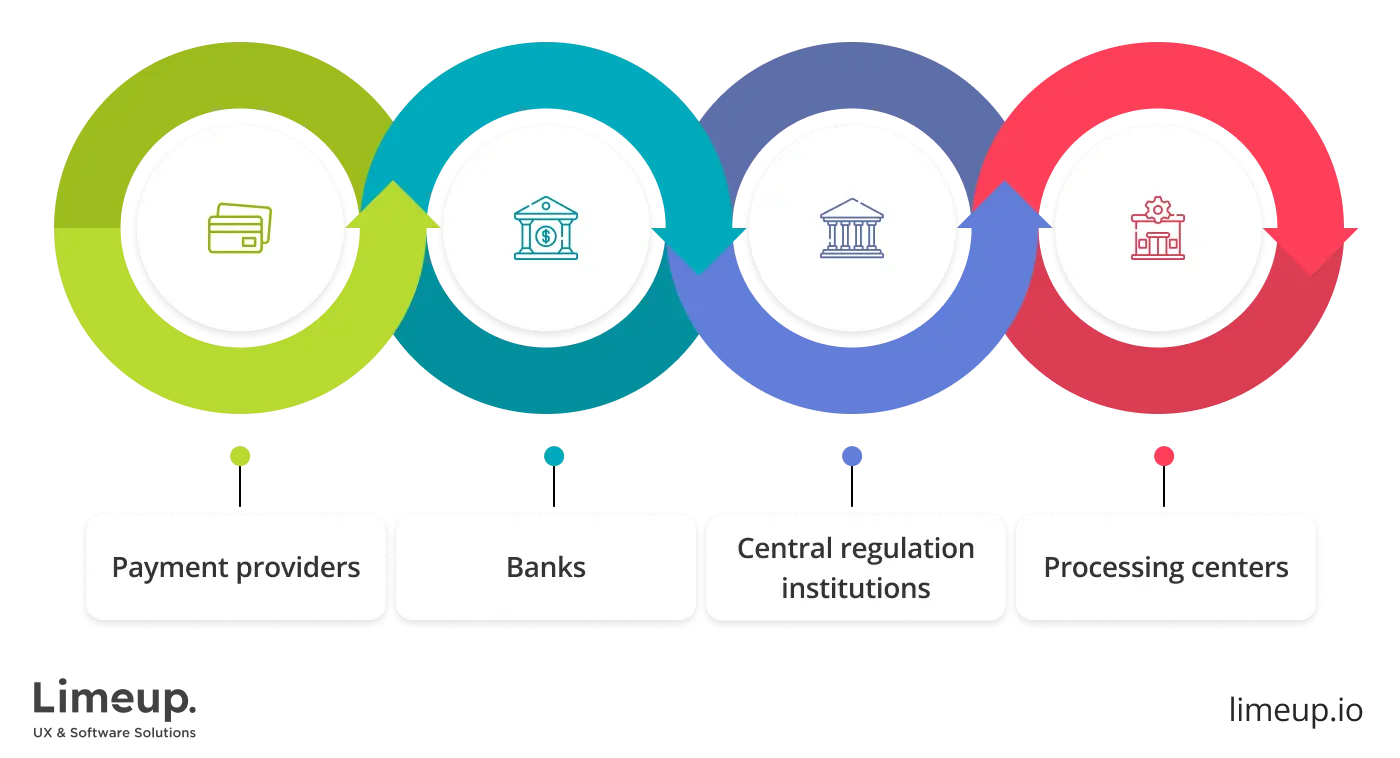

It consists of various components including:

- Payment providers: entities that offer payment processing services.

- Banks: financial institutions that process transactions and maintain customer accounts.

- Central regulation institutions: authorities that oversee and govern payment systems verifying they comply with legal and financial standards.

- Processing centers and tech infrastructure providers: organizations that administer the technical aspects of transaction processing covering security and data management.

To build a website with payment options, web development services specifically designed for the fintech sector should be taken into consideration. There are various kinds of these services thus systems must also be certified internationally in accordance with authorized PCI DSS standards at various coverage levels:

Domestic acts exclusively within their home country, functioning solely as residents and not extending their operation beyond national borders.

International is a large-scale organization operating in many countries, offering various types of accounts and large list of currency in circulation.

Virtual systems fall into two categories: banking and non-banking. The former one is a subject of a central banking structure therefore it is obliged to obey it. Considered fully legitimate after getting the green light with the license, non-banking system has a different status allowing the procedure for checking their transparency to occur in a simplified format and they also include cryptocurrencies in circulation.

How to choose the payment system for your website

When deciding upon a payment system for your website, you must take into consideration a number of things that are of vital importance to the success of your business. We have rounded up some insightful tips to steer you in the right direction:

Check transaction restrictions. Payment gateway providers typically set transaction thresholds, in particular Stripe, a major player, which imposes a minimum limit of $0.50 and a maximum of $999,999.50. Financial institutions may also impose daily or monthly transaction limitations hence be wise to inquire about them along with the other costs and make sure the limits sync up with your business needs, especially if you are selling lower-priced items.

Product compatibility. Inspect whether the gateway service you have chosen is appropriate for your products and services; some of them are limited to certain kinds, including digital or physical commodities. It might not be uncommon to develop a vendor with particular participation from only one kind of commodity, even though some suppliers might not care too much about the distinction between product types because they are willing to serve both ends.

Before exploring how to build a website with payment options double-check your chosen partner is up to your demands.

Pricing options. Quite distinct financial entities and associations within the fintech industry levy charges reflective of variables such as transaction volume, geographical location and nature of goods and services. Standard-issue expenses revolve around setup fees, monthly gateway charges and third-party fees in order to process & authorize transactions.

Payment methods. While not every payment gateway hits the mark with mobile wallet integration, but the top trio of Apple Pay, Google Pay and Samsung Pay have cornered widespread international recognition, teaming up with major credit card networks in numerous countries. Do your due diligence and give your payment gateway provider’s website a once-over to see which mobile wallets they support prior to creating a website that accepts payments.

It’s worth noting that mobile payments incorporate an extra layer of security known as tokenization, safeguarding your sensitive credit card details. The method guarantees that your information is never stored directly on your device; instead, a unique identifier is utilized for transactions.

How to create an online payment website with expert tips?

Constructing a website with online payment capabilities lays the ground and core of an online commerce system. You will guarantee a safe, smooth and intuitive payment process that increases client satisfaction and revenue by adhering to these crucial pointers.

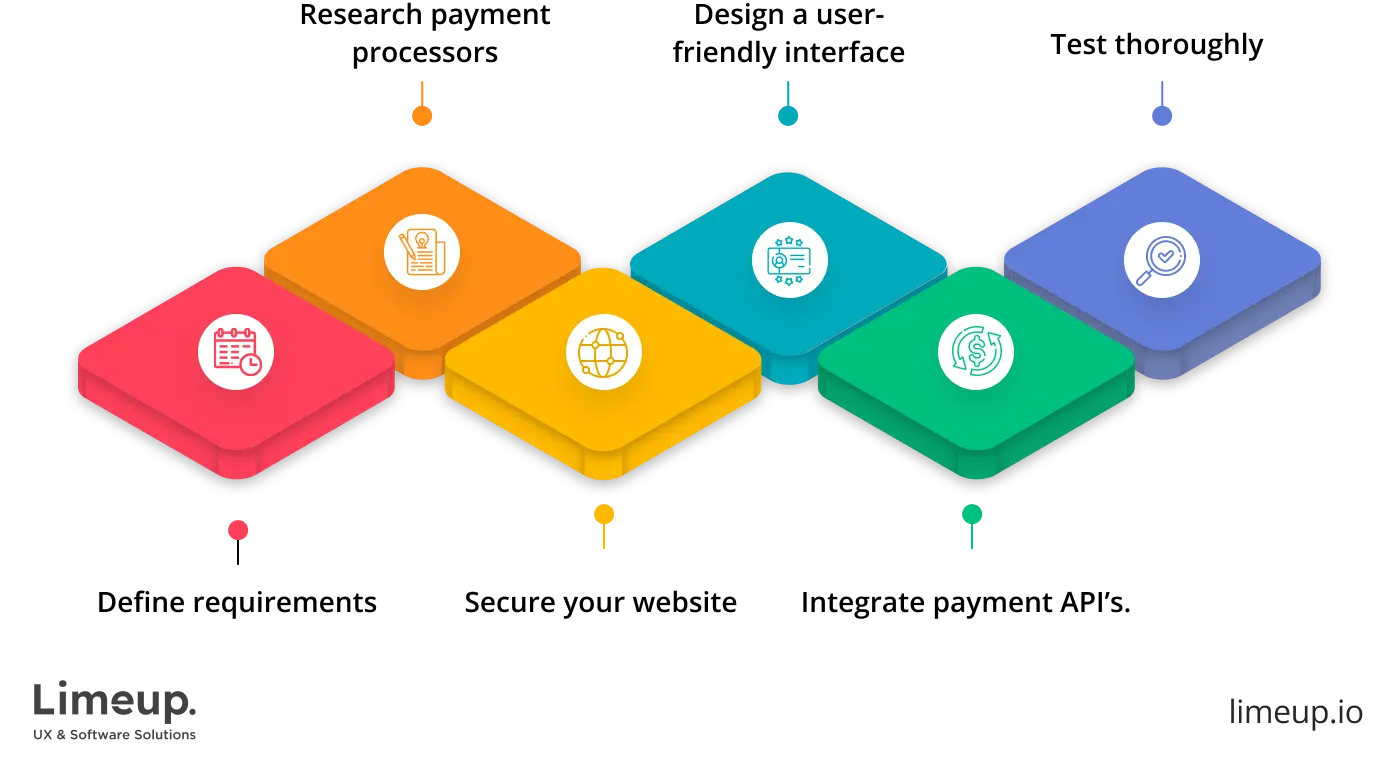

- Define requirements. Describe what your business requires and the expectations of your clients first. Decide which payment methods, such as digital wallets, debit and credit cards, you will accept — it will be your blueprint, similar to sketching the route before setting off on a journey.

- Research payment processors. Pick a payment gateway which should be in sync with your business requirements like a glove — some of them are PayPal, Stripe, and Square which collectively handle more than 100 million transactions per day. Make certain that it accepts your preferred types of currency and is compatible with your website.

- Secure your website. Verify that an SSL certificate is installed on the website — this encodes information and communication that users have with your website, much like locking the front door of your home.

- Design a user-friendly interface. A payment process should be as smooth as silk to avoid cart abandonment which is 70.19% according to recent research by Baymard Institute. It must be intuitive, easy to navigate and mobile-friendly at the same time: aim for a design that makes the checkout process a breeze.

- Integrate payment API’s. To learn how to create a website that accepts payments, start by using the APIs that your selected payment gateway has given. They are best understood as the go-between that enables interaction between your website and payment processor so that transactions run seamlessly. It is expected that it may take a period of 1-3 weeks before you can fully integrate with the software.

- Test thoroughly. It is also important to conduct a number of tests and examinations of the payment system before the site is fully launched. You should run not less than 20 test scenarios in order to find any issues — this is where you are expected to find all loose ends and make all the processes go off without incident.

Tips to create a website with payment options

Starting an online payment website can hugely benefit your business but at the same time it will not be an easy ride. Here’s a roadmap to help you navigate this journey:

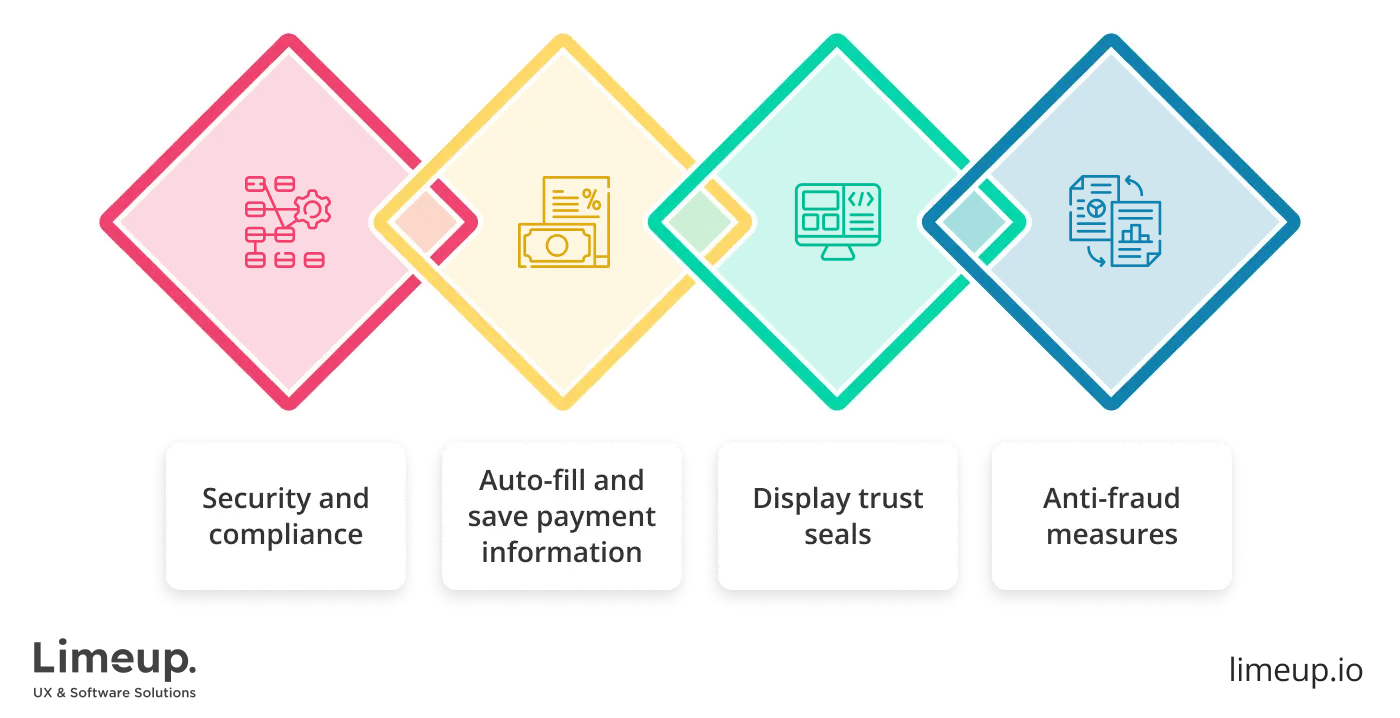

- Security and compliance. Set in stone your website is compliant with the Payment Card Industry Data Security Standard (PCI DSS). It is not just a tick-box exercise — if there is non-compliance then the fines may be as high as $500,000 per event. Keep your security measures up-to-date to stay ahead of potential threats.

- Auto-fill and save payment information. To drive the checkout experience fast, incorporate auto-fill for forms and let the users store their payment information safely. Studies reveal that 56% of customers are more likely to finish a purchase when their payment data are kept, and this may cut down checkout times by up to 30%.

- Anti-fraud measures. Once creating a website with payment options add sophisticated anti-fraud instruments such as 3D Secure (3DS) or address verification systems (AVS). These measures are useful to keep fraudsters at bay hence safeguarding your business and the users. Indeed, it is commonly known that an ounce of prevention is certainly worth a pound of cure.

- Display trust seals. The trust seals will go a long way in reassuring your customers that your site is secure, for instance, those from Norton or McAfee, and certifications such as PCI compliance badges. These could be the trust indicators that make a lot of difference in drastically reducing cart abandonment and, consequently, increasing sales by even up to 20%.

Core features for building a website with payment options

Ahead of customers parting with their hard-earned cash your website needs to be payment-ready. It leads to a more responsive transaction experience, putting both you and your consumers at ease.

- Diverse payment options. When you create a website with online payment options, offering a wide range of methods, like credit and debit cards, bank transfers, and digital wallets such as Apple Pay, Google Pay, PayPal and even cryptocurrencies — will go a long way toward increasing satisfaction among customers and greatly broaden your reach.

- Organized checkout process. An expedited login process like quest checkout, autofill address fields and progress indicators contribute to decreasing cart abandonment and keep your sales humming along. Don’t disregard the importance of optimizing the checkout experience for mobile devices, particularly because many shoppers are now whipping out their phones to make purchases on the go.

- Recurring payments and subscriptions. Automating those regular routines eases the load on your customers, keeping them content and your cash register ticking along as planned. With computerized subscription management, you have the capacity to dodge any billing snafus and keep everything running like a charm.

- Robust fraud prevention. Fraudsters are constantly on the gaze, but you have the capacity to strengthen your defenses. Make the most of tools like AVS (Address Verification Service) and CVV (Card Verification Value) checks to thwart purchases that were fraudulent. Moreover, parlay real-time fraud detection algorithms yielded by many payment gateways, effectively bolstering your security measures.

- Multi-currency and global support. With support for multiple currencies, your consumers will be in a position to comfortably look into the prices they are much easier get to the check-out process in a language they understand best, which is an experience that could turn first-time shoppers into loyal customers and thereby significantly enhance the conversion rate on your website.

- Detailed reporting and analytics. Go with a payment system that features thorough insights into your sales performance, as well as in the moment statistics and easy-to-read dashboards. Tools like that position you to spot red-hot trends, monitor transactions closely and strategize effectively, wrapping up your organization to remain on track for long-term success.

- Reliable customer support. Deciding on a choice to pay with a business that has round the clock help and support through various means of communication is always a reason to breathe easier knowing that help is just a click or phone call away in cases of any eventualities. With a firm customer support behind you there is no payment limitation which may affect customer satisfaction.

Create a website that accepts payments with robust security

Safeguard security for financial dealings, as fintech users rightfully put a premium on the safety of their data. When integrating payment options into your website, it really matters to go the extra mile to build user trust by guaranteeing their information is locked down tight.

The Payment Card Industry Security Standards Council (PCІ SSC) administers the PCI Standards, which establish industry-wide security protocols for payment systems, acting as a protection for conformance to PCI and safeguarding sensitive information regarding card holders with best practices. In a section with tips, we have already talked about PCI, but let’s look closer at key tenets of PCI Standards:

- Secure transmission and usage. Information such as card numbers has to be sent and utilized in a safe mode in order not to pose a threat of interception.

- Improved security. To create a website with payment options and protect any other sensitive information, the site must be hardened and monitored closely and undergo frequent security checks.

- Annual security audits. Seasoned security professionals conduct periodic checks on the system in order to ensure that the mentioned measures provide the guarantee of a fort-knit security structure and standard.

Tokenization pops up as a viable strategy for guarding user data, enclosing card information in a unique set of characters (a token) to shield sensitive financial details. Functioning as a stand-in for the card number, this token raises the stakes for security precautions on websites with payments by preventing retailers from ever holding critical financial information.

The Secure Sockets Layer (SSL) protocol forms the bedrock of all online transaction processes whereby sensitive data sent from your website to the user’s browser are encrypted to minimize the risk of interception. Personal data like a credit card number or login credentials remain safe and invisible to third parties due to such encryption.

Sensitive information, such as credit card details and login credentials, stays confidential and unreadable by unauthorized parties thanks to this encryption. To build a website with payment options, implementing SSL is a surefire way to enhance the security of all website operations, especially those involving payments. Most web hosting providers have SSL certificates up their sleeve offering a readily available solution for boosting your website’s security.

A secure platform is becoming the backbone of success in the field of fintech. Making PCI compliance, tokenization and SSL implementation top priorities creates a trustworthy environment for your users, instilling confidence in your services and laying the groundwork for a thriving business.

Tech stack fundamentals to create an online payment website

Take into consideration the tech stack to be your website’s building blocks — a layered system, with every level offering a distinct purpose. Here is a breakdown of the main components:

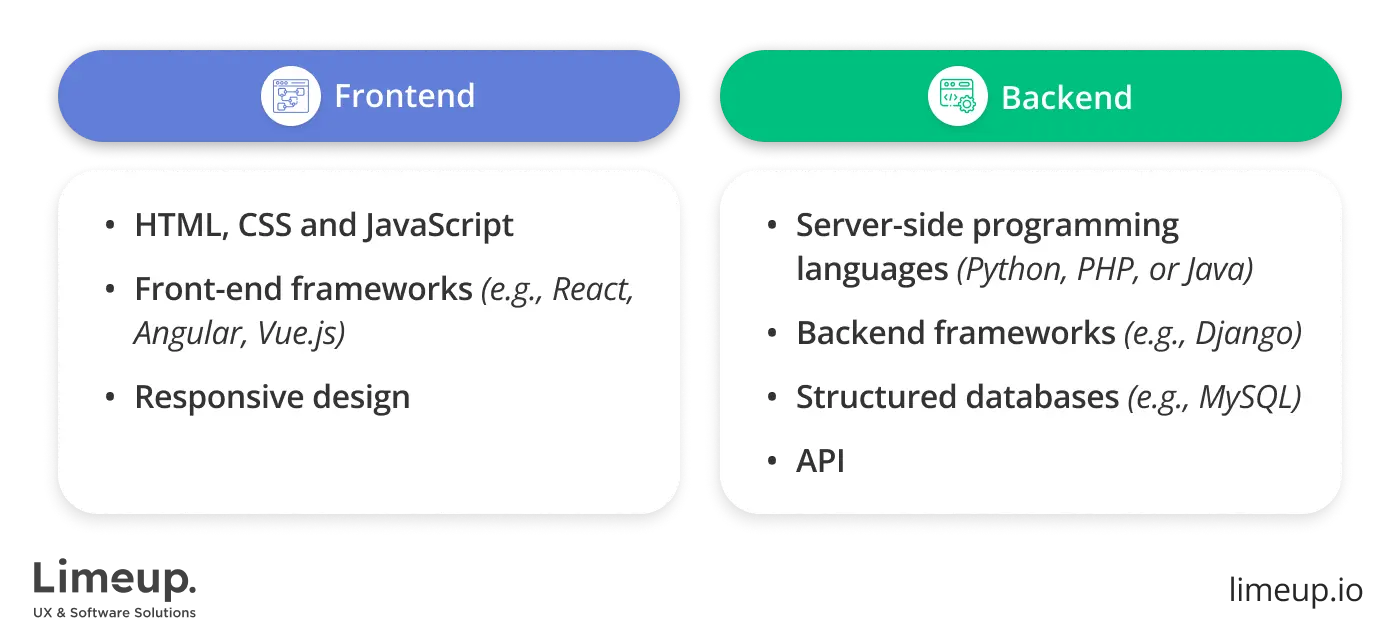

Frontend

This is the user-facing side, the shop window where customers browse products, add them to carts and proceed to checkout. Popular choices include:

- HTML, CSS and JavaScript are the basic structural blocks of each web page, providing structure, styling and interactivity.

- Building a website with payment options, front-end frameworks (e.g., React, Angular, Vue.js) transmit pre-built components and upgraded structure, speeding up development and improving maintainability.

- Responsive design pledges that your website is mobile-friendly, which must be considered as more people access the internet via smartphones and tablets.

Backend

The engine behind the scenes, handling data processing, server communication and functionalities like user accounts and payment processing. Here are some common backend options:

- Server-side programming languages like Python, PHP, or Java power the backend logic and interact with databases contributing to how to create a website with payment options.

- Backend frameworks like Django and Ruby on Rails convey structure and tools for developing sophisticated online applications, both of which have unique capabilities and community support.

- Structured databases such as MySQL or PostgreSQL are best for interconnected data, however, flexible solutions like as MongoDB have greater potential for scalability with massive datasets.

- API. Integrating with payment gateways, third-party services and internal systems commonly requires well-defined APIs in order to simplify communication.

Choosing the right tech stack. To create a website with payment options you should choose the ideal tech stack depending on several factors, so there’s no one-size-fits-all solution:

Project scope. An inadequate framework might do the trick for a store with a limited assortment of goods, but an expansive platform necessitates a more beefed-up technical stack.

Development expertise. Take a measure of your team’s capabilities and comfort level with particular technologies.

Scalability needs. If you foresee substantial expansion, go for a stack that’s geared up to handle higher traffic and larger data loads effectively.

Build a website that accepts payments: know the trends

The digital payments sector is experiencing a meteoric rise, with envisioned transaction values reaching a staggering US$16.62 trillion by 2028. This phenomenal growth isn’t lost on businesses with a clear shift towards embracing digital payment options.

A rather bleak picture is outlined by the Worldpay Global Payment Report that anticipates that cash will be used 6% a year by 2026 as consumers are finding digital payment solutions to be more convenient, secure and easy than handling cash.

Where do these numbers come from? Let’s explore the trends driving these statistics upward.

Modern consumers scream for instant access to their finances and the trend is as clear as day. A recent Forbes survey shines a spotlight on this shift: over 70% of Americans now favor digital wallets for both shopping and travel, a clear sign of the growing disdain for carrying physical cash. Even today, those who still hold onto cash will most likely jump onto the convenience and efficiency of digital solutions within the next 2 years.

While the upsides of digital payments shinе bright, security issues remain a thorn in users’ sides — 62% of users feel on edge when a payment system falls short on security measures. These findings underscore the need to put first strong security protocols when creating a website that accepts payments.

Economic uncertainties and global events like pandemics have stoked a desire for financial control among consumers. Digital tools hand users the keys to effectively manage their savings, creating a trend that’s not going anywhere.

Despite the computerized revolution, many customers still prefer traditional banks primarily because they value personalized service and the comfort they provide. Something that needs to be taken into consideration at all times is the virtue of excellent customer relations as it is the competitive advantage which is capable of saving the company and attracting customers.

With the help of blockchain technology and cryptocurrencies such as Bitcoin people are interested in new and non-conventional payment methods. Websites are now in a sweet spot to incorporate these innovative digital currencies and grant users added flexibility and the enticing appeal of transaction anonymity.

The BNPL services are already trending among those who decided to create a website that accepts payments and is more popular among the youth. The BNPL market is forecasted to grow with a CAGR of 26.1% from 2023 to 2030 with a likelihood of reaching $38.57 billion. This trend escalates the flexibility aspect of payment bills whereby the consumers can make their payment in installments without bearing the charges of interest for the higher exploited items.

The convergence of online and offline shopping experiences triggered the increase in omnichannel payments. In their purchasing journey, 73% of consumers harness several channels, and those who interact with retailers through multiple channels spend 10% more online and 4% more in-store than single-channel buyers, according to a Harvard Business Review analysis.

The use of subscriptions is growing across the industries mainly in entertainment services and food delivery services. More so, subscription e-commerce is expected to be approximately $6,396.96 billion by 2030 due to the increased use of recurring billings. Creating a website with payment options that easily support subscription payments allows businesses to tap into a lucrative and growing segment.

Conclusion

Digital payment capabilities grow and consumer preferences change so businesses must adapt to take advantage of opportunities in the growing online commerce market. To make a website that accepts payments, prioritizes security, embraces innovations such as blockchain and cryptocurrencies and delivers exceptional customer service — this approach will enable you to create a trusted platform that not only meets but exceeds expectations.

Staying on top of payment regulations, bolting on a smorgasbord of payment options and making the checkout process a breeze are all underpinning ingredients for forming a loyal customer base. Remember, crafting a smooth-running payment system isn’t just about ringing up sales – it’s about greasing the wheels of your business, flinging open the doors to a global audience and supercharging your success in the digital age.

These steps are essential if you’re having trouble figuring out how to organize online payments for your website so that your customers have a pleasurable purchasing experience. Contact Limeup to learn more about personalized solutions that will advance your company and promise safe client transactions.