UK Software Development Market Size & Statistics in 2026

The demand in UK software development is a clear indicator of the changing ways of British business tech. Off-the-shelf products have outlived their usefulness; the companies now require developed ones that can manage a difficult infrastructure, observe laws with high-end security, and give them the edge they need over the competitors.

This article examines the current state and future trajectory of the custom software development market in Great Britain. We will explore market size and growth projections, analyse revenue distribution across key segments and review salary trends shaping talent competition. The numbers tell a compelling story.

Software Development Market Overview in the UK

The United Kingdom is one of the top technology hubs in Europe, and software development is at the core of its digital economy. The market was around £43 billion in 2023 and is estimated to be over £56 billion at the current exchange rates by 2030 growing at a compound annual rate of 3.9% as per industry market analysis.

London, Manchester, Edinburgh, and Cambridge have turned into tech centres that are alive and kicking with startups, scaleups and software development agency operations offering new global technology solutions. The UK digital tech economy now employs close to 3 million people, 11% more over the past few years and the increasing role of the sector in the country’s economy is thus reflected.

The United Kingdom is positioned very well globally regarding the software development market. On the one hand, it is also the highest quality producer of worldwide software, while on the other hand, it is paying the lowest prices. The US ranks first in terms of market size, investment in innovation, and the whole of Europe is characterised by lower costs in some areas, but the UK offers a very good compromise with its highly trained personnel, favourable business environment, and good geographical location in terms of time zone.

| Region | Market size | Average hourly rate | Key strengths |

| UK | £47 billion | £40-80 | English proficiency, timezone advantage, strong fintech/AI expertise |

| Europe | £160 billion | £25-65 | Cost diversity, multilingual talent, GDPR compliance leadership |

| US | £420 billion | £80-150 | Innovation hub, venture capital access, largest tech ecosystem |

But the industry’s importance is not merely numerical. Modern banking platforms, eCommerce systems, healthcare apps and public services rely on sophisticated software infrastructure that is built and managed by a custom software development company in the UK.

Historical market growth

Over the last decade, the UK software development industry has not only seen impressive growth but has also undergone a remarkable transformation in its perception from being a hub for tech in the region to being one of the strongest contenders in the global market.

The country offers key facilities: a well-established digital infrastructure, a strong protection of intellectual property rights, and a high level of venture capital availability, which exceeded £11.3 billion in 2020, more than the total of France and Germany put together.

The cloud computing revolution (2015-2019)

The period of 2015-2019 was a turning point. The London tech industry became the biggest beneficiary of venture capital funding as the UK software development companies started adopting cloud-native architectures.

On-premise infrastructures to cloud services transition changed the whole software approach for businesses: cutting down on capital expenditure, making scaling up fast, and giving access to cutting-edge tools to all companies no matter the size. One could say a complete rethink of software delivery and consumption took place instead of just one technology being upgraded.

COVID-19 as an accelerant (2020-2021)

The crisis caused by the pandemic literally squeezed years of digital migration process into just a few months. The situation of remote workers, the booming of eCommerce, and the widespread adoption of telehealth demanded software solutions in all sectors urgently.

The software sector was an exception as it continued to provide software development services to the businesses which, in turn, created a demand for software developers. The pandemic caused them to invest in cloud infrastructure to revalidate their investments and also partly to facilitate the transition to SaaS which had already been their main model for the past decade.

The AI inflexion point (2022-present)

In the last few years, artificial intelligence has moved from being experimented on to actual use in production scenarios. According to McKinsey’s 2025 Technology Trends Outlook, AI has turned into “a foundational amplifier” of the other technologies overall. It is through AI that innovation has been made in the fields of robotics, scientific discovery, and enterprise automation.

For the software development community in the UK, this has resulted in the emergence of new prospects in the areas of agentic AI systems, machine learning integration, and application development powered by AI across the fields of finance technology, healthcare, and enterprise.

With over £14 billion in fresh AI investment secured in early 2025 and an average of £200 million flowing into the sector daily, opportunities for developers have expanded significantly.

The sector’s ability to withstand such factors as changes in the economy, technological disruptions, and world events has proved its core significance to the UK economy and has opened up the possibility of growth in the future as new technologies are developed and new opportunities for development are created.

UK software development market size in 2026

The basis for strategic decision-making in recruiting, capital allocation, and competitive research is provided by market value. These forecasts capture both current performance and expected growth based on real-time turnover data from software development firms operating in the UK.

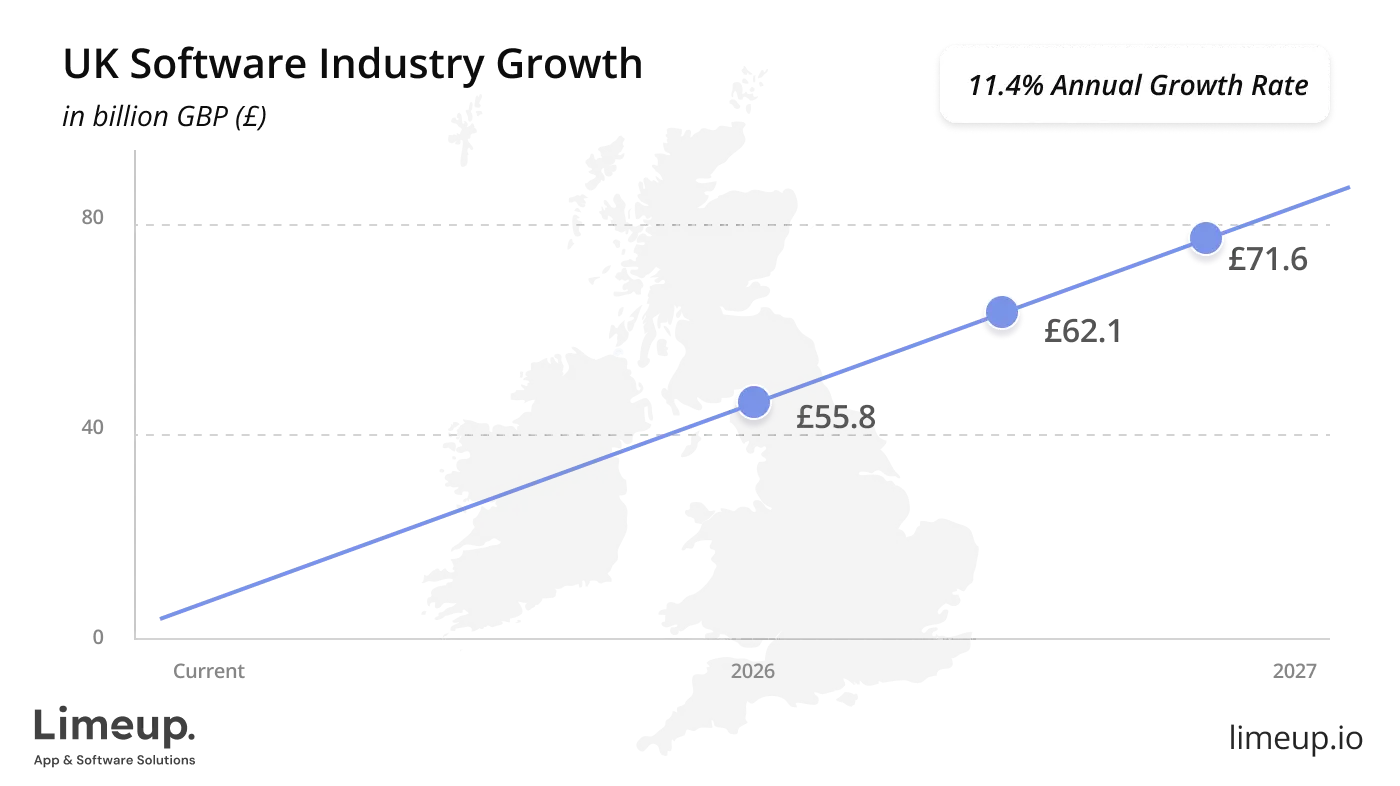

Projected market value

The British software development industry is quite vigorous, and this might be attributed to the factors of its digital transformation and the continual need for tailor-made software solutions. The Data City’s real-time industry classifications denote that currently, the sector, through its 11,424 active companies, generates a turnover of £55.8 billion.

With the sector’s growth rate estimated at 11.4% per annum, the industry is expected to reach around £62.1 billion in 2026 and £71.6 billion in 2027. Thus, the growth movement is considerably faster than that of the general software products market, which indirectly gives a picture of the high demand for custom development services, cloud solutions, mobile applications, and enterprise system integrations among others.

CAGR forecast

The findings of a recent report by Netguru show that the UK software development market will continue to grow at a compound annual growth rate (CAGR) of roughly 6.18% between 2024 and 2029.

The main contributors to the growth are still AI and data-related projects, continuous cloud and SaaS adoptions, heavy fintech investments in London,and higher corporate budgets for cybersecurity and compliance. National GDP growth is going to be slower, and business spending cycles will be tightened, which are the macroeconomic factors against which this growth will occur.

However, digital transformation is still a priority for most big companies’ boards, and these factors are not strong enough to halt the growth altogether, but they will definitely slow it down. Forecasts predict that AI-specific technology will experience much higher local growth, which will push the overall sector average further up.

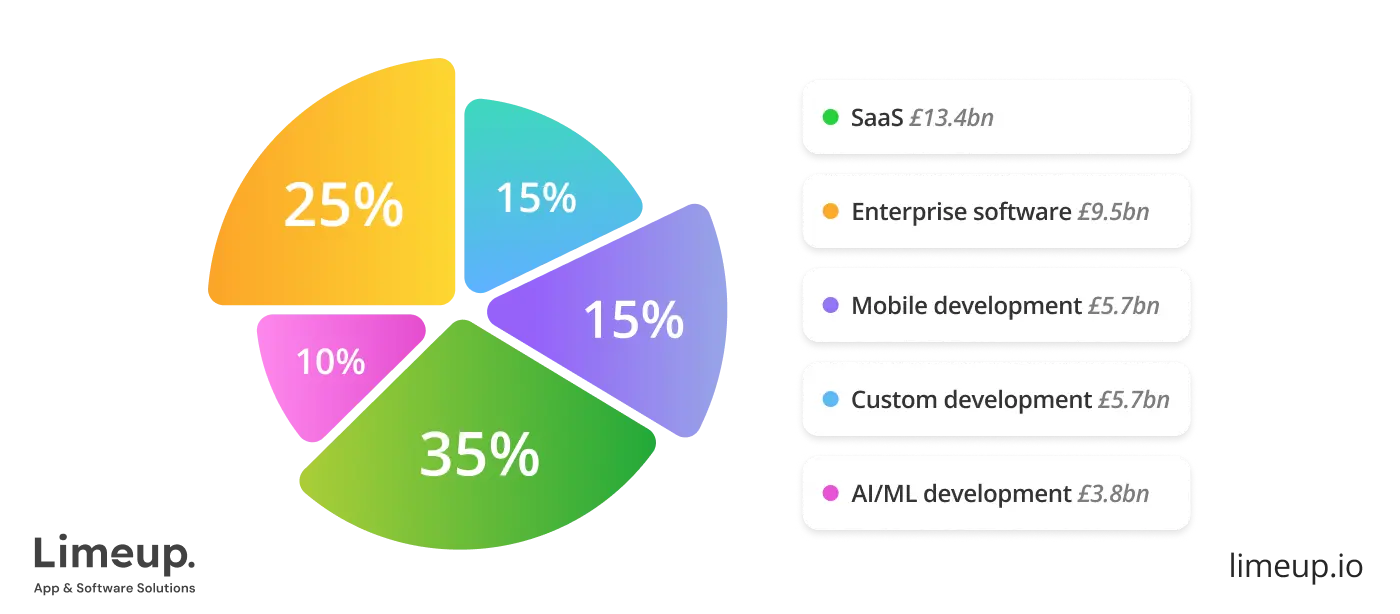

Market size by segment

Below is a useful distribution of the 2026 forecast through the major segments, which can be used for planning, pitch decks or fast sanity checks. The numbers are not precise; however, they are based on segment share patterns that have been noted in the most recent reports.

- SaaS £13.4bn (≈35%). Great combination of strong subscription revenues and fast SaaS adoption by enterprises keeps it the largest slice of the pie.

- Enterprise software £9.5bn (≈25%). Major spending still goes on by giant companies (finance, healthcare, government) on their basic systems.

- AI/ML development £3.8bn (≈10%). The vertical of high-growth: custom models, MLOps platforms, and AI integration projects.

- Mobile development £5.7bn (≈15%). Consumer applications and mobile experiences are still at the heart of the digital strategies of retail, banking, and travel.

- Custom development £5.7bn (≈15%). Bespoke systems, integrations, and professional services aimed at mid-market and enterprise clients.

SaaS and enterprise software hold 60% through steady subscription revenue and core business operations. AI/ML claims just 10% but attracts outsized investment as companies build intelligent features into existing products. That mismatch between current market share and capital inflows marks where the next expansion cycle begins.

Software development in the UK statistics (2026)

The figures paint an attractive picture of the current position and the future of the UK software industry. The statistics provide a detailed view of the market size and salary trends, as well as the distribution of the workforce, which gives us insight into both the large-scale growth and the forces that shape the sector. Let us elaborate on the numbers that characterise the territory.

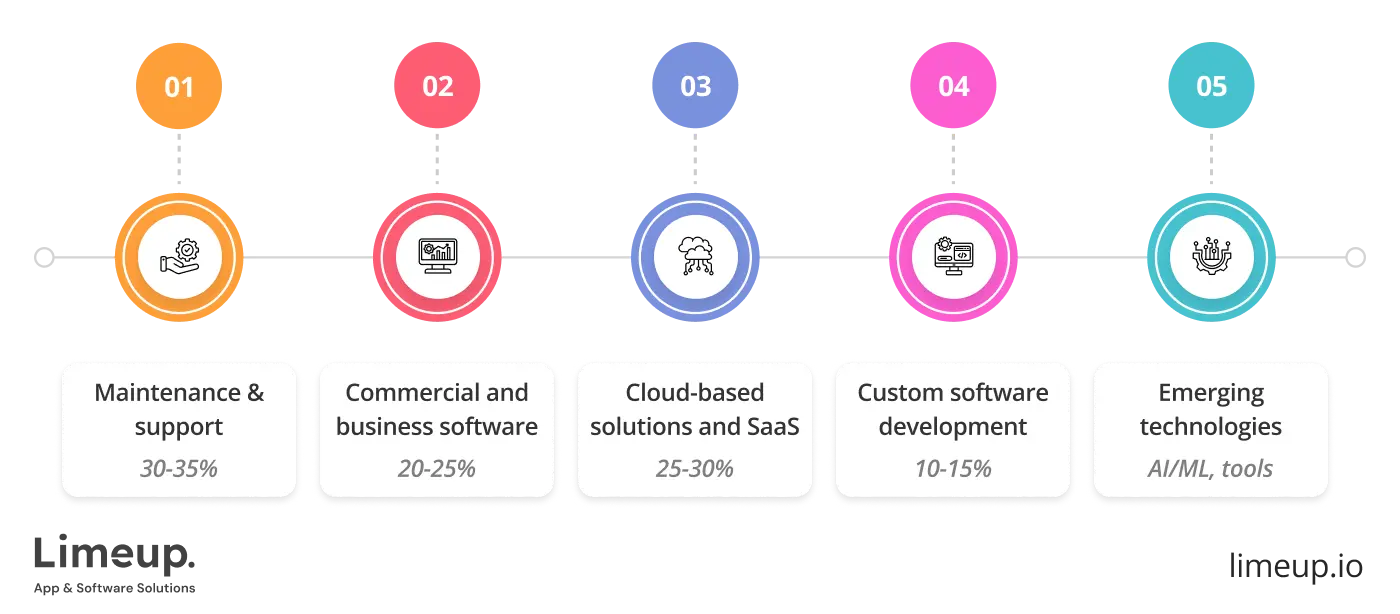

Revenue statistics

The UK’s software market is progressing steadily, with total revenue expected to amount nearly £33.4 billion in 2025 and £41.4 billion by 2029, according to Statista Market Insights. The annual average growth rate of 5.5% is mainly due to business digitalisation, cloud/SaaS adoption, and increased AI usage in business processes.

Analysing revenue by segments gives us an idea about money flows and the UK software company’s priorities:

- Maintenance and support (30-35%): The greatest part of the revenue comes from system maintenance: upgrades, bug fixing, and support of the old infrastructure. This indicates that there is still a high demand for reliable and up-to-date software in both private and public sectors.

- Commercial and business software (20-25%): The systems that take care of the finance, operations, and customer relations form the second-largest segment and thereby show that major companies are making ongoing investments in digital infrastructure that is critical to the business.

- Cloud-based solutions and SaaS (25-30%): Cloud technology and subscription-based products hold a considerable share of the market now, which is primarily due to the transition to remote and hybrid working places and the attractiveness of recurring revenue models.

- Custom software development (10-15%): Personalised applications and specialised workflow integrations always have a constant demand, even if off-the-shelf platforms are getting more advanced. Companies still require developments that are meant solely for their specific needs.

- Emerging technologies (AI/ML, digital platforms): Though these areas still make up a mere fraction of total revenue, they are developing fast and will probably take a larger piece of the pie in the coming years.

The described situation suggests a market that is powerful and varied at the same time. The UK software sector is not only getting bigger but also more intricate, with technology and custom software development services being increasingly fused together.

Segment market share

The hard public segmentation is limited but we can consider the following divisions in the UK market: maintenance and support, application software, cloud and SaaS, enterprise systems, custom projects.

Looking at the sector trends (SaaS and cloud adoption rise, enterprises modernise and custom work is in demand), a 2026 breakdown will probably look like:

- Maintenance & support + legacy software upkeep: about 30-35% of total revenue

- Enterprise & business-software (on-prem or hybrid): around 20-25%

- SaaS and cloud-native products: roughly 25-30%

- Bespoke software development and bespoke solutions: about 10-15%

- Emerging areas (AI tools, integrations, niche domains): a small but growing share

The splitting ratios are consistent with the findings of previous studies that the developed software market consumption pattern is similar for SaaS and other application software types with SaaS always leading.

Salary statistics

UK software industry pay is highly variable and it is determined by factors such as the employee’s experience, role, specialisation, and location.

An updated 2025 salary rates by Glassdoor gives approximate base-pay ranges:

| Developers Level | Outside London | London | Notes |

| Entry-level | £23,000-£33,000 | £30,000-£42,000 | Varies by region and employer size |

| Junior | £30,000-£40,000 | £36,000-£50,000 | First full-time dev role; rapid growth stage |

| Mid-level | £40,000-£55,000 | £50,000-£68,000 | Independent contributors; wider tech stack |

| Senior | £55,000-£65,000 | £68,000-£80,000 | Leadership expectations increase |

Competitive salaries that fall between London rates and the UK average are also offered by Manchester, Edinburgh, and Cambridge.

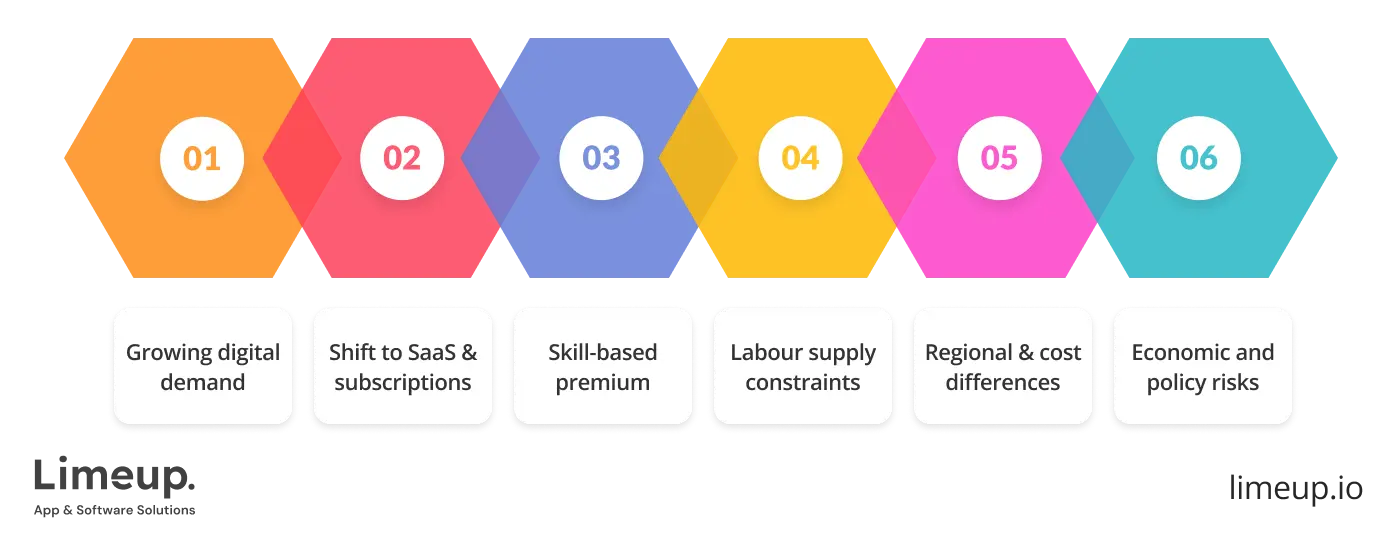

What shapes these numbers (key drivers & risks)

The market for bespoke software development in the UK has been influenced by a series of forces that are interconnected, and they range from changes in technology to the pressure of the economy. The knowledge of these basic drivers and possible risks gives very important context to the figures and also aids in understanding the reasons why some trends are getting stronger while others are facing resistance.

- Strong demand for digital transformation. It is difficult to estimate how much the demand for custom and enterprise software is going to be in the future as the companies in finance, retail, healthcare, etc., are moving their operations online step by step. This is good for the overall revenue growth of the business and healthy demand for skilled developers.

- Rise of SaaS/cloud and subscription-based models. Such recurring revenue models are stabilising the vendors’ income and at the same time enabling the growth in the application software and cloud-native segments.

- Skill premium for specialised roles. Software development company professionals with AI/ML, cybersecurity, fintech, or any other kind of niche skills get paid more than the market average. This contributes to the rising trend of average salaries in the market.

- Labour supply constraints. Despite a large number of employed developers, the demand is still greater than the supply of skilled developers, thus pushing the rates even higher.

- Regional variation & cost-of-living differences. Salaries in London and major tech hubs are generally higher than in the rest of the country due to the high cost of living and the competition for talent.

- Economic and policy risks. Macroeconomic slowdowns, regulatory changes, and global competition factors (like outsourcing, remote work, etc.) would affect not only the demand but also the budgets and hiring patterns.

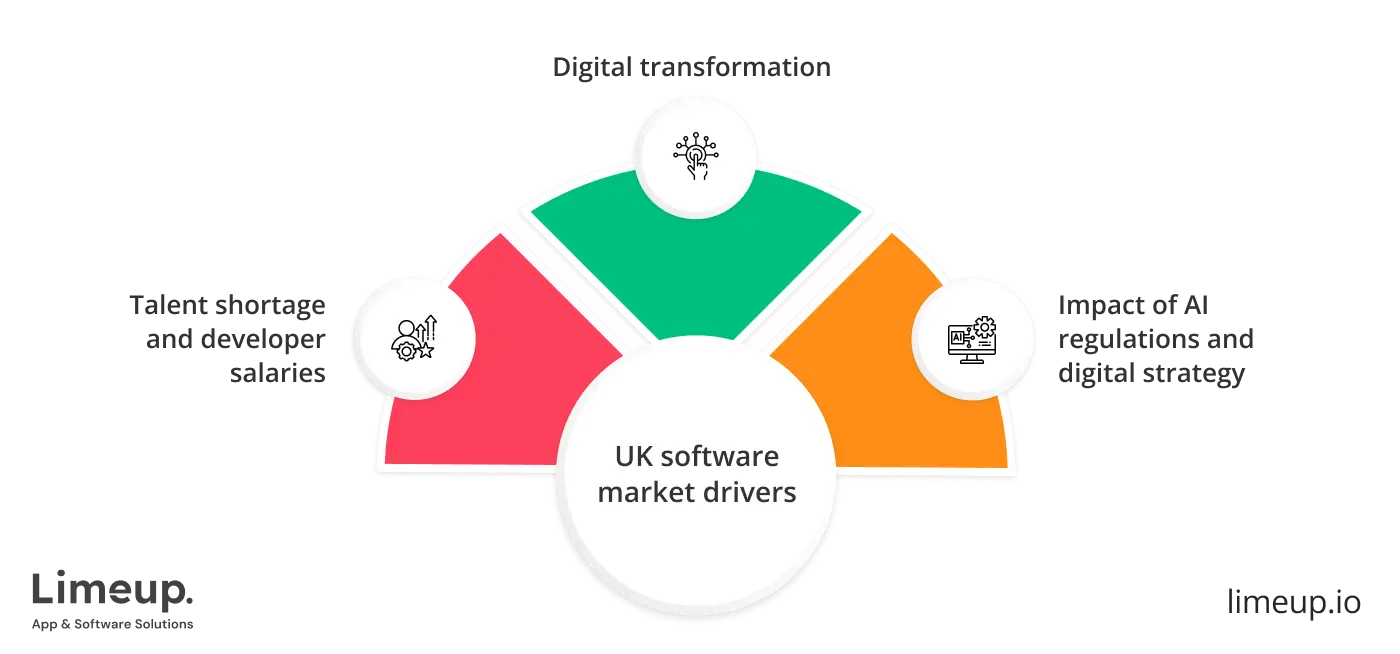

Factors influencing the UK software development market

The UK software development market continues to change as companies pick up cloud usage, automation, and new digital services the fastest. From then on, local capacity is not sufficient to meet the demand that is growing daily, and every change in policy, technology, or workforce dynamics is a cause that shifts the development strategies of businesses in the UK.

The fight for talented engineers, increasing operational costs, and regulatory updates are the factors that determine budgets and timelines of the UK’s software projects. Such factors lead to a situation where organisations are trying to be competitive while at the same time facing restrictions that are impacting their ability to hire, innovate, and deliver.

Talent shortage and developer salaries

The UK tech sector currently faces a serious skills gap. A large number of companies report difficulties finding qualified developers, especially in in‑demand areas like AI/ML, cloud, and cybersecurity.

As a result, developer salaries have surged. For instance, in 2025 median pay for AI and machine‑learning engineers from bespoke software development company reached around £112,000, while cloud‑infrastructure specialists command about £98,500. This shortage and the associated high salaries shape the market in several ways:

- Firms face rising labour costs for new hires and struggle to fill open positions.

- Some companies delay or downsize projects due to lack of available talent.

- Demand-heavy skill sets attract strong pay premiums, making them competitive globally and pushing UK companies to rethink recruitment or outsource.

Overall, limited talent supply and rapidly rising salaries increase costs for businesses while driving market consolidation around companies able to secure top developers.

Digital transformation

Another major driver for growth in UK custom software development for startups and enterprises is broad digital transformation across industries. Traditional companies, from finance to retail to healthcare, are accelerating their shift to cloud, SaaS, and modern software architectures.

That push results in several important trends:

- Strong demand for custom and enterprise‑grade software solutions, as businesses replace legacy systems and move custom software development solutions online.

- Increased adoption of cloud‑native architecture, microservices, serverless computing, and SaaS platforms, which demand new development practices and specialist skills.

- Growth of low‑code/no‑code tools for faster deployment and enabling non‑technical staff to deliver solutions, giving companies flexibility and speed.

Digital transformation creates sustained demand across software segments: enterprise systems, cloud/SaaS, mobile and web apps, custom solutions, which in turn fuels continued growth and diversification of the market.

Impact of AI regulations and digital strategy

The rise of AI in UK business and public‑sector planning also shapes the tailored software development landscape — both as opportunity and challenge. Many firms now invest in AI/ML‑based solutions, integration of AI tools, data analytics, and automation.

However, that surge is accompanied by growing regulatory and compliance demands. Strict data‑protection laws, security and privacy requirements, and emerging AI regulation require developers to follow higher standards and often integrate compliance concerns from the very beginning, which complicates development and raises costs.

Because of that:

- Demand grows especially for specialists who can navigate both AI/ML and regulatory compliance.

- Software projects increasingly include security, data‑governance, and compliance as integral parts — not afterthoughts.

- Software development companies in the UK that deliver solutions with built‑in regulatory compliance and security get a competitive edge.

In short: the push for AI and digital transformation (Stack Overflow recently reported a surge in UK demand for AI and machine‑learning engineers, with median salaries rising), combined with strong regulatory pressure and national digital strategies, means the UK software market is evolving fast and only companies that adapt to these complexities will thrive.

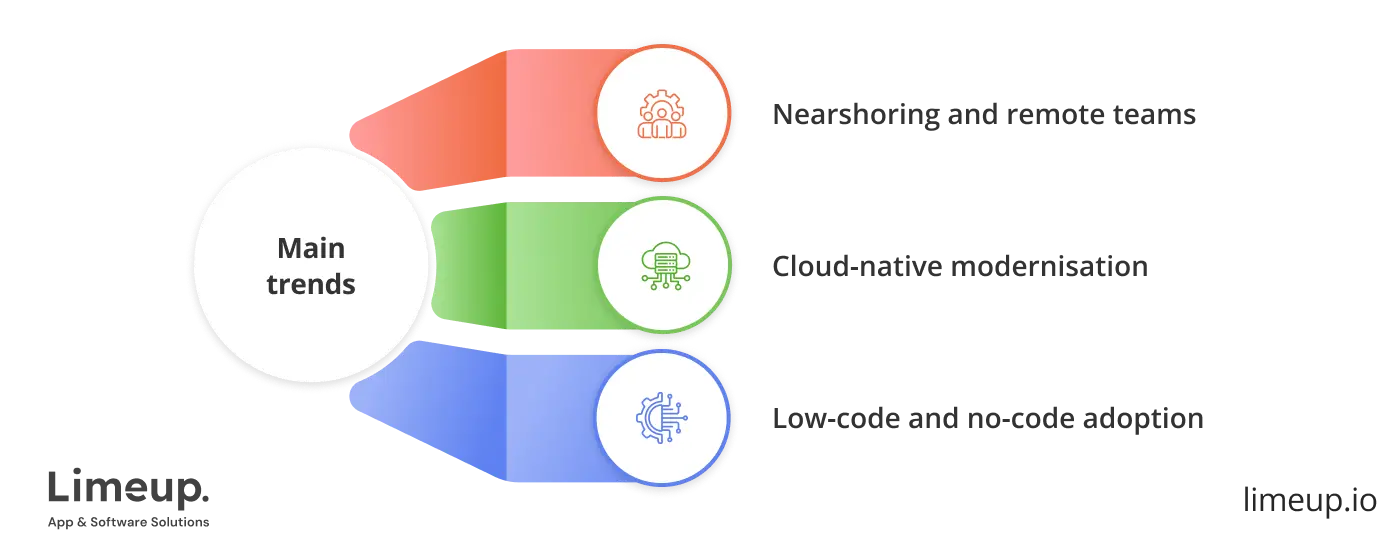

Trends in custom software development in the UK

The UK software industry is in the middle of a real transformation. Organisations no longer accept off‑the‑shelf apps as the final answer. They want to cooperate with IT company in the UK offering custom solutions that scale, integrate with legacy systems, and stay future‑ready. Behind that shift lie three major trends reshaping how software is built and delivered and giving UK companies more flexibility, speed, and competitive edge.

Nearshoring and remote teams

With growing demand and fierce competition for developer talent, many UK firms have turned to nearshoring and remote teams. Outsourcing to Eastern Europe and other regions gives access to highly skilled developers at lower cost — while still avoiding the logistical overhead of far‑flung time zones.

As one forward-looking industry report puts it, over 60% of UK organisations plan to maintain or increase outsourcing as they struggle with local talent crunches. This approach helps firms staff up fast and scale flexibly, combining local leadership and remote execution. When managed properly — with clear communication, agile workflows, and modern tools — remote teams can deliver results on par with in-house development.

Cloud‑native modernisation

Cloud has transitioned from being a “nice-to-have” option to a “must-have” solution in the UK. Approximately 94% of businesses have adopted cloud services in one way or another and the software development industry is quite dominated by cloud-based apps.

What is even more significant is that a lot of UK firms are going for cloud-native structures, such as microservices, containerisation (for instance, with Kubernetes), and serverless setups, to create infrastructures that are more scalable, robust, and manageable.

For sectors like fintech, healthcare, or retail, which demand both persistence and rapid changes, the use of cloud-native is a necessity. As cloud-native adoption rises, companies face fierce competition to hire a software developer proficient in containerisation, multi-cloud architectures and CI/CD pipelines, skills that command premium salaries in today’s market.

By switching to cloud-native, organisations can implement updates more quickly, carry out deployment in different parts of the world, decrease infrastructure expenses, and guarantee compliance.

For the customers and end users, it implies that the applications will always be available, will provide consistent and good quality services, and will undergo changes without causing and being accompanied by downtime painful for the clients.

Low‑code and no‑code adoption

The emergence of low-code and no-code platforms is another significant factor leading to the transformation of the UK software development industry. These handy tools not only allow developers but also other departments, such as marketing, to create applications without going directly into coding.

The effects have been incredible: in 2024, nearly two-thirds (63%) of UK enterprises were using such solutions, which is a significant increase from the previous percentage of 41% in 2022. A cluster of popular platforms is helping teams build faster than ever:

| Platform | Primary use case |

| Bubble | Advanced web applications with complex workflows |

| Glide | Turning spreadsheet data into internal tools |

| Webflow | Professional websites with CMS capabilities |

| Softr | Client portals and business apps on Airtable |

| Loveable | Interactive web apps with UX-focused features |

This wave of adoption is indicative of two major factors, namely the scarce availability of software developers and the immediate requirement for digital solutions.

By automating the development process, software development agencies can get their hands on the internal software, prototypes, or even complete production apps much quicker and at a lower cost. The UK low-code platform market is estimated to grow at an annual rate of roughly 20% and forecasted to reach several times its present size by the year 2030.

For a majority of SMEs in the UK and rapidly growing teams, the low-code/no-code platforms are turning out to be a boon for swift iterations: they are able to launch, test, and modify the software within days or weeks as opposed to months.

Besides, large organisations can take advantage of this whereby they get to assign their senior developers to work on the intricate and high-value areas of the system while the low-code tools take care of the routine workflows.

Conclusion

The UK software development sector in 2026 holds a mixed bag of opportunities and challenges. The clinch of digital transformation which has taken the financial sector, healthcare, retail and enterprises will be augmented by AI-driven tools and cloud technologies.

At the same time, there will be a continuous shortage of skilled workers and an increase in costs that will make nearshoring, flexible hiring models, and low-code/no-code platforms present as the organisations’ primary solutions rather than temporary fixes.

To be successful it is required not only to use the newest technology. Modern software development company in the UK will manage to fuse together the adoption of new regulations and the market’s needs and user-centred design. They will be the ones to create products that deliver long-term value, not just quick returns.

If you are going for a fresh product or the improvement of an existing one, a proper development partner is a must. Limeup’s expertise lies in developing user-friendly and scalable digital solutions that are going to be supported with growth for long term. Reach out to Limeup for turning your idea into reality with the help of professionals.

FAQ

How big is the software development market in the UK?

The UK software development market is expected to attain around £62 billion by 2026 and will continue to grow steadily until 2030. Important aspects of the market include:

- More than 28,000 active development companies present all over the country

- A yearly digital transformation-induced growth rate of 3.9%

- The main growth drivers: Cloud, AI, and bespoke applications

- Dominant sectors: Finance, retail, SaaS, healthcare, and public services

What is the fastest-growing software segment in the UK?

App software is at the forefront of the growth trend, accompanied by vigorous growth in SaaS, cloud-native and AI-assisted business apps. Enterprise solutions like CRM, ERP, and workflow management tools are also experiencing radical growth as companies in the UK revamp their internal systems and the platforms that interact with customers.

Which industry invests the most in software development UK?

The financial services industry continues to be the largest investor in secure software development, driven mainly by the growth of fintech and the demand for a digital infrastructure that is both compliant and secure. Other major investors include:

- Retail & eCommerce. Automation, inventory management, and digital customer experiences

- Healthcare. Telemedicine platforms and patient management systems

- Technology sector. SaaS product development and innovation

- Manufacturing. IoT integration and supply chain optimization