UK Nearshore Software Development: Key Statistics for 2026

British technology leaders continue to grapple with no less than the same puzzle: how to stretch existing budgets without compromising quality and clarity. Nearshore software development brings UK brands a potential solution to access expert staff with time zones that remain remarkably similar.

We, Limeup, have more than a decade of involvement in directing nearshore software development for UK customers. Our team has taken a practical approach and used data available in publications such as Statista and Stack Overflow to establish standards that British firms can use to guide their decisions about nearshoring this year.

The research brings out a remarkable shift in the manner UK companies seek nearshore custom software development collaborations. Cost arbitrage alone no longer drives decisions as cultural alignment, technical specialisation, and regulatory compliance now carry equal weight. Read on to benchmark your approach against current market realities.

Why do UK сompanies сhoose nearshore?

Whether to opt for nearshore software development instead of offshore and domestic recruitment isn’t black and white. Usually, for UK companies, this strategy serves as a means to address more than one issue. Let us discuss why those issues are important.

-

Time zone alignment. Software development companies in Poland or Portugal are in a one to two-hour time zone window for UK time, making real-time collaboration possible. Daily scrums, code reviews, and bug fixes happen in this overlap of hours, not through a cumbersome asynchronous process.

For projects requiring frequent iteration from product builds to MVP launches this alignment of nearshore agile software development reduces cycle times measurably.

-

Talent access remains a constraint. The UK technology community has struggled with gaps in the labour force. This includes a focus on cloud architecture, machine learning approaches, and maintaining existing systems.

A number of software development occupations have recently emerged in the UK government’s official Shortage Occupations List. This indicates that local talent doesnot satisfy employer demand.

Nearshore markets such as Ukraine, Romania, and Poland graduate substantial numbers of computer science students annually, creating deeper candidate pools for specific technical skills.

-

A regulatory rule-book that is simple. Costs are always important. But the equations have become more complicated with Brexit, introducing more complex elements around data management, travelling between countries, and contracting.

UK companies must now weigh their hourly fees with GDPR regulation requirements, intellectual property protection, and accessible legal remedies. Nearshore European partners typically operate under the same regulatory frameworks and thus due diligence becomes easier compared to outside EU/UK adequacy agreements.

In other words, while nearshore success requires a delicate blend of cost efficiency and lower risk associated with operation and legal frameworks, a cheap price tag definitely does not.

UK nearshore software development landscape

Over the past decade, changes have taken place in the UK geography of outsourcing. While India and the Philippines dominated earlier waves of offshore development, British nearshore software development company now directs a growing share of their software budgets toward European partners.

This represents lessons learned regarding friction in communications, quality variability, and coordination overheads for teams based eight or more hours ahead of or behind London.

Shift toward CEE engineering talent

There are strong offerings among Polish, Romanian, and Ukrainian engineers that match perfectly with British technical quality: strong foundations in maths and computer science concepts, system design skills, and practical awareness of a broad range of enterprise technology stacks.

The EF English Proficiency Index 2024 ranks Poland 15th globally and places Romania, Hungary in the “very high,” “high proficiency” section since it is a practical necessity for UK projects requiring precise technical communication.

Evolution of outsourcing models

UK nearshore collaborations have matured beyond simple contractor hiring. British nearshore software development agencies now structure partnerships in three primary ways:

- Staff augmentation — individual specialists joining UK teams for defined periods, useful for short-term capacity gaps.

- Highly dedicated and loyal teams — nearshore crews that work in concert for a single customer in the UK, managed together with a British engineering lead.

- Product partnerships — a nearshore software development company with a feature ownership or end-to-end product development mandate.

The demand for expertise in AI and cloud computing

UK nearshore software development service demand now centres on specialised skills rather than general development capacity. Today, UK engineering companies pursue experts in cloud-native architects who understand cloud-native architecture (AWS, Azure, and GCP), MLOps professionals, and data engineering expertise.

The UK machine learning community based in London, Cambridge, and Edinburgh stimulates a high demand for machine learning integration and hands-on experience for businesses. The Stack Overflow 2024 Developer Survey indicates a total of 61.8% of programmers who target daily usage of AI tooling.

Cloud migration drives equal urgency and gathers projected public cloud spending exceeding $679 billion in 2024 according to Gartner. British financial services, healthcare firms, managing legacy systems, require nearshore partners fluent in containerisation and infrastructure-as-code.

If you are assessing nearshore alternatives for your business when looking for the best nearshore software development company everything that follows presents a series of benchmarks that matter most: developer cost structures for major markets, access to skilled talent for particular skill sets, and cost comparisons for 2026 budgets.

UK nearshore market statistics for 2026

Nearshore market data isn’t like checking stock prices. Sources vary, methodologies clash, and nobody’s tracking this stuff consistently.

No standardised reporting exists for outsourcing. What you get instead: analyst estimates, association surveys, vendor data. All useful, rarely consistent.

The following are synthesised reports about nearshore software development teams based on available literature with source types identified. Use them as directional indicators rather than precise predictions.

Expected nearshore market growth

Let’s talk numbers but with a caveat. Nobody tracks “UK nearshore software development” as its own category. The ONS doesn’t publish it. Neither do the big consultancies. So we’re working with broader market data and drawing connections.

Statista 2024 analysis puts the global IT outsourcing market at $806.55B by 2030, growing around 6.51% annually. That’s the whole pie.

The slice that matters to UK buyers? Grand View Research pegs European IT services growth at 9.7% per year through 2030 and CEE (Central and Eastern Europe) is outpacing Western Europe within that.

What does Brexit mean for all this and nearshore software development firms demand? The barriers didn’t really change with service delivery across borders flowing pretty freely.

Nearshoring appears to remain a strong consideration for agencies in the UK today with Brexit considerations, some recruitment barriers for EU employees have intensified, while contracting primarily remains much the same: providing services remains less problematic than recruiting staff.

Cost savings benchmarks

Comparative ratings establish a budget parameter while underlying costs continue to evolve with seniority level and engagement strategy. If you are considering working with a software development outsourcing company in the UK, you can click on the material and read on about this option.

The table below uses 2024 data from Glassdoor, PayScale and industry salary surveys (for more precise information about a particular nearshore software development team it is advisable to check the sources as the data can vary and change).

| Role | UK | Poland | Ukraine | Portugal |

| Mid level coder | £55,000–£75,000 | £25,000–£38,000 | £18,000–£28,000 | £28,000–£40,000 |

| Senior engineer | £75,000–£100,000 | £38,000–£55,000 | £28,000–£42,000 | £40,000–£58,000 |

| Tech lead | £90,000–£120,000 | £48,000–£70,000 | £48,000–£70,000 | £52,000–£72,000 |

Figures represent annual salary equivalents for full-time engagement. Agency and contractor rates typically add 20–40% for overhead and margins.

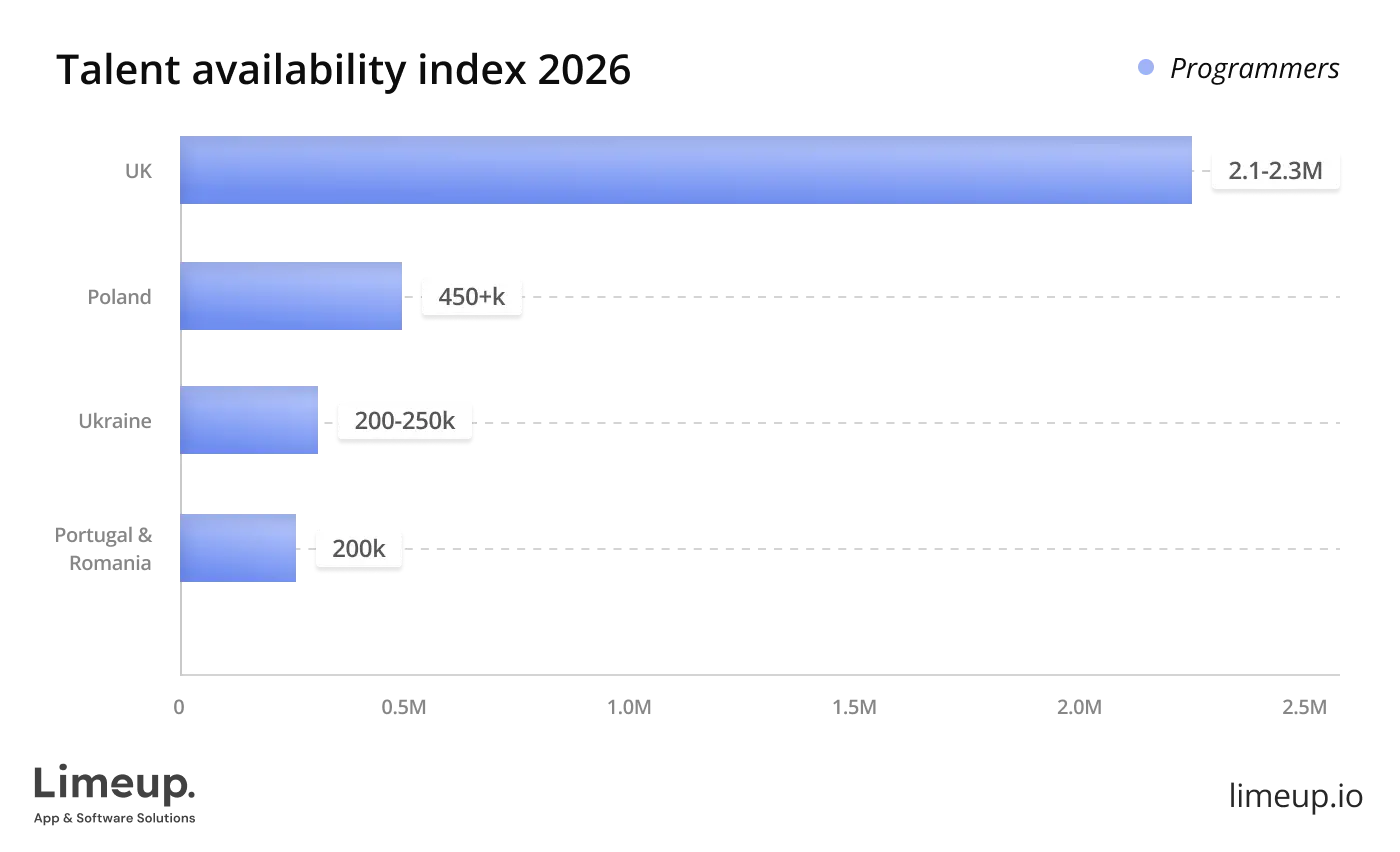

Talent availability index 2026

There is no single registry that tracks all developers by country and skill, which makes it difficult to quantify available talent precisely. Availability of nearshore supplies in the UK can, however, be estimated from several data points.

Listed below are estimates of the number of programmers in the nearshore software development companies (sources: GitHub State of the Octoverse, Stack Overflow surveys).

Below you will find programmer population estimates (sources: GitHub State of the Octoverse, Stack Overflow surveys that shed light on capabilities:

- UK: 2.1–2.3 million tech workers overall with demand consistently outpacing supply. The UK government’s Shortage Occupation List includes multiple software roles.

- Poland: 450,000+ IT specialists with approximately 25,000 new degree holders annually.

- Ukraine: 200,000–250,000 active IT workers (down from 285,000 pre-2022, per DOU.ua industry surveys).

As for Portugal and Romania, there is a growing tech sector with increasing competition from US and UK global and nearshore software development firms offering remote roles though consolidated workforce statistics remain limited.

Setting a plan for 2026, assume the availability of senior and specialist positions will continue to tighten, making it necessary to hire a software developer.

A UK company looking for seasoned cloud architects/machine learning engineers should be prepared for a more extensive interview process than a typical dev candidate.

Challenges in nearshore custom software development

Nearshoring is not a guaranteed fix but an opportunity. As a solution for cutting expenses for English companies, nearshoring may seem like a good idea but this approach frequently leads to tension right where confidence should be abundant.

Rising engineering rates in CEE

The pricing gap between the UK and CEE best nearshore software development companies has compressed steadily since 2020. US and Western European companies discovered the same talent pools that UK firms have relied on, and they are competing aggressively with remote offers denominated in dollars and euros.

Concrete sample: looking back at 2019, a UK company could source a software company in the UK for ~£65,000 to £75,000 a year. Fast forward to 2024, offerings with similar profiles attracted £80,000 to £95,000. While the arbitrage opportunity certainly exists, clearly this more accurately reflects a much narrower margin than was indicated a few years back.

As a business owner be realistic about your expectations. A 60% outsave based on London prices? Target that hypothesis with current market information. Better to budget for 5-8 per cent annual escalators.

Regulatory and IP

Brexit rules have remixed this playing field with new wrinkles that didn’t previously exist when UK policies maintained alignment with standards. England now enjoys a data adequacy decision made by the European Commission, making it possible for an EU-based nearshore software development agency to work without additional safeguards for now.

Post-Brexit legal frameworks create wrinkles that didn’t exist when the UK operated under EU rules. England holds an adequacy decision from the European Commission, meaning EU-based providers can process UK personal data without additional safeguards for now.

One protection that UK purchasers may be missing: being very clear about jurisdiction and arbitration in their contracts. By defaulting to the other party’s home ground for disputes, one invites trouble in case of a possible conflict.

While arbitration clauses referring to London or Paris via ICC arbitration in Paris may not be more favourable but are certainly more foreseeable.

Additionally, ensure that your contracts with a nearshore software development firm contain proper assignment clauses for intellectual properties, apart from work-for-hire clauses.

So, when dealing with delicate projects, code escrow contracts act as a safety net because if your software company in the UK ends your association unexpectedly, you possess access to the source code.

Alignment struggles

Having common time zones is a help. But this does not ensure a common understanding. UK engineering CEOs underestimate the amount of coordination a nearshore collaboration requires.

This tension has nothing to do with coding prowess. How distributed teams function differently from colocated teams does matter. So does assuming that because something works internally, a similar effect would work elsewhere.

According to the Global outsourcing survey 2024 from Deloitte, poor vendor relationship management is one of the challenges they face the most (36%), and here are some other hardles to take into account:

-

Explicit documentation standards. Define what “ready for QA” means, what information a pull request must include, how blockers should be escalated. What seems obvious to your team may carry a different meaning elsewhere.

Make sure deliverables stated behind nearshore software development services match the paperwork. Sounds basic but this is where delays sneak in: someone assumed something, nobody checked, and now you’re three weeks behind.

So, ensure that a vendor meets your expectations and will not cause any delays according to documentation.

-

Stay in regular contact. Here’s what we learned: async handles the doing but staying on the same page requires talking. Fifteen minutes a day with the contractor catches problems while they’re still cheap to fix.

Even a 15-minute daily sync provides opportunities to surface questions that wouldn’t warrant a standalone message.

Vendor reliability and scalability risks

The nearshore environment boasts a continuum of maturity. The larger firms have a track record of a decade or more of software development for nearshore in this environment. They possess disciplined processes with a delivery track record honed from cross-border work. Smaller firms may tempt with lower costs and a personal touch but possess a risk of concentration.

The landscape of nearshore firms ranges in maturity. Large firms such as Limeup, with 10+ years of track record, emphasise disciplined processes and a delivery track record achieved worldwide.

Smaller boutique firms may provide a great price and one-on-one focus. They do come with a risk of concentration. Whether a fit-and-proper model depends entirely on your project scope and risk tolerance. To be assured you are able to receive a top-tier offer, try considering the following moments:

- Average programmer tenure

- The number of engineers hired in the past 6 months

- Backfill process understanding

If your roadmap anticipates rapid growth, validate capacity with additional specificity: current bench depth in this skill set and average time-to-fill for senior roles.

None of these are insurmountable problems, but instead a series of warning flags that separate a strong and stable nearshore relationship from a precarious one. Successful nearshoring requires that you go into this model with your eyes open.

Conclusion

2026 isn’t getting any easier for UK hiring managers. You already know this—senior devs are hard to find, expensive when you do, and half of them get poached within a year anyway. That’s why more British companies are looking at CEE nearshore partners. Close enough to collaborate properly. Skilled enough to deliver. Priced in a way that actually makes sense.

Writing this guide based on market statistics, our presence in the English market for 10+ years, we covered the whole nearshore area points that are valued in 2026. Our average cooperation lasts for 5 years, so we put this experience at the core of this roadmap.

If you’re weighing up your options, let’s schedule a free conversation. We’ll share some UK case studies from your sector, give you honest numbers on what this would actually look like across timeline, cost, team structure.

FAQ

Why would UK firms prefer nearshore software development?

British companies form nearshore relationships for several interlinked purposes:

- Time zone support

- Cost efficiency

- Quick рiring

- Post-Brexit іim

- Еalent gaps in domestic sectors

How much can UK businesses save with nearshore development in 2026?

Savings are dependent on role type, tech stack, and level of engagement. UK-based companies can look forward to annual savings of:

- Senior developers: £25,000–£40,000

- Technical leads: £30,000–£50,000

- Full dedicated team (5 engineers): £150,000–£250,000

What regions in Europe have the best nearshore talent for UK projects?

Various markets provide British companies with a special package of benefits.

- UK: convenient time zones with no time difference, English-perfected customer support staff, ease of legal integration.

- Poland: largest and most mature nearshore offering with a strong presence of English speakers.

- Ukraine: access to a large number of talents with average salaries.

- Romania: strong growth potential in embedded systems and automotive software.

- Portugal: similar cost factors with a convenient time zone advantage of Greenwich Mean Time or +1.