Mobile Banking App Development: Shapes the Future

Mobile banking app development is ushering in a cashless world leaving the days of lugging cash behind and paving the way for more convenient and effective operations. Now this is a territory of new players on the market of modern money transactions.

Learning how to create a banking app means having an app that effortlessly tracks your expenses, securely stores your documents and beats even the most savvy cashiers at crunching the numbers is invaluable. Thanks to the innovative companies in the fintech industry, now everyone can carry a financial guru in their pocket, keeping tabs on their money 24/7.

Developing a mobile banking application is not just revolutionizing personal wealth management by offering banking to customers — it is handing over the reins of financial control to the masses, putting the power of managing the money at their fingertips, with the help of tailored digital banking solutions.

What is a mobile banking app development?

The integration of mobile finance control may seem like a recent development but in reality the history of such operations dates back to the 1990’s, although most of the procedures were done using SMS.

By 2010, the technology had evolved to the point of being able to comprehend how to build a banking app that enabled users to conduct operations at a phone click away which brings us back to today’s landscape of the industry.

The matter of crafting such solutions is not so much of a problem anymore as many providers offer outstanding mobile app development services. Typically, they handle the entire production lifecycle, meaning the coverage of every stage from initial conceptualization and research to design, programming, testing and ongoing support.

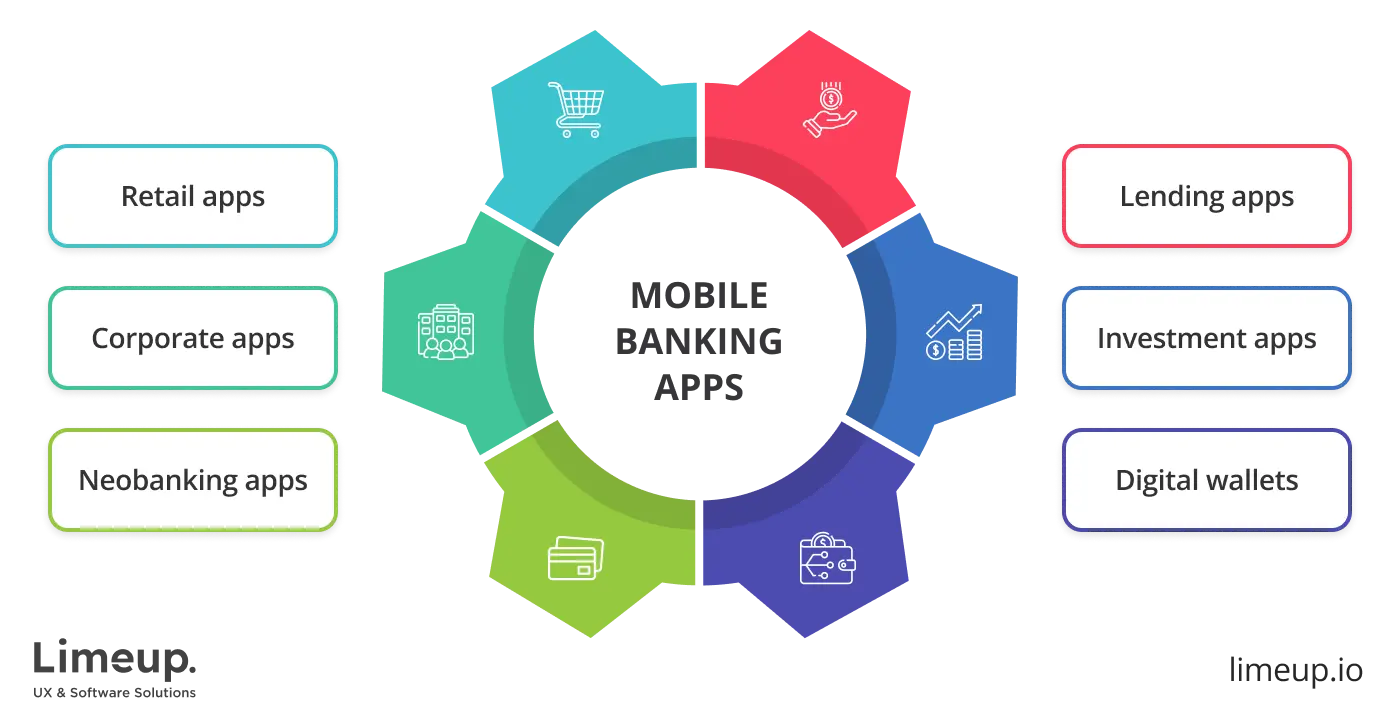

Some of the common solutions within this niche you can apply for include retail payment apps, neo banking solutions, digital wallets, lending and investment applications as well as any kind of corporate software. Each of these options plays a unique role in the operations and drives growth depending on your goals.

Trained specialists utilize a variety of tools to bring to life applications, further diving them into types like native and cross-platform creation. Such types serve distinct purposes and require a certain level of expertise since they necessitate unique technology stacks.

For example, you have the option to go for a native app that is built using platform-specific programming languages and frameworks, i.e., for Android or an iOS solution. The former needs technologies like Kotlin and Java, while the latter is made using Swift and Objective C.

On the other hand, apps that are crafted using the same set of code to fit both of the operating systems are called cross-platform and banking app developers get equipped with tools such as Flutter and React Native which are considered the most popular for this type of creation.

In any case, choosing to opt in for the development of a financial mobile solution is undoubtedly a tedious undertaking but simultaneously very rewarding, both for the business and the customers it caters to. So let’s switch our attention to this topic.

Advantages to gain when you build a banking app

The advent of technology has ushered in a financial revolution, with mobile banking apps leading the way. But what makes mobile banking app production so compelling?

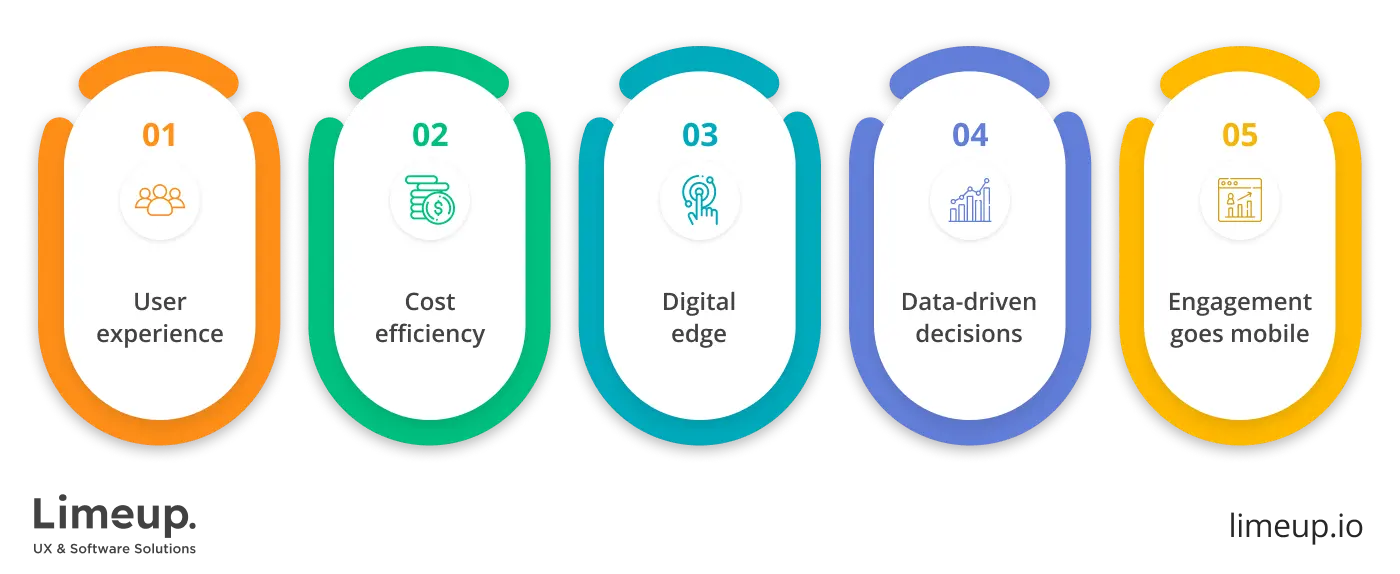

Enhanced user experience

Banking and finance app development delivers unparalleled ease through the ability for consumers to manage their financial affairs at any time and from any location, removing the need for frequent branch visits and giving 24/7 accessibility, fitting everything neatly into their own schedules.

Cost efficiency

Automating routine transactions and inquiries, banking apps significantly cut operational costs for financial institutions freeing up resources for potentially more competitive rates and services. Loan approvals, innovative financial products and personalized financial opportunities — all driven by the profitability of mobile banking.

Digital edge

App development sets financial institutions apart from their rivals, attracting customers who are technologically inclined and consolidating the bank’s image as a forward-thinking and customer-focused entity. Keeping pace with technological advancements allows banks to pull in a broader customer base and secure their top positions in the digital realm.

Data-driven decisions

Information about customer behavior and preferences acts as a financial compass for banks to deliver personalized and efficient solutions that truly resonate with their audiences. Engaged users who interact with these individualized products generate even more data, leading banks to constant refinement of their services.

Engagement goes mobile

Your customers can remotely jumpstart their accounts, store cash and secure loans, all from the comfort of their own devices. Supplementary documents can also be submitted online. If you want to know how to create a mobile banking app that entices clients to use your offer, you must first understand the importance of convenience and accessibility.

Launching a mobile banking app increases client pleasure while driving growth and profitability for financial organizations. With digital technology embraced, banks can transform their operations and deliver exceptional value to their customers.

How to create a banking app: step-by-step tutorial

Constructing a mobile banking application means you avoid bulky wallets and long lines at the bank, but creating one that is both secure and user-friendly is no small feat.

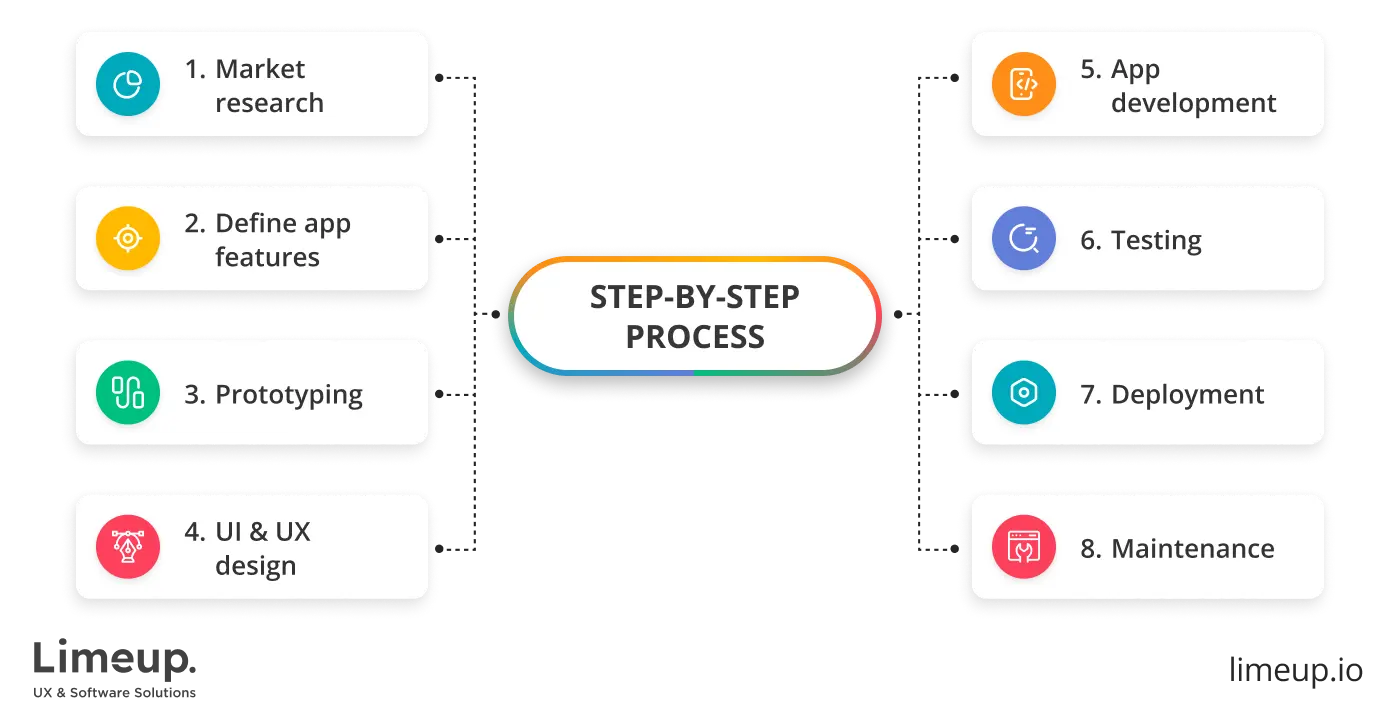

Here is what a typical process of application creation looks like:

- Market research. To carve out a winning strategy, you should begin diving deep into survey data to get the lay of the land regarding customer desires and market dynamics, then give your competitors’ programs a good once-over to identify their strengths and weaknesses.

-

Define app features. Come across the core traits: account management, fund transfers, bill payments and personal banking tools all backed by strong security measures such as biometric verification and encryption.

Add some flavor with functionalities that simplify life — instant alerts, easily reachable customer assistance and tailor-made financial guidance — all bundled within an easy to use user interface.

-

Prototyping. The next step in the process is prototype creation. Here you can experiment with features, user flows and design elements so that your final app not only works flawlessly but feels like second nature to navigate. It is just like taking a test drive before buying a car: a chance to work out the kinks and alter the app’s features for a smoother trip to the finish line.

-

UI and UX design. The design of a mobile banking application permits you to present a bare-bone prototype, a minimally functional version that collects valuable client feedback before the full business logic and features are deployed. Armed with data gleaned from research, user interviews and prototype feedback, the app developer can hit the ground running, crafting an intuitive and user-friendly product.

-

App development. Developers bring the program’s functionality to life, splitting the process into two essential parts: frontend and backend components. In the first case, engineers often lean on platform-specific technologies like Kotlin for Android and Swift for iOS in native applications or the versatile Flutter for cross-platform applications.

As for backend, Python programming language paired with Django framework holds supreme, delivering a powerful stack capable of managing all aspects of banking applications, from basic functionalities to high-traffic services intended for financial institutions.

-

Testing. During the testing phase, the banking app development team, together with developers, carefully hunts down and squashes bugs and technical inconsistencies. Skipping this step may result in losing early adopters post-launch, as malfunctioning features may deter users on different devices.

Mobile app testing begins by evaluating the layout’s alignment with the design, followed by rigorous checks on the functional aspects of the project.

-

Deployment. Once the application is completed it must comply with stringent policies of App Store and Play Market for listing. Adherence to these guidelines is make-or-break as it locks into the inclusion of high-quality, copyrighted photos and content that aligns with platform policies.

Boosting the app’s visibility with descriptive images and videos while actively managing ratings and feedback can significantly impact its success in climbing the ranks within its category.

-

Maintenance. Bear in mind that expenses do not stop there — ongoing costs like server space, tech support and payment gateway continue to chip away at the budget. As users interact with the app, evolving needs surface, necessitating the addition of features making being adaptive to prospective changes in the initial mobile banking app indispensable.

What is the cost of mobile banking application development?

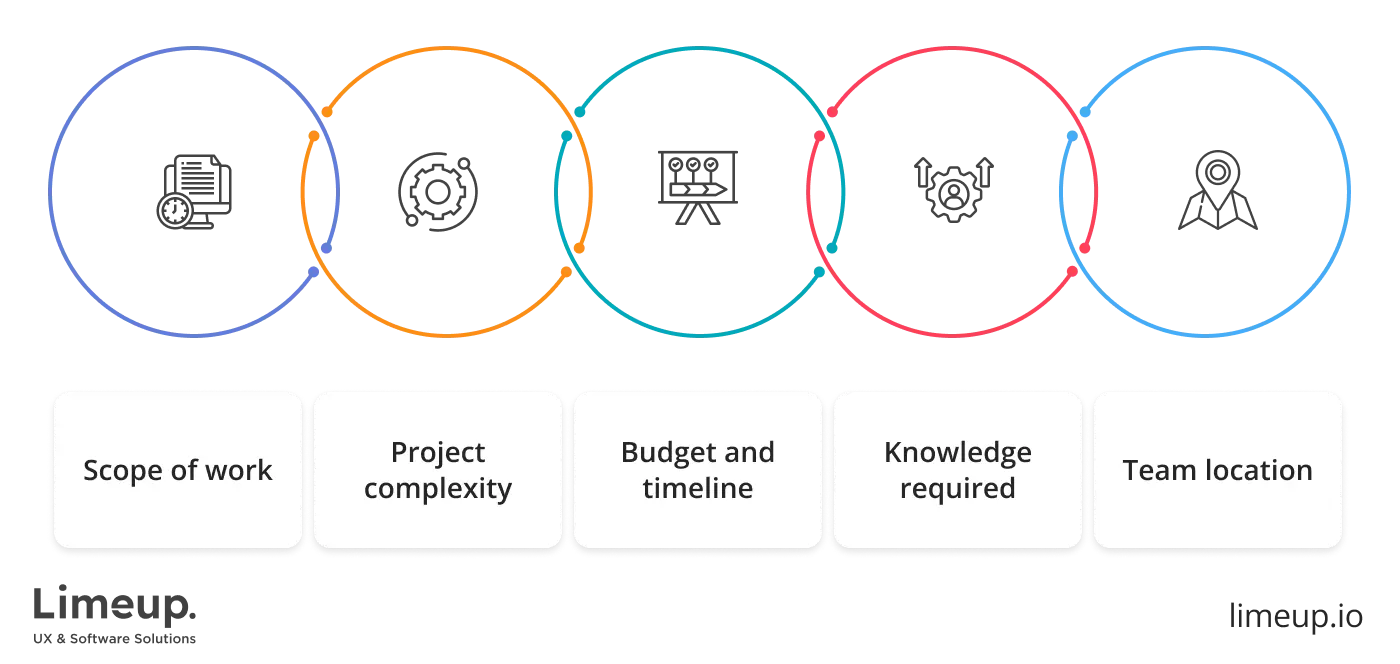

When calculating the price of developing a banking app be aware that numerous factors will influence the final bill. Contracting the software from scratch might set you back a pretty penny while opting for outsourcing team shaves costs down to the ballpark of $300,000 to $500,000. For early fintech startups looking to carve out their niche, the financial investment is typically between $180,000 and $260,000 to launch an initial MVP.

But, as we stated before — the financial commitment extends beyond the initial development phase as ongoing maintenance costs can amount to approximately $130,000 per year, regardless of the chosen construction approach, which is typically 10%-15% of the initial creation cost.

The duration of custom mobile banking app development process is contingent upon several factors, including team dynamics and the intricacy of the app. Typically, crafting a proof of concept may span anywhere from four to six months, while achieving a market-ready MVP could demand a dedicated team’s efforts over a period of 9 to 14 months.

Keep in mind that the price tag hinges on various factors, so it’s like chasing a moving target, fluctuating based on variables like project intricacy, timeframe, team magnitude, and the technology and features integrated.

As an illustration — basic banking app with a development duration ranging from three to six months might come with a price tag of around $30,000 and more.

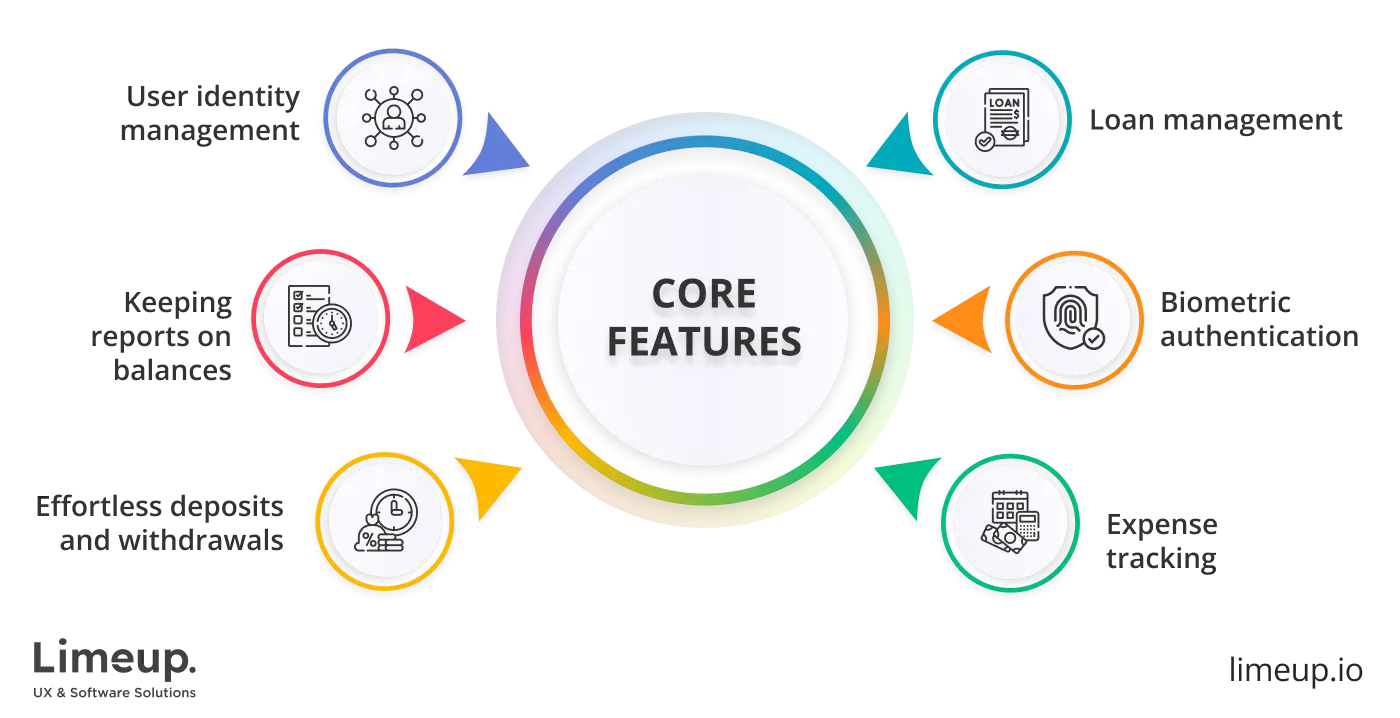

Core features to consider for banking apps development

Incorporating essential features for mobile banking apps boosts user adoption and promotes widespread acceptance. Let’s understand what features can elevate your mobile app’s appeal and functionality, setting it apart in the competitive market.

At the heart of an uninterrupted user experience is effective user profile management supplying users with a hassle-free way to develop mobile banking app by modifying or enriching their personal information whenever necessary.

Other than that, fortifying the app with bulletproof authentication measures like biometric verification, individualized usernames and password protection safeguards login credentials while likewise maximizing transactional security in one fell swoop.

App development services empower users by providing real-time access to their bank accounts, allowing them to effortlessly manage their finances on the go, keeping track of balances, executing transactions and managing bills from the palm of their hand.

Furthermore, furnishing a detailed transaction history that encompasses payment particulars, withdrawals, check deposits, loan repayments, purchases and cash transfers boosts transparency and stipulates users make more well informed financial decisions.

By cutting out the middleman through the app, which excludes the need for users to physically visit brick-and-mortar bank branches and facilitates smooth withdrawals and transactions directly through the app, users experience unparalleled convenience and adaptability. Easy and secure in-app withdrawals further enhance user satisfaction and build trust in the banking platform.

Banking application development entails arming customers with a comprehensive loan repository, complete with elaborate loan details, approval statuses, payback schedules, interest rates and timely warnings, granting them the necessary resources they need to successfully negotiate their financial obligations with precision.

With this armament at their disposal individuals can confidently traverse their financial terrain and make sound judgments regarding their loans and finances.

Bolstering the app’s security infrastructure with state-of-the-art biometric authentication methods such as face and touch ID upgrades user authentication, paving the way for a fortified login experience. The adoption of multi-factor authentication mechanisms raises safety precautions slashing the odds of unauthorized entry into user accounts.

A mix of readily available dashboards to monitor, sift through and handle expenses provides users with priceless insights into their spending patterns and financial behaviors. Likewise, capitalizing on visual depictions of expenses amplifies user understanding and promotes proactive financial management, nurturing financial well-being and responsibility.

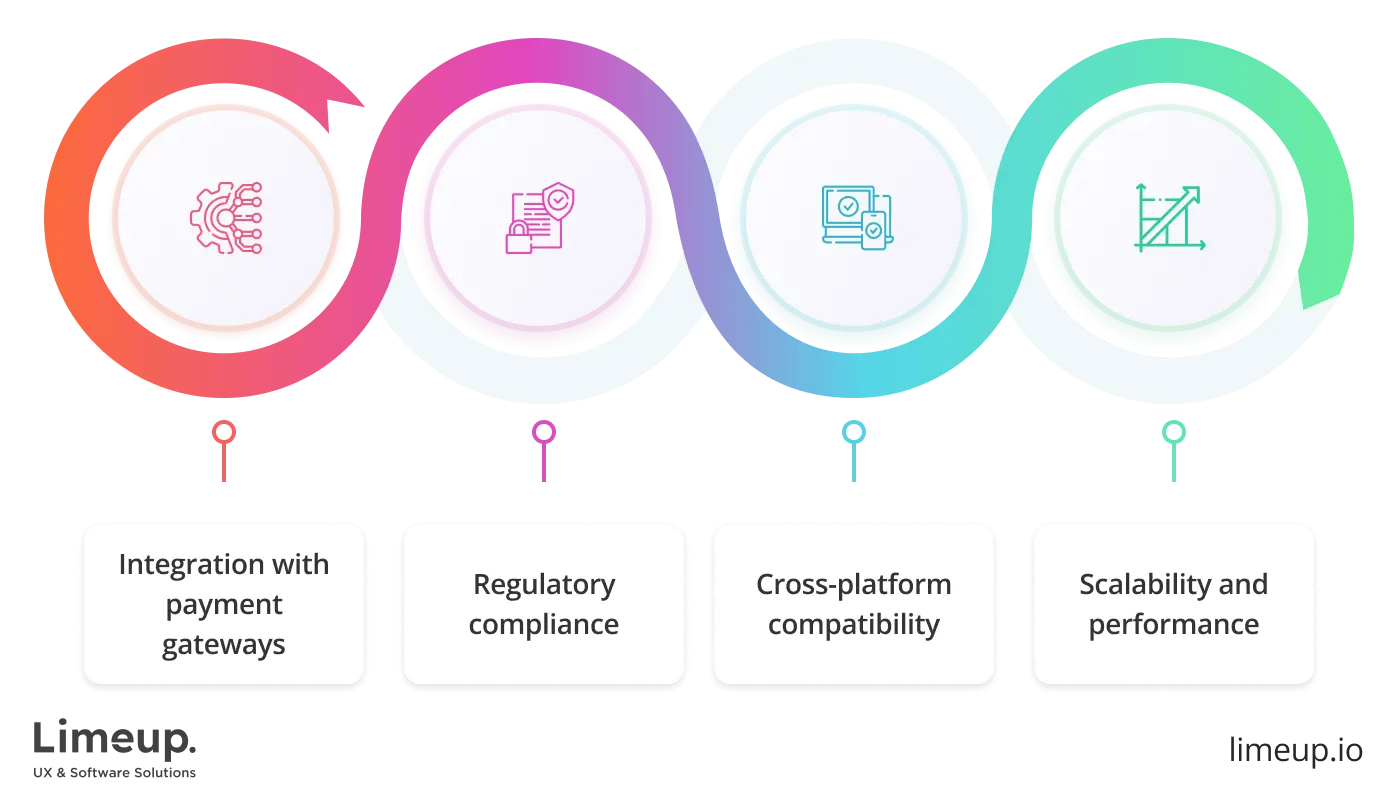

Challenges in developing a mobile banking application

As the banking digital sphere evolves so do the difficulties and expectations involved in developing these critical digital solutions

Integration with payment gateways

Mobile payment applications are revolutionizing the way we transact, but building the bridge between users and financial institutions requires more than just a swipe. App development companies in the UK must cover all the bases to guarantee compatibility with diverse payment methods across various regions and currencies, encompassing credit/debit cards, bank transfers and digital wallets.

To create a banking app with flawless connection with payment gateways and financial institutions, painstaking attention to detail and rigorous testing are required for satisfactory ongoing transaction processing.

Regulatory compliance

Creating a mobile banking app that caters to a worldwide user base necessitates significant efforts to achieve regulatory compliance:

- The Fair Credit Reporting Act (FCRA) safeguards clients privacy and information accuracy especially in reports generated by service providers that contain sensitive information like personalities and assets, and puts a lid on their dissemination, keeping sensitive data under lock and key.

- The General Data Protection Regulation (GDPR) sets the gold standard on how to develop online banking application that collect sensitive user data, with the goal of raising the privacy bar and modernizing data privacy legislation while performing watchful surveillance of users’ digital traces.

- Compliance with Money Service Business (MSB) protocols requires the development company to register its products through the BSA e-filing system, mitigating Anti-Money Laundering (AML) risks and staying in line with BSA reporting regulations.

- The Gramm Leach Bliley Act (GLBA) oversees the collection and disclosure of personal customer information by financial institutions necessitating transparency in product information-sharing policies and practices.

- Obtaining a Money Transmitter License (MTL) is obligatory for organizations involved in monitory operations acting as a bridge between users and financial institutions through the mobile payment app all while keeping compliance with regulatory norms in check.

Cross-platform compatibility

The dizzying number of devices and operating systems makes cross-platform compatibility necessary for mobile payment apps. Dialing in cross-platform banking mobile app development strategies lets developers create an app that feels intuitive on any device and opens the door wide open for everyone to participate in the mobile payment revolution.

Scalability and performance

As user numbers surge, mobile banking applications must demonstrate the ability to handle substantial transaction volumes while maintaining optimal app performance presenting developers with the challenge of designing scalable architecture and implementing load-balancing techniques to mitigate the risks of system overload and maintain uninterrupted operation even during peak usage periods.

Setting priorities for scalability during the development process and adopting substantial mechanisms let mobile banking app developers relax knowing that the application is capable of handling unexpected traffic surges without losing speed or reliability, giving a consistently high-quality user experience.

The user experience must remain straightforward and intuitive despite the complex features working behind the scenes in both iOS and Android development. Striking a balance between advanced security features and an intuitive interface is crucial for the success of a mobile banking app. Engineers should ensure that the application feels intuitive to navigate, eliminating the need for technical knowledge.

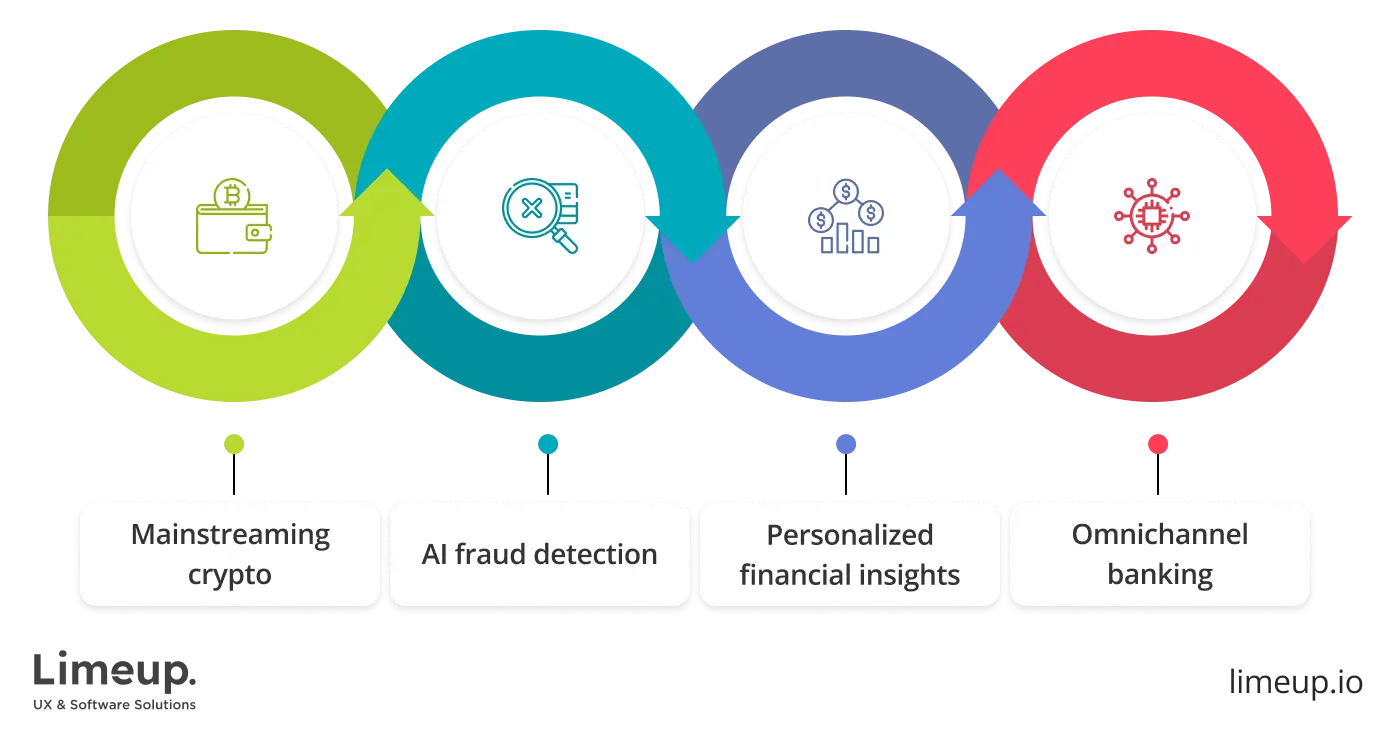

Emerging trends in banking app development

Now let’s explore how to transform your banking app from a functional tool to a trusted financial partner for your customers. Here’s a glimpse into the hottest trends shaping mobile banking in 2024:

Mainstreaming crypto. With over 8,800 digital currencies in circulation and a growing user base banks that integrate cryptocurrency into their mobile application are positioning themselves for success. This doesn’t mean full-blown Bitcoin ATMs in every branch but offering secure ways for users to buy, sell and hold crypto within a familiar app environment can be a major advantage.

AI fraud detection. In the mobile banking application development field, cybersecurity hazards are continually evolving and traditional solutions such as manual transaction monitoring simply cannot keep up — that is why AI emerges as a powerful weapon in the fight against fraud. Behavioral biometrics, predictive analytics and anomaly detection become your silent guardians, protecting users from account takeover, identity theft and other sophisticated scams.

Personalized financial insights. As the monotonous routine of just tracking transactions fades into history, cutting-edge banking apps backed by massive amounts of big data become your personal financial soothsayers. Using anonymized data from your social media activity, these apps methodically create tailored financial roadmaps that perfectly merge with your goals and spending habits.

This hyper-personalization converts banking from an ordinary chore to a trusted financial confidante who directs you with professional guidance and specialized tools to help you reach your financial goals.

Omnichannel banking. Multichannel banking redefines accessibility by harmoniously integrating the convenience of mobile devices with in-person visits, phone conversations, emails and video chats, fostering frictionless banking app development. Through this interconnected ecosystem, support agents gain holistic insights into customers’ banking histories, fostering deeper loyalty and enduring partnerships.

Conclusion

As cashless payments gain ground, the demand for top-notch development is at an all-time high, necessitating a careful balance between cutting-edge technology, solid security measures and user-friendly functionality to succeed.

While the market already boasts a large number of fintech applications, the landscape continues to welcome new contenders to carve out their niche. This constant expansion is due to the presence of numerous untapped opportunities in the field of banking and financial services.

Creating a fintech application in 2024 requires staying ahead of the curve, riding the wave of modern trends and mastering the latest tech tools. Mobile development services backed by their technological skills and shrewd business acumen may lead your project toward success.

With hands-on knowledge of fintech development, Limeup can assist you in building a personalized solution using a robust technology stack as well as give steadfast support throughout the process of creating an application. Contact us to schedule a free consultation.