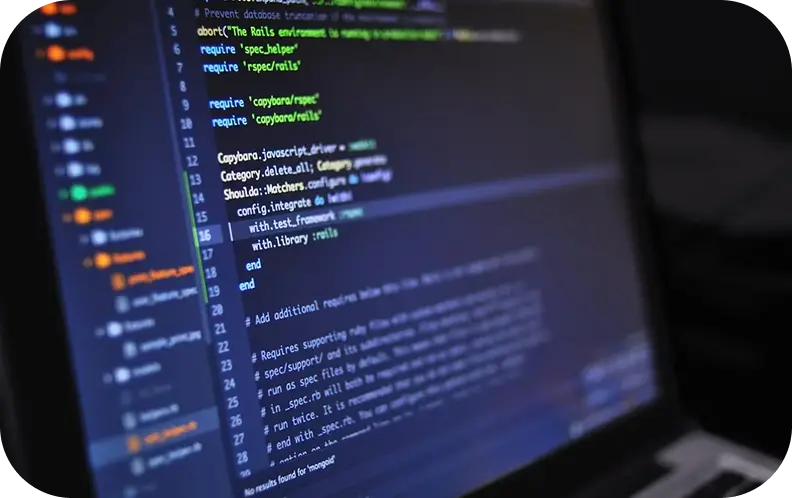

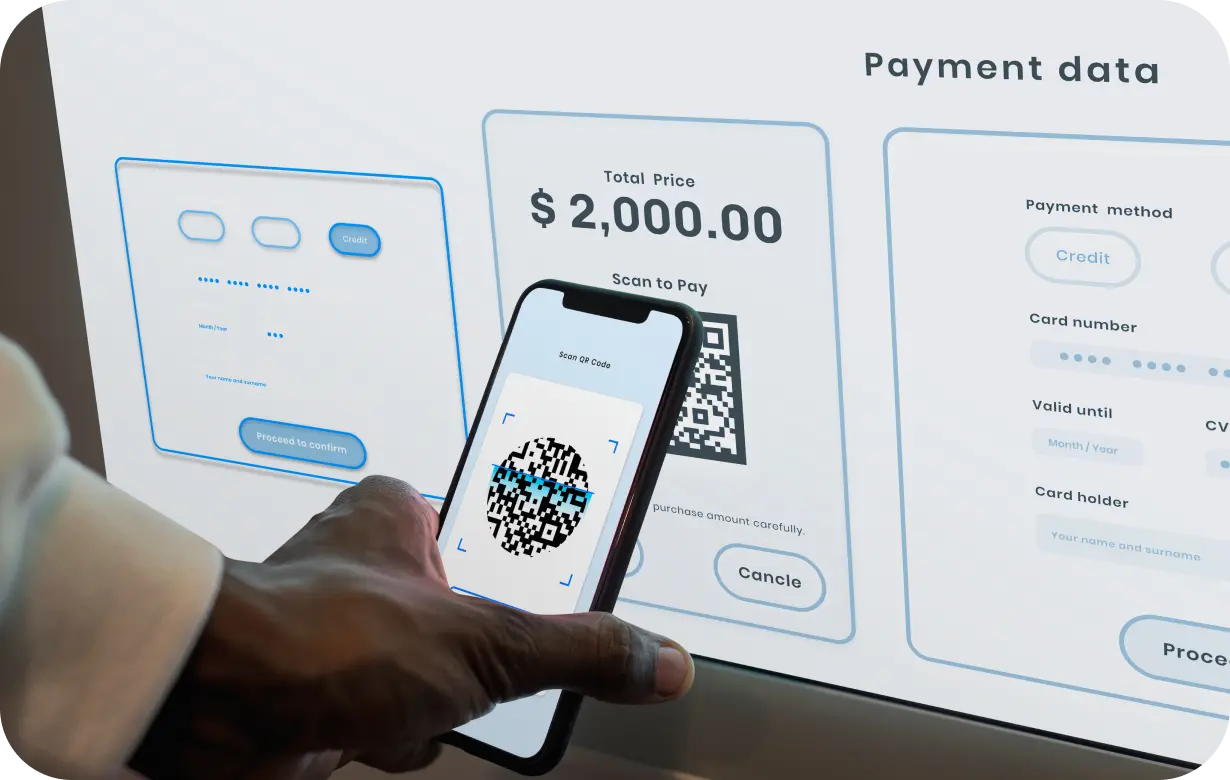

Set Security as a Priority

Considering every development layer, our developers use end-to-end encryption and secure APIs, as well as conduct code tests to provide a system that can withstand attacks. Data protection is our responsibility and must-have, not a nice-to-have practice.